In 2024, will OpenSea disappear from the NFT market?

Author: Terry | Plain-language Blockchain / Source

In just two years, from being relatively unknown to being valued at over $13 billion, and then another two years, dropping 90% from its peak valuation of billions of dollars, even considering selling itself, the seemingly "roller-coaster" rise and fall, what kind of experience is this?

This is exactly the most authentic portrayal of OpenSea in the past 4 years—just recently, OpenSea's CEO and co-founder Devin Finzer revealed that OpenSea has received acquisition intentions, maintaining an open attitude towards potential acquisition deals, but did not specify when or by whom.

As a "unicorn" that once almost disappeared from the NFT trading market, how did OpenSea rise rapidly, and how did it fall from the forefront of the NFT market competition? What possible disruptors and variables will the NFT market landscape encounter next?

01

OpenSea: A unicorn with a valuation of over a hundred billion, now "cutting its toes"

Like Uniswap and Dune, OpenSea is also a startup miracle that started from scratch in the Web3 field—especially in the two years since 2021, OpenSea's valuation has been soaring, from being ignored to climbing to $13 billion, becoming the "undisputed leader" of the entire NFT market.

The beginning of the whole story dates back to January 2018, when OpenSea's co-founders Devin Finzer and Alex Atallah created OpenSea for users to buy and sell NFTs.

However, due to the NFT market being barren except for the short-lived hype of Cryptokitties, the platform's NFT trading users and volume have been hovering at low levels.

Until March 2020, OpenSea had only 5 employees, and the monthly transaction volume fluctuated around $1 million. Based on a 2.5% commission at the time, it meant a monthly income of only $28,000. Fortunately, at the end of 2019, Animoca Brands invested $2.1 million, barely keeping OpenSea financially balanced.

OpenSea's real takeoff began in 2020. The two co-founders planned to double the business volume by the end of 2020, but with the gradual recovery of the crypto market in the second half of 2020, OpenSea's business volume soared rapidly, completing the task ahead of schedule in September 2020.

Starting from 2021, the NFT bull market kicked off, and OpenSea's active users and trading volume surged. In July 2021, the trading volume soared to $350 million, and it received a $100 million investment led by a16z, with a post-investment valuation of $1.5 billion.

A month later, in August 2021, OpenSea's trading volume soared tenfold to reach $3.4 billion, earning over $85 million in commission income.

From then until January 2022, OpenSea was almost unshakable, with a monthly trading volume exceeding $3.5 billion, occupying 90% of the NFT industry's market share, with a valuation exceeding $13.3 billion. Therefore, from a data perspective, OpenSea is definitely the "too big to fail" presence in the entire NFT market, even surpassing Uniswap's market share and influence in the DEX track.

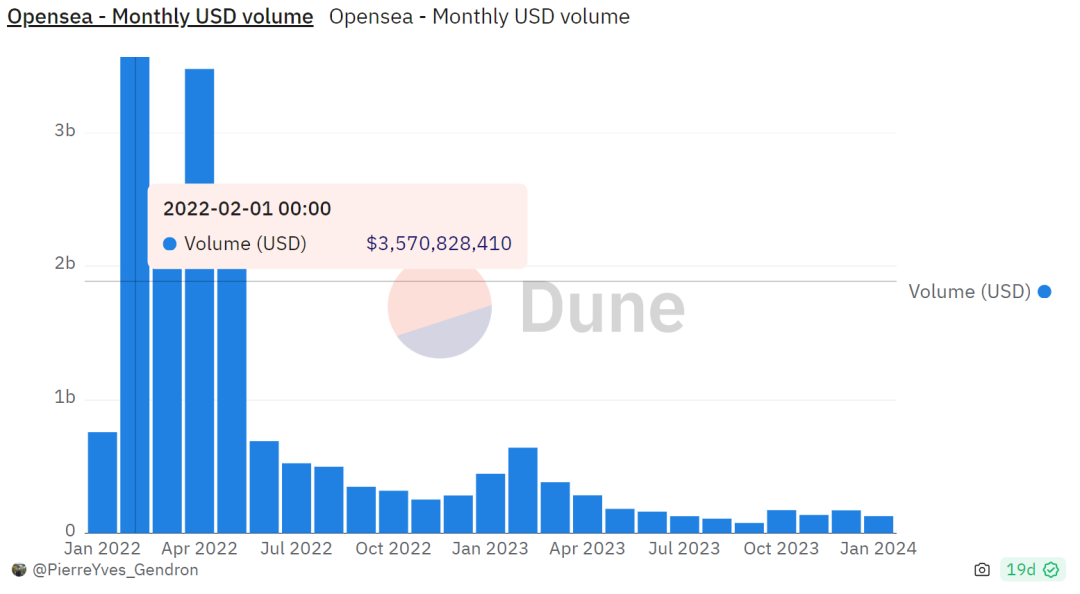

OpenSea Monthly Trading Volume 2022-2024

This also became OpenSea's swan song in dominating the NFT trading market. As the earliest player to enter the NFT trading market and fully benefit from the explosive growth, OpenSea's trading volume experienced a sharp decline in June 2022:

From nearly $2.6 billion in May to less than $700 million in June. Now, OpenSea's monthly trading volume has decreased to $120 million, a drop of over 95% from its peak in January 2022.

According to Bloomberg, Tiger Global Management has written down the value of its stake in OpenSea by 94%, and Coatue has also reduced the value of its OpenSea stake by 90% to $13 million, almost a "toe cut."

02

Evolution of the NFT track landscape

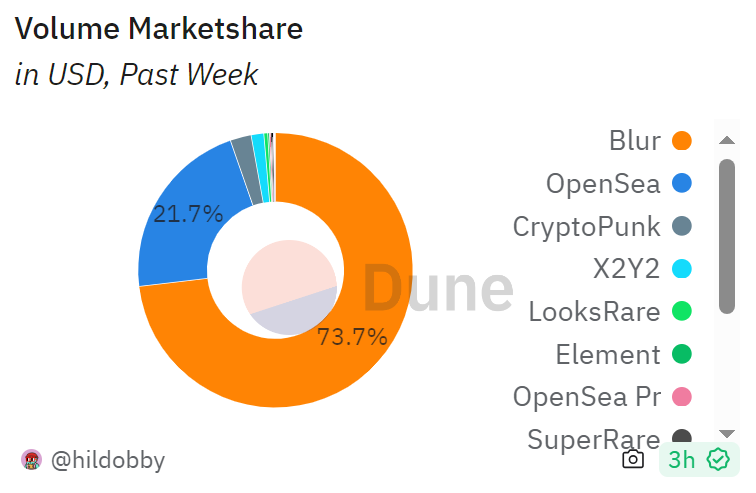

The heaviest blow to OpenSea was brought by the newcomer Blur, which now occupies over 70% of the NFT trading market, surpassing OpenSea and becoming the largest NFT market.

Dune data shows that as of the past week, Blur's market share in the NFT market is as high as 73.7%, ranking first; OpenSea's market share is 21.7%, ranking second.

Market Share of NFT Trading Platforms

If we look back at the evolution of the NFT track landscape and the formidable disruptive ability of Blur, we will find that all the changes are not surprising.

LooksRare, x2y2's "vampire attack"

First, OpenSea's miraculous rise to a certain extent is inseparable from its early first-mover advantage in persevering through the low tide. After the NFT bull market broke out, the product-level competition and "vampire" attacks between NFT trading markets almost never stopped due to OpenSea's dominant position.

It is well known that there is a clear trend in the Web3 and crypto world now, whether it is DeFi, NFT, blockchain games, or infrastructure, there are more and more similar projects, but the homogenized competition is severe, and the differences are almost limited to names, UI, token incentives, and transaction fees.

"In market competition, who copies whom is not important, what is important is who is the first." This is especially true for Web3, as evidenced repeatedly since Sushi's vampire attack on Uniswap.

So, starting from 2022, "OpenSea killers" like LooksRare, x2y2, etc., began to gain relative advantages by focusing on OpenSea's delay in issuing tokens, relying on token distribution incentives, but the internal competition from Airdrop did not truly shake OpenSea's position.

Almost all of the trading reward mechanisms led to a large number of false transactions, and after a brief prosperity, they quickly fell silent, failing to produce a strong competitor that could truly share the NFT market share.

Blur: The true "breaker" of the NFT track

At the end of 2022, Blur emerged and introduced Bid Airdrop, which is a marketing strategy in the crypto asset project that aims to distribute tokens to participants through auctions or bidding, going further than the trading reward mechanism, completely solving the problem of insufficient depth in the NFT market:

Encouraging bidding (make offer), the closer the bid is to the floor price, the more rewards, "essentially, it is the token holders of the secondary market platform subsidizing the bidders," which is similar to Aave's rise path—a protocol that helps big holders "sell off" is a good protocol.

Looking back at the development trajectory of the past year, Blur and its founder Tieshun can be considered the top "breakers" in various "mature tracks":

NFT Trading Track: Blur overturned the dominant OpenSea, slashing its valuation from $13.3 billion to $1.4 billion;

NFT Lending Track: Blend's total loan transactions exceeded $4.6 billion, becoming the leader;

L2 Track: Blast's TVL surpassed $1.78 billion, according to L2Beat statistics, second only to Arbitrum ($12.34 billion) and Optimism ($6.6 billion), higher than Base, zkSync, and other L2s, ranking in the top three L2s.

03

New Trends in the NFT Market

Since 2023, in addition to Blur completing the "replacement" of OpenSea, some potential variables have emerged.

Naturally, the rise of pan-Bitcoin NFTs represented by Ordinals has sparked a new wave of "BitcoinFi," reaching a new peak in the activity of internal Bitcoin ecosystem transactions.

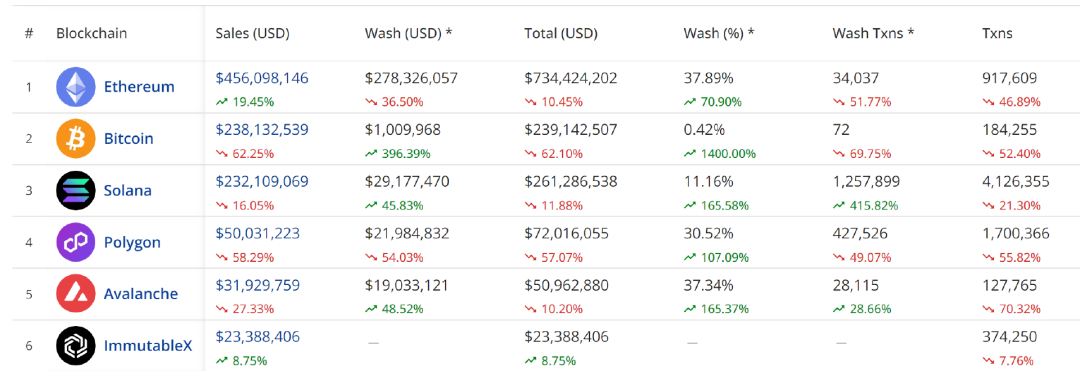

According to the following Cryptoslam data, the past 30 days of Bitcoin on-chain NFT sales reached $238 million, making it the second largest blockchain in NFT sales, second only to Ethereum ($456 million), surpassing Solana ($232 million) and Polygon ($50.3 million).

The latest data from Dune shows that as of February 16, Ordinals' cumulative fees for minting exceeded 6,150 BTC, surpassing $320 million.

This has also given rise to the emergence of Bitcoin-based NFT trading markets such as the OKX Web3 wallet Ordinals market and the UniSat NFT trading market. As of last week, the total trading volume of the OKX Web3 wallet Ordinals market has also exceeded $1.3 billion.

In addition, starting in the second half of 2023, the NFT market seems to have gradually stabilized, with the floor prices of many blue-chip NFTs starting to rebound or soar, and the NFT track in the Solana ecosystem has also entered a new speculative cycle.

At the same time, similar pan-NFTs like ERC404 have re-emerged, as "new assets" with duality, these pan-NFTs can be traded on both OpenSea and Uniswap, which may bring even greater impact to the NFT market landscape in the future.

In particular, Uniswap had previously acquired the NFT trading market Genie, sending a clear signal of entering the NFT trading market—Genie aggregates trades from other NFT markets, while Uniswap provides trading depth.

Overall, the competition in the NFT market has been revolving around product and asset dimensions:

Blur's product-level innovation through liquidity reward mechanisms dealt a blow to OpenSea and x2y2 and other old-generation NFT trading platforms in the first half of 2023;

Meanwhile, OKX, UniSat, and others quickly rose in the second half of 2023 with the new asset category of Ordinals, opening up new territory;

Now, as 2024 begins, the rising popularity of ERC404 as a new asset type, will it give traditional token trading protocols like Uniswap a new ticket to enter the NFT market, stirring up the NFT market landscape in 2024? It's worth paying attention to.

Source: https://mp.weixin.qq.com/s/N2LfMZhRfPg0IAdL38NRWg

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。