This article aims to assess the views of blockchain game industry professionals on the current situation, reflecting the industry's collective outlook after the past two years of the cryptocurrency "crypto" winter, and identifying the challenges and opportunities facing the industry in 2024.

Written by: BGA

Translated by: Zen, PANews

The "Blockchain Game Industry Status Report" (BGA State of the Industry Report) has been released for the third consecutive year. It was initiated by the Blockchain Game Alliance and written by the Web3 consulting company Emfarsis, with the participation of 526 blockchain game industry professionals in the survey. It provides comprehensive resources for industry stakeholders, offering important insights into the current state, potential growth, and emerging trends in the industry.

Compared to the peak of the bull market in 2021, the activity of all Web3 games has significantly decreased. However, the focus has shifted to improving user acquisition and player retention, while blockchain has been continuously developing infrastructure for security, scalability, and smoother transactions. Through online surveys, this report aims to assess the views of blockchain game industry professionals on the current situation, reflecting the industry's collective outlook after the past two years of the crypto winter, and identifying the challenges and opportunities facing the industry in 2024.

Advantages of Blockchain Games

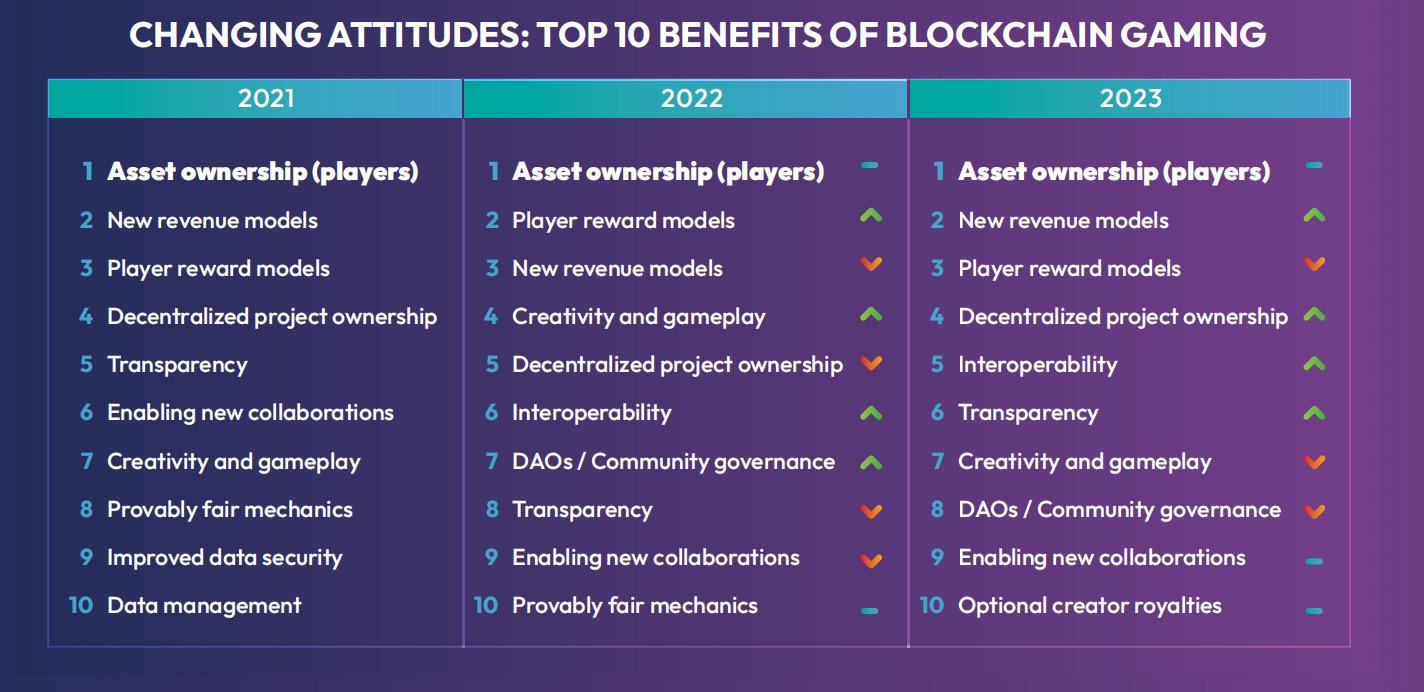

In the 2023 survey interviews, 76.2% of respondents believed that player asset ownership is the greatest benefit that blockchain can bring to players. Since the start of the survey in 2021, this has been a consensus among industry professionals.

In Web2 games, although players can own game items and trade them on dedicated markets, the rules and technical conditions of these games have always prohibited exchanging them for real value outside the game. With the emergence of blockchain technology, players can truly own, trade, and collect in-game resources, skins, and other digital items, rather than renting them from game developers or publishers. This provides players with true property rights and ownership, which has traditionally been controlled by game developers and publishers, opening up various possibilities for interoperability between games, game composability, new business models, and monetization strategies.

Following asset ownership, new revenue models and player reward models were respectively considered the second and third greatest advantages of blockchain games in the survey. These two advantages have consistently ranked second or third in the three surveys since 2021. There are subtle differences in the perception of these two advantages among different regions. Respondents from the United States, Europe, and Oceania believe that new revenue models should be the second greatest advantage, while respondents from Asia and Latin America place more emphasis on player reward models. Over half (52.1%) of the respondents believe that at least 20% of the gaming industry will likely utilize blockchain technology in some way within 12 months.

Challenges of Blockchain Games

More than half of the respondents indicated that acquiring new users remains the biggest challenge for the industry. Despite the adoption of the free-to-own and free-to-play (F2P) models, and the incorporation of blockchain elements as optional, the issue of user acquisition still hinders industry development despite improvements in accessibility.

Poor gameplay is another significant issue, as Web3 games often lack in functionality and gameplay compared to Web2 games. However, in 2023, some Web3 games began to break this deadlock and inherent perception. Games such as "My Pet Hooligan" and "Illuvium" have garnered attention for their high quality. The upcoming game "Star Atlas," which uses Unreal Engine 5, is also highly anticipated and has the potential to rival world-class games like "Star Citizen" and "EVE Online." Other well-received Web3 games include the collectible card game (CCG) "Cross the Ages," which features a story mode and player versus player mode, similar to Web2 CCGs like "Hearthstone"; and the simulation game "Upland," where players can buy and trade virtual properties representing real-world landmarks.

In 2023, regulation has once again become a key concern for the industry, rising from 10th place in 2022 to 5th place. Considering the frequent dialogues and disputes between the cryptocurrency field and regulatory authorities over the past year, it is not surprising that this aspect has regained attention. However, in the first industry survey conducted in 2021, regulation was considered the top challenge facing the industry, with concerns that the speed of cryptocurrency adoption would slow down if countries began implementing stricter policies or compliance measures. Additionally, Web3 founders find it difficult to maintain clarity or confidence in an uncertain regulatory environment, which is a normal reaction for that era, as the earliest blockchain games were highly financialized.

In two consecutive years of surveys, respondents unanimously believed that the "crypto winter" had the greatest negative impact on blockchain games. With the arrival of the bear market, the public and media lost interest in Web3, and even those who continued to actively play games may have experienced some fatigue due to the stagnant market. According to DappRadar data, the active players of Web3 games in 2023 decreased slightly compared to 2022, with an average monthly active users (MAU) of 2.2 million in 2023, a 15.4% decrease from the 2.6 million MAU in 2022. Nevertheless, companies are still using this time to build solutions to enhance the gaming experience and facilitate better player engagement. As the monthly active users began to increase to 2.6 million in October 2023, the situation also began to improve, indicating a positive development in the coming year.

The next most concerning issue for respondents is macroeconomic events. Global macro events such as economic recessions have created a financially unstable environment, limiting access to capital and exacerbating challenges. Furthermore, geopolitical tensions have further complicated matters, making it more difficult for emerging enterprises to navigate and develop in the global market. The "crypto winter" and global macroeconomics are external factors affecting the industry. Taken together, they are the strongest forces putting pressure on blockchain games, with 51.3% and 45.2% of respondents mentioning these two factors in 2022 and 2023, respectively. This indicates that industry professionals in the blockchain game industry believe that once the market turns around, their companies and projects will rise strongly.

The only issue within the Web3 field considered an internal challenge is the ban on NFTs by traditional game studios. This ranked third in both 2022 and 2023, accounting for 8.7% and 11.0%, respectively. Notable bans in the past year include the ban by Mojang Studio, the developer of "Minecraft," who expressed concerns that NFTs might affect the inclusive community experience of the game, as not all players can use NFTs; and the ban by Rockstar Games, the developer of "Grand Theft Auto," on the use of NFTs and cryptocurrencies, as they are concerned that game ownership may be distributed and monetized without the explicit consent of the publisher. Due to the speculative nature of NFT games, South Korea has also explicitly banned NFT games.

Misconceptions about Blockchain Games

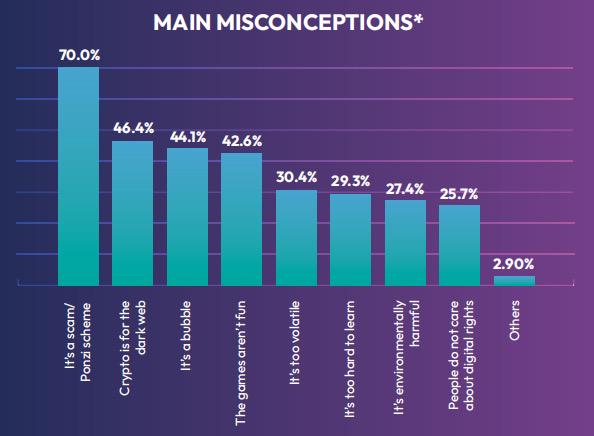

Since 2021, respondents have believed that the biggest misconception surrounding blockchain games is the belief that they are scams or Ponzi schemes. In 2023, 70.0% of respondents still considered this to be the greatest misconception about the industry. In 2022, this proportion was 69.5%, and in 2021, it was 59.0%, indicating that blockchain game professionals are paying more attention to this misconception.

Although there have been some fraudulent projects in this field, these bad actors do not represent the entire blockchain gaming ecosystem. Unfortunately, their malicious behavior has affected the overall reputation of the industry. Like any investment or emerging technology, individuals should exercise caution, conduct comprehensive research, and understand potential risks before getting involved. Equally important is for the industry to adopt best practices and regulatory measures to build trust among users.

In 2023, another misconception mentioned by 46.4% of respondents is the persistent association between cryptocurrency and the dark web. This seems to be an issue of increasing concern for blockchain game professionals, as 38.0% of respondents emphasized this issue in 2022, and 38.2% in 2021. Reports in mainstream media about cryptocurrency being used for criminal activities and funding terrorism may contribute to this perception. The industry needs to enhance education, demonstrate blockchain transparency, and showcase how it can aid law enforcement in tracking criminal-related transactions, among other efforts, to further promote the advantages of blockchain to mainstream audiences.

Transition of Web2 Game IPs and Practitioners to Web3

Poor gameplay was considered the second biggest challenge facing the industry in 2023, with 36.7% of respondents supporting this view. The main reason for this viewpoint may be the comparison of recently invested Web3 games with the works of Web2 studios that have been developing games for decades. When asked about the biggest positive impact on the gaming industry in 2023, 19.8% of respondents believed it was the traditional game studios launching NFT games, while 15.2% of respondents believed it was the transition of Web2 (or traditional) games to Web3. Taken together, this indicates that 35.0% of respondents believe that the positive impact from Web2 game studios transitioning to the Web3 field comes from the talent, experience, brand recognition, and large mainstream audience brought by Web2 studios.

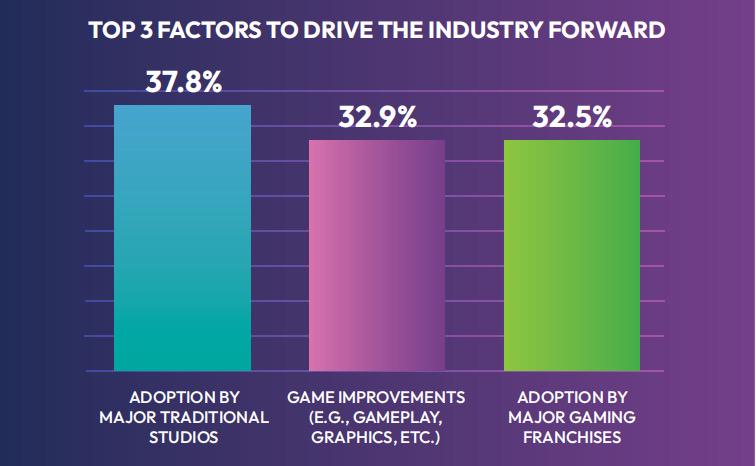

Large game studios have been exploring and experimenting in this field, with many seeing the potential of blockchain games to drive the development of the entire gaming industry. Some Web2 studios have been developing Web3 versions of popular IPs or creating new Web3 games under their studios. This includes but is not limited to traditional gaming giants such as CCP Games (EVE Online), Nexon (MapleStory), Ubisoft, Square Enix, Bandai Namco, and others. Over one-third (37.8%) of blockchain game professionals believe that the adoption of blockchain by large Web2 game studios can drive industry development.

Driving Factors for the Development of Blockchain Games

In addition to the adoption of Web3 by large Web2 game studios, game improvement is another major driving factor, accounting for almost one-third of the survey responses. Since 2021, these two factors have consistently ranked at the top, and they complement each other—large traditional studios can bring experience and talent to bring more Web3 games to market and elevate more Web3 games to the level of Web2 games.

Beyond the top three, considerations for improving accessibility and user onboarding have seen a significant increase, accounting for 27.8% of total responses and ranking fourth. In 2022, it only ranked 10th, indicating that the industry is increasingly focused on making blockchain games more user-friendly. Another notable trend is that respondents believe releasing more blockchain games is an important driving force for the industry, rising from 12th place in 2021 to 6th place in 2023. Overall, one in four survey respondents (25.7%) believe that releasing more online games will help drive industry development, as more games mean a richer variety to cater to a wider range of preferences.

The Play-to-Earn (P2E) mechanism has lost its significance as a driving force for the industry, dropping to eighth place in 2023, after ranking first in 2021 and fifth in 2022. In 2021, millions of new players joined Web3 through "play-to-earn" games, treating these games as work because they could earn token rewards that could be exchanged for cryptocurrency and fiat currency. However, the sustainability of these virtual economies was quickly put to the test as token prices fell, prompting economically motivated players to exit first.

Nevertheless, there is still interest in P2E, especially in Asia, where the gaming culture has a more open attitude towards gamified finance. However, there is still skepticism about how to balance the token economy of P2E games with the volatility of the cryptocurrency market. Developers must figure out how to make their games sustainable in the long run.

When it comes to factors driving industry development, the prioritization of reducing transaction costs and lowering NFT costs has decreased. They now rank 12th and 15th, respectively. One possible reason is the improved scalability of L1 and L2. An example is Polygon's transition to zkEVM rollups, which significantly reduces transaction latency and aggregates numerous transactions into one, thereby reducing costs. In 2021, many blockchain games required players to purchase at least one NFT to play. Especially as NFT prices rebounded from the bull market, the cost for new players to purchase NFTs on the secondary market increased. Today, most games have adopted a free-to-play model, allowing players to start the game without having to purchase NFTs upfront. Therefore, the cost of NFTs is no longer an issue, as most web games no longer require players to purchase NFTs to start playing.

Achieving Web3 Growth: User Acquisition, Distribution, and Expansion

The life and death of games depend on two metrics: user acquisition (UA) and user retention. For decades, Web2 games have relied on a centralized model to collect personal data such as age, gender, and geographic location. They have used a reliable set of methods to launch and scale products and attract new players, including advertising on Facebook, Twitter, YouTube, and Twitch, as well as in-app promotions and email marketing.

In contrast, Web3 games prioritize user privacy and operate on decentralized platforms, making it difficult to collect all the conventional data required for traditional user analytics. However, unlike traditional user analytics strategies, Web3 native approaches often emphasize provable community engagement, decentralized governance, and token incentives. Users are seen not only as consumers but also as active participants contributing to the development and sustainability of the network. This approach aims to foster a sense of ownership and collaboration by redistributing value and decision-making power among participants, creating a more inclusive and fair digital ecosystem.

Challenges in User Acquisition for Web3

In 2022, user acquisition and accessibility were the biggest challenges facing the industry, with 51.0% of respondents considering it a top issue. This trend continued in 2023, with 55.1% of respondents once again listing it as a top concern. There are still many obstacles hindering blockchain games from entering the mainstream. For example, the largest digital game distribution platform in the PC gaming space, Steam, prohibits any form of cryptocurrency or NFT transactions. Web3 games must redirect any transactions outside of Steam or use third-party programs, making the transaction process more cumbersome. This ban is not permanent, but it has caused harm to the entire industry by closing off a Web3 game discovery channel from a Web2 giant.

App stores also impose restrictions. The Apple App Store treats all Web3 and NFT projects equally with traditional applications, charging a 30% commission on all transactions completed using its marketplace. On the other hand, Google Play has been slow in supporting Web3 games. Google itself has been supportive of blockchain technology and recently changed its policy to allow blockchain applications to run on Google Play. However, this change only occurred in mid-2023, meaning many developers are just starting to develop blockchain games for Android phones.

Opportunities for Key Participants in Web3

The Epic Games Store has already released dozens of Web3 games on its platform and plans to release more games in the future. These games include "Illuvium," "GRIT," and "My Pet Hooligan." Amazon Prime Gaming has partnered with WAX game studios for the game "Brawlers," offering exclusive in-game items and physical prizes. The game "Mojo Melee" has also entered into a six-month collaboration with Amazon Prime Gaming, offering prizes every month.

New Methods for User Acquisition

Blockchain technology provides unique possibilities for user experience. One of the earliest attempts was the popular "play-to-earn" (P2E) model in 2021. Players could earn reward tokens and airdrops while continuing to play games. In 2021, as high as 67.9% of respondents believed that "P2E" was the biggest industry driving force. This model was unique when the gaming industry was just emerging, prompting many players to eagerly try it out.

While "play-to-earn" is no longer seen as the primary industry driving force, it does provide possibilities for new user acquisition strategies. Many BGA members are exploring the following Web3-native user acquisition, distribution, and analytics methods:

On-chain targeting: Being able to see on-chain activity means developers can track wallets participating in Web3 games or NFTs. Marketing to them or directly inviting addresses can help with user acquisition and expansion. Companies and developers can also utilize data tracked from player on-chain activity to gain more specific insights into player behavior. For example, it will show player preferences for "play-to-earn" games or RPG games.

On-chain reputation: Blockchain provides players with the opportunity to build reputation online. Others will be able to view in-game achievements permanently and verifiably attached to the player's wallet. This provides players with the opportunity to showcase their reputation.

Web3 launches: Releasing on dedicated Web3 platforms helps increase visibility and target the audience companies want to reach. Additionally, many large Web3 and Web2 companies are now starting to offer programs to help develop this ecosystem.

Outlook for 2024

More Web2 Studios Transitioning to Web3 Adoption

Many Web2 studios have been experimenting with blockchain technology. Some companies are more openly experimenting, such as Square Enix and Ubisoft, while others are taking a "wait-and-see" approach. As these studios begin to consider the iteration of technology, they may gradually venture into Web3. According to survey respondents, mobile games and multiplayer games are the most likely to be adopted. Web2 studios can bring talent and experience, which may improve important aspects such as onboarding and user experience. Some studios may attempt to use on-chain assets, as there is still negative sentiment towards NFTs and blockchain, so some developers may present them as technical applications rather than explicitly promoting them as NFTs, blockchain, cryptocurrency, or Web3.

Artificial Intelligence in Blockchain Games Becoming a Hot Topic

Artificial intelligence has been a prominent topic in many industries this year, including blockchain games. With the popularity of generative artificial intelligence and large language models (such as ChatGPT), some respondents believe that blockchain games have been testing artificial intelligence for Web3 games. For example, behavioral AI can make NPC dialogues richer, interactions more engaging, and also enhance their decision-making abilities. However, some are concerned that the ability to create games using artificial intelligence may lead to an oversupply of low-quality assets and collectibles. On the other hand, artificial intelligence can unleash unprecedented creativity.

Development and Launch of Large-scale Web3 Games

After two years of continuous development, it is possible that a large-scale blockchain game will become popular in 2024, triggering a chain reaction and attracting millions of new players to join Web3, changing the perceptions of most people. Historically, such games may initially be adopted and promoted in the Eastern world before being accepted in the Western world. This is similar to the widespread adoption of free games (such as "League of Legends") in the Asian region in the early 21st century, which was widely adopted globally before being accepted elsewhere.

Blockchain Games Will Simply Be Called "Games"

Currently, there is a separation between Web2 and Web3 games, but it is expected to change. As more Web2 studios explore blockchain technology, they may strive to integrate blockchain technology into existing game elements, making it almost imperceptible to players and making it part of the game rather than an additional feature, to ensure the overall game experience is appealing to existing player groups.

End of Predatory Revenue Models

Free games have completely changed the gaming industry by eliminating barriers to entry. However, it has also led to some developers engaging in predatory practices, attempting to extract more profits from players, whether through pricing game features or inducing fear of missing out through imposed limited-time offers. With more games adopting blockchain technology, 2024 marks a shift towards a transaction-centered environment, benefiting both developers and players. With this new model, we will see the end of predatory practices in games.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。