Dan Robinson of Paradigm, a key investor in the Ethereum L2 platform Blast, has recently discussed the project’s launch via the social media platform X. Robinson cited issues with the messaging and execution, particularly the decision to launch the bridge before the L2 and the restriction on withdrawals for three months.

He remarked, “We at Paradigm think the announcement this week crossed lines in both messaging and execution. For example, we don’t agree with the decision to launch the bridge before the L2, or not to allow withdrawals for three months, since we think it sets a bad precedent for other projects. We also think much of the marketing cheapens the work of a serious team.”

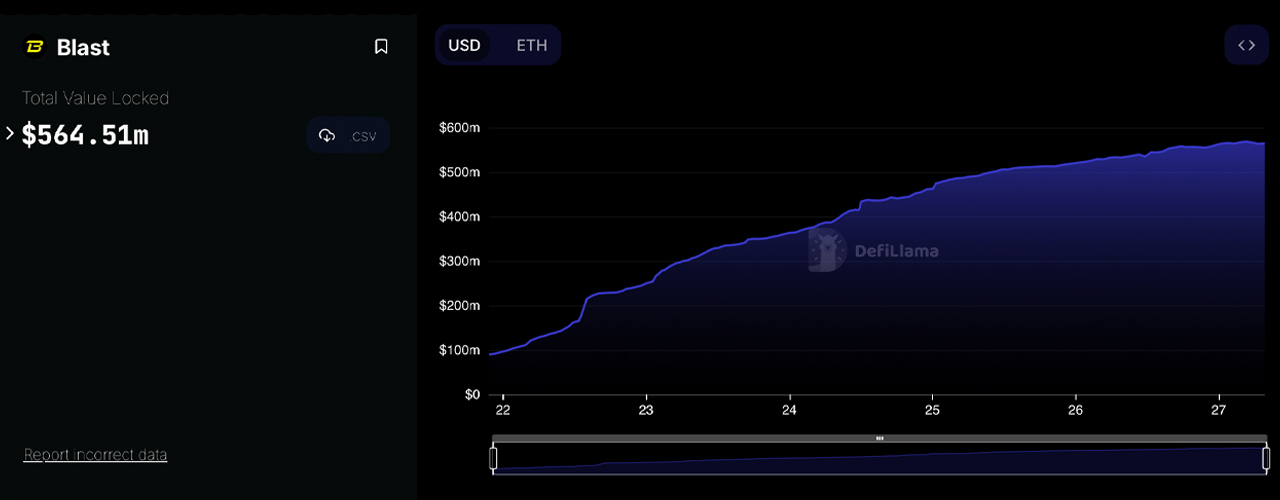

Total value locked in the decentralized finance (defi) protocol Blast according to defillama.com statistics.

Despite these concerns, Robinson acknowledged the team’s proven track record, including their previous work on Namebase and Blur. He stated, “We backed Pacman and his cofounder because they demonstrated an ability to build great products over many years.” Robinson also shared insights into his collaboration with the team on the NFT-collateralized lending protocol, Blend, emphasizing their technical talent and vision for scaling Blur through the L2 chain.

Paradigm, known for its role in investing in the crypto ecosystem, takes its responsibility seriously, according to Robinson. He mentioned ongoing discussions with the Blast team and Paradigm’s commitment to investing in strong, independent founders. “We invest in strong, independent founders who we don’t always agree with. But we understand that people may look to us to set an example on best practices in crypto. We don’t endorse these kinds of tactics and take our responsibility in the ecosystem seriously,” said Robinson.

Addressing the allegations of Blast being a Ponzi scheme, Pacman, the entrepreneur behind the platform, offered an explanation of the yield mechanics. He clarified that the yields come from sources like Lido and Makerdao, stating, “The yield that Blast provides users can feel too good to be true, so this meme is understandable. But to put it simply, the yield Blast provides comes (initially) from Lido and Makerdao.”

Pacman also refuted claims about Paradigm’s involvement in Blast’s go-to-market (GTM) strategy, emphasizing the independence of their approach. “Paradigm had zero involvement in Blast’s GTM. Candidly, they probably would have asked me to change a lot about Blast’s launch if they had been involved,” he explained. He highlighted Paradigm’s expertise in technical design and their contributions to Ethereum development.

In response to criticism over Blast’s invite rewards system, Pacman justified the approach as essential for building a robust community. He argued that such mechanisms are not new and are crucial for the growth of the platform. “If you are a user and help make Blast a thriving L2 by bringing friends along, you are providing real value and should be rewarded for that. That’s why invite rewards exist,” Pacman concluded.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。