With the recent news of Banana Gun token sale, it has once again sparked a wave of enthusiasm for TG Bots in this quiet market. Some people think that TG Bot is just riding the wave of Dogecoin's rise, while others believe that backed by the huge traffic pool of Telegram, TG Bot will be the beginning of the next huge narrative. This article will take advantage of these discussions and enthusiasm to review this controversial track and explore its future possibilities.

Why TG Bot Emerged

The Demand for Trading Experience

Telegram, as a highly open and free social application, has always been characterized by the use of open APIs to build third-party clients and scripts. Even before various Crypto-related Bots appeared, TG Bot had already formed its own ecosystem (although very scattered), mainly composed of various automation scripts and mobile push notifications, based on the logic of IFTTT, such as stock price tracking, RSS subscriptions, and group management, among others.

Due to the highly overlapping user base of Crypto and Telegram, and especially the poor Web3 user experience on mobile, even a simple trading process involves multiple steps or even jumps between multiple apps, and may also face risks such as congestion of public nodes and MEV attacks. Therefore, some sharp developers began to try to optimize the experience with the automation scripts of TG Bots, leading to the emergence of some Crypto Tracking & Trading Bots, with the most representative project being Maestro.

Early Quiet Trading Bots

Maestro is a TG Bot that integrates monitoring notifications and sniper trading. It is an old project that was released as early as October 2021. Initially named Catchy, it released its own token and the Bot had the function of monitoring ETH and BSC tokens and wallets, but it received little attention, and even its first token presale was delayed due to too few participants. It wasn't until August 2022, when the Sniping bot went online and the project was renamed Maestro, that it gradually began to accumulate a small wave of Trader users.

Unfortunately, no matter what operational methods the project tried afterwards, its user base and influence remained stuck at a bottleneck. On the one hand, at that time, users were not very sensitive to improving the trading experience, as it was generally taken for granted; on the other hand, for TG Bot to achieve various automated trades, it required the submission of wallet private keys, or the use of a custodial wallet generated by the Bot, which made it unacceptable to most security-sensitive Crypto users. This situation continued until the spring of 2023.

The Arrival of Dogecoin Season

With the token airdrop of Arbitrum in March, the sluggish crypto market ushered in a grand Dogecoin season. With the airdrop of "riding-type" tokens such as AIDOGE on Arbitrum in April, and the appearance of "meme-type" Meme Dogecoin such as PEPE on ETH, it laid the groundwork for a series of hundredfold or even thousandfold Dogecoin myths, including LADYS, TURBO, COCO, TEST, attracting a large amount of on-chain funds and Crypto users' participation.

However, due to the poor mobile trading experience, many users who could not stay in front of the computer 24/7 found it difficult to participate.Using copy trading as an example, if a user on a mobile app (interface, zapper, etc.) discovers that a target wallet has initiated a transaction and wants to complete the transaction copy, they would need to do at least the following:

Open the transaction details; Copy the token contract; Switch to the wallet app (Uniswap interface needs to be opened and login authorization completed in advance); Paste the contract address + click on risk confirmation; Enter the purchase amount; Confirm the quote and make the purchase;

The overall time consumption of this process will be approximately 10 seconds to 1 minute, depending on the user's speed and network speed. For time-sensitive Dogecoin, this means a world of difference. After all, the lifecycle of some Dogecoins may be only 3 minutes, and a difference of 1 second could mean the difference between selling and buying. This is a matter of life and death.

Therefore, more efficient tools have become the coveted "dragon-slaying swords" in the arena, with Trading Bots at the forefront, entering everyone's field of vision at this time.

In the case of copy trading, through the settings of the Trading Bot, not only can it automatically monitor and track specific wallets, but the delay in the copy process is basically only a few blocks, while also avoiding MEV attacks, and even automatically selling at a profit ratio.

Moreover, the "snatching 0-dollar" feature has turned operations that were previously only achievable by "scientists" into operations that anyone with hands (and money) can do. This is a very interesting development that fundamentally changes the balance between players. In any game, there are basically two important groups: the wealthy players and the skilled players. Skilled players gain advantages and status through outstanding skills, while wealthy players gain advantages and status through spending money. A good game balance allows both to achieve similar advantages at a certain point. However, in the past, wealthy players were basically at the mercy of the "scientists" until the appearance of Trading Bots completely changed this situation. Therefore, even a Bot like AlphaMan, which costs thousands of U.S. dollars in annual fees, still manages to have a stable user base.

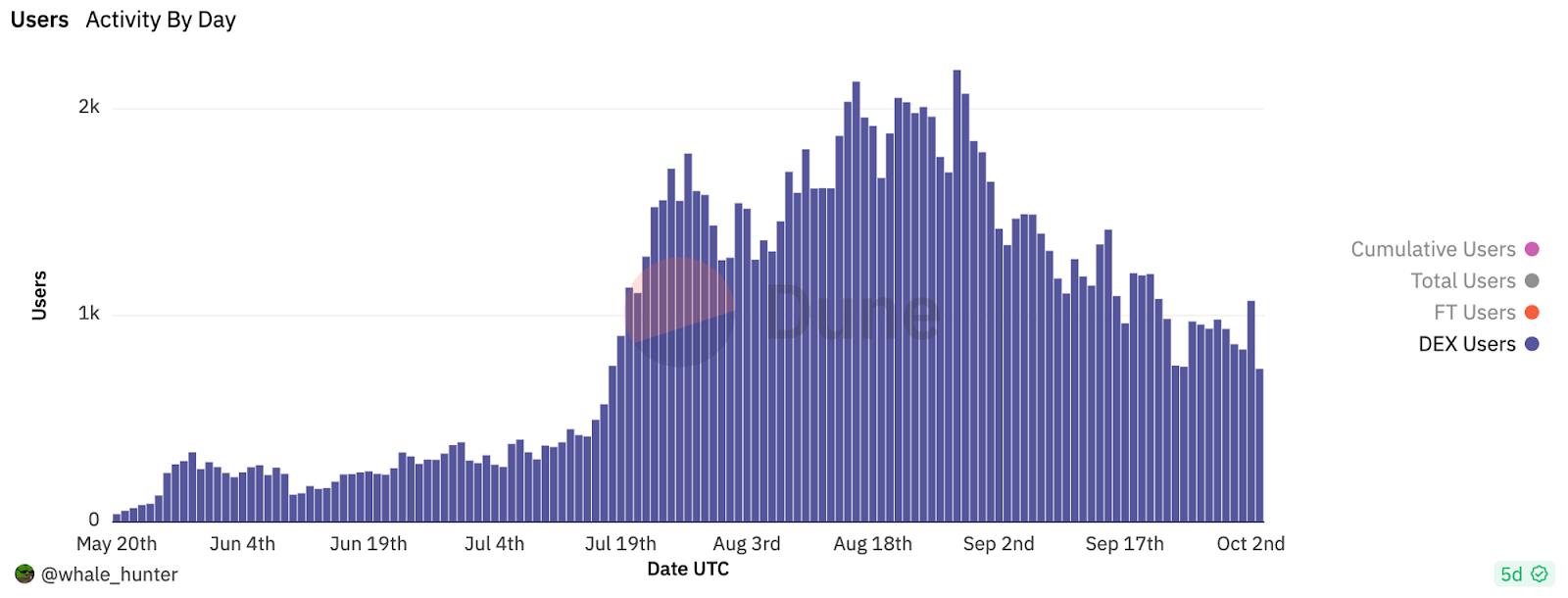

All of the above has caused Trading Bots, along with the entire TG Bot, to become popular, making it the first wave of Intent-centric applications to land. From the chart, it can be seen that the user base of the veteran project Maestro began to surge in the latter half of April.

During this period, Unibot, which entered the market, also rose with the popularity of Dogecoins such as $LOOT in July, the viral TikTok videos of $YYY, and the resurgence of Harry Potter $BITCOIN, and during this period, it launched the web version Unibot X, capturing a large wave of dual-end users with a high-quality trading experience. With the advantage of issuing tokens, Unibot successfully raised its token from $57 on July 15 to an ATH of $199, with a peak market value of $200 million, firmly securing the leading position in the TG Bot at that time.

Current Status of TG Bots

Still Dominated by Trading Bots

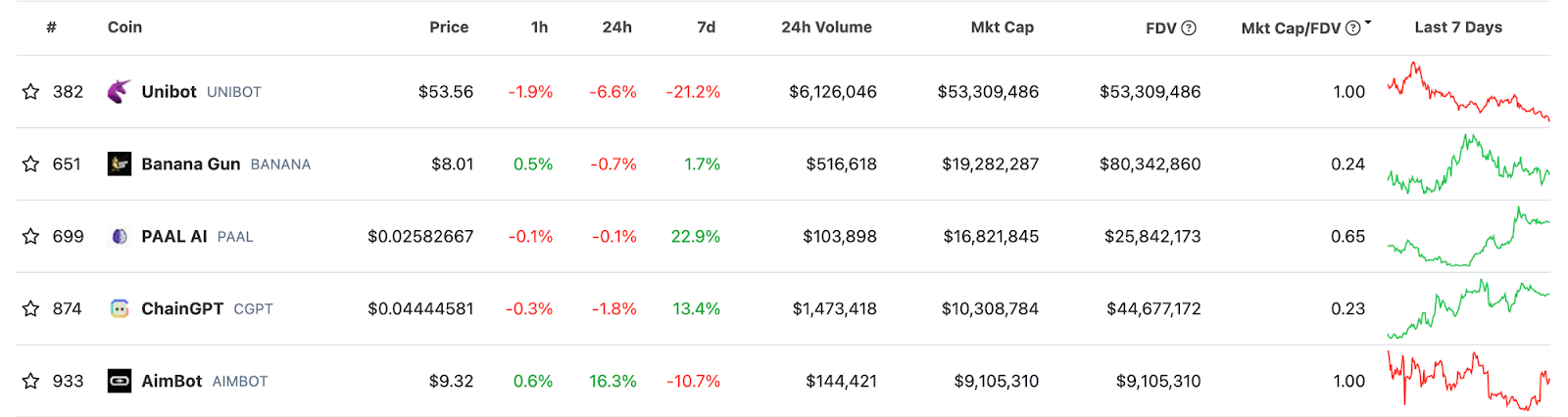

From the Telegram Apps section of Coingecko, it can be seen that the current top five in terms of market value are either two very pure Trading Bots* (Maestro has not issued tokens)*, or Bots that combine the concept of AI. However, in practical use, although they integrate AI, their core functionality still revolves around trading.

Among them, PAAL AI is a platform that allows users to deploy their own GPT Bots by customizing knowledge bases. It uses the GPT-4 model and can access network and real-time on-chain data to answer user questions. However, its core profit model mainly comes from a 4% bilateral trading tax on tokens. Currently, it is also developing its own mobile trading application, Paal X, which includes various common trading functions such as Sniping.

ChainGPT is similar, integrating AI into the functions of on-chain queries, contract generation, NFT generation, and contract auditing on top of the Trading Bot. AimBot, on the other hand, is an AI Trading Bot, with AI acting as the trader, and the profits obtained are distributed to Token Holders through the protocol.

Of course, apart from trading, there are also middleware-type Bots such as Collab.Land and Guild.xyz; various TG wallets represented by @wallet; and game Bots mainly focused on casino games, and so on. Since these applications are relatively less decentralized compared to Trading Bots, their actual usage is difficult to analyze. However, the scenarios for these applications are generally more limited, so their overall popularity is not as high as that of Trading Bots.

For example, Gating Bots represented by Collab.Land and Guild.xyz are leaders in the Discord ecosystem, but due to the fact that Telegram's user identity/permission system is not as rich and diverse as Discord's, these Gating Bots are not very useful in the TG ecosystem, where a Channel/Group has a maximum of 2 levels of permissions: administrators and regular members.

Most wallet applications are based on the TON ecosystem, and wallets that are compatible with EVM also involve the issue of importing private keys. While importing private keys may be acceptable for local wallets, doing so in a social application is a behavior that many crypto users may be concerned about.

Although the audience for casino games may seem to overlap with the crypto audience, in reality, this is not the case. Cryptocurrency trading, especially the trading of various Dogecoins, already has a high level of speculation, enough to satisfy the needs of crypto gamblers. Additionally, most of the underlying operations of casino games are still centralized, which crypto users may not appreciate. While there are some completely decentralized gambling protocols that are interesting, they are fundamentally aimed at traditional gamblers and require these users to be familiar with Web3 operations. Therefore, the audience for these types of Bots is relatively small at the moment.

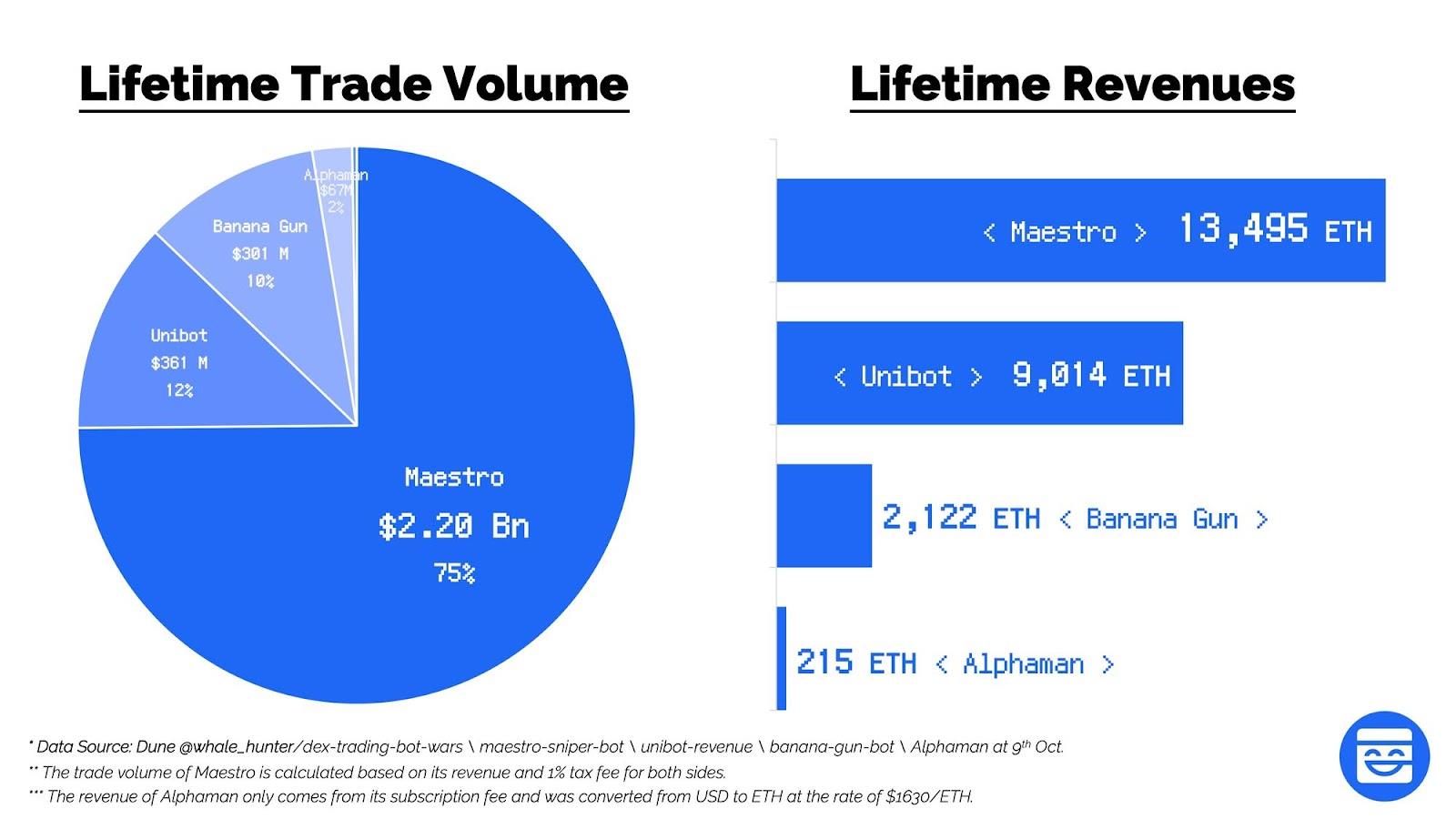

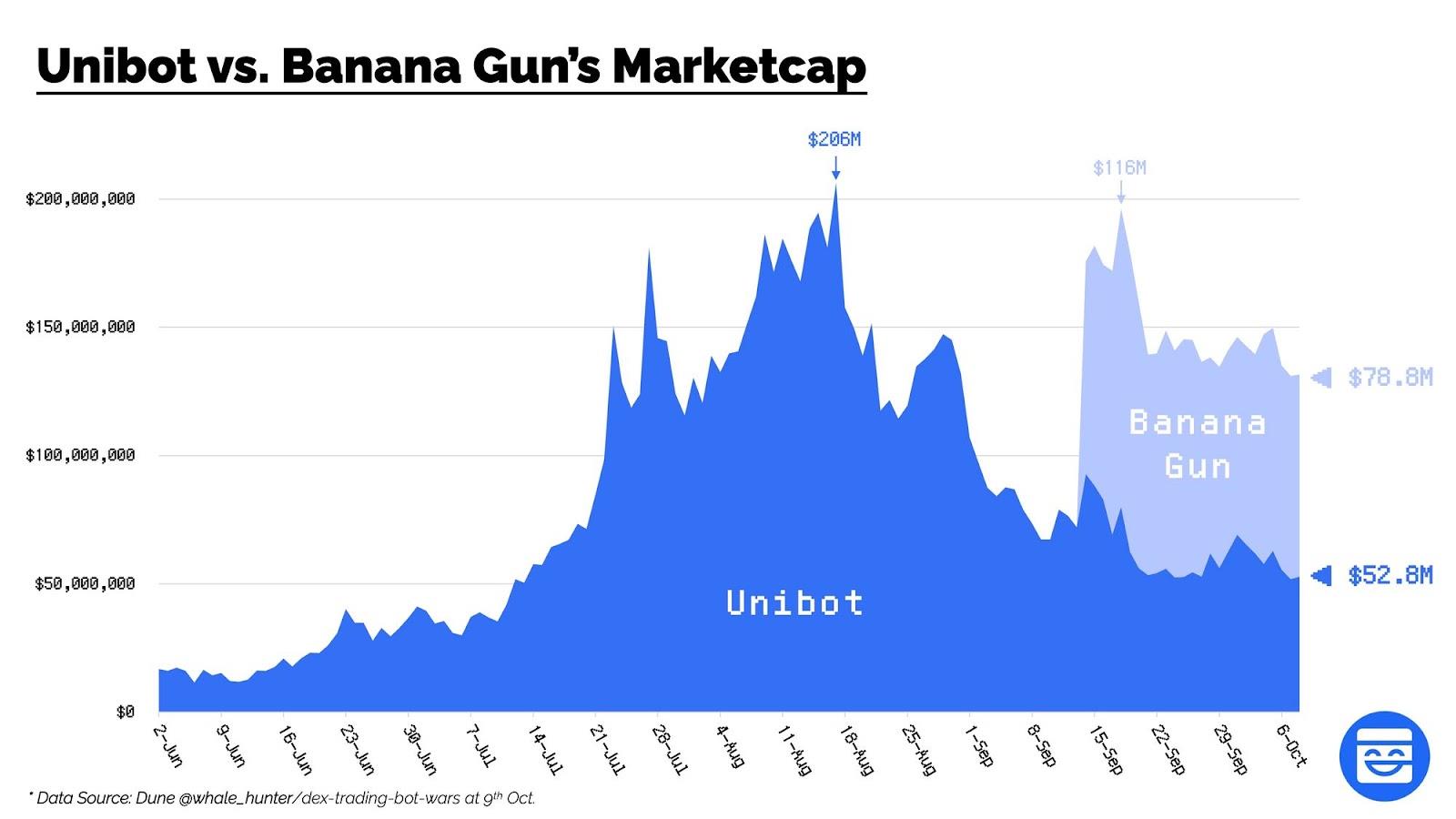

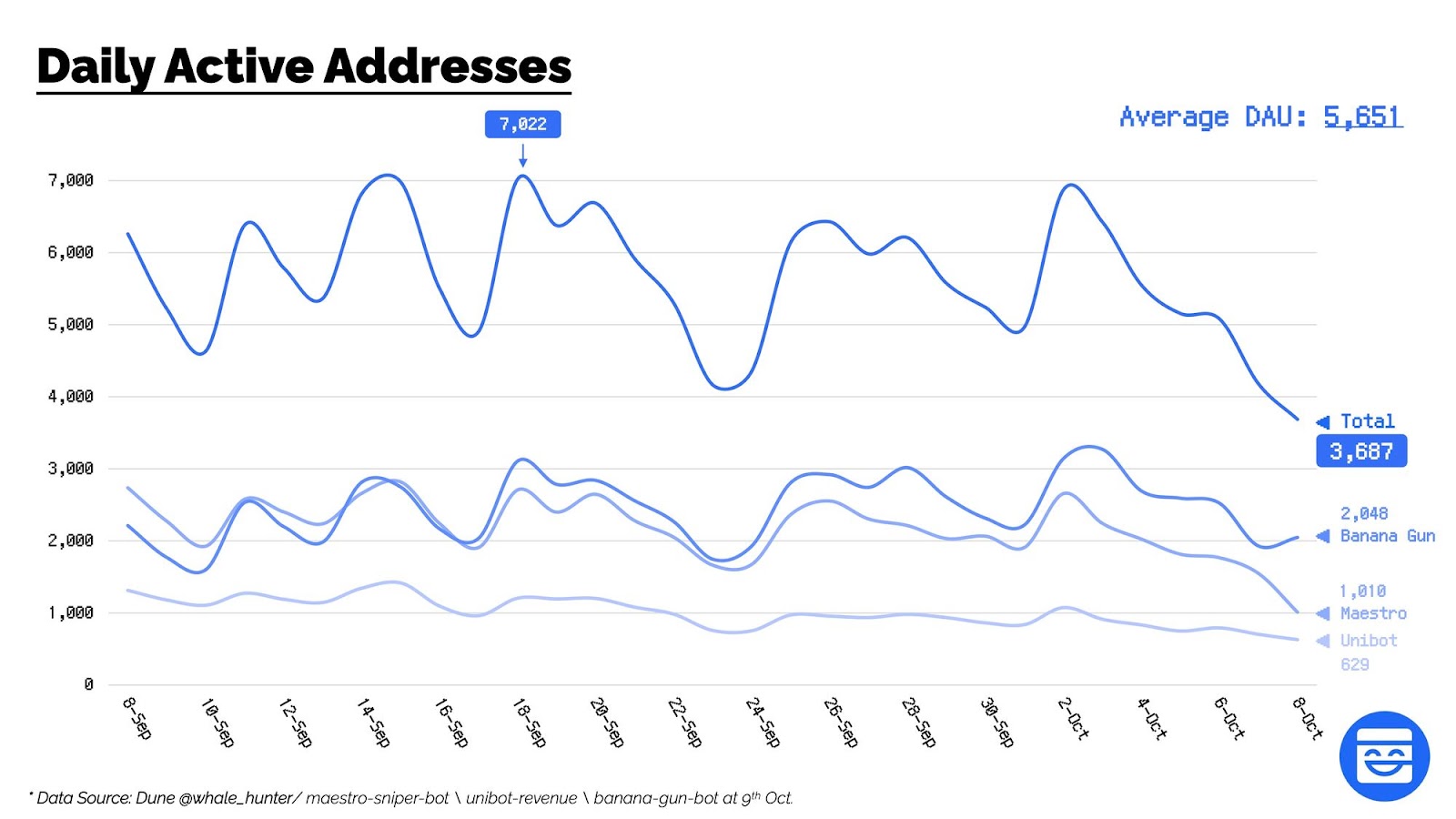

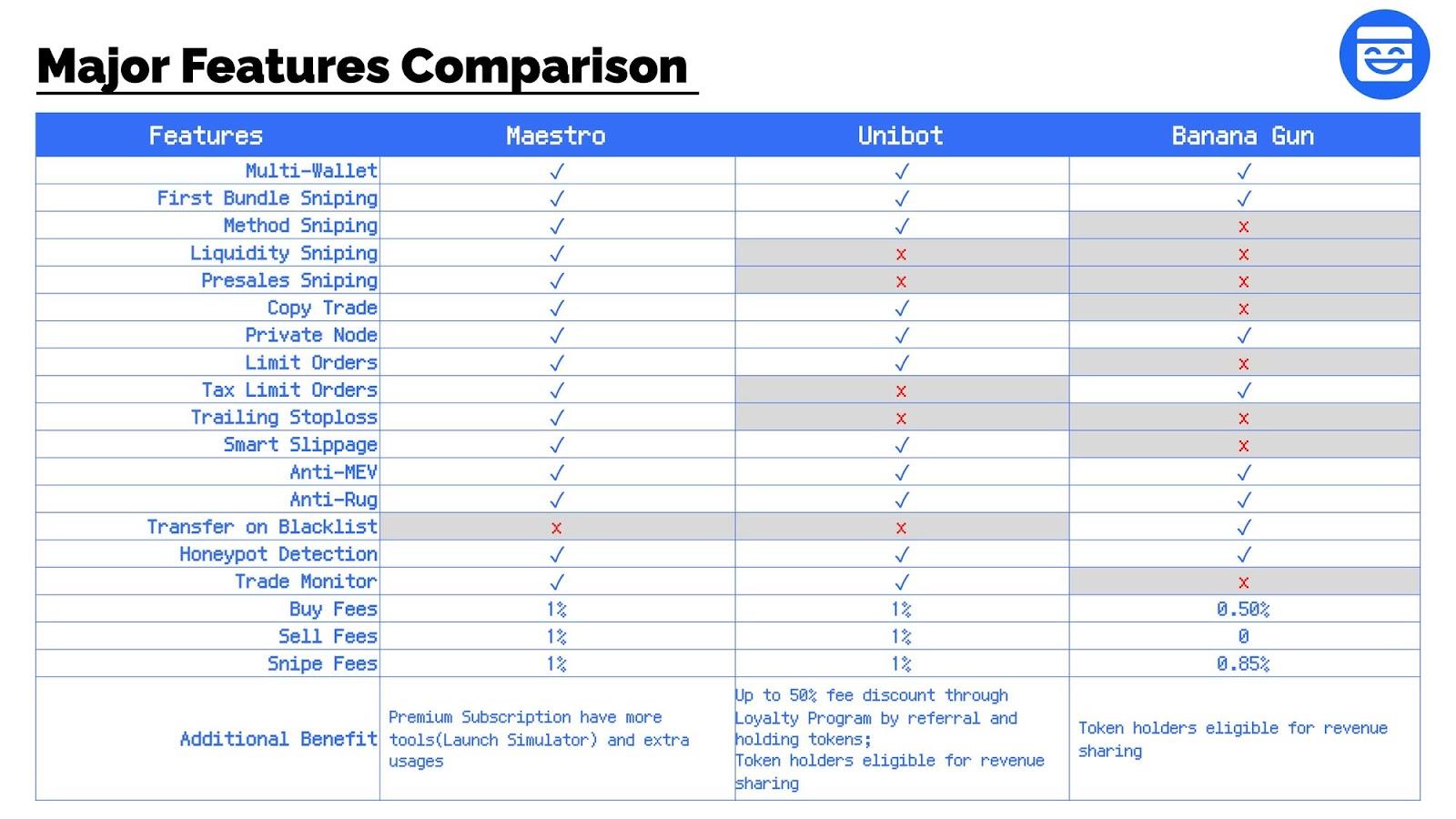

Therefore, it can be said that the entire Crypto TG Bot race is still dominated by Trading Bots. According to the data from Dune, as of October 8, 2023, the overall performance of Trading Bots in the relatively sluggish bear market is still quite impressive: The total trading volume reached $29.4 billion, with 74.9% coming from the well-established project Maestro, 12.3% from the former leader Unibot, 10.3% from the up-and-coming Banana Gun, 2.3% from DC Bot Alphaman, and the remaining approximately 0.2% from other projects. It is important to note that the Dune dashboard does not directly display Maestro's trading volume data. Unlike Unibot and Banana Gun, which have issued tokens, Maestro does not profit from token trading taxes. Therefore, all its income comes from a 1% trading service fee, and relying solely on trading services, its accumulated income has reached 13,495 ETH (approximately $22 million) to date, from which its historical total trading volume can be calculated. In terms of token market value, Unibot had dominated the market with over 90% to 95% of the market value before the appearance of Banana Gun. At its peak, Unibot's market value reached $200 million. However, with the launch of Banana Gun's tokens on September 14, it quickly seized market share due to lower fees, similar user experience, and high social popularity, becoming the new leader. Currently, the total market value of Trading Bot tokens is $137 million, with Banana Gun accounting for 57.3% and Unibot accounting for 38.4%, together occupying 95.7% of the total market value. In terms of user numbers, the average DAU (Daily Active Users) of the top 3 bots in the past month is 5,651 addresses. Both the new leader Banana Gun and the established Maestro have similar user numbers, with around 2000 addresses daily, while Unibot has relatively stable numbers of around 1000 addresses daily. However, all have experienced varying degrees of decline due to the recent cooling of the crypto market. Overall, from the perspective of Web3 products, Trading Bots have performed well in both revenue and user data, even in the current relatively quiet trading environment. The top 3 projects have relatively stable user numbers of over a thousand daily, although they undoubtedly include many bot scripts. From the project's perspective, they still hold value. Currently, the long-standing Maestro, which has not issued tokens and relies solely on service fees, still generates a daily income of approximately 40 to 80 ETH. Since we are talking about income, let's briefly break down the Trading Bot business model. In fact, whether it's TG Bot or Discord Bot, they are basically similar at this stage: Product Functionality In terms of product functionality, it mainly includes buying, selling, and trading assistance. Buying The core of the buying section is the token sniping function. Sniping usually involves 3 methods: First Bundle Sniping, which involves monitoring the first transaction of a token and bribing miners to include your transaction in the first block, with the success rate depending on the amount of money offered; the other two methods are Method Sniping and Liquidity Sniping, which involve monitoring specific functions in the contract or liquidity addition behaviors to complete the sniping, requiring users to have a certain level of blockchain technical knowledge and may fail due to special settings in some token contracts. Two other relatively important functions in the buying section are **Copy Trade** and Presales Sniping, which involve monitoring the trading activities of specific wallets and copying them, and purchasing hot token presales using whitelisted addresses, respectively. Banana Gun also has a special buying function called Tax Limit Orders, which triggers the buying action only when the buying or selling tax reaches the target position. Selling The selling section is relatively simple, mainly including Limit Orders, Trailing SL, and Transfer on Blacklist. Trading Assistance This is a relatively common and general function, including private nodes, MEV attack prevention, and front-running detection, mainly to accelerate trading speed and reduce trading losses. Below is a comparison of the functions after using the 3 mainstream products: Overall, Maestro has the most comprehensive functionality, with its own Call Channel for various operations and strong systematization; Unibot has the clearest and most organized operations, making it very suitable for beginners, and can be directly linked to the UnibotX web platform; Banana Gun is the simplest and most straightforward, focusing on core functions and affordability. First of all, the common income source for Trading Bots is the trading fees. From the above chart, the general fee rates are between 0.5% - 1%, and other Bots are similar. The different parts are divided into token issuance projects and non-issuance projects. Token Issuance Projects For token issuance projects, another source of income is the trading tax on project tokens, as well as token unlocking. Taking Banana Gun as an example, the team holds 10% of the token supply, with half locked for 2 years and the other half locked for 8 years, both with a linear unlock over 3 years. This part may not make much money in the short term. However, the token also has a 4% bilateral trading tax, with 2% going to token holders, 1% to the treasury, and the remaining 1% to the team. As of October 9th, the team's share of the trading tax over the past half month has reached 166 ETH (approximately $270,000). On the other hand, Unibot, with a larger scale, has earned 2,667 ETH (approximately $4.34 million) in team shares over the past 3 months under the same proportional structure. From the overall income composition, the trading tax on tokens generally accounts for more than 50-60%, becoming the main source of income for projects. The main uses of tokens are equity levels, fee discounts, and revenue sharing. Different projects will have different combinations, but revenue sharing is generally the core, as in the case of Banana Gun's token holders, who have no other rights besides enjoying the revenue sharing. Non-Issuance Projects For non-issuance projects, another source of income is through subscription fees. Subscription fees are divided into two types: threshold-based subscription fees, such as Alphaman and abot, where only paying users can use the Bot's functions, but these Bots often do not charge trading fees; and value-added subscription fees, such as Maestro, which, while charging trading fees, provide users with more usage quotas and additional tools. From a data perspective, the latter's performance will undoubtedly be better. On the one hand, threshold-based fees significantly reduce the conversion rate of new users, and on the other hand, the trading of meme coins is generally relatively high-frequency, resulting in higher-than-expected income from trading fees. Overall, TG Bots seem to be a transitional product in the Inten-centric trend, being lightweight, efficient, backed by the Telegram ecosystem, and having some potential for social dissemination. However, the completeness of its product presentation will always be inferior to a well-packaged application. Therefore, it can be seen that in the current main trading field, two different paths have emerged. One is to combine with AI, enriching other scenarios in the Inten-centric trend by integrating LLM led by GPT, and attempting to build Chatbots similar to Crypto AI Agents, with typical examples being Chain GPT and PAAL AI. The other is more practical, focusing solely on trading, complementing the product experience through mobile and web-based apps, deepening various trading functions, and potentially presenting a better wallet experience through AA in the future. The most representative example is Unibot, and the AI-focused PAAL AI is actually developing its own mobile app.Still Eye-catching Data in the Bear Market

Analysis of Trading Bot Business Models

Income Sources

Where is TG Bot Heading

So it can be seen that, from its underlying logic, TG bots are very close to the Intent-centric approach. The essence of Intent-centric is actually a concept that is not common in the Web2 world (the closest might be user-centric), but due to the overall relatively immature development of blockchain applications, many interactive operations are cumbersome, indicating that it will inevitably move towards a more simplified and refined stage. Therefore, rather than saying Intent-centric is a concept, it is more like an established trend and direction, and Bots will be an important manifestation of it.

At the same time, backed by a huge social ecosystem like Telegram, I believe that even in the mature future of Intent-centric, TG Bots will not disappear, but will serve as carriers of specific vertical modules and social entry functions, relying on the openness of the Telegram ecosystem to achieve the composability of the decentralized blockchain ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。