Title: "Understanding the Correlation between Bitcoin Price and Mainstream Assets such as US Stocks through 6 Charts Over a 10-Year Period"

Source: R3 PO

Author: WealthBee

As the giants step up their pace to enter the Bitcoin market, the financial asset properties of Bitcoin are becoming increasingly strong. Although Bitcoin is considered an independent asset with its own price trends, as Bitcoin further becomes an important part of the global financial system, its correlation with traditional assets will inevitably increase.

Over a period of more than ten years from 2012 to the present, we discuss the degree of correlation between Bitcoin and risk assets (US stocks), safe-haven assets (US bonds and gold), and the global macroeconomic cycle (commodity index). We focus on the period after Bitcoin's price successfully broke through and stabilized at $1,000, and analyze the correlation between Bitcoin and other assets after 2017.

In the early stages, Bitcoin went through a period of exploration and imitation because when Bitcoin first appeared, people did not fully understand its nature and potential, and the value and uses of Bitcoin were not clear at this stage, leading mainstream investors and institutions to be cautious about it.

However, over time, Bitcoin's decentralized nature and fixed supply limit attracted increasing attention and trust, gradually shaping Bitcoin and ultimately gaining mainstream recognition. Especially since 2017, the price of Bitcoin has shown increasingly strong correlation with four traditional assets: US stocks, US bonds, gold, and commodities.

From the stage of exploration and indistinct positioning to clear positioning and maturity, the evolution of Bitcoin over the past decade has not only witnessed its price curve growth but also its increasingly prominent position in the global asset market.

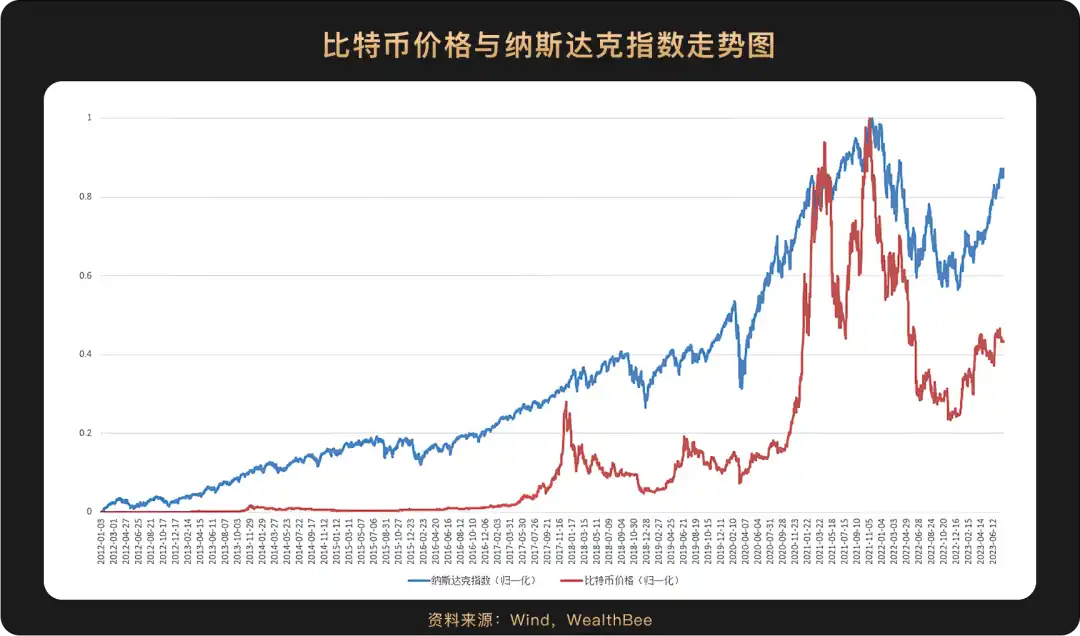

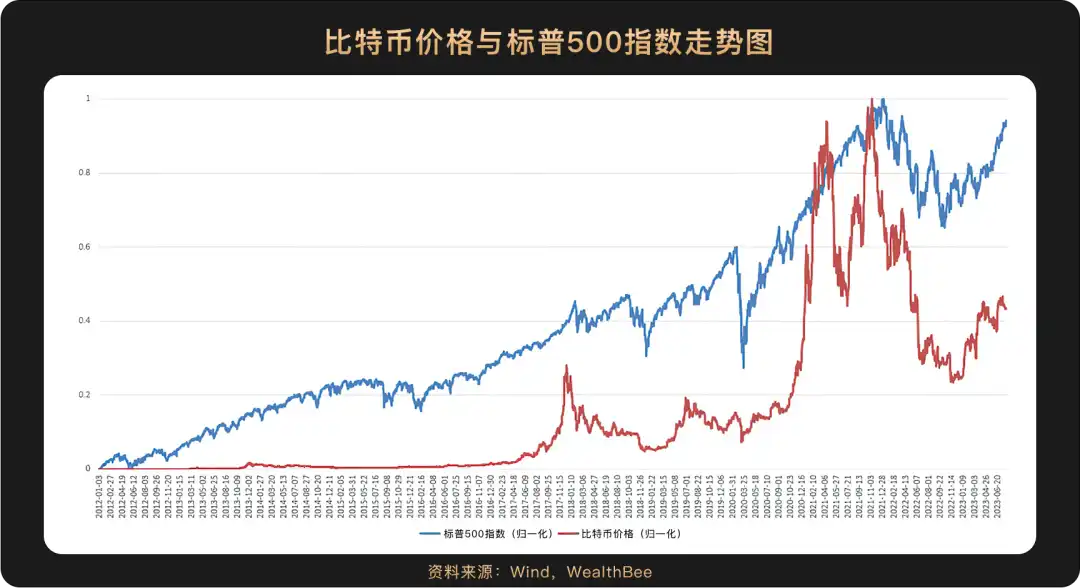

1. Bitcoin and US Stock Trends: Strong Correlation

From the charts, it is clear that the trend of the US stock index is highly correlated with the price of Bitcoin. Calculations show that before 2017, the correlation coefficients of Bitcoin with the Nasdaq and S&P 500 were 0.6996 and 0.7217, respectively (Pearson correlation coefficient), after Bitcoin's price broke through $1,000 in 2017. Both reached near-synchronous phase highs near the end of 2017 and near the end of 2021, followed by synchronous declines and rebounds. After 2017, the correlation coefficients of Bitcoin with the Nasdaq and S&P 500 were 0.8528 and 0.8787, respectively (Pearson correlation coefficient). A comparison shows that the correlation between Bitcoin and US stocks has gradually strengthened. After 2017, the correlation coefficients were both greater than 0.8, falling into the category of strong correlation.

2. Bitcoin and Gold Price Trends: Moderately Linearly Correlated

We chose London spot gold (XAU) as the anchor for analyzing the gold price trend. Gold is a typical safe-haven asset. From the chart, it can be seen that before 2016, the gold price was gradually decreasing while the price of Bitcoin was slowly rising. Subsequently, their trends showed convergence, with both reaching phase highs in 2018. In August 2020, the gold price reached its highest point and then declined, while the price of Bitcoin quickly rose thereafter, entering a major bull market. The peak of the Bitcoin price coincided with a temporary low point in the gold price (2021). However, after November 2022, both bottomed out and rebounded, showing consistent trends.

Similarly, we chose 2017 as the watershed. Before 2017, the correlation coefficient between the two was -0.6202, indicating a relatively clear negative correlation trend; after 2017, the correlation coefficient was 0.6889 (Pearson correlation coefficient), indicating a moderately linear correlation.

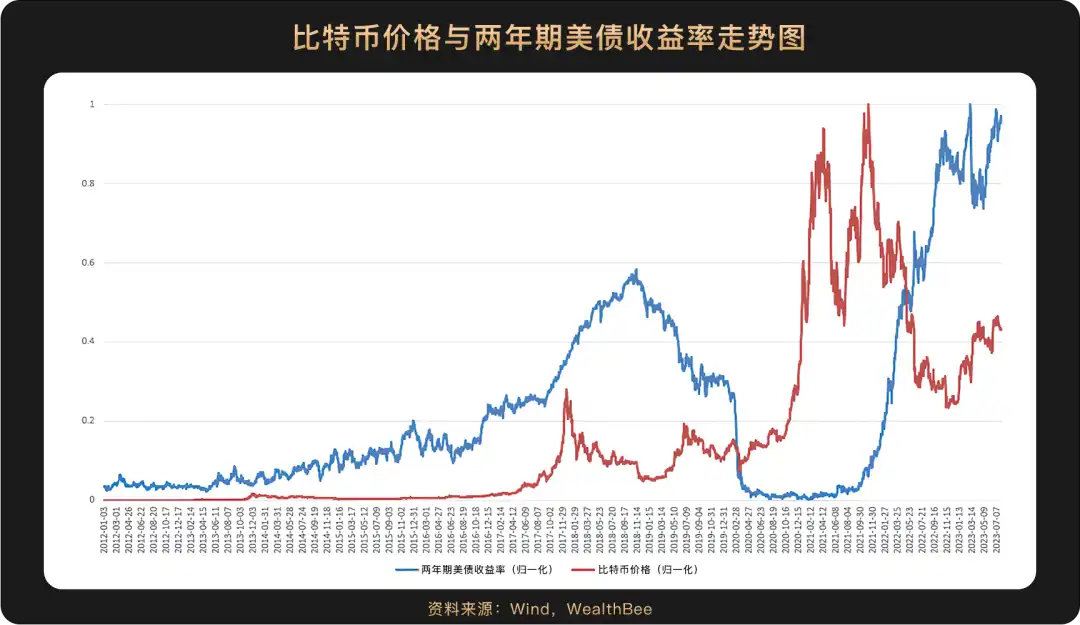

3. Bitcoin and US Bond Yield Trends: Low Degree of Correlation and Negative Correlation

We chose the most representative US ten-year and two-year Treasury bonds, assuming that they represent long-term risk-free interest rates and short- to medium-term risk-free interest rates, respectively. Similar to gold, US bonds are typical safe-haven assets. From the chart, it can be seen that both the ten-year and two-year yields show relatively poor correlation with the price of Bitcoin. In particular, the two-year US bond yields were very low in 2020 and 2021, but the price of Bitcoin continued to rise. After testing the correlation after 2017, the correlation coefficients of Bitcoin with the ten-year and two-year US bonds were -0.1382 and -0.1756 (Pearson correlation coefficient), falling into the category of low degree of correlation and showing a negative correlation.

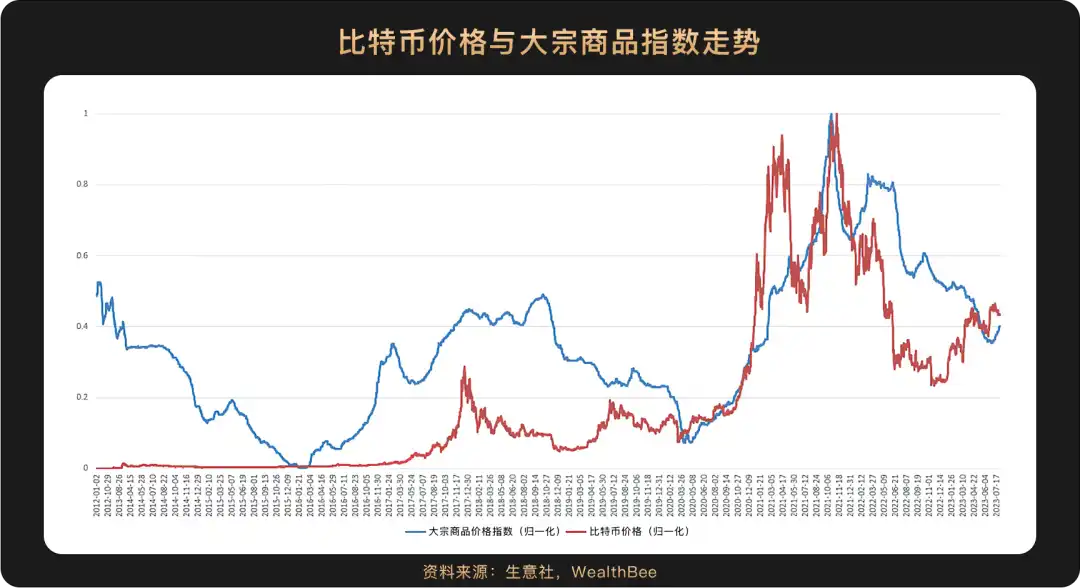

4. Bitcoin and Commodity Price Index: Moderately High Correlation

Commodity prices are influenced by many factors but can generally reflect the global macroeconomic cycle. From the chart, it can be seen that the correlation between the two is relatively high, both continuously rising after bottoming out in the first half of 2020, and nearly simultaneously reaching their highest points in November 2021, before starting to decline synchronously. Testing the correlation after 2017, the correlation coefficient between the two was 0.7184 (Pearson correlation coefficient), indicating a moderately high correlation.

5. Conclusion

Based on the above calculations and analysis, after 2017, the ranking of Bitcoin's correlation with other assets is as follows: "US stocks > commodities > gold > US bonds," showing high correlation with risk assets and the macroeconomy, but low correlation with safe-haven assets. Therefore, we can consider Bitcoin as a risk asset.

Fundamentally, the price movement of a financial product is influenced by two factors: changes in fundamentals and market risk preferences. When the global economy is doing well, such as when commodity prices are rising, market risk preferences naturally increase, causing Bitcoin to rise along with other risk assets like US stocks. With the US economy continuing to be strong and the widespread application of AI's large models expected to be the main driver of productivity growth in the next 10 to 20 years, along with the increase in productivity, it will be easier to accommodate more liquidity with interest rate cuts. Therefore, we have reason to believe that global investors' risk preferences will gradually increase, and more investment funds will flow into the market, at which time the price of Bitcoin will likely perform well.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。