Author: Jiang Haibo, PANews

Saddle Finance was once seen as a strong competitor to Curve and raised $11.8 million in two rounds of financing in 2021 from investors such as Coinbase Ventures, Alameda Research, Polychain, Framework Ventures, Nascent, and Electric Capital.

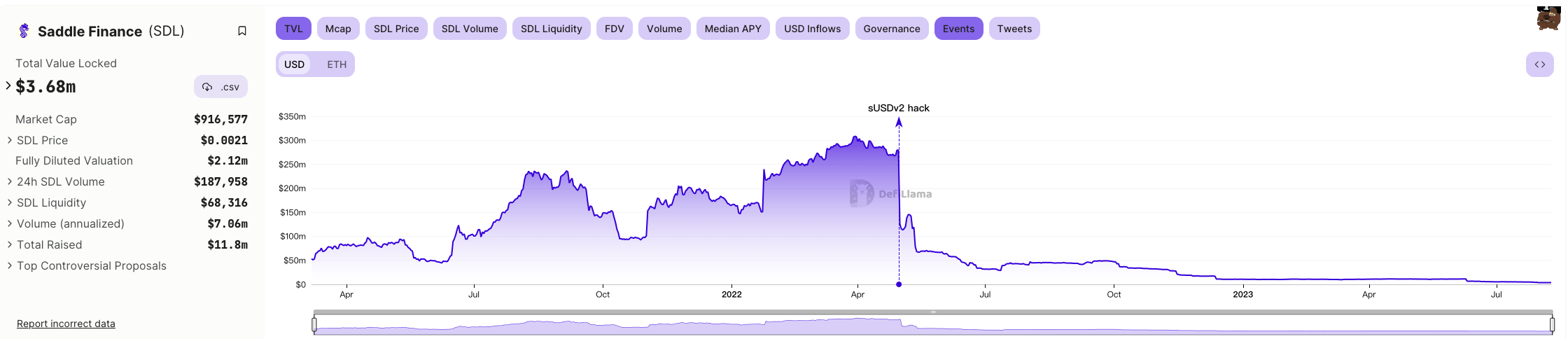

On August 8th, the Saddle community initiated a proposal to shut down operations and liquidate funds. According to DeFiLlama's data, the total value locked (TVL) in Saddle Finance is only $3.68 million, and the market value of the governance token $SDL is only $917,000. How did it develop to its current situation?

Top VC Support, Launch, and Airdrop Attract Popularity

An important difference between Saddle and Curve is that Curve is implemented in Vyper (the programming language that recently had a vulnerability), while Saddle has ported this code to Solidity, thus avoiding the impact of the recent Curve theft issue.

When launched in January 2021, Saddle announced that it had raised $4.3 million in seed funding from top VCs such as Coinbase Ventures, Alameda Research, Polychain, and Framework Ventures. Before the launch, Saddle also underwent audits from several security institutions including Certik, Quantstamp, and OpenZeppelin.

Saddle did not issue a governance token at the project's launch, but it was almost certain that it would. Because for DEX, liquidity is crucial, and projects like Curve have rewarded liquidity providers with valuable governance tokens when issuing them. The combination of top VCs, multiple security audits, and the expectation of an airdrop drew high attention to Saddle at launch.

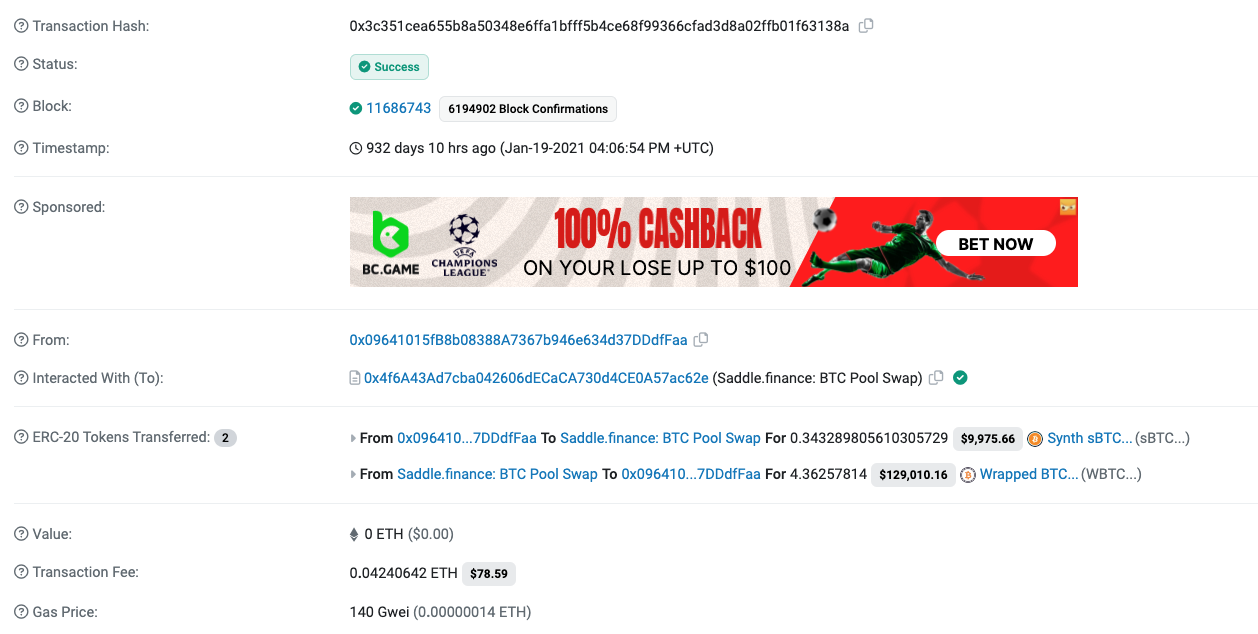

High expectations also brought some problems. At the beginning of the launch, liquidity providers flocked in. Due to the similar mechanism of Saddle and Curve, where a pool contains multiple similar assets, adding liquidity with the same asset would cause imbalance in the pool's assets' ratio and price, resulting in high slippage for those who continue to add liquidity. A transaction on Etherscan showed that at the early stage of Saddle's launch, a user exchanged 0.34 sBTC for 4.36 WBTC in Saddle's BTC pool, which meant that liquidity providers suffered permanent losses, and there were many such arbitrage examples at the early stage of the launch.

On November 17, 2021, Saddle announced the issuance of governance tokens and the launch of liquidity mining rewards, airdropping 15% of the total tokens to users. In mid-2022, the $SDL token began circulating. In addition to the $SDL airdrop, other projects also rewarded early liquidity providers of Saddle, such as $KEEP from Keep Network, and Keep Network, Saddle, and Fold are all projects under Thesis. This brought high visibility to Saddle during the early launch and airdrop period.

Stolen $11 Million, Beginning of Decline

On April 30, 2022, Saddle's sUSDv2 pool was hacked. This pool consists of liquidity tokens composed of Synthetix's sUSD and SaddleUSD-V2 LP tokens, which are similar to Curve 3pool's LP tokens and include DAI, USDC, and USDT stablecoins.

According to Rekt's report, this was due to an error in the old version of the MetaSwapUtils library, which did not use "VirtualPrice" to calculate the value of LP tokens during the transaction process. The hacker used flash loans to manipulate the price of sUSD/saddleUSD-V2, thus obtaining more sUSD.

During this process, $11 million was stolen from Saddle, but $3.8 million was returned by the white-hat hacker group BlockSec, which received a $380,000 bounty. Misleading statements from the Saddle team also caused dissatisfaction among users, such as "user funds are safe," which actually only referred to the portion returned by BlockSec.

As shown in the DeFiLlama TVL chart mentioned earlier, the liquidity in Saddle dropped from $280 million before the attack to $120 million after the attack.

In May 2022, with the collapse of UST, liquidity in Saddle dropped again to $70 million and has since been in a state of decline.

Liquidation Proposal

On August 8th, the Saddle community's SIP proposal suggested dissolving the community and distributing the remaining value of the protocol to $SDL and veSDL holders. The reasons for liquidation given in the proposal can be summarized as follows:

- Saddle's core vision has been achieved, and many core contributors plan to stop working by September 30, 2023.

- Recent Curve hacks indicate potential risks due to vulnerabilities in the protocol.

- The treasury value of the protocol has exceeded the circulating market value of the protocol token, and community members suggest distributing the DAO's $ARB airdrop to token holders.

- Continuing operations is an option, but it requires support from the community multisig and Delos HQ multisig, which is difficult to achieve long-term coordination and management.

The main funds held in the treasury at present are $1.545 million $ARB received from Arbitrum. The proposal suggests liquidating all remaining DAO funds into $ARB and distributing them to everyone based on the weight of their $SDL and veSDL holdings.

According to the proposal, the value of $ARB airdropped for each $SDL is approximately $0.0026. However, as of August 10th, CoinGecko shows the price of $SDL as $0.00209, lower than the expected airdrop value.

With almost no usage of the project and remaining funds in the treasury, liquidation is indeed a feasible way to end the project. In the Saddle community, most people agree with the liquidation. However, there are still some questions about the specific execution, such as the weight multiplier for $SDL and veSDL. The proposal suggests a 4x multiplier for veSDL and a 1x multiplier for $SDL; for the snapshot time, the proposal suggests at Ethereum block #17870642, which has already passed, meaning users who have funds on centralized exchanges will not be able to receive the airdrop.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。