关键要点

全球加密货币总市值为2.60万亿美元,较上周2.75万亿美元,本周内加密货币总市值跌幅为5.45%。截止至发稿,美国比特币现货ETF累计总净流入约360.7亿美元,本周净流出1.73亿美元;美国以太坊现货ETF累计总净流入约23.6亿美元,本周净流出4993万美元

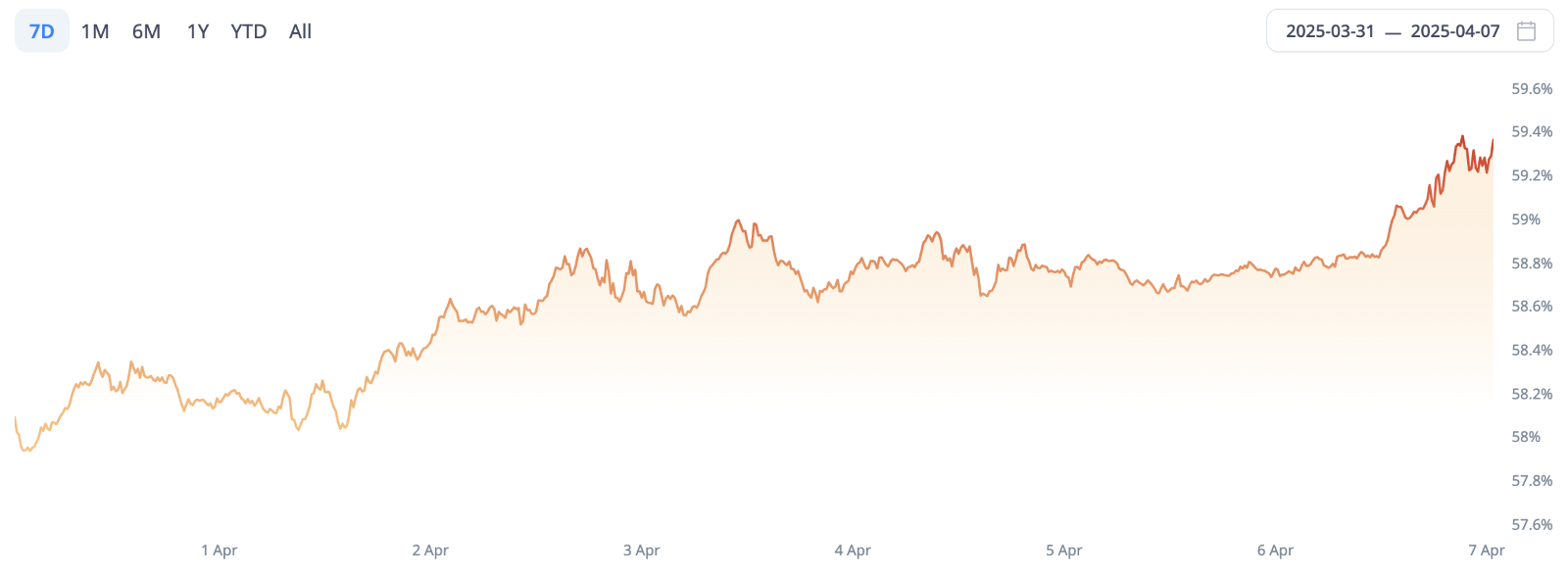

稳定币总市值为2,374亿美元,其中USDT市值为1,439亿美元,占稳定币总市值的60.6%;其次是USDC市值为603亿美元,占稳定币总市值的25.4%;DAI市值为53.7亿美元,占稳定币总市值的2.26%。

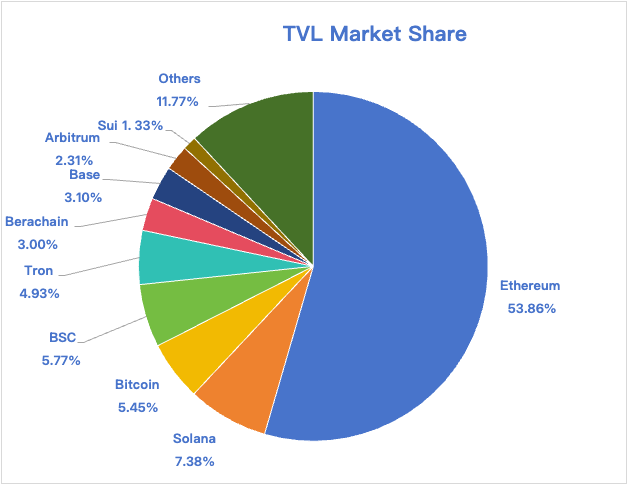

据DeFiLlama的数据,本周DeFi总TVL为904亿美元,较上周跌幅为2.2%。按公链进行划分,其中TVL最高的三条公链分别是Ethereum链,占比53.88%;Solana链,占比7.38%;Binance Smart Chain,占比5.77%。

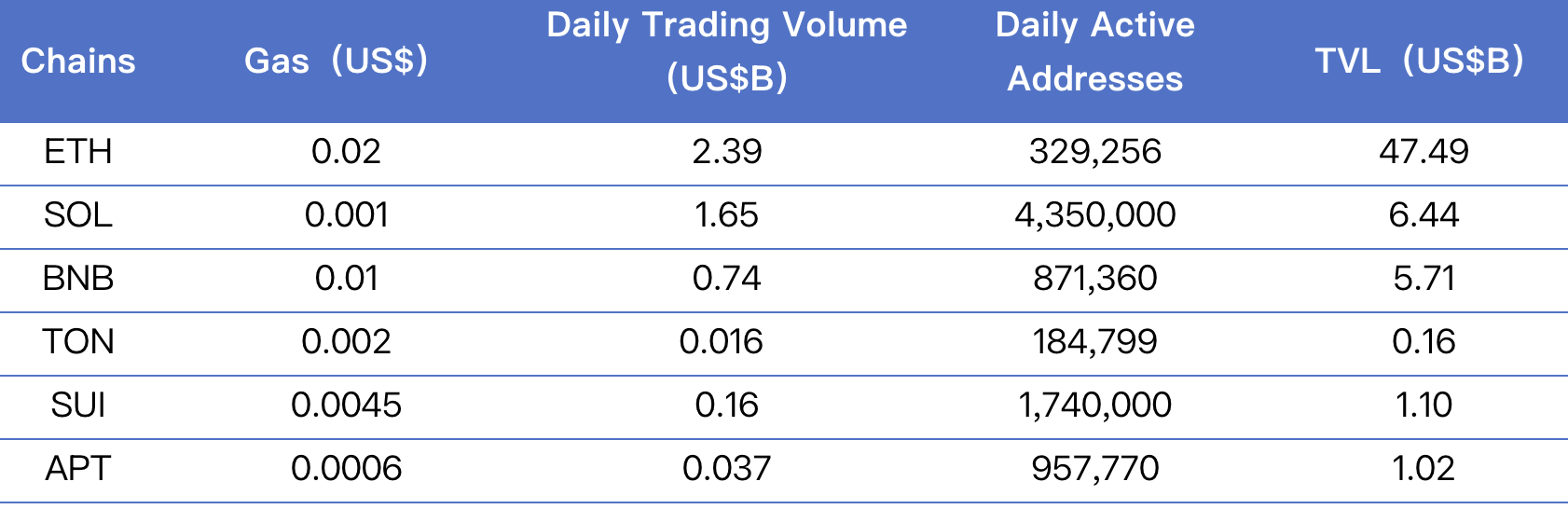

从链上数据看,本周Layer1公链日成交量整体上都有一定的下跌,其中Solana下跌最为显著,较上周跌幅约为60.15%;交易费用上,Sui增长显著,较上周涨幅为354.5%。从日活跃地址上看,Solana日活增涨明显,较上周涨幅约为70.6%,TON涨幅为38.4%;Aptos日活下降明显,较上周跌幅为65.1%。TVL方面,本周除BNB链和Aptos有一定上涨,剩下4条公链的TVL均有轻微下降。BNB链较上周上涨8%,Aptos上涨5%。

创新项目关注:Cambrian Network是一个整合链上与链下数据的 AI 基础设施协议,通过整合链上与链下数据,赋能 AI 代理进行市场预测和金融决策,支持多链网络,并提供数据访问与分析 API。项目已启动私测,计划推出测试网。Launcher Capital 是一个利用游戏化和区块链技术构建下一代人工智能代理的平台,旨在使多个代理在复杂环境中自主互动、学习和发展。KYD Labs是一个基于 Web3 的现场活动票务平台,利用区块链技术(智能合约与 NFT)提供安全、高效的票务解决方案,增强粉丝互动并提升主办方收益。

目录

4.ETH/BTC和ETH/USD兑换比例

5. Decentralized Finance (DeFi)

1.本周涨幅前五的VC币和Meme币

一.市场概览

1.加密货币总市值/比特币市值占比

全球加密货币总市值为2.60万亿美元,较上周2.75万亿美元,本周内加密货币总市值跌幅为5.45%。

数据来源:cryptorank

截止至发稿,比特币的市值为1.56万亿美元,占加密货币总市值的60%。与此同时,稳定币的市值为 2,374亿美元,占加密货币总市值的15.22%。

数据来源:coingeck

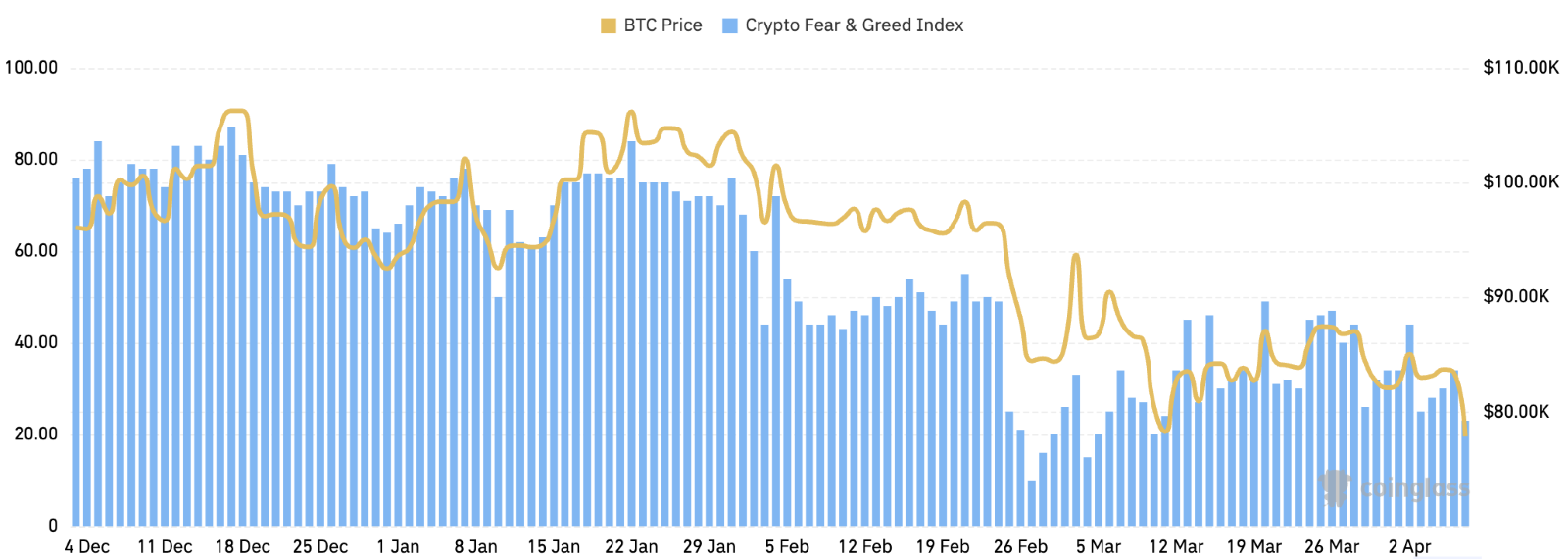

2.恐慌指数

加密货币恐慌指数为23,显示为恐惧。

数据来源:coinglass

3.ETF流入流出数据

截止至发稿,美国比特币现货ETF累计总净流入约360.7亿美元,本周净流出1.73亿美元;美国以太坊现货ETF累计总净流入约23.6亿美元,本周净流出4993万美元。

数据来源:sosovalue

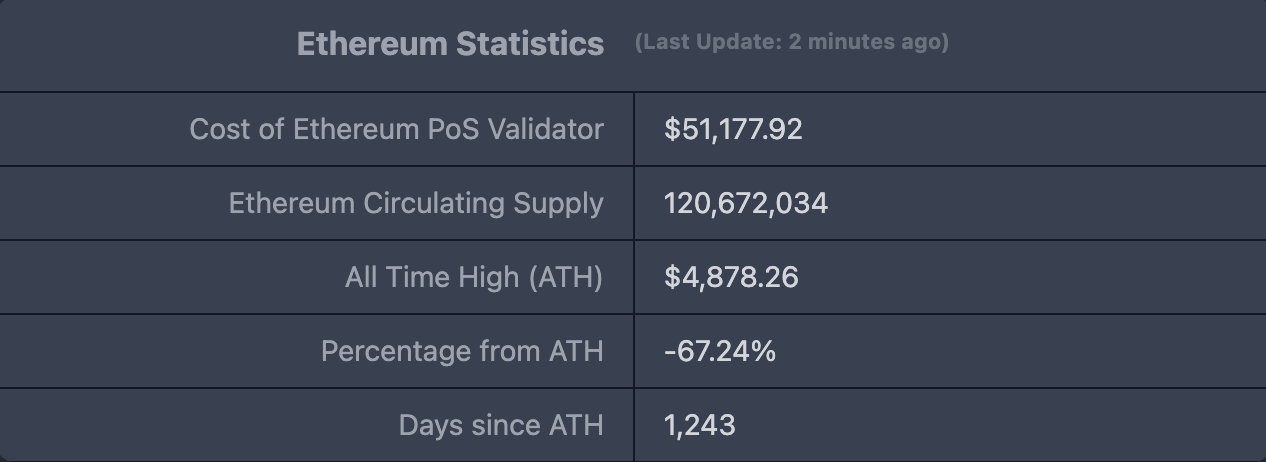

4.ETH/BTC和ETH/USD兑换比例

ETHUSD :现价 1,596.78美元,历史最高价 4,878 美元,距最高价跌幅约67.27%

ETHBTC :目前为 0.020261,历史最高为0.1238

数据来源:ratiogang

5. Decentralized Finance (DeFi)

据DeFiLlama的数据,本周DeFi总TVL为904亿美元,较上周($924亿)跌幅为2.2%。

数据来源:defillama

按公链进行划分,其中TVL最高的三条公链分别是Ethereum链,占比53.88%;Solana链,占比7.38%;Binance Smart Chain,占比5.77%。

数据来源:CoinW研究院,defillama

数据截止至2025年4月6日

6 .链上数据

Layer 1相关数据

主要从日交易量、日活跃地址、交易费用分析目前主要Layer1含ETH、SOL、BNB、TON、SUI以及APT的相关数据。

数据来源:CoinW研究院,defillama,Nansen

数据截止至2025年4月6日

● 日成交量与交易费用:日成交量和交易费用是衡量公链活跃度和用户体验的核心指标。本周日成交量整体公链,都有一定的下跌,其中Solana下跌最为显著,较上周跌幅约为60.15%;交易费用上,Sui增长显著,较上周涨幅为354.5%。

● 日活跃地址与TVL:日活跃地址反应了公链的生态参与度和用户粘性,TVL反应了用户对平台的信任程度。从日活跃地址上看,Solana日活增涨明显,较上周涨幅约为70.6%,TON涨幅为38.4%;Aptos日活下降明显,较上周跌幅为65.1%。TVL方面,本周除BNB链和Aptos有一定上涨,剩下4条公链的TVL均有轻微下降。BNB链较上周上涨8%,Aptos上涨5%。

Layer 2相关数据

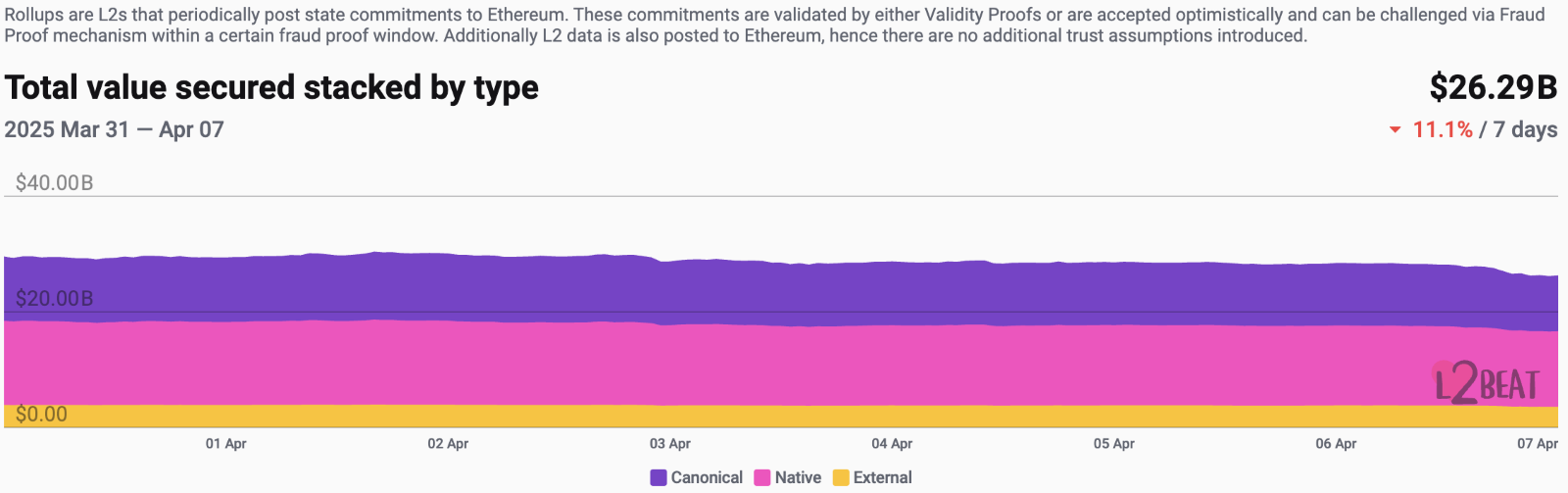

据L2Beat数据显示,以太坊 Layer 2总TVL为262.9亿美元,本周较上周($294.7亿)整体跌幅为10.79%。

数据来源:L2Beat

数据截止至2025年4月6日

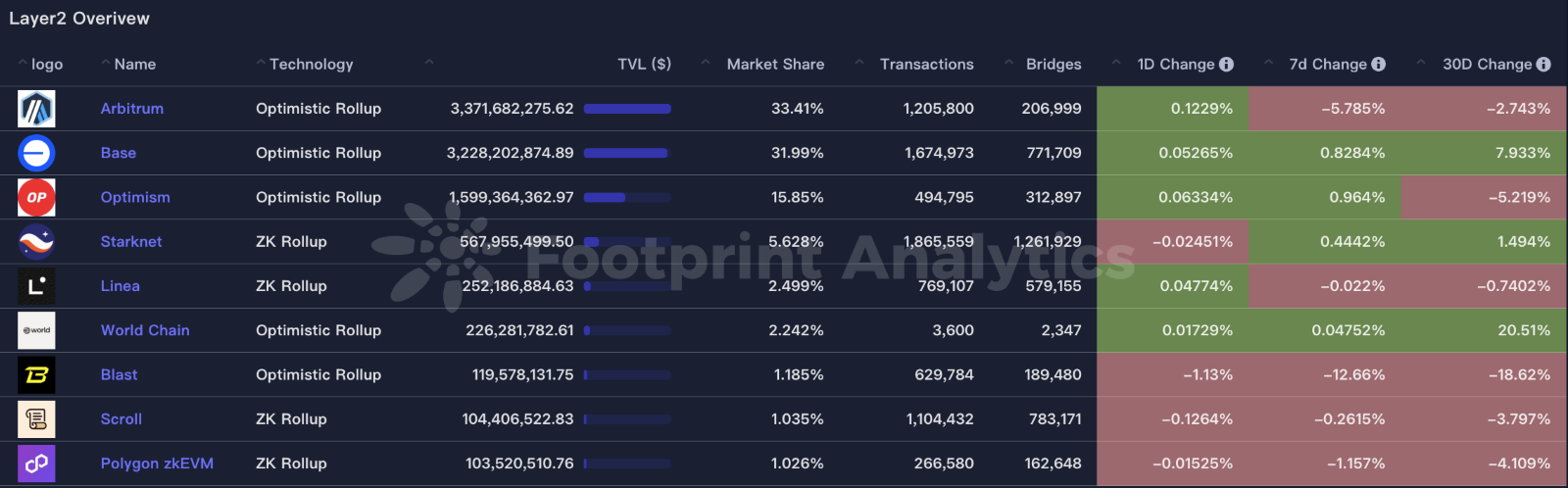

Arbitrum 和 Base分别以33.41% 和 31.99% 的市场份额占据前排,但整体占比都有所上涨。

数据来源:footprint

数据截止至2025年4月6日

7. 稳定币市值与增发情况

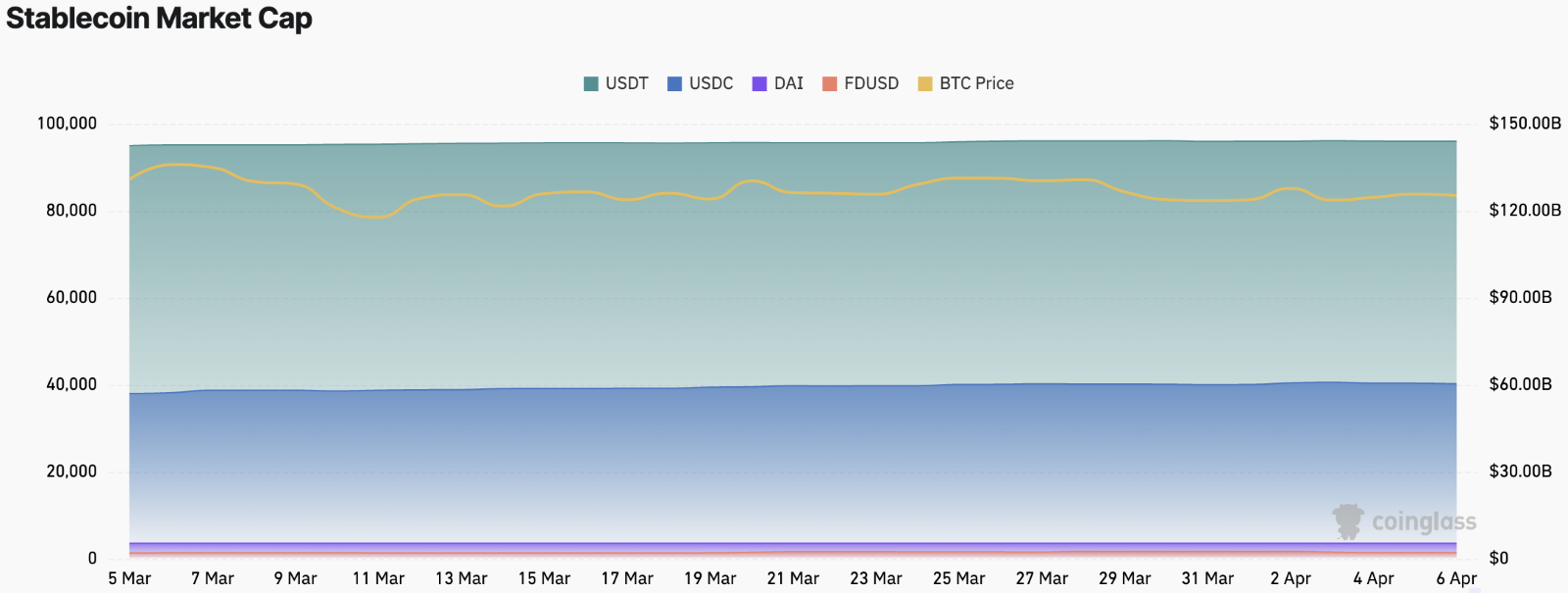

据Coinglass数据,稳定币总市值为2,374亿美元,其中USDT市值为1,439亿美元,占稳定币总市值的60.6%;其次是USDC市值为603亿美元,占稳定币总市值的25.4%;DAI市值为53.7亿美元,占稳定币总市值的2.26%

数据来源:CoinW研究院,Coinglass

数据截止至2025年4月6日

据Whale Alert数据显示,本周USDC Treasury总计增发9.02亿枚USDC,Tether Treasury总计增发 10亿枚USDT,本周稳定币增发总量为19.02亿枚,较上周稳定币增发总量(23.75亿枚)跌幅约为19.9%。

数据来源:Whale Alert

数据截止至2025年4月6日

二.本周热钱动向

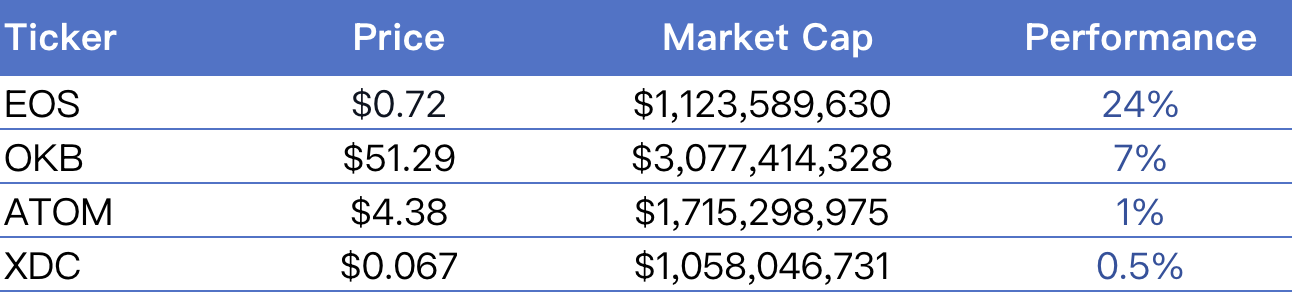

1.本周涨幅前四的VC币和Meme币

过去一周内涨幅前四的VC币

数据来源:CoinW研究院,coinmarketcap

数据截止至2025年4月6日

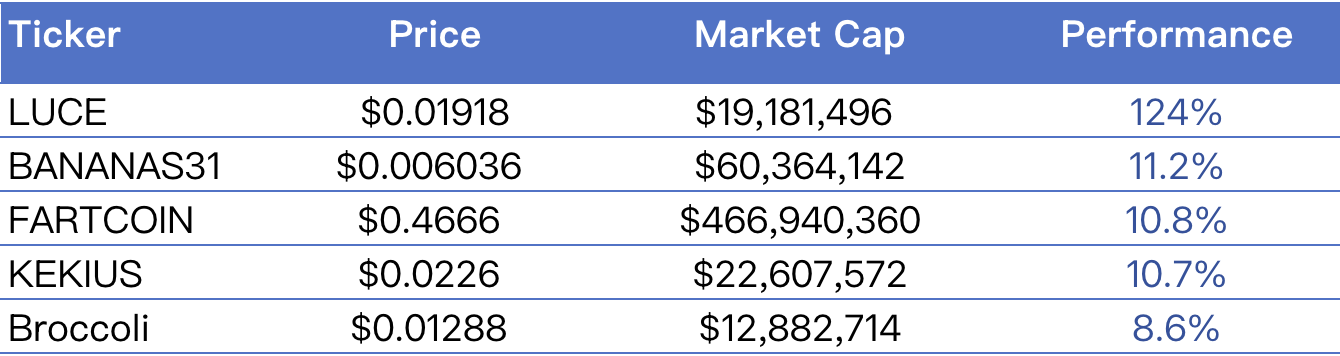

过去一周内涨幅前五的Meme币

数据来源:CoinW研究院,coinmarketcap

数据截止至2025年4月6日

2.新项目洞察

Cambrian Network:这是一个整合链上与链下数据的 AI 基础设施协议,通过整合链上与链下数据,赋能 AI 代理进行市场预测和金融决策,支持多链网络,并提供数据访问与分析 API。项目已启动私测,计划推出测试网。2025年4月,Cambrian Network 宣布完成 590 万美元种子轮融资,由 a16z Crypto Startup Accelerator 领投,Blockchain Builders 及 The Graph 生态投资人参投。

Launcher Capital:一个利用游戏化和区块链技术构建下一代人工智能代理的平台,旨在使多个代理在复杂环境中自主互动、学习和发展。

KYD Labs:一个基于 Web3 的现场活动票务平台,利用区块链技术(智能合约与 NFT)提供安全、高效的票务解决方案,增强粉丝互动并提升主办方收益。最初基于 Solana,后迁移至 Aptos 以提升性能和成本效益。KYD Labs 已支持 50 万次粉丝体验,销售额超 100 万美元,并与纽约音乐场馆 Le Poisson Rouge 签订四年独家链上票务合作协议,推动行业去中心化发展。

三.行业新动态

1.本周行业大事件

4 月 2 日 BNB Chain 公布了其 1 亿美元永久流动性扶持活动的首批获胜项目名单,旨在通过提供流动性支持,促进生态系统内新兴项目的发展。首批获得流动性支持的 5 个项目及其对应的支持金额分别为: KiloEX (KILO) - 29 万美元;Mubarak (MUBARAK) - 50 万美元;CZ'S Dog (BROCCOLI714) - 50 万美元;Tutorial (TUT) - 50 万美元;Banana For Scale (BANANAS31) - 51 万美元。此次扶持活动旨在增强 BNB Chain 上项目的流动性,提升用户体验,并鼓励更多开发者参与其生态系统建设。

4 月 3 日,特朗普宣布对多国商品征收高额关税,其中包括对越南征收 46% 关税、对英国和巴西征收 10% 关税、对瑞士征收 31% 关税、对泰国征收 36% 关税、对印尼征收 32% 关税,以及对欧盟各国实施 20% 的报复性关税,并对日本商品征收 24% 关税。特朗普政府宣布大规模关税政策后,全球市场迅速作出反应,比特币下跌 3.35%,显示出加密市场对宏观经济政策的敏感性。纳指期货大幅下跌,表明市场避险情绪升温,而 美元指数 DXY 波动 0.5%,反映出资本流动的不确定性。

4 月 5 日,pump.fun 宣布重新向 5% 的用户开放直播功能,并加强了内容审核政策。pump.fun 现禁止播放包含暴力、骚扰、性内容、危害青少年、非法活动、侵犯隐私、侵犯版权以及恐怖主义或暴力极端主义等内容的直播,否则将立即终止并暂停未来对 pump fun 直播或 pump fun 本身的访问。此前,Pump.fun 于 2024 年 11 月暂停了直播功能。

4月6日,BNB Chain在香港举办了第九季“最具价值建设者”(MVB)计划的线下活动,主题聚焦于人工智能(AI)、去中心化金融(DeFi)和去中心化物理基础设施网络(DePIN)等领域。CZ 与 Vitalik 共同出席了该线下活动。 入选团队将参与为期四周的密集孵化,并有机会获得 YZi Labs 的投资支持。

2.下周即将发生的大事件

白宫高级官员宣布,基准关税税率 10% 将于 4 月 5 日凌晨生效,而针对相关国家的对等关税将于 4 月 9 日凌晨生效。此前,特朗普已宣布对多个国家商品征收高额关税,包括 越南 46%、欧盟 20%、日本 24% 等,引发市场震荡。

2025 香港 Web3 嘉年华将于 4 月 6 日至 9 日 在香港会议展览中心 5BCDE 展厅 举行。本次活动由万向区块链实验室与 HashKey Group 联合推出,W3ME承办,延续前两届的高规格影响力。此前两届活动汇聚 250+ 参展项目、800+行业领袖,吸引 8 万+ 观众,并举办 300+ 场周边活动。往届嘉宾包括香港财政司司长陈茂波、以太坊联合创始人 Vitalik Buterin、ARK Invest CEO Cathie Wood,今年活动预计将围绕行业趋势、监管政策、技术创新展开深入讨论,推动香港在全球 Web3 生态中的影响力。

美国证券交易委员会(SEC)将于美东时间 2025 年 4 月 11 日下午 1 点至 5 点,在华盛顿特区举办题为“Between a Block and a Hard Place: Tailoring Regulation for Crypto Trading” 的第二次加密监管圆桌会议。此次活动由 SEC 的加密工作组主办,聚焦如何根据加密货币市场的特性,制定更精准、可执行的监管政策。会议将邀请来自交易所、政策研究机构和区块链企业的专家,包括纽约证券交易所首席产品官、Texture Capital 创始人兼 CEO 等,共同探讨交易平台结构、市场透明度、利益冲突和监管适应性等核心议题。

据 Tokenomist 数据显示,TRUMP 将于 4 月 18 日解锁 4000 万枚代币,占当前流通量的 20%,按当前价格计算总价值约为 4.132 亿美元。

3.上周重要投融资

Codex 完成 1580 万美元的种子轮融资,由 Dragonfly Capital 领投(出资约 1400 万美元),Coinbase Ventures、Circle Ventures 以及 Cumberland、Wintermute 和 Selini Capital 等参投。此次融资以股权和代币期权的形式进行,资金将用于链的研发和生态构建。Codex 是一家专注于稳定币基础设施的区块链初创公司,致力于打造一个通用电子现金系统,并正在开发一条专为稳定币设计的高性能区块链。(2025年4月4日)

Ultra 完成 1200 万美元融资,由卢森堡多家族办公室 NOIA Capital 通过 NOIA Digital Assets 基金领投。本轮资金将用于平台扩展、技术升级及战略收购,助力其实现 2025 年路线图,推动 Ultra 成为欧洲领先的区块链游戏平台。Ultra 是一个由区块链驱动的下一代 PC 游戏发行平台,致力于为开发者与玩家提供统一入口,整合游戏分发、NFT 市场、生态应用与区块链基础设施等服务。平台基于其高速且碳中和的 Layer1 区块链,推出了旗舰产品 Ultra Games,旨在超越传统游戏平台如 Steam,开创游戏娱乐新范式。(2025年4月3日)

Ambient,获 720 万美元种子轮融资,a16z、Delphi Digital 和 Amber Group 参投。Ambient是一条 Layer-1 区块链,结合 Solana SVM 兼容性与创新的工作量证明机制,旨在提供高速、低成本、可验证的 AI 推理,并支持 600B+ 参数模型及其微调。Ambient 为进行推理、微调或训练 AI 模型的节点提供比特币式激励,但回报更可预测。Ambient 旨在打造高效、开放的智能计算网络,提供快速、廉价的 AI 服务。(2025年3月31日)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。