The OKX app integrates a Web3 wallet, allowing users to invest in mainstream coins and trade on-chain assets all within the same application, which is very convenient. Unfortunately, due to regulatory reasons, the OKX aggregated DEX has been taken down.

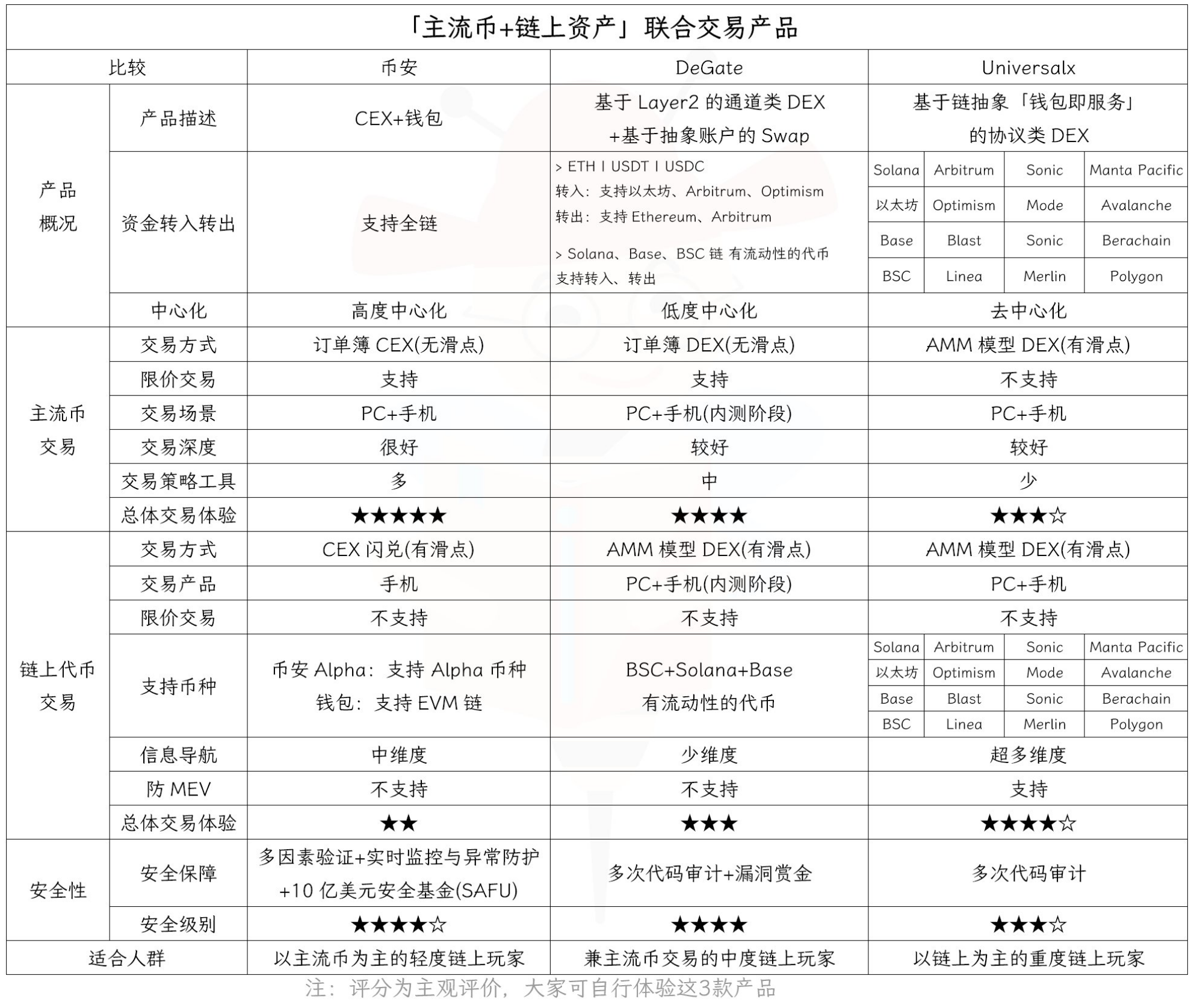

So, what are some relatively good alternatives? There are three products that I find quite user-friendly, and coincidentally, all three support cross-chain trading and are products that combine wallet technology.

➤ Binance

The Binance app also integrates a Web3 wallet, allowing users to trade mainstream coins on the Binance CEX as well as Binance Alpha tokens, and access on-chain trading through the Binance Web3 wallet.

The trading depth, trading strategy products, and overall product experience on Binance CEX are excellent, so I won't elaborate further.

❚ Binance Alpha Trading

The newly launched Alpha trading is quite convenient.

Binance Alpha trading executes user transactions and keeps records via smart contracts, without transferring tokens into the user's wallet. Considering Binance's brand and reputation, it can be trusted. However, it only allows trading of Alpha tokens and does not support a wider range of on-chain assets, and trading is currently only available on mobile, with no PC trading option.

❚ Binance Web3 Wallet

The Binance Web3 wallet supports trading of EVM on-chain assets and cross-chain trading, but unfortunately, it is only available on mobile and lacks a PC version. Additionally, there is no K-line view during trading, nor is there an MEV protection feature.

❚ Security

In terms of security, Binance offers multi-factor authentication, real-time monitoring, and anomaly protection. There was an instance where a user triggered Binance's security mechanism by transferring funds to a hacker's address due to an insecure device, resulting in their account being temporarily frozen, thus protecting their assets.

Moreover, Binance has set up a $1 billion security fund. Since the establishment of this fund, Binance has not encountered any security issues.

➤ DeGate

Similar to Hyperliquid and DYDX V3, DeGate is a Layer2-based channel DEX.

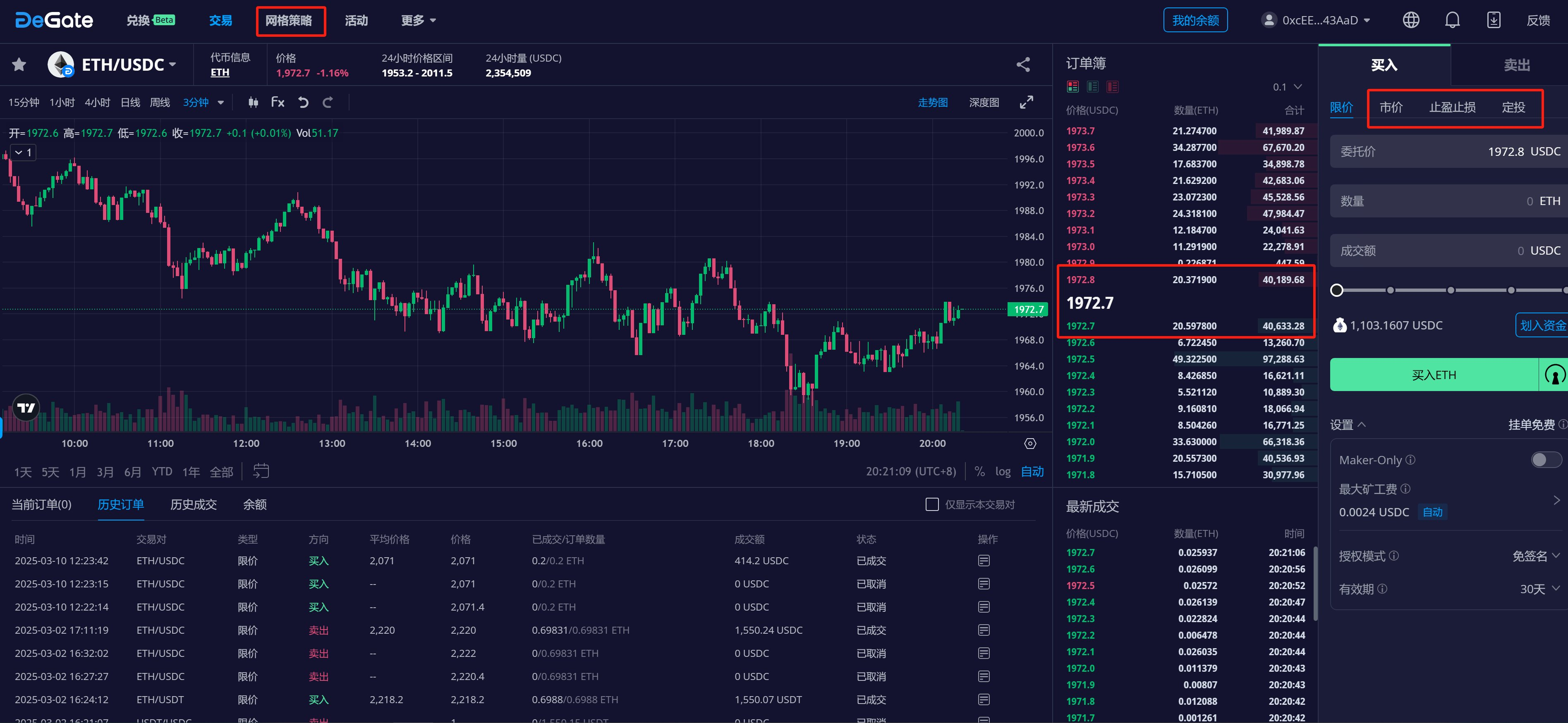

❚ Order Book DEX

Mainstream coin trading uses an order book DEX, providing a trading experience similar to CEX. It supports limit orders and dollar-cost averaging (ETH supports stop-loss and take-profit). Users can view account balances, trading history, and more.

There are zero fees for placing orders, and the popular grid trading products give DeGate's mainstream coins good trading depth and a small bid-ask spread.

As an order book DEX, while DeGate allows anyone to list tokens, it still lacks trading depth if there are not enough traders.

Additionally, mainstream coin trading occurs on DeGate Layer2, which has weak centralization characteristics.

❚ On-chain Swap

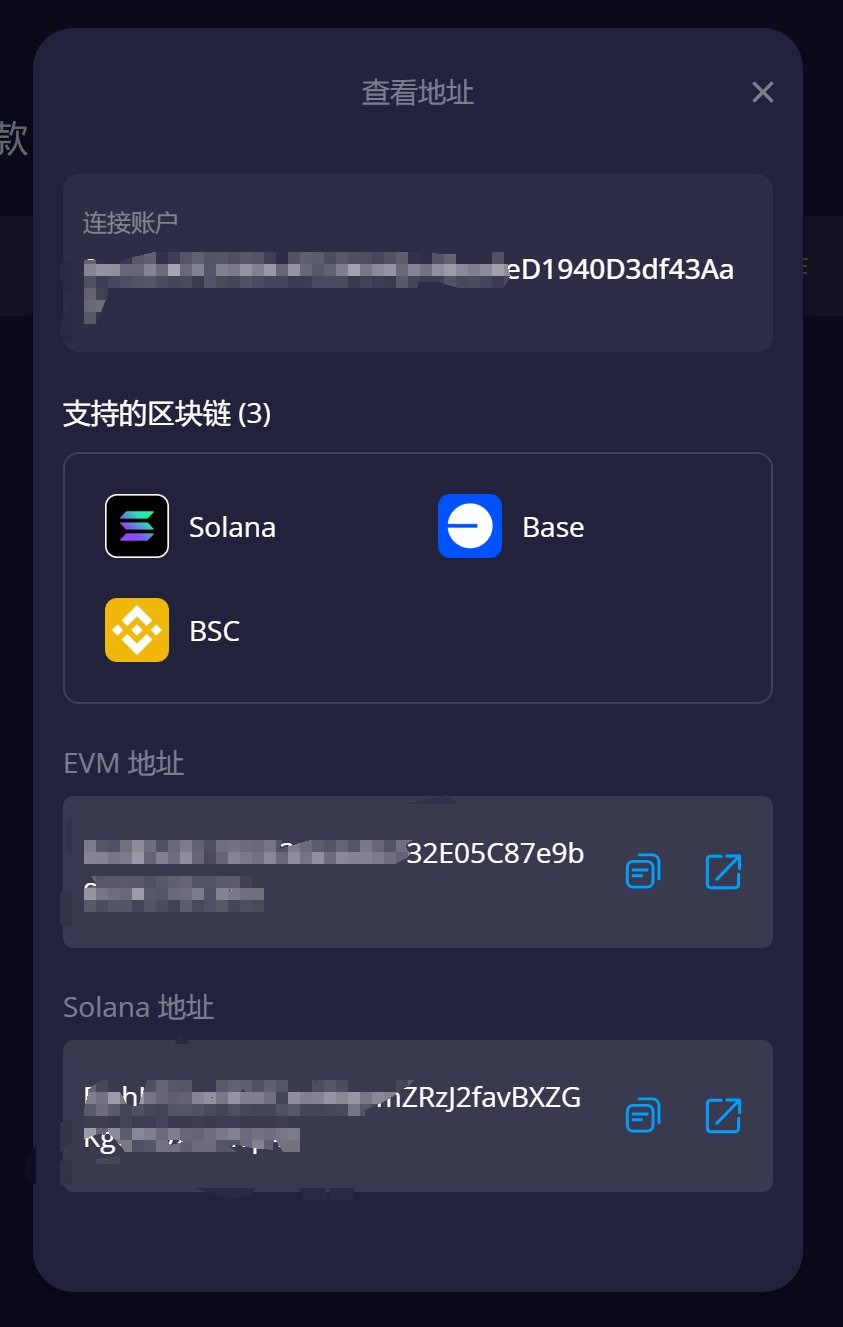

Unlike Binance Alpha, DeGate uses abstract account technology. After users create an account on DeGate Layer2, they receive an EVM abstract account wallet address and a Solana wallet address.

DeGate supports trading on BSC, Base, and Solana chains.

The user's abstract account wallet address directly participates in trading and asset storage.

On the "Swap" page, users can view the K-line chart of tokens.

However, the "Swap" feature currently lacks MEV protection.

❚ Security

DeGate has been operating securely for 20 months, during which multiple code audits have been conducted, showing no significant risks. DeGate has also launched a $1.1 million bug bounty on the Immunefi platform, with no vulnerabilities discovered to date.

➤ Universalx

Universalx is a DEX based on Particle chain abstraction, with Wallet as a Service (WaaS) being one of Particle's core technologies. Similar to DeGate, Universalx users also receive an EVM abstract account wallet address and a Solana address. However, chain abstraction technology goes far beyond just abstract accounts.

❚ CEX-like Protocol DEX

Universalx, based on chain abstraction technology, implements a protocol DEX similar to CEX.

First, Universalx has trading depth similar to CEX, supporting assets across 16 major public chain ecosystems, with most mainstream coins having good liquidity on-chain, including BTC, XRP, etc.

Second, Universalx offers a trading experience similar to CEX, allowing users to check trading balances, trading history, and more.

Third, Universalx is highly decentralized. While Universalx resembles channel DEXs like DeGate, it is a protocol DEX based on chain abstraction technology, making it highly decentralized.

Channel DEXs store assets in a weakly centralized ecological chain, while Universalx stores assets in the user's wallet within the chain abstraction alliance.

All transactions are visible on-chain, and all assets are stored in the user's own abstract account.

The chain abstraction alliance is not an isolated channel but consists of multiple ecological chains that use smart contracts for execution, forming an interoperable multi-chain alliance that remains decentralized. This is why I say "chain abstraction technology goes far beyond just abstract accounts."

However, mainstream coin trading does not support limit orders. Of course, developing a virtual order book and implementing limit trading is not difficult for Universalx.

❚ A Game-Changing On-chain DEX

Compared to trading mainstream coins, Universalx is a game-changing product on-chain.

First, Universalx offers seamless cross-chain and universal assets. Based on the Particle chain abstraction alliance, users' assets and gas do not need to be distinguished by specific chains. Users can use base tokens to access on-chain assets across 16 public chain ecosystems at any time.

Second, Universalx has MEV protection features. Based on chain abstraction technology, it has automatic MEV protection on EVM chains, while Solana requires manual activation. This is why I say "chain abstraction technology goes far beyond just abstract accounts."

With these two points, Universalx users can access on-chain assets as easily as using a CEX.

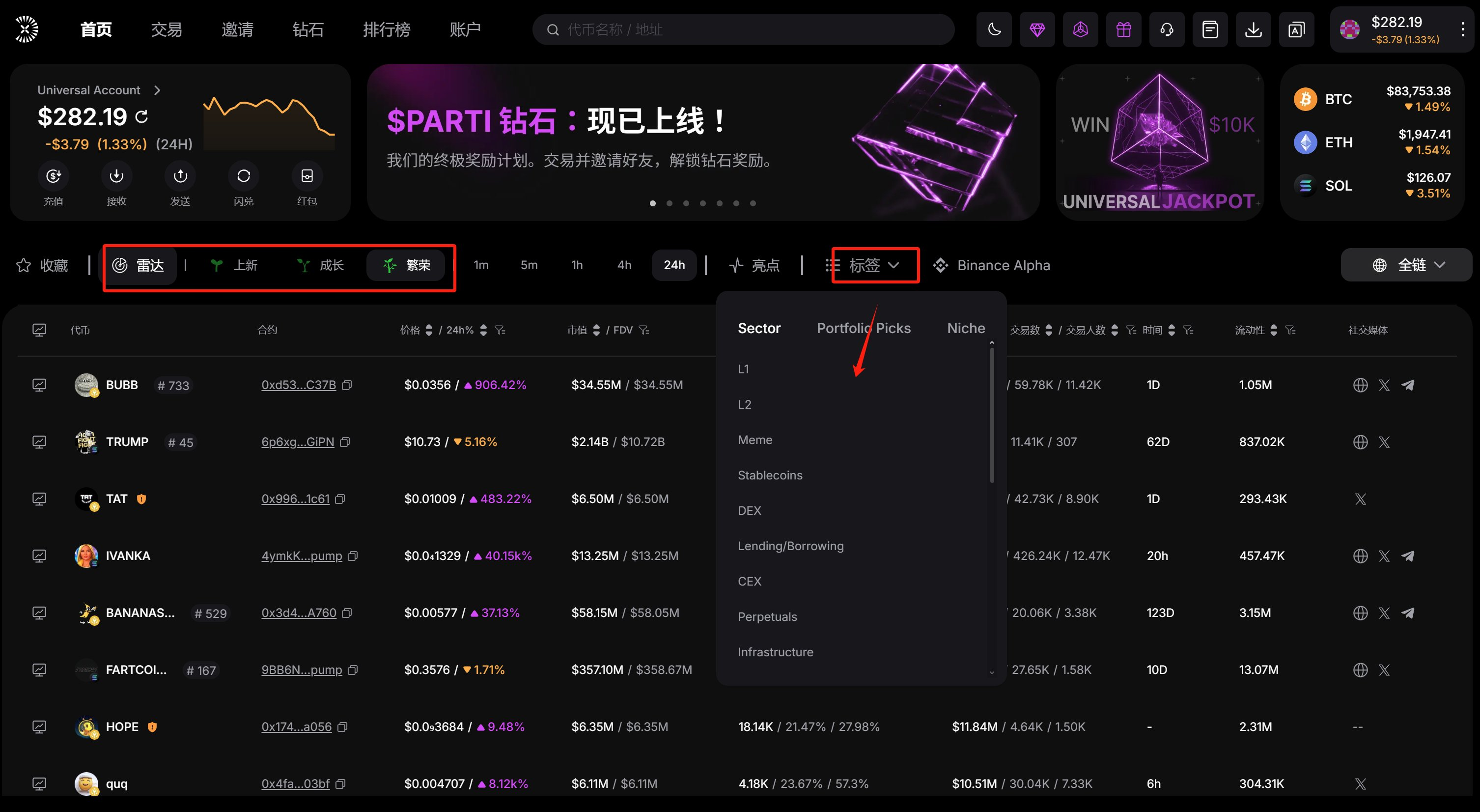

Third, Universalx aggregates a wealth of token information and navigation features.

On the token list page, Universalx provides comprehensive information navigation.

On the trading page, in addition to market capitalization, trading conditions, and holding addresses, users can also view relevant security information about the token contract address.

Scrolling down the page, users can also view information about the liquidity pool, official website, and social media related to the token on the left side.

For on-chain players, Universalx helps improve the efficiency of token selection and trading, and even reduces certain risks in token selection.

❚ Security

Universalx has undergone multiple code audits, and I have carefully studied the audit reports, finding no significant risks.

➤ In Conclusion

After comparison, Binance's CEX products and security are superior, while its on-chain products are somewhat lacking, making it suitable for occasional on-chain traders.

DeGate offers a balanced experience for mainstream coin trading and "on-chain access," making it suitable for moderate on-chain players.

Universalx's mainstream coin trading products have room for improvement, but its "on-chain access" features are very powerful, likely surpassing all similar products currently on the market, making it suitable for heavy on-chain players.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。