文/Hedy Bi, OKG Research

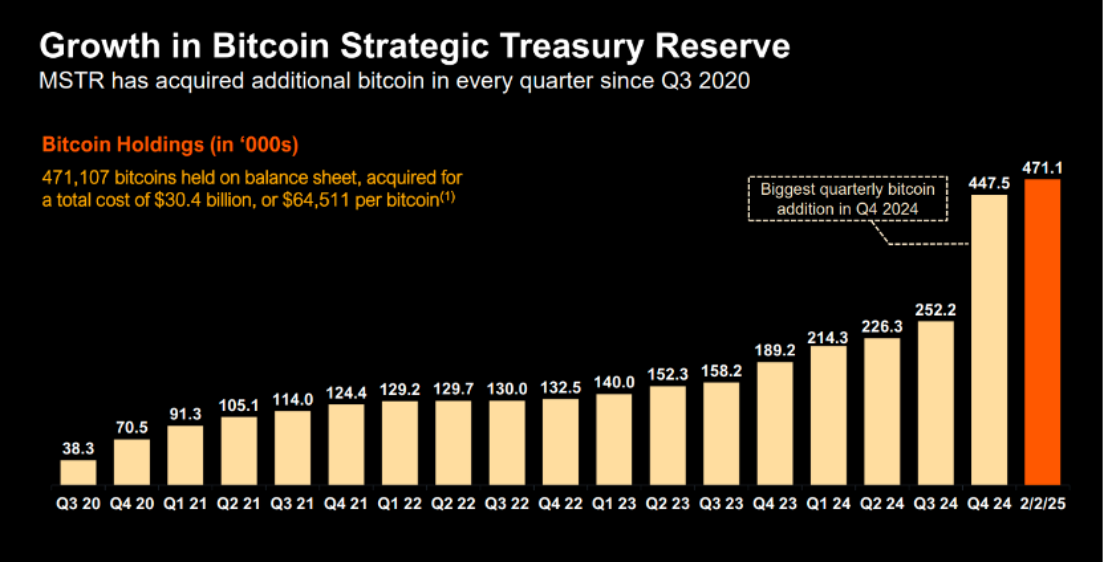

特朗普再度掌舵,政治风向与经济政策正以惊人速度重塑全球资本版图。在这一背景下,策略公司(原名微策略,后文均以Strategy表示) — — 以大举收购比特币而闻名的上市公司,却突然宣布暂停新增比特币购入。而在昨夜凌晨的财报会议上,Strategy设定了2025年年度“比特币美元收益”目标为100亿美元。假设Strategy购买比特币的资金全部来源于融资,要实现这一目标,要么比特币价格涨一倍,要么Strategy至少以现有持仓成本,在比特币维持现价的理论条件下,再增持一倍。

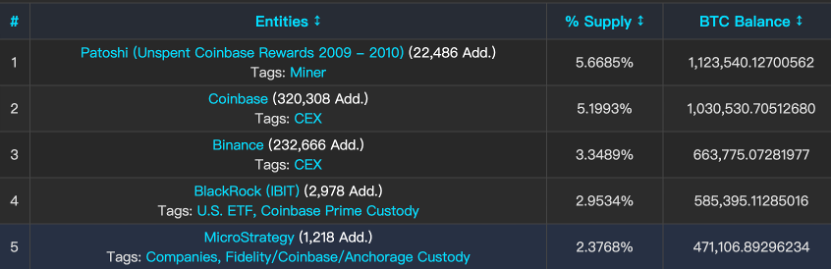

作为全球最大企业级比特币持仓者,截至2024年2月7日,Strategy持有45万枚比特币,平均成本约为6.2万美元,在比特币全球持有者中位列前五,约占比特币供应总量的2.38%。这一比例可媲美在央行黄金储备排名第一的美国官方黄金储备(世界黄金协会),也显示出Strategy在加密资产领域的领先优势和战略决心。正因如此,Strategy的透明度和明确的投资策略,使得其持仓变动成为全球投资者关注加密货币的重要视角。

对于那些习惯将Strategy视为“数字黄金国库”的投资者而言,近期Strategy的种种举动无疑引发了激烈讨论。这样的“心口不一”策略该如何解读?笔者将从Strategy为何改变购买比特币的投资策略,以及此举将对比特币市场带来的影响进行分析。

为何Strategy会在特朗普上台后选择暂停购买?答案远比表面看起来复杂。其中一个关键因素,就是公司近期在业绩和会计处理上的压力。

首先,Strategy在2024年第四季度虽然比特币持有量翻倍,但录得每股净亏损达3.03美元,远超分析师预期的每股亏损-0.12美元,这主要归因于对所持数字资产的大额减值处理。按照旧的会计准则,当比特币的价格下跌,低于其购买成本时,公司需要将这部分损失在财务报表中体现出来。如果资产的公允价值低于其账面价值,就必须确认减值损失。

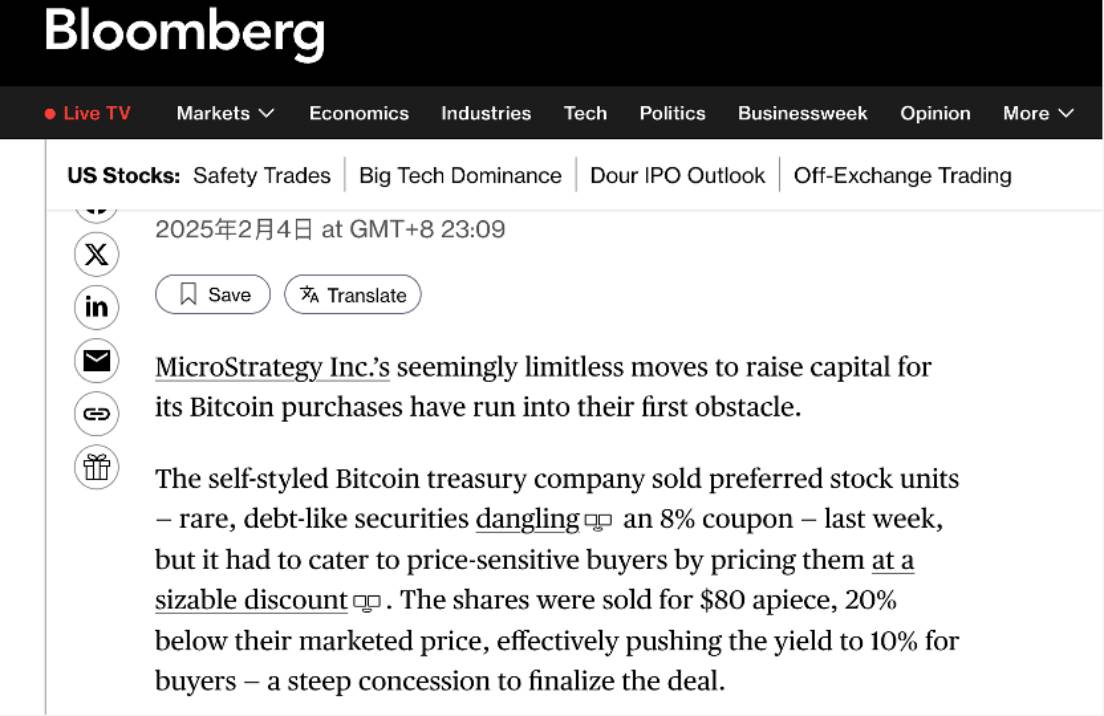

这样的超预期亏损会降低投资者对公司的信心,导致他们要求更高的回报率以承担投资风险,更难吸引投资者购买其优先股,也因此我们看到了据彭博社,Strategy折价20%出售新发行的优先股。不过,对于看好Strategy公司前景的投资者来说,折价发行有效地将买家的收益率提高。

同时,随着新的FASB(财务会计准则委员会)准则的实施虽能让Strategy首次确认其比特币头寸的未实现收益,但这让它所面临的税务问题更为复杂:根据新的会计准则,Strategy需要以公允价值计量其持有的比特币,并在财务报表上反映未实现的收益。虽然这使得资产负债表更加透明,但也意味着公司可能需要对这些未实现的收益缴纳公司替代最低税(CAMT,约15%税率)。面对潜在的巨额税单,Strategy必须进行财务规划以应对纳税义务。暂停购买可能是一种财务风险控制手段,以便更好地评估和管理未来的税务负担。

此外,自公司被纳入纳斯达克100指数以来,其需遵守更严格的信息披露和公司治理要求,其中包括更严格的内部交易政策,以防止内幕交易的发生。暂停增持比特币的原因之一可能与禁售期的限制有关。尽管美国证券交易委员会(SEC)并未强制要求企业设立禁售期,许多公司出于合规考虑会主动设定,尤其在财报发布前后。例如,Strategy的2024 年第四季度财报于2月5日公布,禁售期可能自1月起开始实施,从而限制了其在此期间的比特币增持行为。

简单来说,Strategy并非对比特币的前景失去信心,“心口不一”的表现也并非外部市场因素影响,更多的是自己内部财务合规等原因。

而市场上其他机构并不会因为Strategy的自身原因停购而选择跟随。相反,美国以州为代表正在自下而上地进行推行比特币在州级可以成为战略资产。目前已有16个州提交了相关法案,其中两个州进展较快。根据下图,28,312枚比特币大概率是可以被购买用作投资。而在“Pending”状态的州并不意味着不是比特币等数字货币的支持者。就在今日(2月7日),肯塔基州众议员TJ Roberts发起HB376法案,提议将10%的州资金投资于市值超7500亿美元的数字资产。

7500亿美元的投资,如果真大部分落实到比特币投资,这笔资金几乎相当于比特币当前市值(截至2月7日)的39%,也相当于美国黄金储备的2/3。根据世界黄金协会的统计,美国的黄金储备价值约为11,000亿美元。而这一规模的资金流入尚未通过任何国家储备建设的背景,而是纯粹依靠州政府的政策推动。这意味着,除了像Strategy这样的公司外,其他机构或政府也在进行比特币购买。比特币在全球金融体系中的地位,正以一种兼具非传统特点和前所未有的速度不断提升。

而这只是特朗普时代新政策下的一个缩影,充满不确定性却也充满想象。

该篇为“特朗普经济学”系列专题的第三篇。

OKG Research特别策划推出“特朗普经济学”系列专题,深入分析随着特朗普2.0新政的不断推进,加密市场的未来趋势和核心逻辑。

该专题其他文章:

《特朗普再任:新政经济时代的比特币、石油与黄金》聚焦比特币对国际金融格局的影响。

《特朗普归来:稳定币与比特币,谁才能解美债之困?》则从美债这一传统金融核心资产切入,深入剖析规模高达36万亿美元的美债市场,如何借助区块链技术和加密领域的工具,进一步巩固和扩展美元在全球金融体系中的主导地位。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。