撰文:ChandlerZ,Foresight News

在传统加密货币波动剧烈的市场环境下,稳定币以其与法定货币锚定的特性,为用户提供了一种相对稳健的价值储存手段。但目前单纯的稳定币功能已无法满足市场对资本增值和收益获取的多元化需求。为此,越来越多的项目开始尝试将收益生成机制嵌入稳定币产品之中,力图在保证币值稳定的前提下,为用户创造额外的经济回报。

在这种趋势下,Noon 应运而生。作为专注于智能收益和公平分配的稳定币,Noon 定位为 Web3 生态中兼具稳定性与收益性的新型稳定币,旨在通过智能资本配置与公平治理模型,重塑金融工具的价值分配机制。其核心稳定币 USN 锚定美元 1:1 价值,并引入质押衍生品 sUSN,用户可通过抵押 USDT 或 USDC 铸造 USN,同时持有 sUSN 捕获协议收益。目前该项目已在以太坊、Sophon 和 ZKsync 3 条链上线,并即将在更多链上推出。

sUSN:收益型资产的核心载体

USN 是 Noon 协议的基石,是一种与美元 1:1 锚定的稳定币。用户通过存入 USDT 或 USDC 铸造 USN。在这一过程中,USN 本身并不直接产生收益,而是为后续的收益生成提供基础资产。与此同时,通过铸造和赎回机制,USN 能够保持高度的流动性,方便用户在市场上自由交易。在公测期间,USN 持有者可将通过累计积分的方式,间接参与到未来 NOON 治理代币的分配中。

当用户将手中的 USN 抵押到指定的质押池后,会获得与之对应的 sUSN。这一过程实际上将用户的资产转化为参与收益生成的资格。平台内置的智能调仓系统会将质押池中的 USN 投向一系列预先设定的低风险、市场中性策略。随着这些策略不断产生「原生收益」,平台会自动将额外生成的 USN 添加到质押池中,从而使得每一份 sUSN 代表的资产份额随之增长。从而确保 sUSN 持有者能够在不动用本金的情况下享受到由智能策略带来的复利效应,进而实现资产的稳步增值。

智能收益与公正分配的新模式

Noon 的核心创新在于其动态策略引擎,这套系统通过智能分配资本至多种 delta-neutral(市场中性)策略,平衡风险与回报。初期策略组合包括资金利率套利与代币化国债投资。资金利率套利通过现货与永续合约的对冲操作,捕获市场周期性的资金费率收益;代币化国债投资则依托低风险、固定收益的国债资产,提供基础收益稳定性。系统基于如利率环境、资金费率水平等实时市场数据自动优化策略权重,确保在不同市场条件下实现收益最大化。这一系统的运行依赖于多项数据监控与实时反馈机制,确保整个资产配置过程既安全又高效,进而为平台用户提供全周期稳定的收益体验。

在技术架构上,Noon 围绕安全性、流动性及策略灵活性进行了深度设计。其动态调仓系统能够实时监控策略表现与市场风险指标,自动切换至最优策略组合,规避单一策略失效的风险。此外,Noon 设立了保险基金,占收益的 10%,用于缓冲潜在亏损,并优先支持快速赎回功能,确保用户资产的流动性需求。去中心化治理框架则通过节点运营者与验证者的共同参与,提升协议的透明度与抗操控性。

在收益分配上,Noon 在收益分配与治理模型上体现了高度的用户导向性。其收益分配机制相对透明且公平,80% 的策略收益直接分配给 sUSN 持有者,10% 注入保险基金,超额部分归属质押治理代币(sNOON)持有者,剩余 10% 用于覆盖协议运营成本。长期目标是通过规模效应降低运营费率,并将盈余回馈给用户。

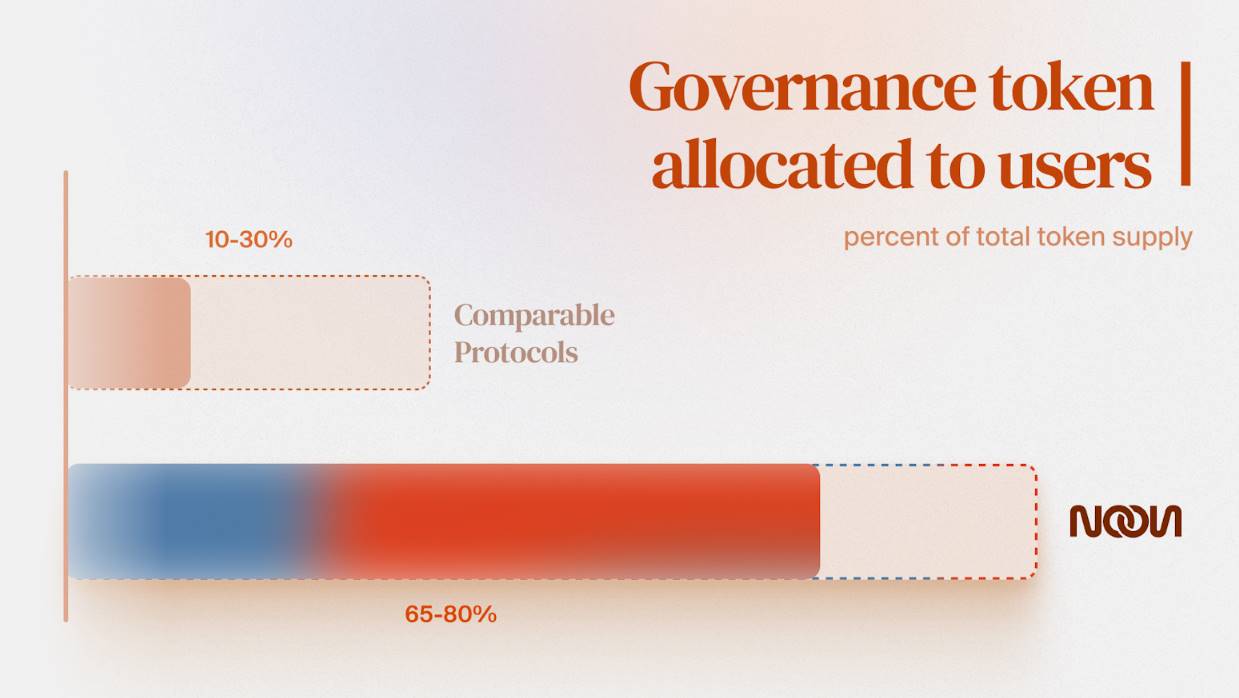

在治理代币(NOON)的分配上,Noon 采取了严格的抗投机设计。65% 的代币按 8 年以上的周期分配给长期参与者,确保治理权与用户利益的深度绑定;15% 的代币存入信托基金,用于生态激励与流动性支持;20% 的代币分配至团队,并设置了 7 年的锁定期(1 年锁仓 + 6 年线性释放),以规避短期套利行为。此外,Noon 明确拒绝外部资本(如 VC、天使投资者)的介入,避免治理代币集中抛售的风险,确保用户利益的最大化。

Noon 的目标用户群体广泛,涵盖低风险偏好者与高收益追求者。对于低风险用户,Noon 通过 sUSN 提供稳定的收益捕获功能,用户无需主动管理即可享受收益;对于高收益用户,USN/sUSN 的流动性支持其在 DeFi 生态中进行杠杆操作、借贷等复合收益场景。同时,该协议的储备数据现已实现实时更新,确保透明度和可验证性。Noon 强调,其无法更改或查看数据在公开前的状态,从而保障整个验证流程的完整性。

1 月 27 日,Noon 正式启动测试网,进一步检验 USN 和 sUSN 的部署策略,并为更广泛的用户群体提供参与机会。该协议计划于 Q2 全面上线治理代币。未来长期战略包括扩展策略库、与主流 DeFi 协议集成以及通过社区治理机制推动协议的持续优化。

总的来说,Noon 通过技术创新与制度设计,在稳定币赛道中开辟了差异化路径。其智能化策略引擎与用户至上的分配模型,有望解决现有稳定币收益波动性高、治理中心化等痛点。同时其还拥有偿付能力证明,若后续能有效执行战略规划并扩大生态合作,Noon 或将成为链上不可或缺的「智能基轴货币」,推动金融普惠与市场效率的双重提升。项目的长期成功将取决于其策略可持续性、社区凝聚力及对市场风险的动态适应能力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。