每日比特币(BTC)交易量已降至2023年底以来的最低水平,未确认交易的排队区(mempool)异常空旷。这一下降导致交易费用大幅减少,现在几乎无法为矿工收入做出贡献。再加上四月份的第四次减半,将区块补贴削减至3.125 BTC,矿工面临着不可持续的收入压力。

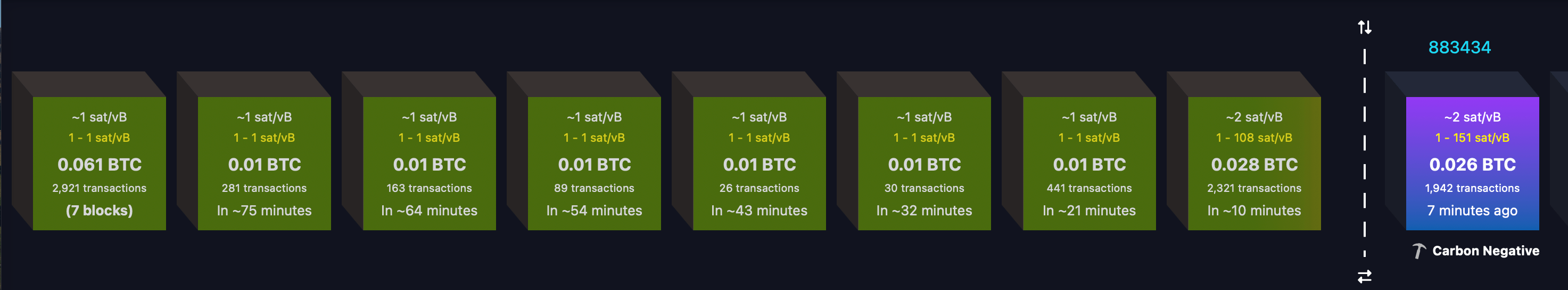

截至发稿时,根据mempool.space的统计,有八个区块在等待确认。

单单补贴的减少就使矿工每个区块的收入减少了50%,迫使他们更加依赖费用,但这些费用并未如预期出现。尽管链上活动急剧下降,网络却见证了大规模的BTC整合。像中心化加密交易所这样的实体,正在进行大宗交易而不是频繁的小额交易。例如,一次整合可能转移10,000 BTC,但只产生一笔交易费用——远低于数千笔单独转账。

左侧的大绿色区块代表整合。来源:Mempool.space

这并不是什么新鲜事——中心化交易所一直利用大宗交易——但当考虑到最低活动时,情况进一步恶化。与此同时,托管服务、政府、企业(尤其是像Microstrategy这样的公司)和交易所交易基金(ETF)进一步抑制了交易需求。仅美国现货ETF就持有超过100万个BTC(1117.8亿美元),大部分资产存储在托管钱包中。这些产品需要的区块链交互极少,缩小了矿工依赖的费用池。

无论关于区块大小和费用市场的争论如何,无法否认的真相是:交易量减少可能危及比特币的安全模型。矿工通过验证交易来保护网络,资金来源于补贴和费用。如果收入低于运营成本——特别是能源费用——矿工可能会关闭设备,降低网络的哈希率。持续的下降可能使链条更容易受到攻击,因为竞争验证区块的矿工减少。

长期解决方案依赖于采用。增加的交易需求——由零售使用、序号、符文或现实世界资产(RWA)或去中心化金融(defi)代币化驱动——可能会恢复费用。如果没有增长,矿工面临着收入下降和成本上升之间的困境,危及比特币1.88万亿美元生态系统的去中心化基础。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。