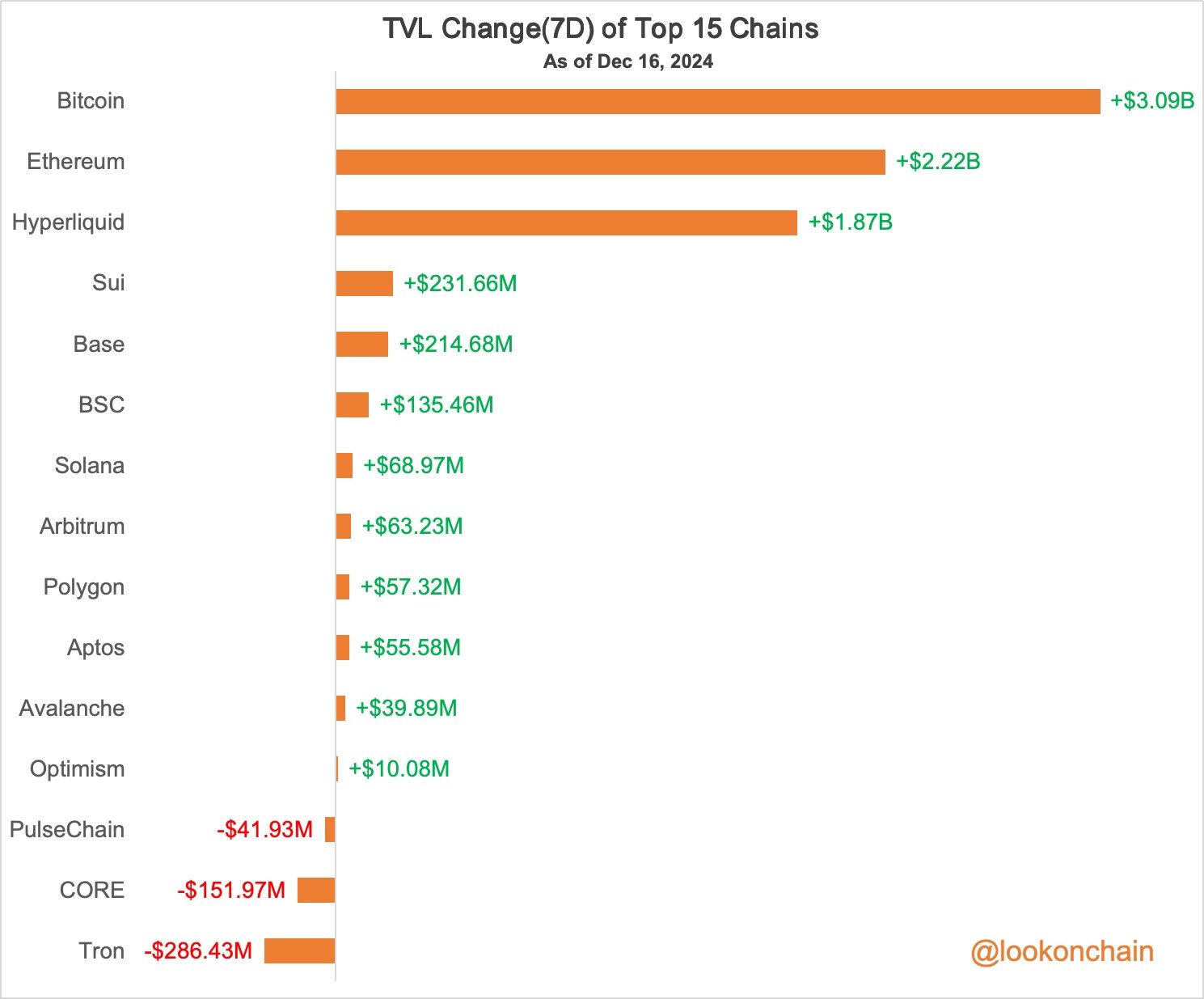

在过去七天中,比特币、以太坊和Hyperliquid的总锁定价值(TVL)分别增加了30.9亿美元、22.2亿美元和18.7亿美元。这是根据Lookonchain的数据,该平台是一款智能资金链上追踪工具,指出这三个网络的资金流入显著。

与此同时,Sui、Base和币安智能链(BSC)等链的TVL也出现了显著增长。Sui增加了2.3166亿美元,Base增加了2.1468亿美元,BSC增加了1.3546亿美元。

另一方面,Tron、Core和Pulsechain的TVL则显著下降,分别减少了2.86亿美元、1.52亿美元和4193万美元。这些减少可能归因于用户活动减少或投资者偏好向更知名网络的转变。

比特币的TVL激增得益于机构对比特币现货ETF的兴趣,推动其创下106,500美元的新历史高点。凭借其强大的去中心化应用生态系统和价格达到4,000美元,以太坊继续吸引大量资本流入。虽然不如比特币和以太坊成熟,Hyperliquid的创新特性可能正在吸引区块链爱好者的关注。

X用户对Hyperliquid的TVL超过Base等热门链表示热情。@KamBenBrik表示:“Hyperliquid将从以太坊和L2s中捕获大量TVL。超高性能时代。”@mikocryptonft也评论道:“HyperliquidX

目前正处于HYPE增长阶段。TVL刚刚超过Base,达到了40.9亿美元。”

随着TVL作为网络健康和投资者信心的关键指标,关注实用性、可扩展性和创新仍然是捕获和保留价值的核心。目前,比特币、以太坊和Hyperliquid正乘着强劲的势头。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。