本文最初发表在 First Mover,CoinDesk 的每日新闻简报,将加密货币市场最新动态置于背景中。 订阅以每天收到简报。

CoinDesk 20 指数:1,925.79 +5.55%

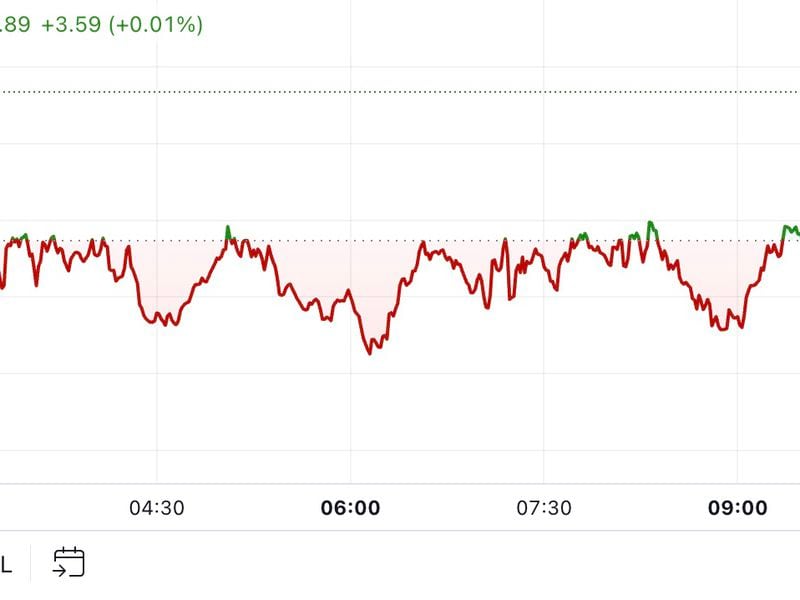

比特币(BTC):62,521.19美元 +4.22%

以太坊(ETH):2,428.37美元 +5.2%

标普500指数:5,618.26 -0.29%

黄金:2,585.66美元 +1.03%

日经225指数:37,155.33 +2.13%

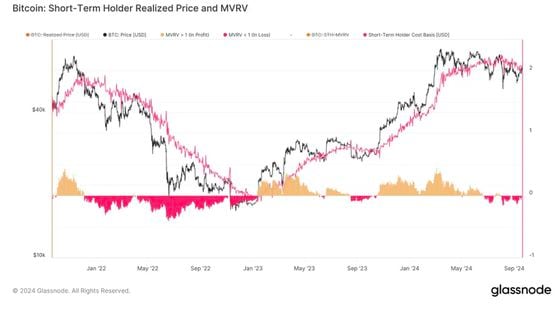

比特币上涨 超过62,000美元,受美联储50个基点的降息提振 **。传统上,借贷成本的降低通常是对风险资产(如加密货币)的看涨指标,而宽松周期历来与比特币价格飙升至历史高点同时发生。比特币在过去24小时内上涨约4.35%,而整个数字资产市场的涨幅超过5%,由 CoinDesk 20 指数(CD20)衡量。领先的替代币以太坊(ETH)和 SOL 领涨,分别上涨了5.8%和7.4%。

尽管期待已久的美国降息似乎对加密货币市场产生了预期效果, 交易员警告称这波涨势可能是短暂的。 他们认为经济放缓和地缘政治不确定性的大局将阻碍加密货币价格的上涨。Presto Research 指出,对降息的各类资产的反应是褒贬不一的,这表明“增长担忧显然存在”。Maelstrom 的首席投资官 Arthur Hayes 认为,降息将助长通货膨胀,这可能导致市场动荡,然后“他们只会做更多的这种事情,他们会让问题变得更糟”。

德国最大证券交易所运营商的子公司 Crypto Finance 与 Commerzbank 签署协议, 为该银行的企业客户提供交易服务,就在两周前,该公司与瑞士苏黎世州立银行达成了类似协议。 Commerzbank 将提供托管服务,这些公司周四表示。德意志证券交易所子公司提供的交易服务将面向德国的客户,并最初专注于比特币和以太坊的交易。Commerzbank 在2023年11月获得了德国的加密货币托管许可,允许该金融服务公司提供与数字资产相关的广泛服务。

- James Van Straten

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。