When you’re trading digital assets, speed matters — particularly so if you’re engaged in high-frequency trading, when every millisecond counts. Executing orders a fraction of a second ahead of the market can mean the difference between profit and loss. New data reveals which cryptocurrency exchanges are the fastest — and which are struggling to keep up.

Speed Analysis Shows Significant Variation Between Platforms

Data provided by Deribit shows marked differences in the speed at which six leading cryptocurrency exchanges fulfill orders. The derivatives exchange looked at three major spot exchanges: Bitfinex, Binance and Coinbase. It also examined three major crypto derivatives exchanges: Bitmex, Okex and its own platform. It should be noted, however, that Deribit has an incentive to share its analysis, as it recorded the fastest order execution in tests.

The most liquid pair on each exchange was tested to determine the time it takes to add a limit order and execute a market order. Most of the exchanges that were tested failed to achieve either task in under 10 milliseconds, with Okex faring the worst.

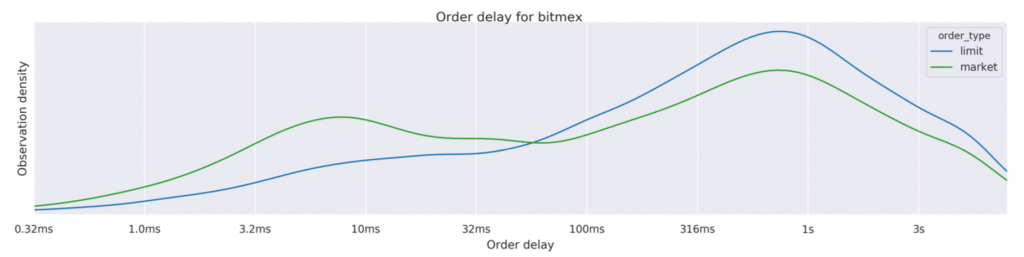

Speed analysis for Bitmex

Order speed doesn’t normally concern retail investors, who aren’t reliant on split-second execution when buying and selling assets. However, it matters a lot to professional traders, particularly on Wall Street, and increasingly in the cryptocurrency markets, too. On derivatives exchanges such as Bitmex and Deribit, where cryptocurrencies such as BTC can be traded with up to 100x leverage, timing is everything. And for trading strategies dependent on a fast response to market news, order speed can prove crucial. Many financial brokers base their entire business model around high-frequency trading, relying on algorithmic trading aided by low latency, high speeds and high order-to-trade ratios.

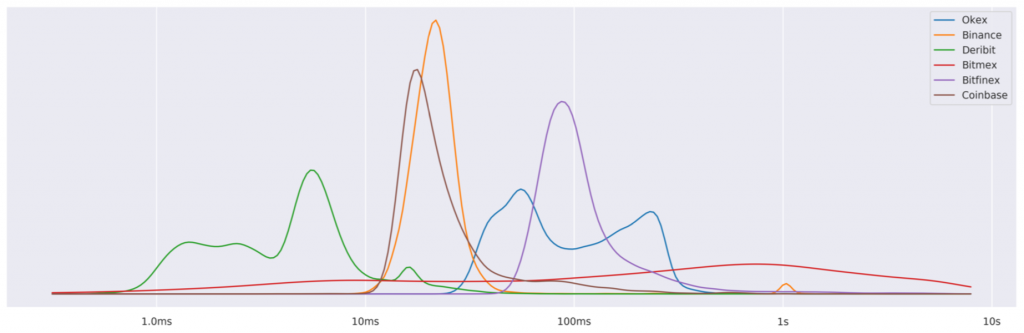

Logarithmic results for all six exchanges tested

Derivatives Exchanges Are Quicker Than Their Conventional Counterparts

Deribit has invited interested parties to download its speed analysis data and inspect it for themselves, to verify its findings. Describing its methodology, the platform wrote:

We measured the time from the initial request until the confirmation that the order had been placed. To compensate for network delays outside the control of the exchange, we recorded the latency for a trivial API request. The duration for these requests was subtracted from the duration of the order requests. The remaining time is assumed to be the true execution time for a request.

The exchange claimed that it conducted all of the tests on machines that were situated as close as possible to the exchanges in question. The results were as follows:

Binance’s average order execution delay was 37.2 milliseconds, with 0.1 percent of orders executed within 10 milliseconds. Bitfinex’s average order execution delay was 156 milliseconds, with 0 percent of orders executed within 10 milliseconds. Bitmex’s average order execution delay was 1.11 seconds, with 13.4 percent of orders executed within 10 milliseconds. Coinbase’s average order execution delay was 33.0 milliseconds, with 0.2 percent of orders executed within 10 milliseconds. Deribit’s average order execution delay was 6.1 milliseconds, with 89.6 percent of orders executed within 10 milliseconds. Okex’s average order execution delay was 127 milliseconds, with 0 percent of orders executed within 10 milliseconds.

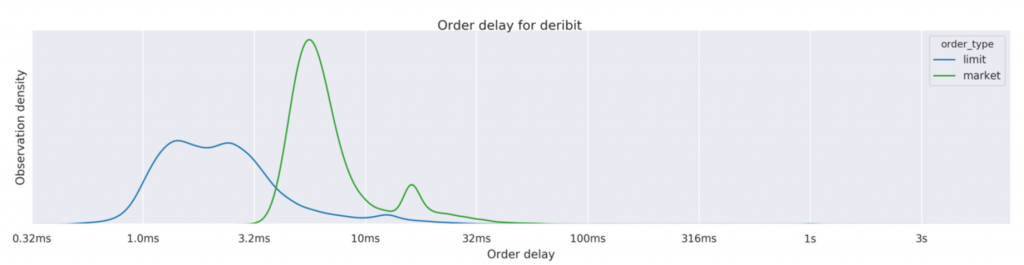

Speed analysis results for Deribit

Competition between exchanges is fierce, especially among those that offer the high risk and reward cocktail that is derivatives. While there’s a lot more to successful margin trading than speed, its significance is sure to grow as competition intensifies and traders are forced to fight for that all-important edge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。