一小时的细分视图显示,领先的加密货币正在维持在一个压缩的区间内,从短暂下跌至 $95,662 中恢复。一个新兴的支撑区间在每个比特币 $95,500 和 $96,000 之间形成,吸引了抄底者的出现。然而,$98,000 和 $100,185 的上方阻力抑制了向上的进展。在每个比特币 $96,000 附近的活动波动暗示出试探性的积累,尽管方向性信念仍然难以捉摸。突破 $98,000 可能会催化向六位数的冲刺,而若跌破 $95,500 则可能会引发回撤至 $92,000。

BTC/USD 1H 图表,来源于 Bitstamp,日期为 2025 年 2 月 8 日。

放大到四小时的视角,比特币的中期下跌加剧,徘徊在 $96,000 附近,之前在 $98,500 遭遇阻力。该资产在关键的 $99,500 阈值下徘徊——这是一个需要征服的天花板,以实现看涨的愿望。下方,$91,530 的支撑——一个近期的低点——在空头力量加剧时可能会被触及。交易模式暗示资本外流,清算引发突然的下跌。突破 $98,500 的决定性跳跃成为乐观情绪的关键,而若跌破 $95,000 则有可能向 $92,000 回撤。

BTC/USD 4H 图表,来源于 Bitstamp,日期为 2025 年 2 月 8 日。

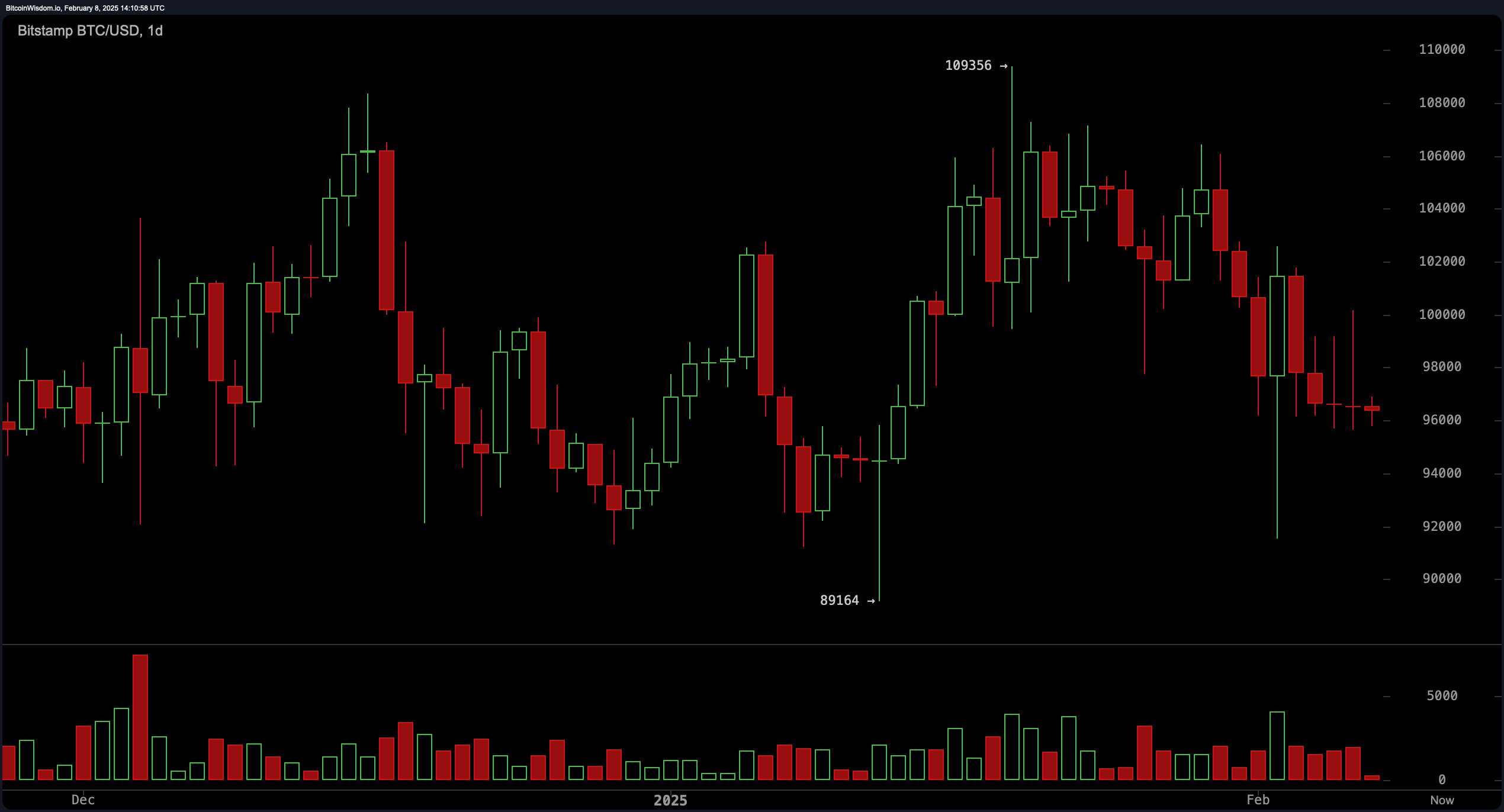

日线全景揭示比特币从 $109,356 的高峰中更广泛的回撤,受到 $100,000 到 $102,000 的阻力束缚。一个基础的防线位于 $89,164,这是一个经过先前测试的水平。红色的成交量柱状图信号显示清算活动加剧,强调了持续的看跌情绪,除非买家能够聚集热情重新夺回 $100,000。被这一心理障碍所阻碍,市场在刀尖上摇摆,接下来的交易时段将决定其轨迹:复苏还是回撤。

BTC/USD 1D 图表,来源于 Bitstamp,日期为 2025 年 2 月 8 日。

振荡器描绘出多种视角。相对强弱指数(RSI)为 42,随机指标(Stochastic)为 32,处于平衡状态,而商品通道指数(CCI)为 -127,倾向于看跌。平均方向指数(ADX)为 24,证实了趋势的不确定性。然而,谨慎依然存在:动量指标为 -7,557,MACD 为 -802,反映出卖方的主导地位,强大的振荡器的 -2,229 读数使得在情绪转变之前,持续反弹的希望黯淡。

移动平均线回响着看跌情绪的合唱。短期的指数和简单平均线(10 到 50 周期)在 $98,453 和 $101,288 之间发出负面信号。较长的时间范围提供微弱的安慰:100 周期的 EMA 和 SMA 分别在 $93,227 和 $95,267,而 200 周期的 EMA 和 SMA 分别在 $83,766 和 $78,803,作为遥远的支撑堡垒。交易者关注两条路径:突破 50 周期平均线以重燃乐观,或跌破 100 周期线,加速下滑至更深的谷底。

看涨判决:

比特币仍处于短期到中期的下行趋势中,但 $95,500 和 $96,000 的关键支撑水平保持稳定,长期移动平均线提供额外的支撑。突破 $98,500,随后重新夺回 $100,000,可能会将动能转向买方,潜在目标为 $102,000 及更高。如果这一走势伴随成交量的增加,比特币可能会看到重新的看涨情绪,并从近期的下跌中反转。

看跌判决:

尽管在 $96,000 附近有暂时的支撑,比特币仍处于更广泛的下行趋势中,$98,500 和 $100,000 的强大阻力限制了上行潜力。振荡器和移动平均线表明持续的卖压,未能维持在 $95,500 之上可能会触发向 $92,000 甚至 $89,164 的更深回撤。在没有买入量激增的情况下,比特币在短期到中期面临进一步下行的风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。