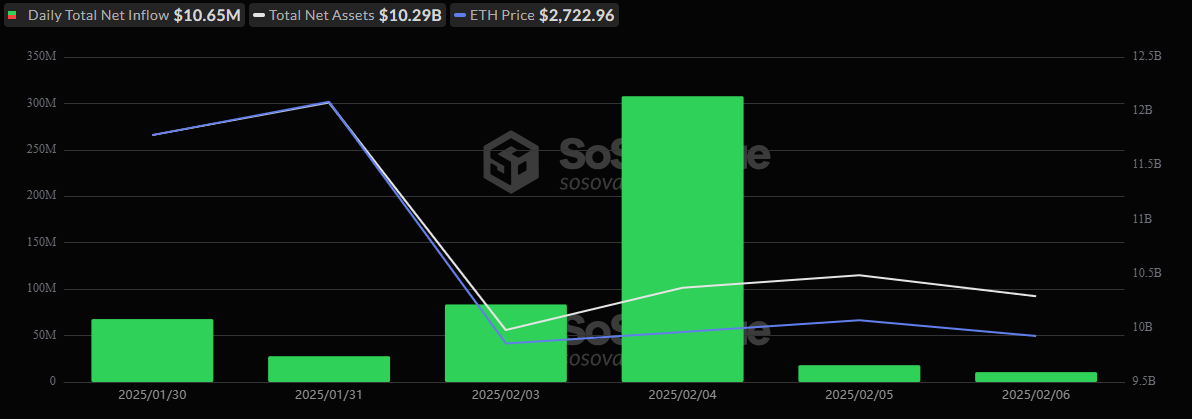

在2月6日星期四,比特币ETF面临净流出1.403亿美元,而以太坊ETF则继续其上升轨迹,获得净流入1065万美元。这是以太坊ETF连续第六天出现正向波动,Sosovalue对此进行了报道。

比特币ETF的流出主要是由于Fidelity的FBTC,该基金出现了1.0325亿美元的显著撤资,使其总净资产降至203.5亿美元。

此外,Grayscale的GBTC也经历了4221万美元的流出,使其净资产降至194.6亿美元。比特币ETF中唯一的流入来自Grayscale的BTC基金,该基金带来了515万美元的流入,使其净资产增至40.6亿美元。

相反,以太坊现货ETF保持了其积极的势头。Blackrock的ETHA是唯一的流入贡献者,带来了全部的1065万美元。这使其净资产增至36.7亿美元。

以太坊ETF连续六天的正向流入突显了机构和零售投资者对以太坊投资的日益吸引力。

截至2月6日,以太坊现货ETF的累计净流入总额为31.8亿美元,总净资产为102.9亿美元,而比特币ETF的净流入记录为405.3亿美元,总净资产为1135.1亿美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。