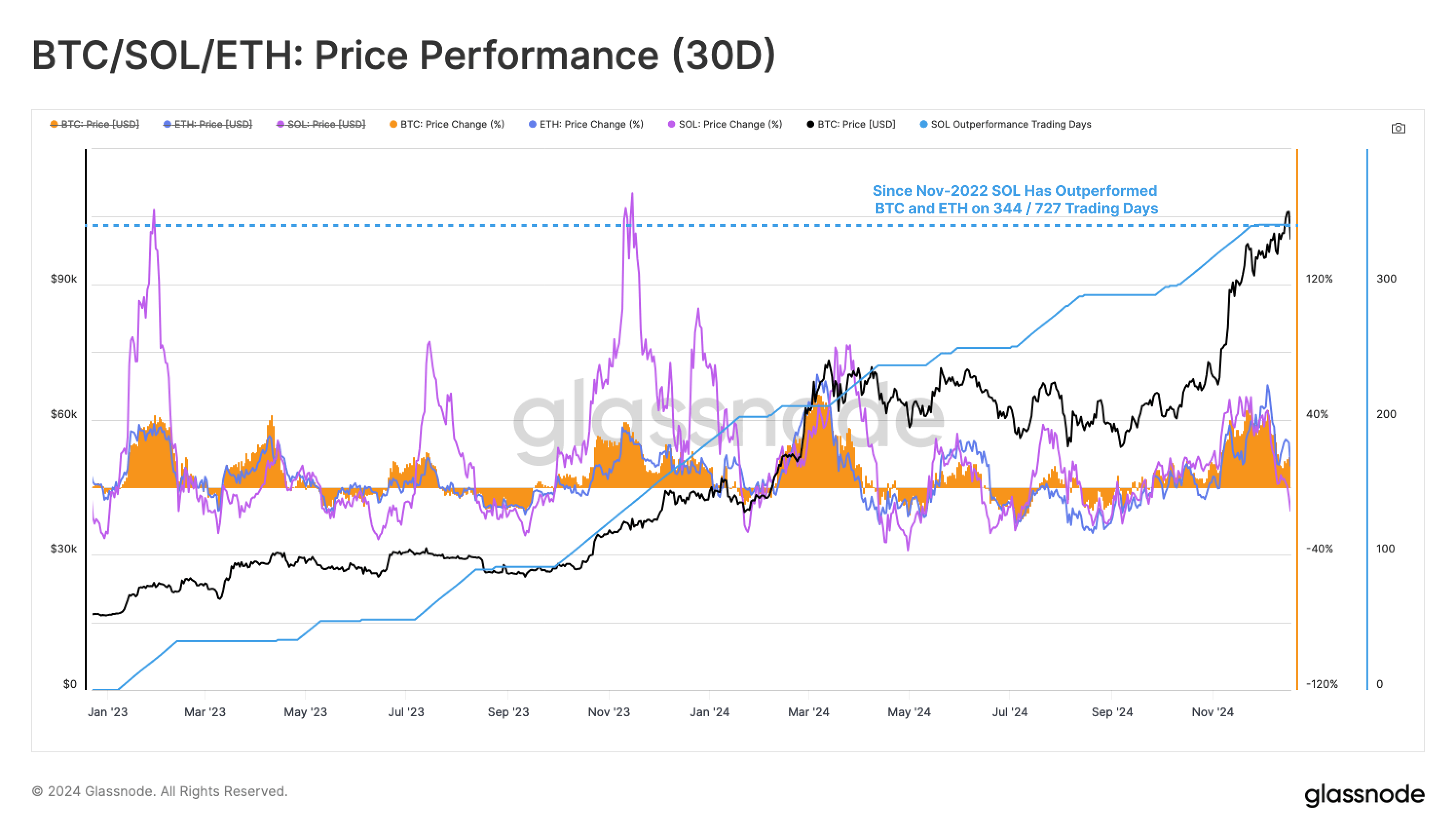

The Glassnode report examines the asset’s recovery, its competitive performance against major cryptocurrencies, and the factors driving its momentum. From its November 2022 cycle low, solana (SOL) has consistently outperformed bitcoin (BTC) and ethereum (ETH), fueled by substantial capital inflows.

Glassnode’s analysis indicates a net liquidity increase of $55 billion in this period, which has been a significant contributor to its price surge. “After plummeting to a shocking low of just $9.64, solana has made a remarkable recovery, recording an astonishing increase of +2,143% over the last 2 years,” the report notes.

Glassnode adds:

This impressive price performance has allowed solana to outperform both bitcoin and ethereum on 344 out of 727 trading days since the FTX event, showcasing the substantial growth and demand for the asset.

Capital flows, Glassnode’s findings show, have played a pivotal role in solana’s resurgence. By measuring metrics like Net Realized Profit/Loss and Hot Realized Cap, Glassnode found that SOL has consistently attracted new investor capital. Notably, new capital inflows into solana surpassed ethereum for the first time before the start of 2024. These inflows have helped stabilize its market position and provided further growth opportunities, the report highlighted.

“During the same time period, the significant inflow of capital has allowed solana to accrue over +$55B in USD liquidity, increasing the Realized Cap from $22B to an astonishing $77B,” the firm’s researchers state. Glassnode’s metrics reveal that coins held by short-term investors and those aged 6 to 12 months account for over 50% of sell-side pressure. The report emphasizes that such balanced profit distribution reflects confidence across a diverse investor base.

Using the Market Value to Realized Value (MVRV) ratio, Ukuria OC’s and Cryptovizart’s findings suggest solana’s market is relatively heated but not at extreme levels. The asset’s current positioning between the mean and +0.5 standard deviation band implies the potential for continued growth before entering an overheated phase that could trigger widespread profit-taking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。