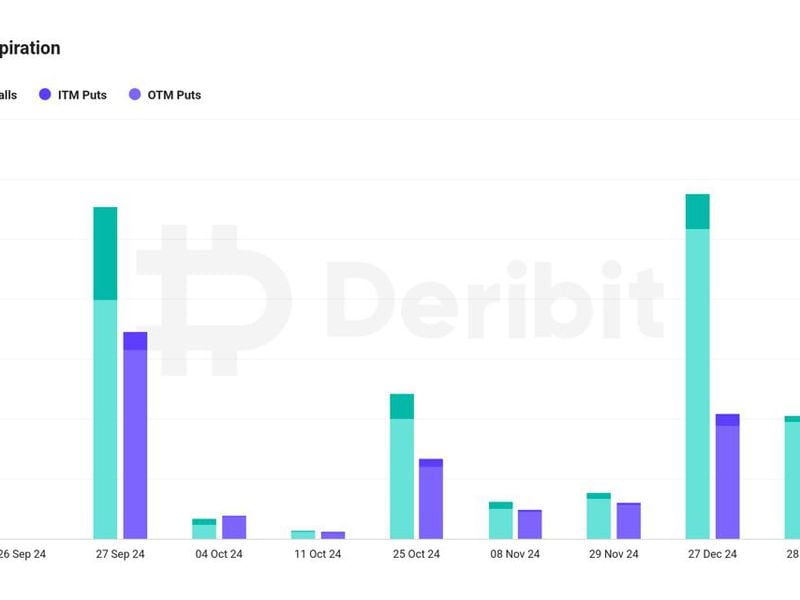

比特币(BTC)市场可能在接下来的两天变得繁忙,因为价值数十亿美元的期权合约将于周五08:00 UTC到期,加密货币交易所Deribit在周三的消息中告诉CoinDesk。

截至目前,价值58亿美元的9万个BTC期权合约将与价值19亿美元的以太期权一同到期。Deribit的一个期权合约代表一个BTC或一个ETH。Deribit是全球领先的加密货币期权交易所,占全球活动的85%以上。

在总共58亿美元的比特币期权持仓中,约20%处于“实值”状态,即具有有利的行权价格,与加密货币的市场价格相比。以太期权也呈现类似的情况。对于认购期权,实值意味着行权价格低于市场价格,而对于认沽期权则相反。这两者都允许持有者行使其买入或卖出的权利,为市场波动铺平了道路。

“在即将到期的BTC期权中,约20%处于实值状态。这一较大的到期可能会加剧市场波动或活动,因为交易者关闭或延期其持仓,这也可能会影响价格,”Deribit首席执行官Luuk Strijers在接受CoinDesk采访时表示。

持仓延期意味着关闭即将到期的现有交易,并在随后的到期日开立新的交易,以延长持有期。盈利头寸通常会延期,因为经验丰富的交易者更愿意让盈利继续增长。

未来几个月的活动可能会保持强劲,因为美国证券交易委员会(SEC)决定批准与BlackRock比特币ETF(IBIT)相关的期权,这可能加速机构的采用。

“最大的潜在驱动因素之一是ETF的期权。SEC已经表示支持,但OCC和CFTC尚未批准,也不太可能在本周批准,”Strijers表示。

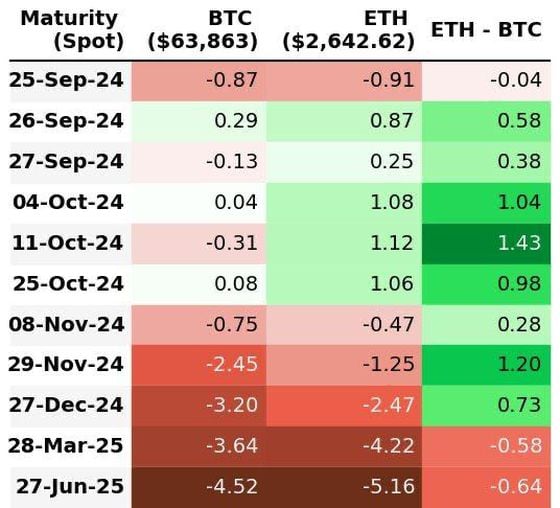

未来几个月到期的期权定价表明了看涨的前景。

“在9月到期后,BTC和ETH的认购-认沽偏斜为负,这是一个看涨的指标,因为认购相对于认沽来说相对更昂贵,”Strijers指出。

认购期权为买方提供了不对称的看涨风险,可以保护免受价格上涨的影响,而认沽期权则提供了对市场下跌的保险。

在期权市场中的看涨偏向与共识一致,即美联储重新启动降息周期以及其他央行(包括中国人民银行)的类似举措将支撑比特币和以太的需求。根据Birtfinex的分析师,一旦比特币突破65,200美元的水平,涨势可能会加速。

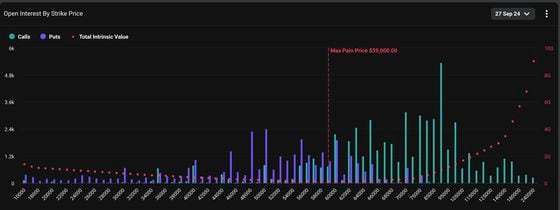

最大痛点是期权买家在到期时遭受最大损失的价格水平。传统市场上的一种流行理论经常将最大痛点水平视为到期时的磁铁。这是因为期权卖家,通常是拥有充足资本供应的大型机构,会交易基础资产以影响现货价格,使其围绕最大痛点处施加最大损失于买家。

比特币在本周五到期的最大痛点水平为59,000美元。“当前的最大痛点水平为59,000美元,大约低于现货价格8%,在我们接近到期时确实会产生一些潜在的下行压力,”Presto Research的分析师Rick Maeda告诉CoinDesk。

最大痛点理论自2021年以来一直存在,尽管一些人认为加密期权市场仍相对较小,对现货价格的影响不大。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。