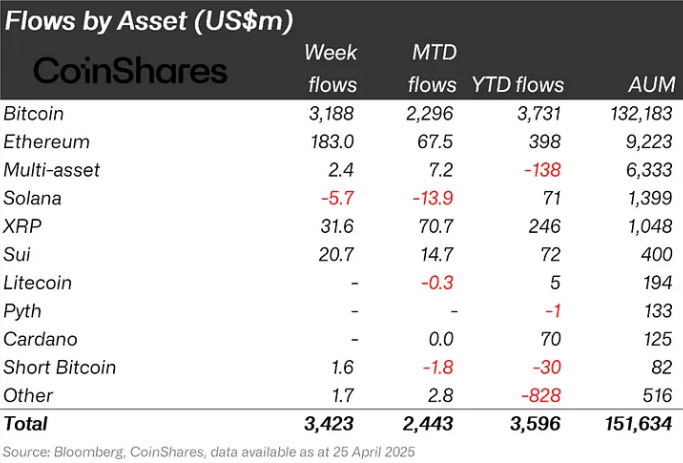

Digital asset investment products recorded a massive $3.4 billion in inflows last week, the third-largest weekly total on record, according to Coinshares’ fund flows report. The spike comes as investors increasingly view cryptocurrencies as safe havens against the backdrop of escalating trade tensions.

Bitcoin products dominated, pulling in $3.18 billion in inflows, helping total digital asset assets under management (AuM) climb back to $132 billion, levels not seen since February 2025.

Source: Coinshares

Ethereum also saw a resurgence, netting $183 million in inflows after suffering eight consecutive weeks of outflows. Meanwhile, altcoins remained mostly quiet. Solana bucked the positive trend with $5.7 million in outflows, though XRP and Sui registered notable inflows of $31.6 million and $20.7 million, respectively.

Regionally, the surge was led by U.S. investors, who contributed $3.3 billion, with notable support from Germany and Switzerland as well. Blockchain equities also enjoyed positive momentum, with $17.4 million in inflows, primarily into bitcoin mining ETFs.

The sharp move into crypto underscores growing demand for alternative assets as macroeconomic uncertainty lingers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。