Summary

● In April 2025, the Trump administration announced the launch of a "reciprocal tariff" policy, imposing a uniform 10% "minimum benchmark tariff" on global trade partners, which triggered severe fluctuations in global risk assets.

● Bitcoin, as a major public chain adopting the PoW (Proof of Work) mechanism, relies on physical mining machines for mining. These mining machines are not on the U.S. tariff exemption list, leading to significant cost pressures for mining companies.

● The decline in mining machine manufacturers over the past month has been particularly pronounced, primarily due to the impact of the tariff policy on both the supply and demand sides of mining machine manufacturing.

● Self-operated mining farms are mainly affected by the supply side, and their business of selling Bitcoin to cryptocurrency exchanges is less impacted by the tariff policy.

● Cloud computing mining farms are relatively less affected by the tariff policy because the essence of cloud computing is to pass on the mining machine acquisition costs to customers through computing service fees, thus the erosion of platform profits is significantly less than that of traditional mining models.

● Although the tariff policy has hit Bitcoin mining in the U.S., Bitcoin spot ETF funds represented by BlackRock's IBIT and U.S. stock companies hoarding Bitcoin represented by MicroStrategy still hold the pricing power of Bitcoin.

● Bitcoin prices are no longer the sole indicator; policy trends, geopolitical security, energy scheduling, and manufacturing stability are the true keys to the survival of the mining industry.

Keywords: Gate Research, tariffs, Bitcoin, Bitcoin mining

Introduction

On April 2, the Trump administration announced the launch of a "reciprocal tariff" policy, imposing a uniform 10% "minimum benchmark tariff" on global trade partners and adding "personalized" high tariffs on countries with significant trade deficits. This policy triggered severe fluctuations in global risk assets, with the S&P 500 and NASDAQ both recording their largest single-day declines since March 2020; the assets in the cryptocurrency industry also significantly shrank. Following Trump's announcement of the tariff policy, China announced an 84% retaliatory tariff on the U.S., and the European Union imposed a 25% tariff on $21 billion worth of U.S. goods, leading to a total evaporation of over $10 trillion in global stock market value in just one week.

On April 9, the tariff policy saw a reversal, with Trump announcing a 90-day suspension of tariffs on 75 countries, excluding China, while the EU also suspended additional tariffs and began negotiations with the U.S. On that day, the S&P 500 rose by 9.51%, the NASDAQ rose by 12.02%, Bitcoin prices rebounded by 8.19% to $82,500, and Ethereum prices recovered to $1,650.

Among the many tracks in crypto assets, Bitcoin mining, due to its strong reliance on hardware, wide global supply chain span, and high capital intensity, has become one of the on-chain economic modules most directly affected by the tariff policy. The global trade friction caused by the U.S. reciprocal tariffs poses multiple shocks to the crypto mining industry. Since most Bitcoin mining machines are manufactured in China, the U.S.-China tariff war will increase the import costs of mining machines, with China's export tax rate to the U.S. rising to 145%, which will compress North American mining expansion plans; the depreciation of the RMB exacerbates the dollar debt pressure on Chinese mining companies, combined with fluctuations in electricity and energy prices, leading to continuous increases in operating costs. At the same time, the volatility of coin prices also affects miner income, with Bitcoin prices retreating from $82,500 before the tariff announcement to below $75,000.

At the macro level, concerns about stagflation from the Federal Reserve and risk aversion have combined, with high yields on 10-year U.S. Treasury bonds suppressing risk appetite and tightening financing conditions, causing mining company stock prices to decline alongside the tech sector. Against the backdrop of geopolitical tensions, the global mining layout faces reconstruction, and companies may accelerate their shift to tariff-friendly regions such as Southeast Asia and the Middle East. In the short term, policy uncertainty will continue to amplify the risks in Bitcoin mining, and the industry may enter a new round of reshuffling.

1. Bitcoin Mining Faces Direct Impact from Tariff Policy, Most Related Companies' Stock Prices Decline More Than NASDAQ 100 Index

Bitcoin, as a major public chain adopting the PoW (Proof of Work) mechanism and the highest market cap cryptocurrency, is widely regarded as "digital gold." Since the PoW mechanism relies on physical mining machines for mining, and mining machines and their upstream key components such as semiconductors are not on the tariff exemption list, related mining companies face significant cost pressures. The upstream shock brought by the tariff policy may indirectly affect the medium- to long-term trend of Bitcoin prices through cost transmission mechanisms.

The main ecosystem of Bitcoin mining includes mining machines, self-operated mining farms, and cloud computing mining farms. Mining machine companies include Bitmain, Canaan Creative (NASDAQ: CAN), Bit Micro, and Ebang International (NASDAQ: EBON), among others. Most of these companies' main factories are located in mainland China. Among them, Bitmain holds a major share of the mining machine market (its 2018 prospectus disclosed a market share of over 70%).

Self-operated mining farm companies include Marathon Digital (NASDAQ: MARA), Riot Platform (NASDAQ: RIOT), Cleanspark (NASDAQ: CLSK), and several others. The self-operated mining companies listed on NASDAQ are headquartered in the U.S., but their mining farms are distributed across multiple countries, including the U.S., UAE, and Paraguay. Marathon owns the largest mining farm globally, with a total computing power exceeding 54EH/s, accounting for about 6% of the current total network computing power.

The main companies in the cloud computing mining farm sector include Antpool, Bitdeer (NASDAQ: BTDR), BitFufu (NASDAQ: BFBF), and Ecos, among others. Unlike self-operated mining farms, cloud computing mining farms package the computing power required for mining and sell it to individual or institutional clients, thereby partially transferring the risk of Bitcoin price fluctuations to customers. The platform itself focuses on site selection, construction, and daily operations of the mining farms. Bitdeer has a portion of self-operated mining farms and a portion of cloud computing mining business. BitFufu only has cloud computing business.

Affected by Trump's tariff policy, the stock prices of companies related to Bitcoin mining have declined. Their declines have exceeded that of the NASDAQ 100 index. Using data from Yahoo's yfinance database, I collected the closing prices of eight Bitcoin mining-related companies over the past month, as well as the NASDAQ 100 index as a reference standard. On April 2, when Trump announced the tariff policy, the stock prices of Bitcoin mining-related companies all fell sharply, while on April 9, after Trump announced a 90-day delay in the implementation of the tariff policy, the stock prices of Bitcoin mining-related companies showed a significant rebound.

After standardizing the data, since the announcement of the tariff policy on April 2, mining machines have been the most significantly declining sector in Bitcoin mining, with Canaan Creative down over 17% and Ebang International down over 11%. The self-operated mining farm sector follows, with Core Scientific leading the decline, down over 10% in the past month; Marathon's decline was only 0.8%, the lowest in the sector. Finally, cloud computing mining farms were less affected, with BitFufu only down 5.9%. The NASDAQ 100 index, as a reference standard, fell by 2.2%.

Table 1: Performance of Bitcoin Mining Companies and NASDAQ 100 Index (NDX) Over the Past Month

2. Analysis of the Impact of Tariff Policy on Various Sectors of Bitcoin Mining

After Trump announced the tariff policy, companies related to Bitcoin mining experienced varying degrees of decline, but as mentioned above, the stock price performance of different sub-sectors also showed a certain degree of differentiation. The core reason for this is that different levels of tariffs affect various links in the Bitcoin mining supply chain.

Figure 1: Core Supply Chain of Bitcoin Mining

2.1 Mining Machine Manufacturers

From the stock price performance, mining machine manufacturers have seen the most pronounced decline over the past month, primarily due to the impact of the tariff policy on both the supply and demand sides of mining machine manufacturing. The upstream of mining machine production includes foundries such as TSMC, Samsung, and SMIC. Mining machine companies first complete the IC design of ASIC chips independently, then send the blueprints to foundries for wafer fabrication. After successful wafer fabrication, the foundries will mass-produce the ASIC chips, which the mining machine companies will then package into mining machines.

TSMC holds a 64.9% market share in the chip foundry sector【1】, and the Trump administration has demanded that TSMC build factories in the U.S., or it will impose tariffs exceeding 100%【2】. Foundries such as SMIC, Hua Hong Semiconductor, and Samsung are also under pressure from high U.S. tariffs. Foundries have only two options: pay tariffs or reduce orders from the U.S.; either choice will lead to a decline in the foundries' profits. This pressure may be passed down to downstream mining machine manufacturers, forcing them to pay higher prices to improve the gross margins of foundry orders.

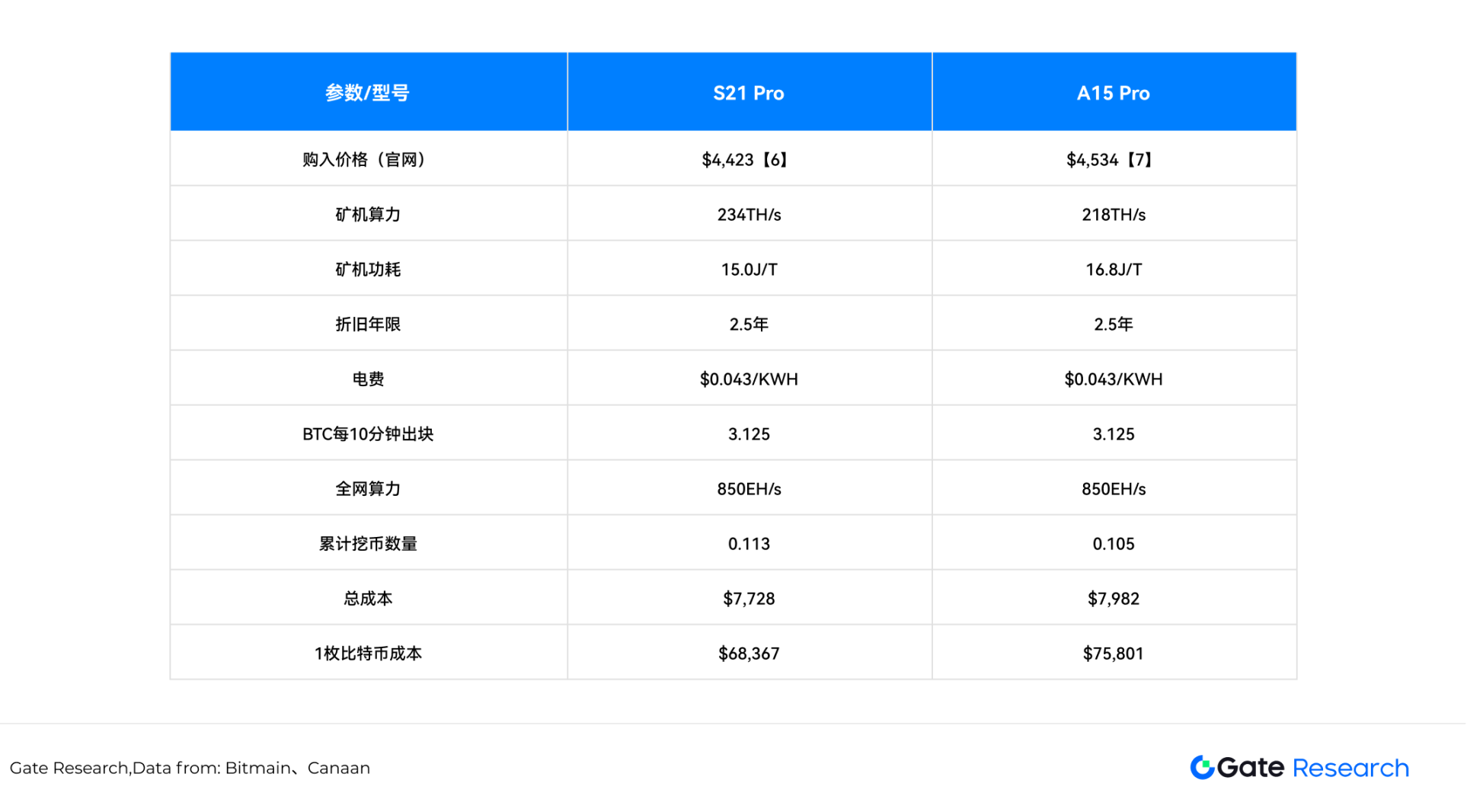

On the demand side, since companies like Bitmain, Canaan Creative, and Bit Micro are registered in China, U.S. mining farms like Marathon, Riot, and Cleanspark must bear high tariffs when purchasing mining machines, incurring higher costs. Therefore, in the short term, orders for mining machines will see a significant shrinkage. Taking Bitmain's main model, the Antminer S21 Pro, and Canaan Creative's main model, the Avalon A15 Pro, as examples. Before the implementation of the tariff policy, assuming an electricity cost of $0.043/KWH (Cleanspark's projected electricity cost for 2024)【3】, with a total network computing power of 850EH/s【4】, and a depreciation period of 30 months for the mining machines【5】, the current cost of mining one Bitcoin with the S21 Pro is $68,367, while the A15 Pro's cost is $75,801.

Table 2: Mainstream Mining Machine Parameters in Bitcoin Mining

Note 1: The main calculation formulas are as follows:

Cumulative number of mined coins = Mining machine computing power × 60 × 24 × 365 × Depreciation period × Block reward / 10 / Total network computing power / 1,000,000

Total cost = Mining machine price + Mining machine computing power × Mining machine power consumption × Electricity cost × 24 × 365 / 1,000 (excluding personnel and site rental costs)

Mining cost = Total cost / Cumulative number of mined coins

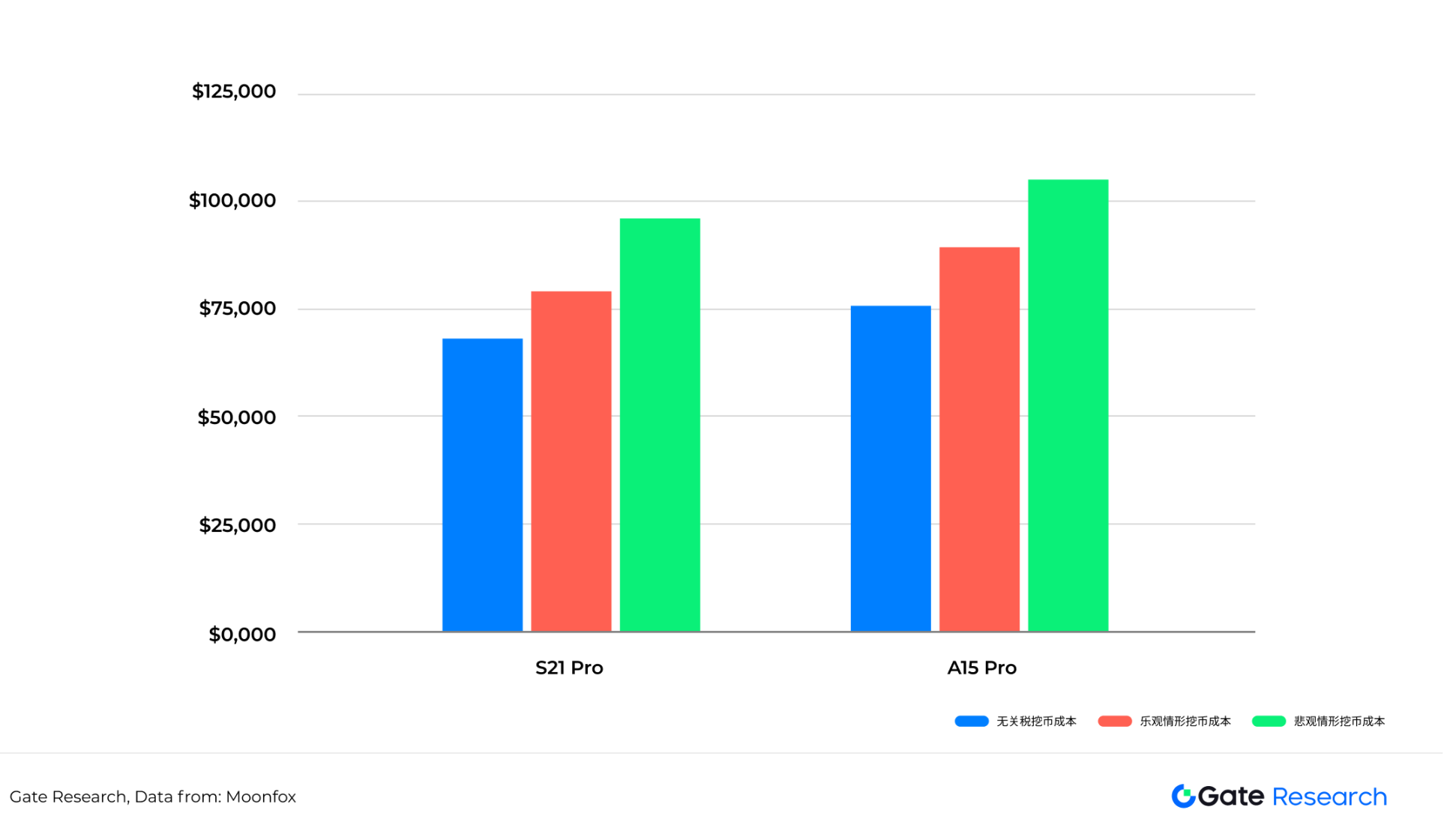

Once the tariff policy is implemented, in an optimistic scenario, if the export price of mining machines increases by 30% from the original price, the cost of mining one Bitcoin with the S21 Pro would be $80,105, and with the A15 Pro, it would be $88,717. In a pessimistic scenario, if the export price of mining machines increases by 70% from the original price, the cost of mining one Bitcoin with the S21 Pro would be $95,756, and with the A15 Pro, it would be $105,938.

Table 3: Mining Costs of Mining Machines Under Different Tariff Scenarios

The above prices do not take into account the complex operating costs of mining farms, which include site rental costs and personnel costs. Including these costs would further increase the mining costs. The significant increase in tariffs will lead mining farms to bear higher mining costs, and the weakening of demand will also have a substantial impact on upstream mining machine manufacturers.

From a long-term perspective, mining machine manufacturers may prioritize capacity layout in tariff-friendly regions, effectively avoiding potential tariff policy risks and achieving supply chain cost optimization through global capacity allocation strategies.

2.2 Self-Operated Mining Farms

Compared to mining machine manufacturers, which are squeezed from both the supply and demand sides, self-operated mining farms are mainly affected by the supply side, and their business process of selling Bitcoin to cryptocurrency exchanges is less impacted by the tariff policy. Bitcoin prices are influenced by the tariff policy, leading to a capital aversion to uncertainty, resulting in a short-term capital outflow and a noticeable decline in Bitcoin prices. However, self-operated mining farms like Marathon, with sufficient cash flow, will choose a hoarding strategy rather than immediately selling Bitcoin on exchanges after mining. Similar to MicroStrategy's strategy of borrowing to buy Bitcoin, Marathon has issued convertible bonds multiple times to directly purchase Bitcoin. Therefore, large mining farms are relatively less affected by the decline in Bitcoin prices.

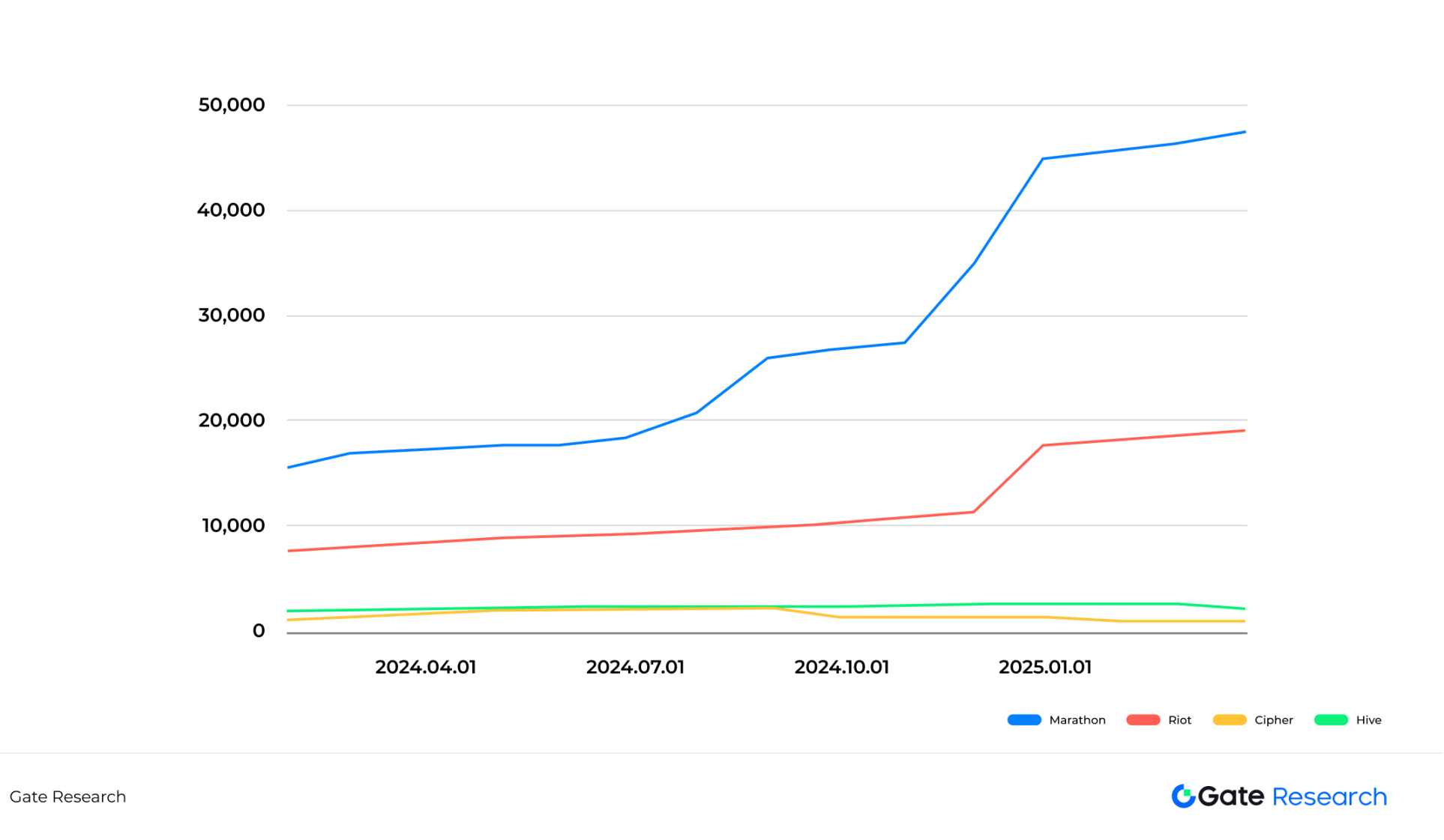

For small mining farms with tight cash flow, the decline in Bitcoin prices significantly impacts their stock prices. Due to limited funds, these farms typically cannot hold onto mined Bitcoin for long and must sell immediately after mining to maintain operational funds. During market downturns, this "mine and sell" strategy may exacerbate market selling pressure, further affecting Bitcoin price trends. As shown in the figure below, Cipher and Hive held 1,034 and 2,201 Bitcoins respectively in March 2025, down 40% and 3% year-on-year; while Marathon and Riot held 47,531 and 19,223 Bitcoins respectively in March 2025, up 173% and 126% year-on-year.

Table 4: Changes in Bitcoin Holdings of Self-Operated Mining Companies (January 2024 to March 2025)

In the past month, small and medium-sized self-operated mining farms Cipher and Hive Digital saw stock price changes of -7.1% and -5.5% respectively since the announcement of the tariff policy, with declines significantly exceeding those of larger mining farms like Marathon that adhere to hoarding strategies.

However, from a long-term perspective, the depreciation cycle of mining equipment typically lasts 2.5 to 3 years, which means self-operated mining farms need to continue capital expenditures (CAPEX) to purchase new mining machines to replace old equipment. Although different mining companies use varying statistical standards when disclosing computing power data (such as average monthly computing power, powered-on computing power, end-of-month computing power, etc.), it is difficult to directly compare computing power metrics across different companies. From January 2024 to March 2025, the disclosed computing power data from mainstream listed mining companies showed that their computing power growth rates generally exceeded 70%. The core driver of sustained computing power growth is "relative competitiveness": in the context of rising total network computing power, if a mining farm's own computing power does not increase accordingly, the number of Bitcoins it can mine will continue to decline. Bitcoin mining is a dynamic game; expanding computing power is like rowing upstream—if you do not advance, you will retreat.

In this context, if the tariff policy on mining machines is formally implemented, the cost pressure on upstream mining machine manufacturers will inevitably be transmitted to downstream mining farms, further increasing the marginal production costs of the industry and posing challenges to the profitability of medium-sized mining farms.

2.3 Cloud Computing Mining Farms

Cloud computing mining farms are essentially a leasing model, with upstream being mining machine manufacturers and downstream being individual and institutional clients. Cloud computing mining farms do not hold or sell Bitcoin; instead, they package computing power for 30, 60, or 90 days and sell it to clients, who will choose to hoard or sell Bitcoin based on their judgment. Therefore, cloud computing mining farms primarily earn service fees paid by clients and do not directly bear the profits or losses resulting from Bitcoin price fluctuations.

The core competitiveness of cloud computing mining farms lies in optimizing site selection to reduce leasing, electricity, and labor costs while maintaining high flexibility in computing power deployment to respond to market fluctuations—rapidly expanding mining machines and sites to meet client demand during bull markets, and streamlining operations and converting redundant computing power to self-mining during bear markets. This dynamic balancing ability directly determines the company's market competitiveness.

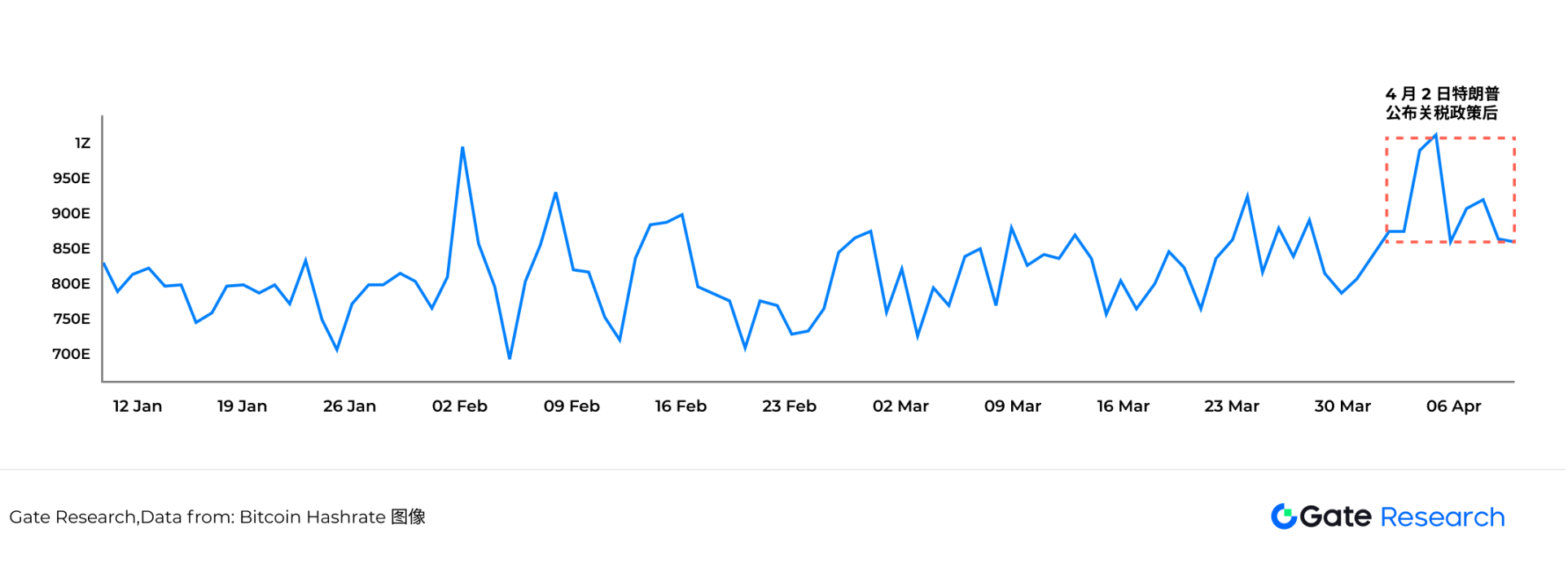

The revenue of cloud computing companies is mainly driven by total network computing power. When total network computing power rises, it indicates that most miners remain optimistic about Bitcoin's future price, or more clients choose to purchase cloud computing power; when total network computing power declines, it means miners are pessimistic about Bitcoin price trends, and the portion of cloud computing power in total network computing power will also decrease. The data in the figure below shows that after Trump announced the tariff policy on April 2, the average daily total network computing power of Bitcoin even reached a historical high on April 5, breaking through 1 ZH/s for the first time.

Figure 2: Changes in Bitcoin Total Network Computing Power (January 2025 to April 2025)

From a cost perspective, although the price of mining machines faces upward pressure due to the transmission of tariff policies, the leasing business model of cloud computing mining farms inherently possesses a risk buffer mechanism—essentially passing on the mining machine acquisition costs to clients through computing service fees, and some clients directly share hardware investments through mining machine hosting agreements, making the erosion of platform profits from mining machine premiums significantly less than that of traditional mining models. This cost transfer and sharing characteristic makes cloud computing mining farms one of the sectors least impacted by the Trump administration's tariff policy.

3. The Impact of Restructuring the Bitcoin Mining Landscape on Bitcoin Prices

The recent imposition of tariffs on Bitcoin mining equipment imported from countries like China by the U.S. has significantly increased the operating costs for U.S. miners. This provides greater potential opportunities for non-U.S. companies to enter the Bitcoin mining industry, as they can procure Chinese-manufactured mining machines from other countries at lower costs, thus gaining a cost advantage. Although U.S. mining farms can mitigate some tariff impacts by establishing operational bases overseas, it is undeniable that these tariff policies have increased the operating costs and policy risks for domestic mining farms.

Based on the above reasoning, with a daily Bitcoin output of 450 coins, the mining of Bitcoin will become more decentralized, and the influence of U.S. mining companies like Marathon, Riot, and Cleanspark may decline. Since large mining companies like Marathon have historically adopted hoarding strategies, while the attitudes of potential entrants from other countries towards holding Bitcoin remain unclear, they may choose a "mine and sell" strategy (immediately withdrawing mined Bitcoin and selling it on exchanges). From this perspective, high tariff policies are generally bearish for Bitcoin price trends. The departure of some mining farms from the U.S. also contradicts Trump's original intention of ensuring that all remaining Bitcoins are "Made in America."

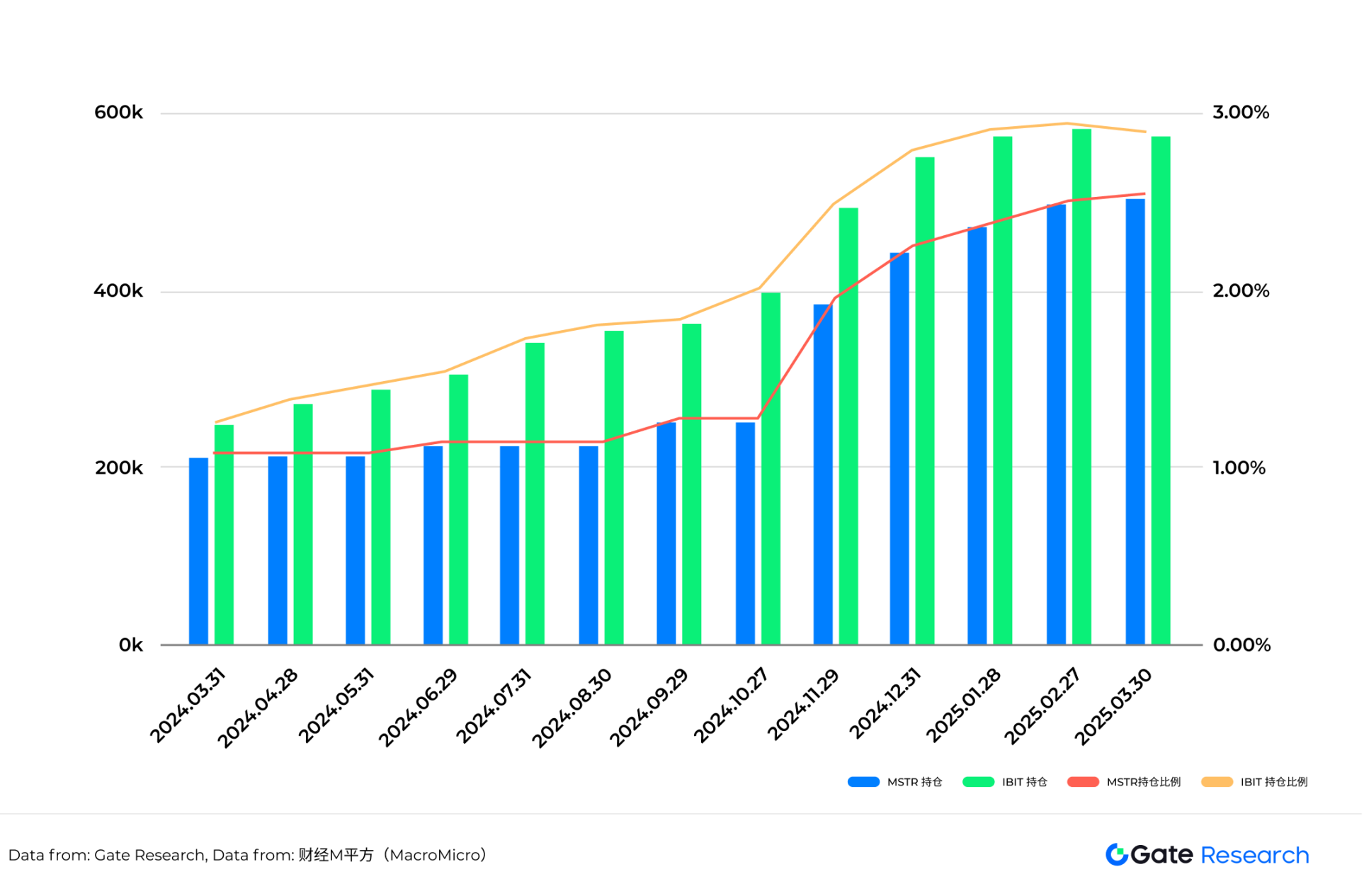

However, in the long term, the core logic of Bitcoin underwent fundamental changes in 2024. Bitcoin spot ETF funds represented by BlackRock's IBIT and U.S. stock companies hoarding Bitcoin represented by MicroStrategy still hold the pricing power of Bitcoin. As of April 2025, IBIT holds 570,983 Bitcoins【13】, and MicroStrategy holds 528,185 Bitcoins【14】. The proportion of Bitcoin holdings by both continues to increase【15】, and their purchasing power is sufficient to absorb the number of newly produced Bitcoins each day.

Table 5: Bitcoin Holdings and Proportions of MicroStrategy and IBIT

Conclusion

The Trump administration's promotion of the "reciprocal tariff" policy poses dual challenges of upstream costs and geopolitical layout for Bitcoin mining. Mining machine manufacturers are under the most pressure due to constraints in the foundry chain and reduced demand, while self-operated mining farms face dual squeezes from rising costs and increased capital expenditures, and cloud computing mining farms have relative buffering capacity due to their "risk transfer" mechanism. Overall, the pace of mining expansion in North America may be limited, and global computing power may further disperse to low-tariff regions such as Southeast Asia and the Middle East, leading to a potential decline in the influence of U.S. mining companies within the Bitcoin ecosystem.

Mining enterprises often involve significant investment, long cycles, and weak risk resistance; the Bitcoin network itself cannot actively adjust these risks, as its mechanism is "open, fair, and competitive," rather than "defensive, adaptive, and regulatory." This creates a structural contradiction: the most decentralized asset globally is supported by an industrial chain that is one of the most susceptible to centralized policy interventions. Therefore, mining participants must reassess the importance of policy. Bitcoin prices are no longer the sole indicator; policy trends, geopolitical security, energy scheduling, and manufacturing stability are the true keys to the survival of the mining industry.

In the short term, rising mining costs combined with some miners' "mine and sell" behavior may pose marginal bearish pressure on Bitcoin prices; however, from a medium- to long-term perspective, institutional forces represented by BlackRock's IBIT and MicroStrategy have become the dominant market forces, and their sustained buying power is expected to offset supply pressures and stabilize market structure. Bitcoin mining is at a critical juncture of policy reshaping and structural transition, and global investors need to closely monitor the policy evolution and the industry chain rebalancing brought about by computing power migration.

Data Sources

Cleanspark, https://www.sec.gov/Archives/edgar/data/827876/000095017024056324/clsk-ex99_1.htm

Bitinfocharts, https://bitinfocharts.com/comparison/bitcoin-hashrate.html

CoinShares Research, http://www.minerupdate.com/news/miner-insights/majority-of-bitcoin-miners-profitable-at-current-prices-according-to-coinshares-research

Bitmain, https://m.bitmain.com/cn/product/detail?pid=00020240402210032893O1Et7keX0682

Canaan, https://shop.canaan.io/products/avalon-miner-a15pro?VariantsId=10492

Marathon Digital, https://ir.mara.com/news-events/press-releases

Riot Platform, https://www.riotplatforms.com/overview/news-events/press-releases/

Cipher, https://investors.ciphermining.com/news-events/press-releases

Hive Digital, https://hivedigitaltechnologies.com/news/

Bitinfocharts, https://bitinfocharts.com/comparison/bitcoin-hashrate.html#3m

iShares, https://www.ishares.com/us/products/333011/ishares-bitcoin-trust-etf

Finance M Square, https://sc.macromicro.me/series/8120/bitcoin-circulating-supply【Bitcoin Mining Core Supply Chain](https://docs.google.com/presentation/d/1BjG5mUX7eeIw48ILD6VqIlnsOQY2fQhYXigXw5XxqL4/edit?slide=id.p#slide=id.p)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。