编译:Tim,PANews

PANews编者按:Sui生态流动性质押协议Haedal将于4月29日进行TGE,用户可领取空投。本文作者是Comma3 Ventures的创始合伙人,该机构曾参与Haedal Protocol的种子轮投资。Haedal Protocol是Sui生态中流动性质押领域隐藏的宝石项目。随着Sui质押市场蓄势待发,Haedal的创新产品和强劲数据使其成为DeFi首选投资标的之一。

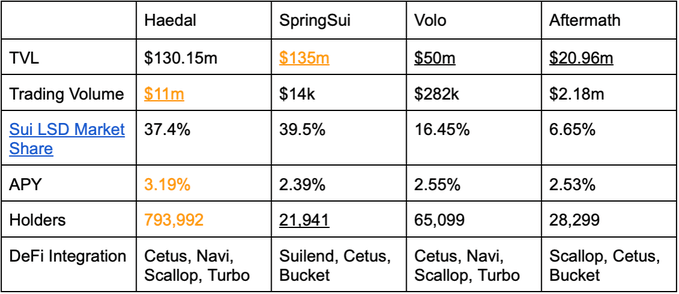

以下是值得投资的原因以及你需要关注的重点?(所有数据截至4月15日)

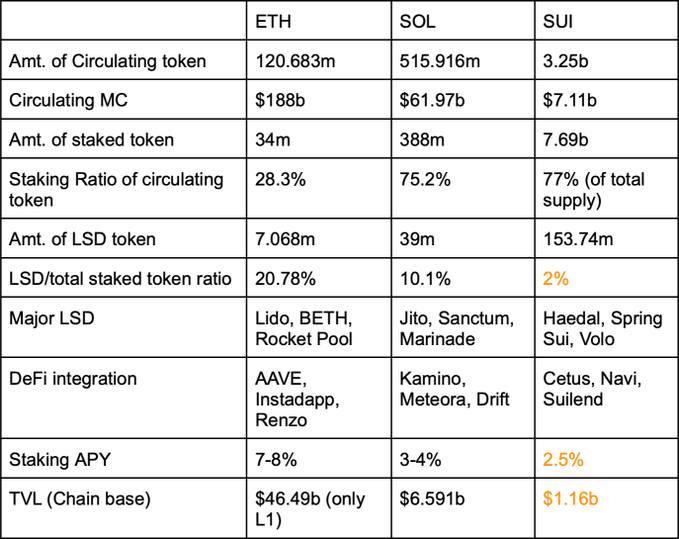

Sui网络的流动质押市场还不繁荣,被质押的SUI总价值为3.0748亿美元,其中仅2%具有流动性。相比之下:Solana网络中被质押SOL总价值42.9亿美元中有10.1%具流动性;以太坊网络的质押ETH总价值102.5亿美元中有30.5%具流动性。随着Sui生态发展,当前拥有1.2亿美元TVL的Haedal质押协议有望成为该生态的流动质押龙头。

Sui的流动质押衍生品市场的一个主要问题在于其质押年化收益率较低,约为2.5%,而Solana的APY为7-8%,以太坊的为3-4%。

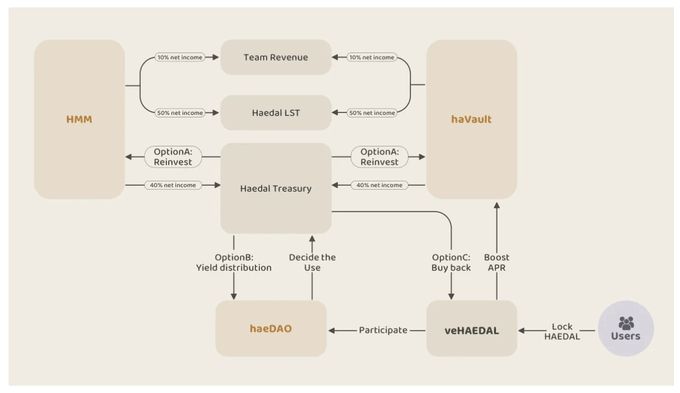

Haedal通过采用动态验证器选择机制及创新的Hae3框架:包括HMM、HaeVault和HaeDAO三大组件,显著提升了Sui网络的质押性能,其表现超越其他LSD协议。

Haedal通过监控所有网络验证节点的状态,在质押时选择APR最高的节点。而在取消质押时,Haedal会优先从APR较低的验证节点撤出资金,这种策略能持续保障流动性质押代币维持高年化收益率。

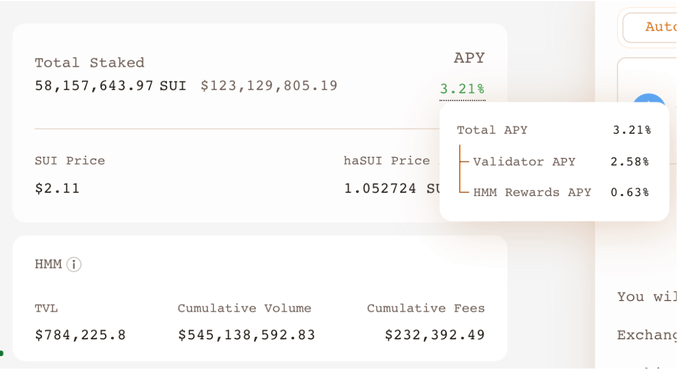

HMM(Haedal做市商)通过结合预言机定价和实时市场数据,优化Sui区块链上各DEX的流动性,并从中收取0.04%的交易手续费。

从2月到3月,交易量从5913万美元增长至2.8415亿美元,产生了23.6万美元的费用,期间平均TVL为80万美元。将50%的收入用于激励后,haSUI的年化收益率提升了24.4%,从2.58%提高至3.21%。

Cetus Protocol是Sui生态系统中规模最大的DEX,日交易量达9200万美元。Haedal于2025年1月6日上线,目前日交易量为569万美元,相当于Cetus交易量的6.12%。通过采用预言机定价机制,HMM正蓄势待发,有望通过捕获套利交易量实现收入快速增长。

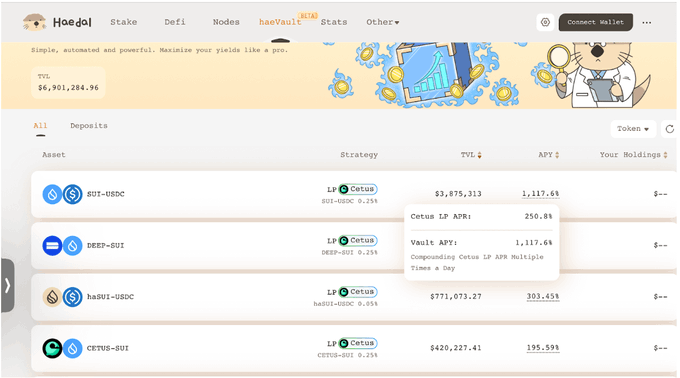

Haedal Vault为拥有闲置资金的用户简化了流动性供给流程,省去管理LP头寸的繁琐操作,让用户能轻松存入资金并获取更高收益。

Haedal Vault为拥有闲置资金的用户简化了流动性供给流程,省去管理LP头寸的繁琐操作,让用户能轻松存入资金并获取更高收益。

HaeVault通过超窄幅再平衡策略提升收益。以SUI-USDC交易对为例,Cetus平台提供的年化收益率为250.8%(基于Cetus数据),而HaeVault实现了1117%的年化收益率,在扣除16%的费用后,净收益率仍高达938%。

Hae3深度集成至Sui DeFi生态(TVL超10亿美元)。其中,HMM协议捕获DEX手续费收益,Haedal金库优化流动性提供者收益,HaeDAO则赋予治理决策权。

专注于基础质押和借贷业务的Volo和Suilend缺乏这种协同效应,这使得Haedal成为更优越的收益优化器。

HAEDAL代币的用例进一步巩固了其应用价值。将其锁定为veToken,可参与HaeDAO治理,或用于提升金库的年化收益率。此外,潜在的空投机会(这在Sui生态系统中十分常见)也为其增添了额外优势。

Haedal的核心指标表现强劲:TVL达1.1736亿美元(对比Suilend的1.174亿美元和Volo的5000万美元),日活跃钱包数超44000个,持有者数量达79.4万。当前,Haedal在交易量、年化收益率和持有者规模三项关键指标上暂时处于领先地位。

Hashed、Comma3、OKX Ventures 以及Animoca Brands等VC机构的支持进一步说明了其潜力。

Haedal凭借高增长市场(LSD渗透率仅2%,具备10倍上涨潜力)、创新产品和坚实基本面脱颖而出。随着Sui生态扩展,该协议在流动性质押领域处于有利地位,有望成为行业领导者。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。