Source: cryptoslate

Translated by: Blockchain Knight

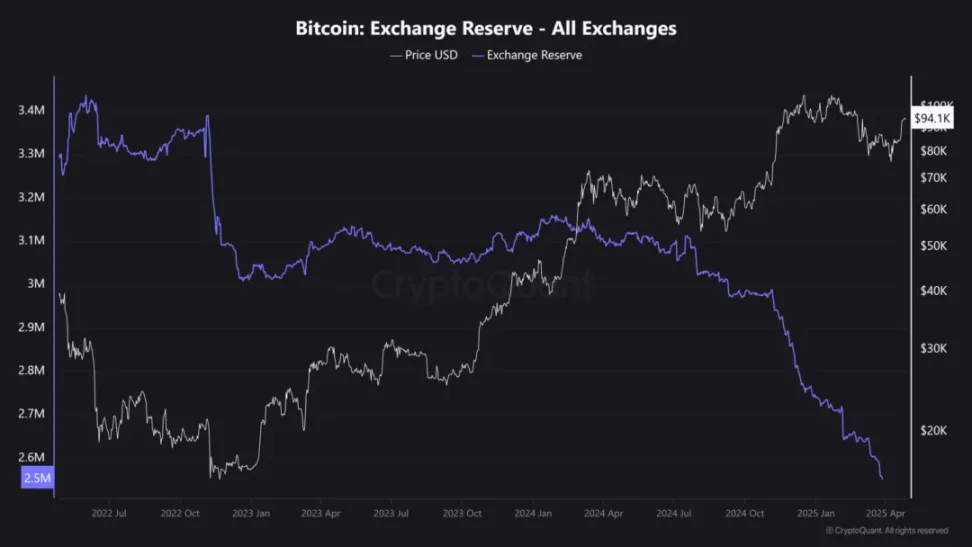

According to data from CryptoQuant, as of the end of April 2025, the supply of BTC held by centralized exchanges has dropped to its lowest level since 2019, with only about 2.5 million BTC remaining, a decrease of 500,000 BTC compared to the end of 2024.

Exchange BTC Supply Shows Trend Towards Self-Custody

The decline in exchange BTC supply is widely interpreted as a signal that investors are transferring BTC from platforms to private self-custody wallets. This behavior is typically associated with a long-term holding (HODLing) strategy, as investors withdraw tokens from exchanges to reduce the potential sell-off risk associated with the convenience of platform operations.

Since the beginning of 2023, withdrawing BTC from exchanges has been an evolving trend, when the BTC reserves on exchanges were about 3.2 million. Over the past year, this trend has accelerated with the participation of major institutional investors.

Institutional Demand May Trigger Global BTC Supply Shortage

Institutional demand for BTC could be a key factor driving the supply shortage. For example, major companies like Fidelity have recently significantly increased their BTC holdings, with Fidelity alone purchasing BTC worth $253 million, directly exacerbating the outflow of tokens from exchanges.

BTC veteran Dennis Porter expressed excitement about this, stating, "We have never seen anything like this before. A global BTC supply shortage has never occurred. This is a significant bullish signal."

Notable crypto asset trader Cas Abbe also pointed out on social media, "The BTC supply on exchanges has dropped to its lowest level since Q3 2018. Currently, only 2.5 million BTC remain on exchanges, down 500,000 from Q4 2024. A few days ago, Fidelity mentioned that institutions are continuously buying and withdrawing BTC from exchanges. Supply + demand = price explosion."

According to Coinbase's latest survey, over three-quarters of institutional investors plan to increase their allocation to digital assets in 2025, with many institutions using BTC for portfolio diversification and as a hedge against macroeconomic uncertainty.

Additionally, publicly traded companies represented by Strategy are also actively accumulating BTC. Since November 2024, these companies have withdrawn over 425,000 BTC from exchanges, with a total holding approaching 350,000 BTC.

Impact of Declining Exchange BTC Supply on the Market

The reduction in exchange BTC supply has several implications for the market, including a decrease in sell-off pressure. With the amount of BTC available for immediate sale decreasing, the risk of large-scale sell-offs is reduced, which helps stabilize or even push prices higher.

If demand continues to grow while supply remains constrained, the market may face a supply shortage, a situation that has historically led to sharp price increases.

On-chain analyst Willy Woo commented, "The fundamentals of BTC have turned bullish, and the conditions for breaking historical highs are already in place."

The shift towards self-custody and long-term holding reflects the maturation of the crypto asset market, where both retail and institutional investors increasingly view BTC as a strategic asset rather than a speculative tool.

The decline in exchange BTC supply is generally seen as a bullish signal, but it also means that a surge in demand could lead to increased price volatility. In the coming weeks, the market will test whether this supply shortage will drive BTC prices into a new upward trend or if market sentiment will change with the emergence of new macroeconomic data.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。