Author: Frank, PANews

Inflation management has always been a core proposition of public chain economic models and ecological development. Recently, the Aptos community has been embroiled in intense debate over a proposal, AIP-119, aimed at reducing staking rewards. Supporters view it as a necessary measure to curb inflation and activate ecological liquidity, while opponents warn that it may undermine the decentralized foundation of the network and even trigger capital outflows.

When the game of throttling and opening up collides with the redistribution of validator interests, this reform in Aptos not only concerns the future of the APT token economy but also reflects the deep-seated contradictions in PoS public chain governance. PANews explores how Aptos can find a breakthrough between high inflation and low activity by analyzing the proposal's controversy and comparing mainstream public chain models.

The Debate Over Inflation "Surgery": Healing or Harming?

AIP-119 was proposed by community member moonshiesty on April 17, 2025, on the Aptos Foundation's GitHub. The specific suggestion of the proposal is to reduce Aptos's base staking reward rate by 1% each month over the next three months, with the ultimate goal of lowering the annual percentage rate (APR) from about 7% (or 6.8%) at the time to 3.79%. In terms of content, the proposal itself is not complex; it merely aims to alleviate APT inflation by reducing staking rewards, which is beneficial for the long-term health of the ecosystem. However, it touches on the core interests of large staking nodes accustomed to passive income, leading to considerable debate within the community.

The mainstream supporting view holds that this proposal, in addition to quickly reducing APT inflation, can also incentivize token holders to move funds into other on-chain DeFi activities rather than relying solely on passive staking.

However, from the community discussions, the controversy surrounding this proposal is not limited to the opposition from large holders; many members have also raised concerns from the perspective of small validators and the entire community regarding the potential negative implications of this proposal.

Some opponents argue that significantly reducing staking rewards will have a greater impact on small validators. Many validators' profit margins will be compressed, potentially making it impossible to cover the costs of operating a validator (approximately $30,000 per year), forcing them to exit the network. This could indirectly weaken the decentralization of the Aptos network, ultimately concentrating power and resources among large validators.

Eric Amnis, co-founder of Amnis Finance, specifically calculated in the forum that a validator holding 1 million APT incurs annual server costs of about $72,000 to $96,000 (though this figure differs significantly from the $35,000 proposed by the proposer). If the yield is reduced to 3.9%, the final earnings may only be $13,000, leading to a situation where expenses exceed income. Only those holding over 10 million APT would barely break even, which would directly eliminate small validators.

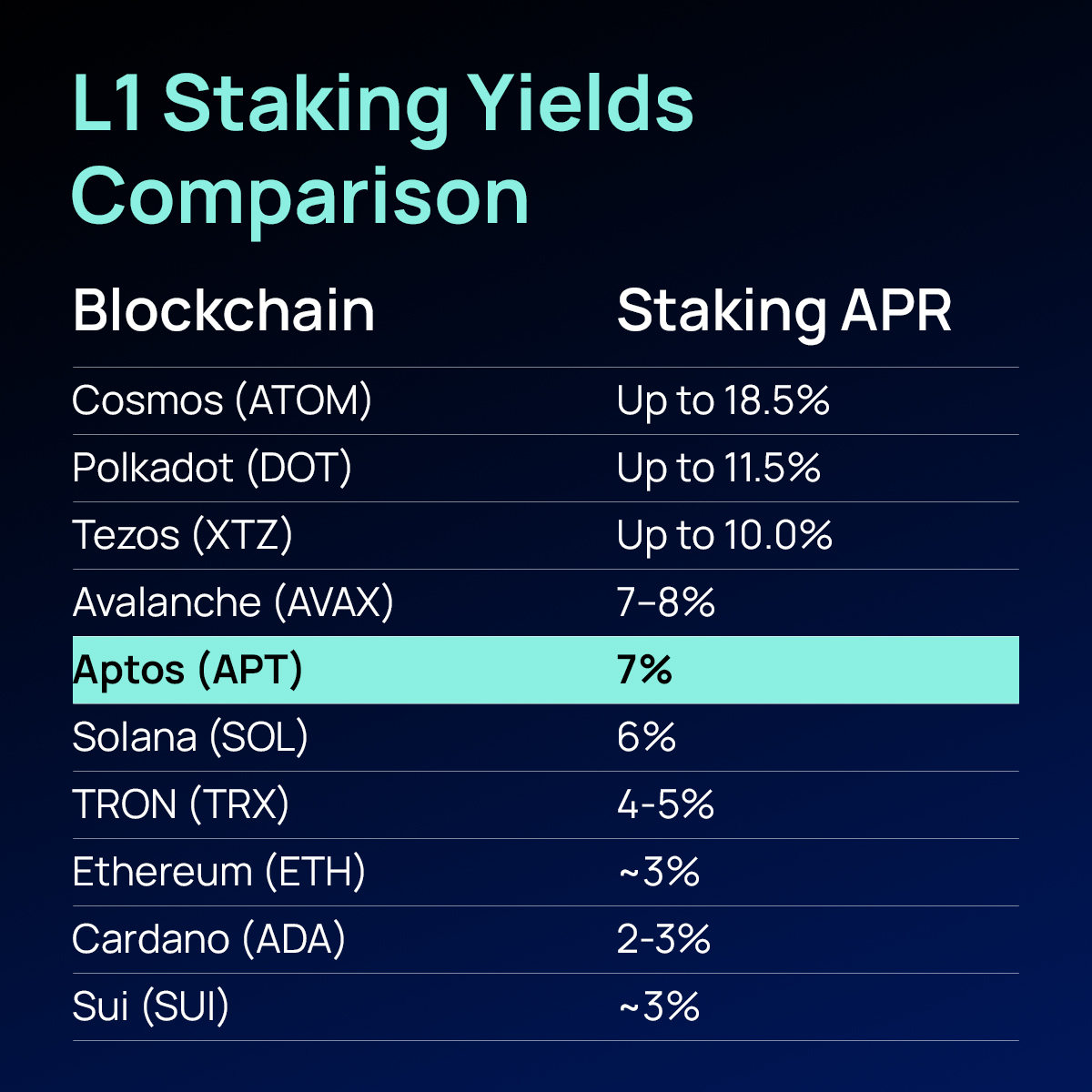

Additionally, some comments suggest that the reduced staking yield (3.79%) lacks competitiveness compared to other chains offering higher returns (such as Cosmos at about 15%), which may lead large holders and institutions seeking high yields to move their funds to other networks, reducing Aptos's TVL and liquidity, and creating a risk of capital outflow. Furthermore, the lower staking yield may also diminish the attractiveness of Aptos DeFi protocols to liquidity providers, affecting the growth and user participation of the protocols.

The Common Dilemma of PoS Governance: Balancing Rewards and Inflation

In fact, this proposal is similar to the previously proposed and ultimately rejected SIMD-0228 proposal on Solana, both attempting to curb network inflation by lowering validator yields, reflecting the dilemma of interest games in public chain governance. This governance dilemma is particularly pronounced in PoS consensus mechanisms.

Therefore, to assess whether the Aptos proposal is reasonable, the best approach is to compare how several similar mechanism public chains balance this issue and the effects produced.

Currently, Aptos's token inflation model issues 7% annually. According to the AIP-30 proposal, this maximum reward rate is planned to decrease by 1.5% each year (relative to the previous year's value) until it reaches a 3.25% annual lower limit over 50 years. As of April data, the staking rate of APT reached 76%, maintaining a relatively high ratio among public chains. In terms of fee burning, all transaction fees on Aptos are currently burned; however, since Aptos's on-chain fees are only a few thousand dollars per day, this burning is merely a drop in the bucket in resisting inflation.

From the token's performance over the past year, Solana is one of the more successful public chains within the PoS mechanism. Unlike Aptos's current fixed issuance ratio, Solana's inflation model is a gradually decreasing pattern, starting at 8% and decreasing by 15% each year, currently around 4.58%. Therefore, this dynamic inflation model seems to align with the expected goals of the Aptos proposal reform. However, for Solana, this inflation is still considered too high by the community, which led to the emergence of proposal 0228. In terms of staking ratio, Solana's current staking ratio is about 65%, lower than Aptos's 76%.

In terms of fee burning, previously, 50% of Solana's transaction fees were burned, but after the passage of proposal 0096, this 50% burn was canceled and rewarded to validators, further exacerbating Solana's inflation. However, due to the high activity level of the Solana network, it seems to have been less affected by inflation.

Additionally, another MOVE-based public chain, Sui, is often compared with Aptos. In terms of staking yield, Sui's yield is relatively low, ranging from 2.3% to 2.5%. Moreover, the SUI token has a hard cap of 10 billion SUI, fundamentally controlling the possibility of unlimited issuance. In terms of staking rate, SUI's staking rate is about 76.73%, close to APT. However, in terms of fee burning, the Sui network chooses to use fees as rewards and does not have a burning mechanism. Relatively speaking, Sui's hard cap model seems to alleviate some inflation anxiety within the community, resulting in a more favorable price performance.

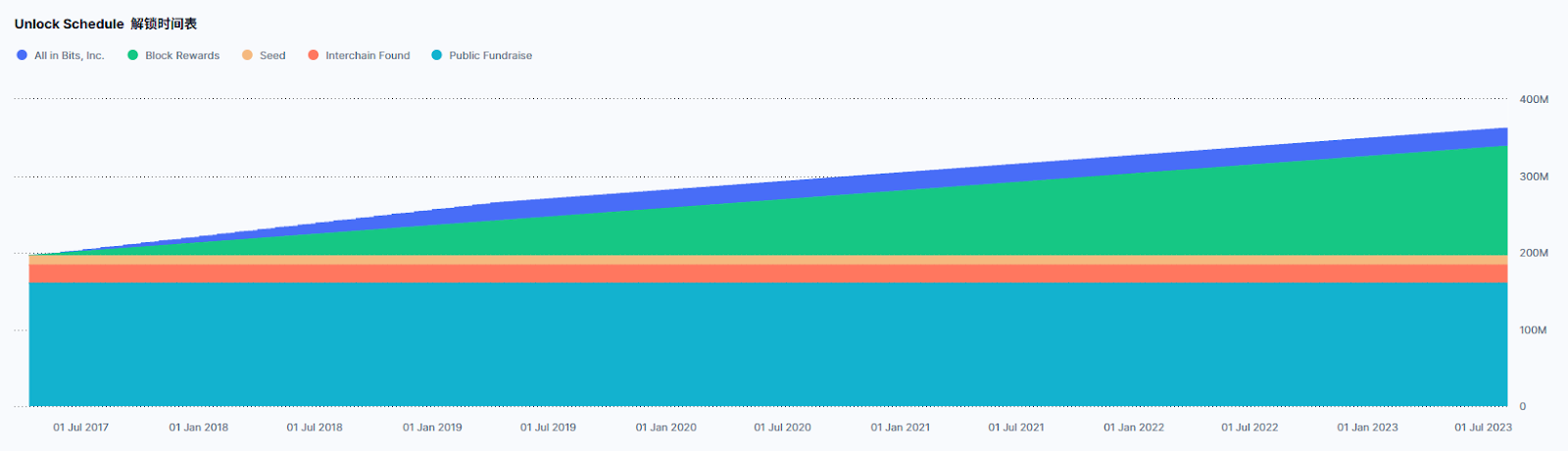

Furthermore, Cosmos's staking yield is quite typical, reaching 14.26%, and the circulating supply of tokens shows a continuous upward trend. Currently, Cosmos's staking rate is about 59%, and this inflation will continue until it reaches 67%. However, despite the high staking yield, the price trend of the ATOM token has been continuously declining, dropping from a high of $44 to a low of $3.81, a decrease of 91%.

Aptos's Choice—Throttling or Opening Up?

Overall, among the major PoS public chains, none have perfectly solved the balance between inflation rates and network participation. In addressing these games, one must control the inflation rate to maintain the healthy development of the token economic model while also attracting validators to participate in network governance through reasonably set staking rewards. Ethereum has achieved deflation at one point through its PoS transition and base fee burning. However, ETH does not seem to have experienced a price increase due to solving the inflation issue. In contrast, Solana, as of now, has recently passed a proposal to increase inflation (proposal 0096), while the deflationary proposal (0028) was rejected by the community. Yet, this does not seem to have significantly impacted Solana's token price. Ultimately, this is because Solana's network activity remains among the highest across public chains.

Curbing inflation is akin to throttling, while enhancing network activity is like opening up. For an active network, balancing throttling and opening is naturally important; however, for a currently less vibrant network, how to enhance activity is the true key to increasing the network's token value. Looking at the issues currently faced by Aptos, its TVL is only $1.1 billion, ranking 11th among public chains. Overall data is not particularly impressive, and the current number of validators in the network is 149, with 495 full nodes, which is also not very high. If many validators exit due to reduced yields, there is indeed a risk of significant damage.

Therefore, for Aptos, while considering "throttling" through AIP-119, it may be more prudent to reflect on its potential impact on the validator ecosystem and network decentralization. Rather than aggressively cutting rewards, a more pressing choice at this stage may be how to "open up"—that is, enhance network activity, attract more quality projects to settle, thereby building a truly prosperous and sustainable ecosystem. This may be the key to supporting the long-term value of APT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。