作者:Zen,PANews

Vintage 原指葡萄酒的“年份”,好的年份是自然对人类的馈赠,而差的年份受制于天气与土壤难掩缺陷。在基金中通常将“成立年份”也叫作Vintage,如同葡萄酒的年份是“风土”的反馈,基金的年份更是经济周期的快照,直接影响着回报。

对于成立于疫情大放水时期的加密基金而言,当下正经历着来自“坏年份”的痛苦反噬。

成也泡沫败也泡沫

近期,加密基金投资人们在社交媒体上互诉苦水。起因是Web3 基金 ABCDE 宣布,这支4亿美元的基金将不再投资新项目,也不会再为第二期募集资金。该基金的创始人杜均称,过去三年,ABCDE 已向 30 多个项目投资了价值超过 4000 万美元的资金,尽管当前的市场环境不佳,但其内部收益率 (IRR)仍然处于全球领先水平。

ABCDE为投资按下暂停键,反应出如今加密VC们的困境:机构募资规模与项目投资热情双双下滑,代币上线锁仓模式频遭质疑,灵活投资者甚至通过二级市场和对冲操作为自身组合保值。在宏观利率高企、监管不明和行业内部难题交织下,加密VC正经历迄今最为严峻的调整期。尤其是成立于2021年左右的加密基金,当前的环境加剧了基金们的退出期的工作难度。

Cypher Capital的联合创始人Bill Qian披露了他们投资的基金的表现,“我们这个周期投了10+VC funds,GP都非常优秀,都捕获了头部项目。但对于我们对于整个vc基金的投资(我们做LP),已经做了60%的会计减持,也就是希望最后能回来40%的本金;没办法,2022/23投资的这个年份(vintage)赶上了,就得认。有时候你什么都没错,只是败给了时间和年份。”但他对下个周期的crypto vc反而很看好,因为物极必反。就好像2000年的web2 VC 在硅谷全军覆没,但之后的年份又成了孕育和投资创新的好年份。

2021至2022年的“资本狂欢”,除了行业内部创意连连,先后凭借DeFi、NFT和链游的繁荣助推市场情绪外,也与特殊的时代背景有关——受COVID-19疫情影响,多国央行在此期间大规模实施量化宽松与零利率,导致全球流动性泛滥,“热钱”纷纷寻找高回报资产,这一环境被学界与业界称为“一切都是泡沫”(Everything Bubble)。彼时崛起的加密货币行业,就成为了重要受益者之一。

面对如此风口,轻松获得资金的加密风投机构纷纷玩起了“抬轿式”投资,以大手笔下注的方式押注概念赛道,而更少理性分析项目的内在价值。与科技股泡沫相似,这种脱离基本面的疯狂投资和短期涨势,本质上是超低资金成本下的“预期定价”。加密VC们将大量资金投入估值虚高的项目,也就此埋下了隐患。

借鉴传统股权激励机制,代币锁仓机制旨在通过长期分期释放代币,以防止项目方和早期投资人短期内集中抛售,从而保护生态稳定性和散户利益。常见设计机制包括“1年悬崖期 + 3年线性释放”,甚至有更长的5–10年锁仓,以确保团队和VC在项目成熟前无法套现。这套设计本身并没有太大问题,尤其对于经过多年野蛮生长的加密行业来说。为了打消外界对项目方与VC“作恶”的顾虑,通过代币锁仓进行约束,对于提升投资者信心来说算是一套行之有效的方法。

然而,当美联储从2022年开始缩表加息,流动性迅速收紧,加密行业的泡沫也随之破裂。当这些虚高估值迅速回落,市场便进入到了“价值回归”的阵痛阶段。而自食其果的加密VC们也逐渐陷入“至暗时刻”——不少机构在早期投资中不仅亏得底儿掉,还要被误以为其获得大额收益的散户投资者们诘问。

据STIX 创始人 Taran Sabharwal 日前发布的数据,在其追踪的项目中,几乎所有项目都出现了估值大幅下跌,其中SCR和BLAST的同比跌幅甚至分别达到了85% 和 88%。多项数据表明,许多承诺锁定仓位的加密VC,可能在去年错过了他们在二级市场的更好的退出机会。这迫使他们不得不另谋生路——彭博报道称,多家风投与做市商秘密合作,通过衍生品和空头头寸对冲锁仓风险,在市场下跌中获利。

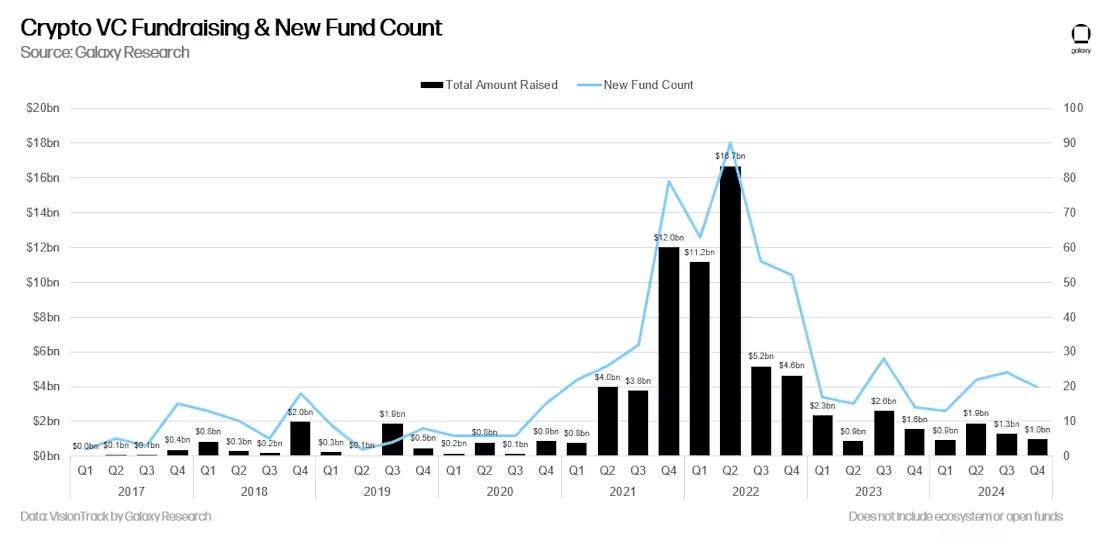

在疲软的市场中,新的加密基金的募资同样充满挑战。Galaxy Digital报告显示,尽管2024年全年新基金数量有所增加,但按年率计算,2024 年是自 2020 年以来加密风险投资融资最疲软的一年,共有 79 只新基金筹集了 51 亿美元,远低于2021至2022年牛市期间的狂热水平。

而据PANews此前发布的研究文章显示,据不完全统计,2022年上半年推出的与Web3相关的投资基金达107支,总金额高达399亿美元。

Meme与比特币ETF的资金截流

在行业缺乏明确产品叙事和实际用例的背景下,社区开始倾向于借助Meme热点制造话题和流量。Meme代币凭借“暴富神话”的吸引力,屡次掀起交易狂潮,吸走了大量短期投机资金。

这些Meme项目往往一次性炒作迅猛,但缺乏持续性支撑。在链上“赌场化”叙事不断蔓延的情况下,Meme代币开始主导市场流动性,占据了用户注意力与资本配置的焦点。这导致一些真正具备潜力的Web3项目被挤压和遮蔽,曝光度与资源获取能力均被受限。

与此同时,一些对冲基金也开始寻求进入Memecoin市场,捕捉高波动带来的超额收益。其中就包括由 a16z 联合创始人Marc Andreessen支持的风投机构Stratos。该对冲基金推出了一只持有基于Solana的模因币 WIF 的流动基金,并在2024年第一季度为其带来了 137% 的可观回报。

除了meme之外,加密行业另一具有里程碑意义的事件——比特币现货ETF的落地,或许也是山寨币市场低迷以及VC面临困境的潜在原因之一。

自2024年1月首批比特币现货ETF获批以来,机构与散户便可通过受监管的渠道直接投资比特币,传统华尔街资管巨头纷纷入场。ETF推出前三天便吸引了近20亿美元的资金流入,大幅提升了比特币的市场地位与流动性。这也进一步强化了比特币作为“数字黄金”的资产属性,吸引了更广泛的传统金融参与者。

然而,由于比特币ETF的出现,提供了一个更便捷、更低成本的合规投资路径,行业原有资金流转逻辑开始发生转变。大量原本可能流向早期风投基金或山寨币的资金,选择了留存在ETF产品中,转为被动持仓。这不仅打断了以往比特币上涨后山寨补涨的资金轮动节奏,也让比特币与其他代币在价格走势与市场叙事上日趋脱钩。

在虹吸效应的持续作用下,比特币在整个加密市场的主导地位持续抬升。据TradingView数据,截至4月22日,比特币市占率(BTC.D)已拉升至64.61%,创2021年2月以来新高。表明比特币作为“机构主力入口”的地位正愈发巩固。

这种趋势带来的影响是多层次的:传统资本愈发集中于比特币,让Web3领域的创业项目难以获得足够融资关注;而对于早期VC而言,项目代币的退出渠道受限,二级市场流动性薄弱,导致回款周期延长、收益兑现困难,只能收缩投资节奏甚至暂停投资。

此外,外部环境同样严峻:高企的利率与日益收紧的流动性让LP对高风险配置望而却步,而监管政策虽不断演进却仍待完善。

正如Hashkey Capital的Rui在推特上所写到的:会像20年一样绝地大反击吗?很多朋友是悲观的态度,所以纷纷离场,他们的逻辑很简单也很有效。一方面是该进来的用户都进来了,大家习惯了Casino的玩法,习惯拉盘砸盘定义项目好坏,就和习惯做空ETH一样,用户的属性已经定型。另一方面是我们很难看到类似链上级别的打大应用爆发,Social、Gaming、ID等等等等领域都已经被Crypto“尝试重构”一遍,但最终大家发现都是一地鸡毛,很难找到新的Infra机会,新的无限想象。

在多重压力之下,加密VC的“黑暗时刻”恐怕还将持续相当一段时间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。