Source: Cointelegraph

Original: “If Trump Fires Jerome Powell, How Will the Cryptocurrency Market React?”

In recent months, a pattern has repeatedly emerged: U.S. President Trump takes certain actions that objectively harm the U.S. economy, causing market turbulence, and then turns to Federal Reserve Chairman Jerome Powell, demanding a cut in the federal funds rate (the interest rate at which the Fed lends to banks). The resolute Powell always responds, "No."

Trump wants lower interest rates because it is an effective way to inject liquidity into the U.S. economy, stimulate economic activity, and boost the market. He believes this can showcase his achievements. Powell, on the other hand, insists on setting rates based on rigorous economic standards to balance the Fed's dual mandate of "maximizing employment" and "stabilizing prices."

This struggle over the independence of the Federal Reserve is drawing significant market attention. Chairman Powell's primary task is not only to maintain the central bank's independent decision-making authority but also to ensure public confidence that the Fed is free from political interference. Market analysts point out that if investors begin to doubt the Fed's independence, the U.S. Treasury market could suffer severe damage, which would undoubtedly exacerbate the situation for a country already burdened with $30 trillion in debt.

In the current economic climate, the issue of financing costs for U.S. government debt is particularly sensitive. Experts warn that if the market loses confidence in the U.S. government, leading to a rise in refinancing rates, the interest payments alone could severely drag down U.S. GDP, resulting in catastrophic consequences for the U.S. economy.

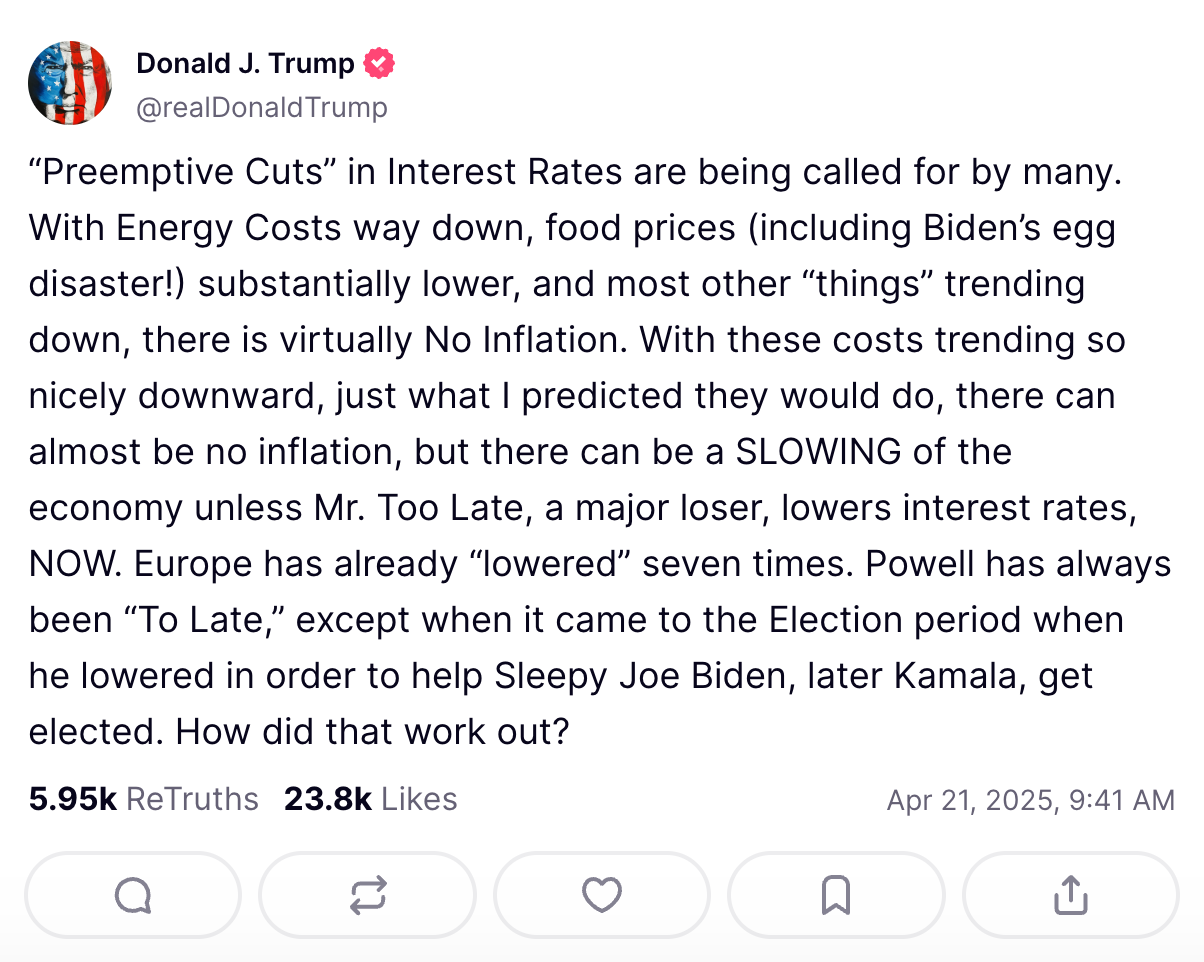

Recently, the political game surrounding the position of Federal Reserve Chairman has intensified. Trump hinted multiple times last week that he might replace Powell, causing significant market turmoil. On Monday, Trump directly criticized Powell on the Truth Social platform, calling him a "big loser," which led to a market drop. In light of this situation, Treasury Secretary Scott Bessent reportedly expressed concerns about the associated risks to Trump. Fortunately, Trump seems to have recognized the seriousness of the issue, publicly stating on Tuesday that he would not fire the current Fed chairman, temporarily easing market worries.

Caption: Trump and Powell in 2017 Source: Trouw

Last week, Trump hinted multiple times at possibly replacing Powell, causing the market to drop. On Monday, he further criticized Powell as the "number one loser," triggering a stock market crash. Reports indicate that Treasury Secretary Scott Bessent has made it clear to Trump the risks of replacement, and on Tuesday, Trump temporarily backed down, stating he would not fire Powell. However, observers believe this is more like the beginning of a vicious cycle, with the core issue being: if Trump does replace Powell, what impact will it have on the cryptocurrency industry?

To understand the workings of the Federal Reserve, it is important to note that the U.S. president cannot arbitrarily dismiss the Fed chairman. Section 10 of the Federal Reserve Act of 1913 clearly states: "Each member's term shall be fourteen years from the expiration of the term of his predecessor, unless he is removed from office by the President for cause."

This wording may seem vague, but in the 1935 case of "Humphrey's Executor v. United States," the Supreme Court ruled that the Constitution does not grant the president "unlimited removal power," thus the president's removal authority is constrained by legal provisions. This ruling established the legal concept of "independent agencies"—these agencies, while part of the executive branch, possess independent decision-making authority. Although agencies like the SEC, CFTC, and FTC share this characteristic, the Federal Reserve is undoubtedly the most important independent agency.

Economists typically do not focus much on the issue of central banks being politically manipulated. Politicians' decision-making motives often have a short-term focus, with their thinking cycles measured in years or election cycles. This characteristic naturally drives them to favor short-sighted policies, with the injection of hot money being the most typical manifestation. However, fiscal and monetary policy is an art that requires delicate balancing, often accompanied by painful policy choices.

A classic case occurred before the 1972 election when Richard Nixon pressured then-Fed Chairman Arthur Burns to implement an expansionary monetary policy, believing it would improve his chances of re-election. Although Nixon ultimately won by a landslide, the ensuing disastrous "stagflation" paralyzed the U.S. economy for a decade, and the industries severely impacted that year still feel the aftershocks today.

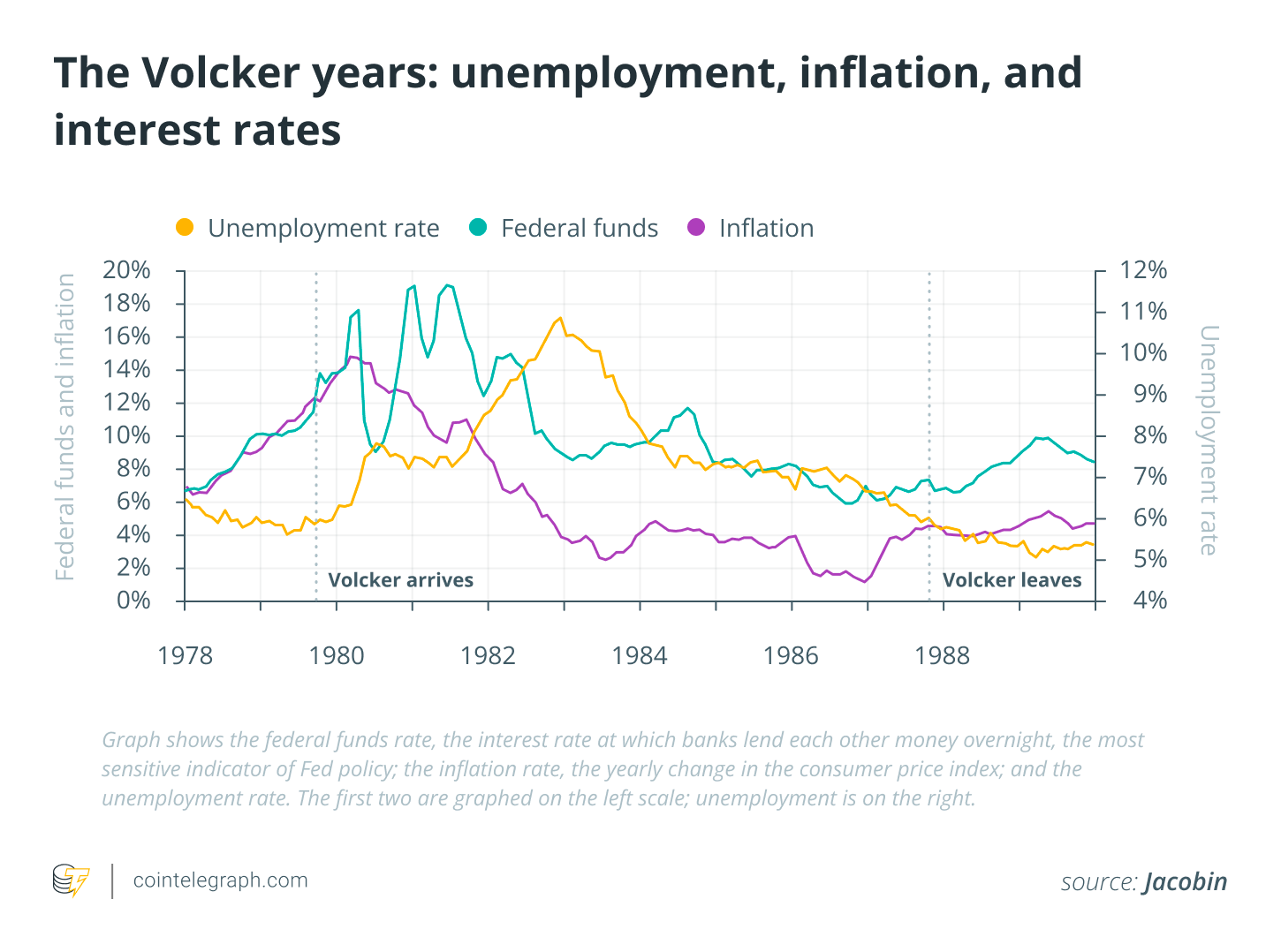

This stands in stark contrast to Paul Volcker's policies. After the period of stagflation ended, Volcker implemented a series of radical interest rate hikes from 1979 to 1987, triggering a chain of economic recessions known as the "Volcker Shock." However, this policy ultimately crushed inflation, paving the way for the economic boom of the 1990s and creating conditions for Bill Clinton's outstanding fiscal policies.

No politician has ever been able to make such a decision, nor will they in the future—this is the crux of the issue. Economists (and more importantly, market participants) firmly believe that the Fed must maintain its independence; otherwise, the entire economic structure of American society will face the risk of collapse. This is no exaggeration: countries where central banks have been politically manipulated, such as Weimar Germany, Peronist Argentina, and Venezuela, have all experienced devastating hyperinflation, leading to geopolitical setbacks for generations, reports of people starving to the point of eating rats, and the rise of Adolf Hitler. This is a very serious historical lesson.

If Trump were to remove Powell, he would first need to overturn the precedent set by the "Humphrey's Executor case." Given the current composition of the Supreme Court, many legal scholars believe this possibility is quite high. It is akin to crossing the Rubicon; once crossed, there is no turning back. Not only Trump, but every future president would gain absolute legal power to direct all executive officials (including the Fed chairman) at will. Most believe this would lead to catastrophic consequences.

But whether or not it leads to disaster, it will serve as a litmus test for cryptocurrencies. The original purpose of the Bitcoin white paper was to liberate financial transactions from "financial institutions acting as trusted third parties." If the Fed collapses and U.S. monetary policy deviates from rational decision-making anchors, the value of the early ideals of cryptocurrencies will suddenly become prominent.

In recent weeks, amid the capital flight triggered by Trump, investors have been seeking various safe-haven assets. Conventional wisdom holds that during a crisis, savvy capital always flees from risk assets to U.S. Treasuries—once considered risk-free assets. But that era may have ended: during the peak of the tariff crisis, the yield on ten-year Treasuries approached 5% and has yet to fully return to historical lows. If Trump destroys the Fed's independence, this capital outflow will be like drops of water flowing into a river, with some of it likely pouring into the cryptocurrency space.

Trump warns Powell, calling him "Mr. Slowpoke" Source: Donald Trump

Historically, Bitcoin prices have always been highly correlated with the Nasdaq index (albeit with greater volatility). However, since the onset of the tariff crisis, while U.S. stock prices have remained sluggish, Bitcoin has miraculously risen against the trend. This raises the question: the long-predicted moment of "decoupling" may be approaching—cryptographic assets will ultimately realize their original intent, breaking free from the linkage with traditional centralized assets.

While it is still difficult to predict whether this prophecy will come true, if Trump does indeed remove Powell, we will surely witness the answer unfold.

Out of the frying pan and into the fire

Of course, a world-class economic collapse is not purely beneficial for cryptocurrencies; this crisis will also bring multi-faceted severe pains. The first to suffer will be stablecoins—they will immediately face a fatal blow.

Over the past decade, the dollar-pegged stablecoins USDC and USDT have dominated the market. Their issuers, Circle and Tether, are not only important systemic institutions but also major buyers of U.S. Treasuries, which constitute the underlying collateral for their stablecoins.

The most direct consequence of a Federal Reserve crisis could be a default on U.S. Treasuries. Economist Noah Smith has speculated that Trump might attempt to write down U.S. sovereign debt:

"With his business style, he always seeks cheap bailouts when debt worsens, and if that fails, he declares bankruptcy."

In fact, this February, Trump himself hinted darkly at possibly writing down debt through "technical means":

"There could be problems with Treasuries; some debts shouldn't even count because we find a lot of fraud in them."

A sovereign default would directly lead to a devaluation of the collateral assets of Circle and Tether, triggering insufficient collateral for stablecoins and inducing a run on them. The market may eventually stabilize, but it is more likely to evolve into a complete collapse of mainstream stablecoins.

This would create a series of chain reactions: smart contracts collateralized by stablecoins would begin to force liquidations, spreading risk throughout the entire market. Interestingly, these technical shocks may not be as severe as the political costs of a Federal Reserve crisis—because what is crucial to the crypto system extends far beyond U.S. Treasuries.

The U.S. dollar has maintained its status as the global reserve currency for decades, with its strength and stability forming the basis for international trade settlements. However, if the credit pillar of the U.S. government collapses, this paradigm will inevitably shift. As more transactions move to euro or renminbi-denominated accounts, EU and Chinese regulators will gain greater control over the fiat channels in the crypto market. A well-known crypto lawyer, who wished to remain anonymous, candidly stated:

"China will fill most of the vacuum, while the EU will take over the remaining part. The excessive regulation by the CCP and the EU will not be a boon for the crypto industry."

This may prompt funds to flow into uncollateralized original crypto assets, but such assets have no successful precedent in large-scale real-world transactions. The more likely scenario is that the stablecoin crisis will directly strike the crypto industry, which is at a critical development stage, causing it to stagnate for years.

Ultimately, no one knows whether Trump will (or can) remove Powell, nor can anyone predict the ultimate impact of his decision. But if the butterfly effect of Argentina can trigger a hurricane in Prague, then the incantations from the West Wing of the White House will surely forever change the trajectory of blockchain's fate.

Whether we like it or not, we have already boarded this speeding train.

Related Articles: Nansen: After the dinner announcement, traders are still selling Trump meme coin (TRUMP)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。