Ark Investment Management (Ark Invest) explained its bitcoin forecasts in an article published April 23, based on its Big Ideas 2025 report. The article analyzes the modeling methodology and assumptions behind the firm’s three 2030 price scenarios, including expected total addressable markets (TAMs) and penetration rates. The firm stated:

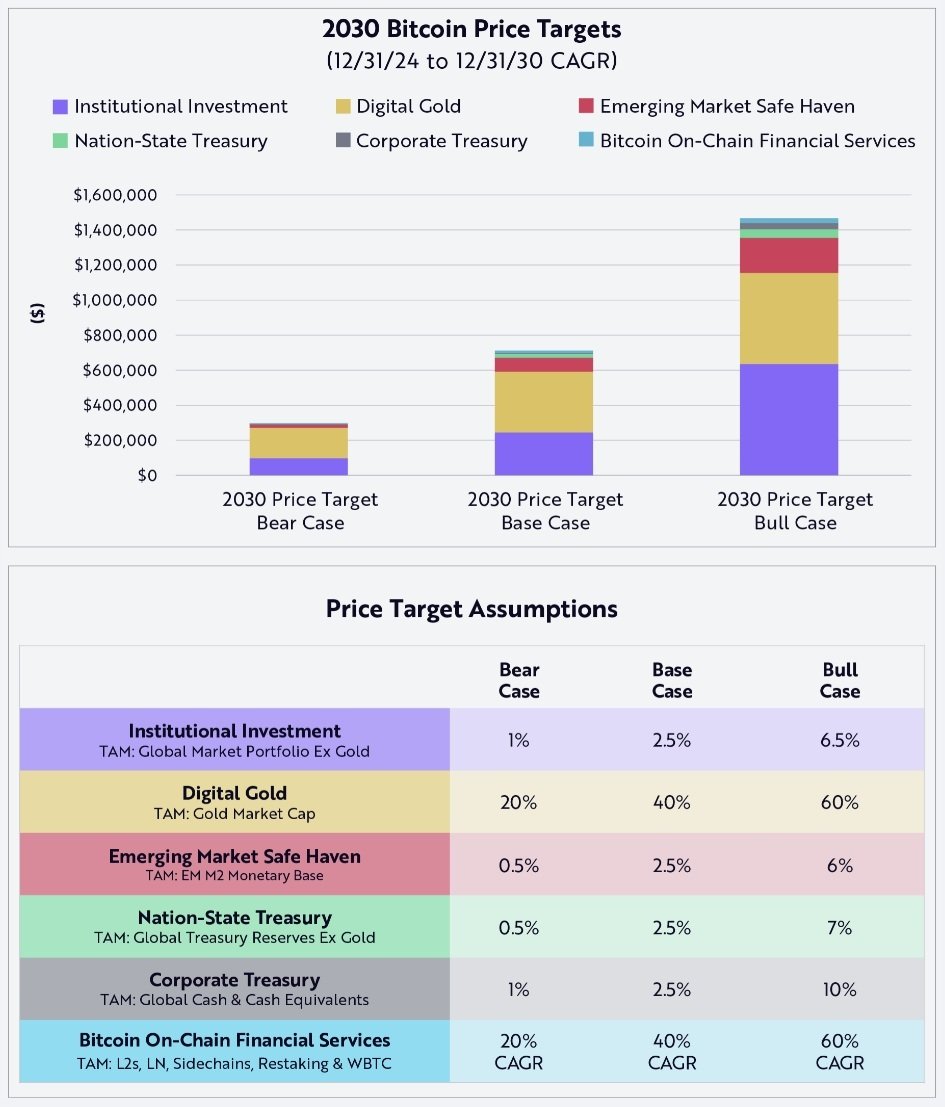

In Ark’s Big Ideas 2025 report, we updated our bitcoin price targets for 2030, projecting bear, base, and bull cases of ~$300,000,~$710,000, and ~$1.5 million per bitcoin, respectively.

The article elaborated that bitcoin’s fixed issuance schedule should result in roughly 20.5 million coins in circulation by 2030. Several sources of capital accumulation were highlighted, including institutional investors, participants from emerging markets, nation-state treasuries, corporate cash managers, and expanding bitcoin-native financial services. Ark Invest clarified that bitcoin may not reach its projected price targets if any TAMs or penetration rates are unmet, noting that risks and limitations could prevent its forecasts from being realized.

Institutional allocations were identified as a crucial factor, with Ark stating: “Institutional investment contributes 32.7% to the bear case, 34.3% to the base case, and 43.4% to the bull case.” Additionally, the role of bitcoin as an alternative to gold was detailed: “Digital gold contributes 57.8% to the bear case, 48.6% to the base case, and 35.5% to the bull case.” The article cited geopolitical factors, including the March 6 executive order by President Donald Trump that designated bitcoin as part of U.S. strategic reserves. It also highlighted corporate examples, such as Strategy (Nasdaq: MSTR) incorporating bitcoin into its financial strategies.

The growing importance of BTC’s second-layer solutions and tokenization was also addressed. Ark noted, “Bitcoin’s native financial services are an emerging contributor to capital accrual,” with networks like Lightning and assets like WBTC expanding functionality. Moreover, Ark applied a “liveliness” metric to adjust the total effective bitcoin supply, assuming that 60% of coins would remain actively circulating by 2030. Despite the detailed methodology, ARK issued a final caution, “Forecasts are inherently limited and cannot be relied upon,” underscoring the speculative nature of future projections.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。