Original Author: Longye

First, let's talk about the conclusion:

(1) Right now may be the best time this year to buy crypto.

(2) I maintain the views I expressed in my article during last December's bull market: https://reurl.cc/4L6O5Y

(3) Besides BTC, if I had to choose another token to invest $500,000 in, I would choose Hyperliquid; if it were $5 million, I would choose SOL.

Returning to the "rhythm" itself: Structural opportunities are emerging again

Currently, it is very likely one of the best times this year to buy crypto.

This judgment is not made lightly. Whether from price structure, macro signals, on-chain data, or the evolution of asset value, the current market state is highly similar to the "low-level restructuring" moment during the spring of 2020 amid the pandemic—Bitcoin plummeted to $3,800 in just a few days, followed by one of the most astonishing rebound rallies in cryptocurrency history.

Now, the market seems to be replaying this script. At that time, the Nasdaq index entered a 3-4 week period of oscillation and recovery after a panic sell-off, while Bitcoin quickly completed its bottom formation within two weeks and then rebounded strongly over the following months.

This time, the short-term sell-off triggered by the "tariff war + new highs in U.S. Treasury rates" starting in early April also caused BTC to briefly drop below $74,000, and SOL even fell below $100 for a short time, but both have quickly stabilized.

Currently, it appears that this bottom has basically formed. In contrast, the U.S. stock market, especially the Nasdaq, is still in an extended oscillation range.

In other words: the emotional correction in the crypto market has moved faster, more decisively, and has shown stabilization signals earlier than in traditional markets.

This "weak hands turning into strong hands" market structure change is a typical characteristic before a major market movement. Looking back at 2020, Bitcoin rose over 300% within six months after the March crash. If history repeats itself, the current market adjustment may be a good opportunity for positioning.

In terms of time and structure, crypto is already ahead.

The Turning Point of Macro Capital Flow: From Misunderstanding to Active Embrace

Beyond this structural correction, what is more noteworthy is that the macro perspective on capital is changing.

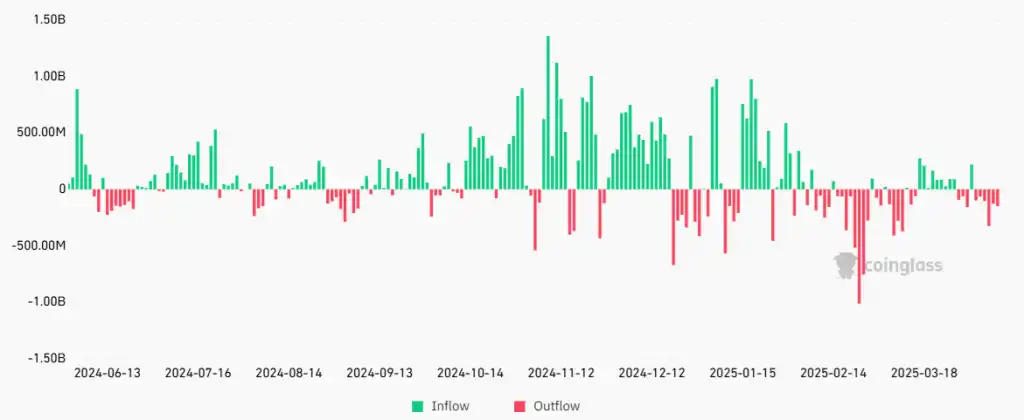

An undeniable trend is that traditional capital is flooding into the crypto market at an unprecedented speed. The approval of the U.S. spot Bitcoin ETF has opened the door for institutional investment. Data shows that since its approval in January, these ETFs have seen a net inflow of over $12 billion.

Total net inflow of spot Bitcoin ETFs (USD)

More importantly, cryptocurrencies are transitioning from speculative tools to practical tools. I recently visited several foreign trade companies in Shenzhen and Yiwu and found that the use of USDT in cross-border trade settlements has become quite common. A boss engaged in electronic product exports admitted, "Using USDT for settlement is much faster than bank remittances, and the fees are only one-tenth of traditional methods."

This trend is accelerating globally. In high-inflation countries like Argentina and Turkey, people are using stablecoins to preserve their assets; in Southeast Asia, more and more small and medium-sized enterprises are beginning to accept cryptocurrency payments. Cryptocurrencies are completing the transition from "speculative assets" to "practical tools," a process that will bring more lasting demand support.

In the past month, I have chatted with some friends in China who are engaged in export business. They were not the target users of crypto and even had extreme aversion to it. However, against the backdrop of global supply chain restructuring, geopolitical tensions, and shrinking foreign exchange channels, they have started to frequently raise some previously unimaginable questions:

Can we find a third country for simple reprocessing and settle exports to the U.S. using USDT to avoid sanctions? Physical goods are too uncertain; are there any virtual goods we can deal with, like NFTs? After factory shutdowns, how can we exchange cash to buy coins? More importantly, with the free time, what coins can we speculate on?

You will find that crypto is no longer just an "asset choice," but has become a resource outlet after a "real-world interruption."

Among them, USDT is becoming increasingly common: in some cross-border settlement scenarios, USDT has already become a habitual tool. In their words, "It is unrealistic not to hold BTC now."

The Link Between Gold and BTC: A Historic Leading Signal

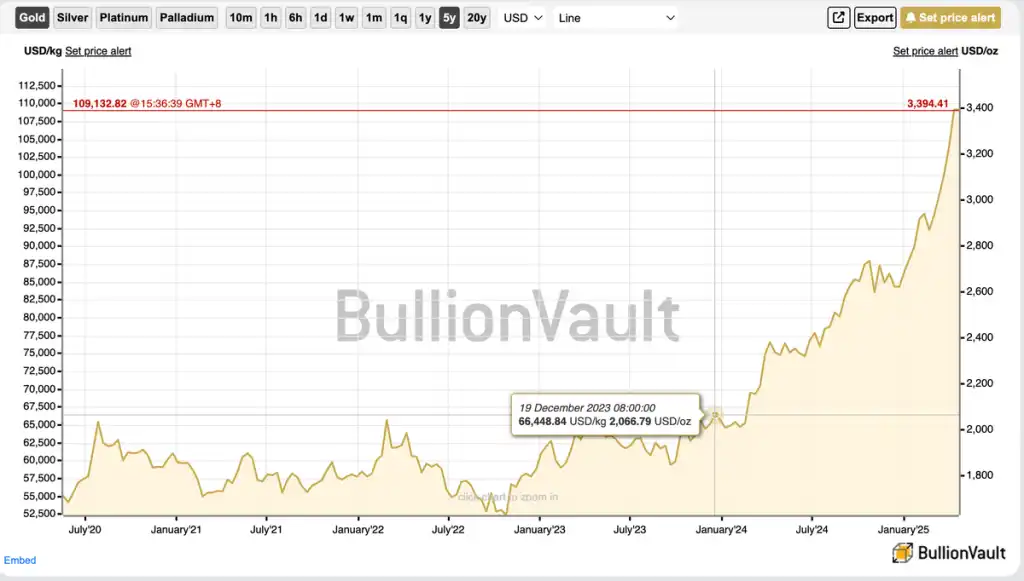

Another point that is rarely mentioned but highly significant is that gold has reached a historic high and is still accelerating.

In early April, gold briefly fell 5% in just four days, breaking below $3,000, causing market panic to intensify. But less than a week later, it rebounded to a new high, now surpassing $3,300, entering a strong upward trend.

From historical experience, after gold prices reach a new high, Bitcoin often follows and breaks previous highs within 100-150 days. This is not a coincidence, but a resonance signal highly related to capital flow and market structure; as well as the high correlation in macro attributes between gold and Bitcoin—they are both tools to combat fiat currency depreciation.

If this historical rhythm repeats, we may see BTC break previous highs by the end of Q2 or the beginning of Q3, with Q4 being a potential market peak.

ETH, SOL, Hyperliquid: Three Structural Narratives and Value Differentiation

Now we come to another important question: After BTC, if we want to hold another asset, what should we choose?

I still maintain my previous views:

If it's an investment of $500K, I choose Hyperliquid.

If it's a configuration of $5M or more, I would choose SOL.

These three represent completely different asset logics and user paths:

ETH: The Infrastructure Connecting On-Chain Finance and the Real World

Regarding the core value of Ethereum, my judgment is clear: RWA (Real World Assets) is the biggest narrative for ETH's future, but the explosive moment is not this year.

As the second-largest crypto asset by market cap, I am now clearer that Ethereum will be the infrastructure for the integration of reality and crypto, serving institutional capital (not web3 institutions, but real-world funds with utility needs).

The key is RWA, whose fundamentals involve systematically transferring offline trade to on-chain through DeFi, meaning systematically moving offline trade, financing, and credit systems onto the chain.

Although the implementation of RWA is still relatively fragmented, and the infrastructure and regulatory framework are still under construction, the trend is already very clear. Traditional financial giants, including Blackstone, Citigroup, and BlackRock, have begun to engage in core financial activities such as bond tokenization and cross-border settlement based on Ethereum. In the future, not only bonds but also stocks, gold, carbon emission rights, and other asset classes are likely to circulate on the ETH network.

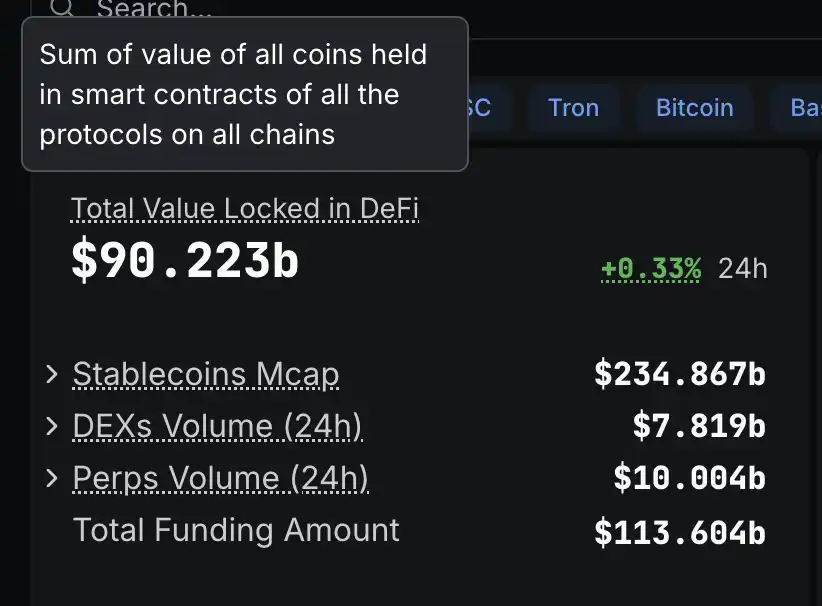

Moreover, from the data perspective, over 80% of projects in the two core sectors of DeFi and RWA are built on Ethereum. For example, the total value locked (TVL) in DeFi remains at the level of hundreds of billions of dollars, indicating that the underlying demand is still substantial.

Therefore, in my view, Ethereum's role is evolving from a "smart contract platform" to an "operating system for real-world finance." It is like "oil" in the digital age—supporting the continuous operation of the entire on-chain economy and potentially becoming the underlying infrastructure of the future global financial system.

SOL: A Reflection of On-Chain Activity and Retail Narratives

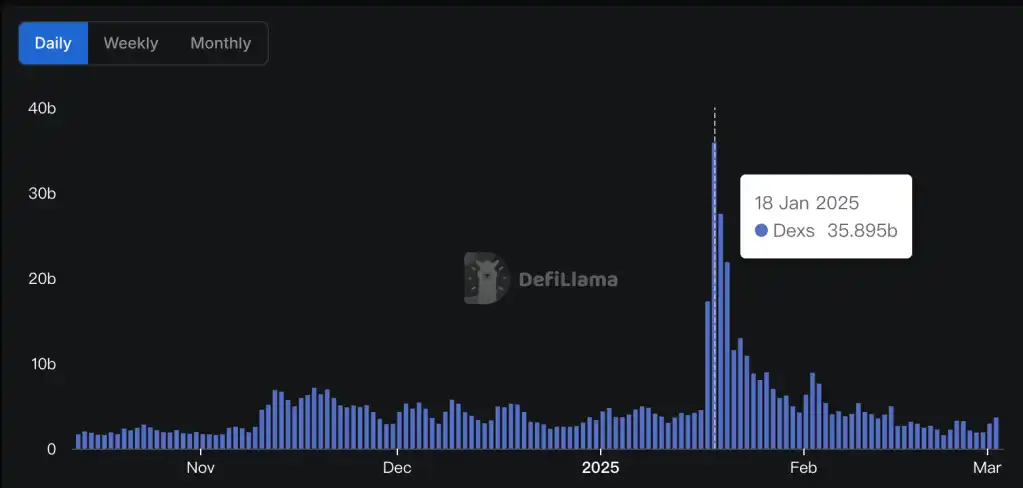

SOL may not be the most technically advanced public chain, but it is the hottest public chain in terms of on-chain liquidity. From memecoins, GambleFi, to various strong operation-driven projects, SOL has become the main stage for retail speculation. And active retail participation means sustained liquidity. If you believe that the retail cycle will still have a wave this year, then SOL is the most beta-responsive asset.

During the fermentation of the MEME market, DEX alone had daily trading volumes of hundreds of billions of dollars.

In the future, the classification of cryptocurrencies will also change; there may only be three types of coins: Bitcoin, mainstream coins, and MEME coins. MEME coins do not aim to replace BTC or gold, but represent a form of consensus and culture; they will not only be accepted by the public but will also become the most volatile vortex of capital in the cryptocurrency market.

Solana is the barometer of current market sentiment. The frenzy of meme coins and the boom in on-chain trading have made SOL the best place for short-term speculation—like the "Las Vegas" of the cryptocurrency world—where wealth myths are played out daily, filled with euphoric gamblers. But it is undeniable that it is attracting the most active capital and developers globally.

Hyperliquid: The On-Chain Mirror of TradeFi, the Perfect Landing Ground for AI Trading

Hyperliquid is actually a structural narrative: it is neither a meme nor an L1/L2, but one of the core scenarios of on-chain finance: perpetual contracts + leveraged trading + high-frequency strategies.

This is the platform I have been paying the most attention to and operating on frequently lately. I almost operate here every week, not because I am following the trend, but because it truly solves a key problem—how to achieve professional-level derivatives trading in a decentralized environment.

Hyperliquid currently seems more suitable for professional traders, which is also why it has not been recognized by a larger group. However, with the development of AI, a large number of strategy designs and executions will be handled by AI Agents—users will only need to express their trading intentions in natural language, and the AI can call complex modules on-chain to implement them, such as arbitrage, cross-commodity hedging, grid strategies, and so on.

In the future, you will no longer need to perform complex operations yourself; you will just need to tell the Agent: "Open a 5x leveraged ETH long on Hyperliquid, and automatically stop loss if it drops below 2000." The AI Agent will automatically break it down into: contract calls, slippage control, on-chain gas optimization, etc., helping you complete complex trading operations in the most efficient way.

For example, if you want to earn dual returns from "trading platform price differences + funding rates" during BTC price fluctuations, manual operation requires: simultaneously monitoring 5 trading platforms, calculating the breakeven point for funding rates, dynamically adjusting margins, and preventing liquidation from price spikes. This is too difficult for ordinary people, but for an AI Agent, it only requires a series of basic analyses and operations such as capturing price differences, optimizing funding rates, and risk control responses.

In terms of speed, accuracy, and even emotion, AI Agents have advantages that humans cannot match. Of course, AI Agents will not replace human traders, but will transform professional-level strategies into something as simple as ordering takeout through "human-machine collaboration."

Hyperliquid's high level of openness and clear on-chain settlement make it very suitable as the trading backend for future "AI x DeFi" scenarios. Therefore, the core battleground of this transformation is likely to be on-chain derivatives protocols like Hyperliquid.

Summary: Bull Markets Are Born in Doubt and Grow in Hesitation

This round of market activity reminds me of that tumultuous yet opportunity-filled spring of 2020—when the market bottomed out in panic and then embarked on an epic rebound. Now, it seems the same script is being played out: gold has first broken through historical highs, like the sound of a starting gun; traditional capital is quietly entering through USDT; and more Smart Money has begun to consider how to position for the next round of AI-driven trading on Hyperliquid.

The market landscape is already very clear: BTC is digital gold, ETH is the operating system of real-world finance, SOL is the main battlefield for retail liquidity and sentiment, while Hyperliquid has become the platform for professional traders and future AI trading behaviors. As AI officially intervenes in the design and execution of trading behaviors, Hyperliquid is likely to become the landing ground for the next round of on-chain behavioral migration.

Those still waiting for a "better entry opportunity" may not realize: when foreign trade bosses start discussing USDT settlements, when gold breaks previous highs, and when AI begins to automatically execute arbitrage strategies, the time left for observers is running out. Many trends will not wait for you to fully understand them before they happen—and now is the window where you can still get on board.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。