Bitcoin ETF Boom Continues With $917M Inflows With Ether ETFs Unable to Maintain Momentum

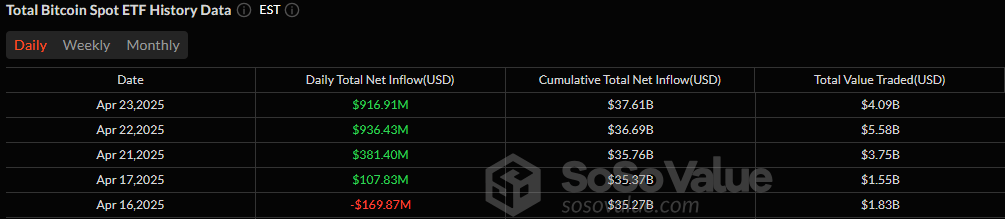

Investor appetite for bitcoin ETFs remains insatiable. Just a day after posting record-breaking inflows, U.S. spot bitcoin ETFs welcomed another $916.91 million in fresh capital on Wednesday, April 23, cementing their role as the market’s current favorite.

Blackrock’s IBIT carried the bulk of the day’s haul with an eye-popping $643.16 million inflow. Ark 21shares’ ARKB and Fidelity’s FBTC followed, pulling in $129.50 million and $124.37 million, respectively.

Grayscale’s BTC added $29.84 million to the rally, while Vaneck’s HODL chipped in $5.28 million. The only blemish came from Bitwise’s BITB, which saw a modest $15.25 million withdrawal.

Source: Sosovalue

In total, $4.09 billion in value changed hands, and net assets surged to $106.39 billion, marking another major milestone for bitcoin ETFs. The story wasn’t quite as bright on the ether side. After briefly snapping a prolonged outflow streak, ether ETFs slipped back into the red with $23.88 million exiting the space.

Blackrock’s ETHA accounted for the bulk of the movement with a $30.28 million outflow. Grayscale’s ETH managed to soften the blow with a $6.40 million inflow, but it wasn’t enough to tip the scales.

Total ether ETF trading volume came in at $432.87 million, and net assets settled at $5.93 billion. As bitcoin ETFs roar forward, ether ETFs continue to grapple with uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。