Macroeconomic Interpretation: The current cryptocurrency market is undergoing an unprecedented structural transformation. Recent data shows that the correlation between Bitcoin and the S&P 500 index has dropped from 0.88 at the end of 2024 to 0.77, while its correlation with the Nasdaq index has also shrunk from 0.91 at the beginning of the year to 0.83. This trend of "de-Americanization" contrasts sharply with the significant increase in the correlation between Bitcoin and gold, which has quickly rebounded from -0.62 at the beginning of the month to -0.31, suggesting that Bitcoin is gradually shedding its label as a risk asset and returning to its essential nature as a store of value. This transformation coincides with global trade policy uncertainties, exacerbating volatility in traditional financial markets. Although the S&P 500 index recorded a 1.67% increase, the intraday reversal of more than half of its gains exposes the fragility of market confidence.

The enhanced linkage with gold opens up new valuation space for Bitcoin. The continuous improvement in the correlation coefficient between the two coincides with the largest increase in global central bank gold reserves since 1999. After the U.S. Treasury hinted that it would not unilaterally reduce tariffs on China, the simultaneous emergence of anti-inflation attributes for Bitcoin and gold reflects a fundamental shift in the pricing logic of institutional investors regarding geopolitical risks. This shift is manifested on a micro level: over 37.5% of cryptocurrency users have begun to experiment with AI asset management tools. Although there are still doubts about fully entrusting operations to algorithms, 87.1% of respondents have accepted allocating at least 10% of their assets to AI agents. This technological empowerment is innovating the investment paradigm and reshaping the decision-making chain of market participants.

At the institutional investor level, the trends disclosed by Coinbase are more enlightening. Since April 2025, sovereign wealth funds have been accumulating Bitcoin at an unprecedented scale, with their operational rhythm forming a clear distinction from retail investors reducing their holdings through ETFs. This reverse operation between institutions and retail investors explains why the 30-day average of Bitcoin deposits into exchange addresses has dropped to 52,000, only a quarter of the peak three years ago. This "freezing" phenomenon of holding addresses has reached levels last seen in December 2016, effectively locking trillions of dollars in liquidity temporarily in cold wallets, fundamentally reshaping the supply and demand structure of Bitcoin.

The evolution of the market's microstructure is validated in the derivatives market. Among the $7.2 billion BTC options expiring on April 25, the maximum pain point of $85,000 shows a significant price difference from the current price of $92,300, indicating that call option holders are collectively profiting. This long-short game pattern is corroborated by the strong performance of the spot ETF, which has seen a net inflow of $917 million for four consecutive days, pushing Bitcoin's market capitalization to surpass $1.87 trillion, officially overtaking Google's parent company to become the fifth-largest asset globally. Notably, institutional investors are laying out their strategies through dual paths: continuously accumulating in the spot market while using the options market for risk hedging. This multi-dimensional operational strategy is common in traditional commodity markets and is now reappearing in the cryptocurrency space, marking a substantial increase in market maturity.

The tenth anniversary celebration of the Ethereum ecosystem has become an important window for observing market sentiment. On the eve of the Genesis block anniversary on July 30, the foundation's global community activity funding program is catalyzing a second wave of prosperity for the developer ecosystem. Historical experience shows that whenever the underlying protocol reaches significant milestones, it is often accompanied by the opening of a technological upgrade window. The current efforts of Ethereum to stabilize above the $1,800 mark resonate with the explosive growth of layer two solutions. This improvement in infrastructure objectively diverts some speculative funds from Bitcoin, promoting a healthier value rotation pattern in the market.

Looking ahead, three core variables will dominate the market direction: first, the allocation rhythm of sovereign funds, as marginal changes in their trillion-dollar scale can reverse market trends; second, the penetration rate of AI asset management tools, as market volatility patterns may undergo qualitative changes when algorithmic trading surpasses a critical point; finally, the evolution of the correlation between Bitcoin and gold. If a positive correlation pattern is established, it will attract systematic inflows of traditional safe-haven funds. It is worth noting that the extreme case of Trump Coin (TRUMP) surging 40% in a single day warns us that, in the absence of a sound regulatory framework, the market still carries irrational speculative risks. However, overall, under the triple drive of continuous institutional accumulation, technical breakthroughs, and macroeconomic resonance, Bitcoin stands at a new starting point for value reassessment, with the $100,000 mark potentially becoming the next strategic battleground for long and short positions.

Data Analysis:

The meme token TRUMP, launched by former U.S. President Trump, announced that it will host a "TRUMP Dinner" on May 22, inviting the top 220 holders by quantity. Among them, the top 25 VIPs will receive special reception at the White House and private club closed-door communication qualifications. This event uses a composite weighting mechanism of "holding quantity × holding duration" to screen participants. Data shows that the total holdings of the current top 25 VIPs have exceeded 2 million TRUMP, with a concentration rate of 2.099 million.

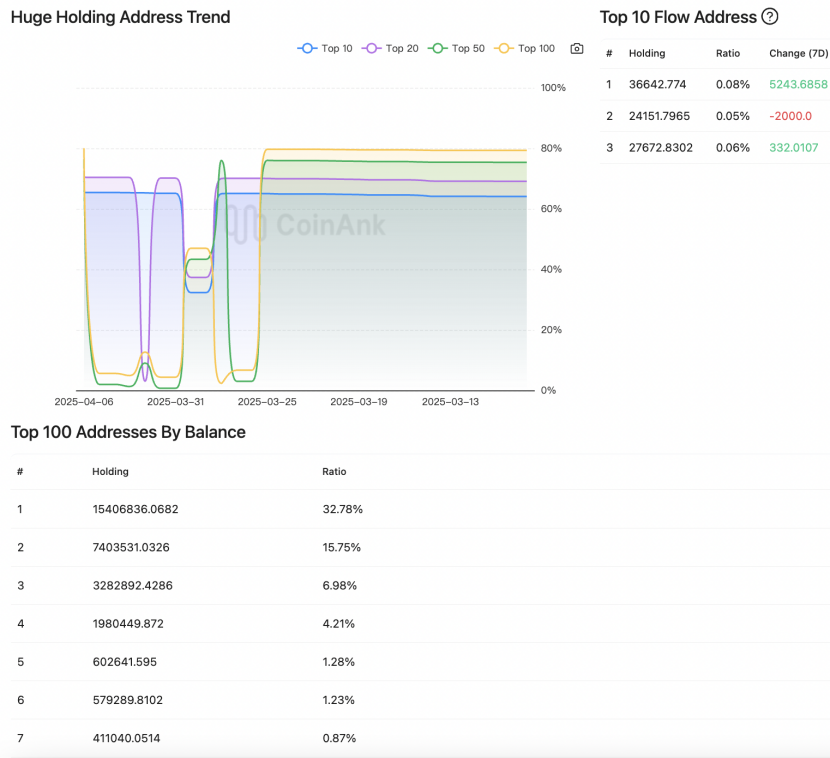

In the market, Coinank data shows that this news stimulated the TRUMP price to surge nearly 80% in a single day, soaring from $9.03 to a peak of $15.84. The top ten addresses still control 82% of the circulating supply, and 80% of the project's tokens are locked, which may lead to significant price volatility when they are eventually unlocked. Notably, most whales only withdrew tokens from exchanges or built positions on-chain after the dinner announcement, with only two holders using early accumulation addresses.

Democratic lawmakers have criticized the event as a potential abuse of power, and the SEC may reassess the token's securities attributes. Although the project team emphasizes that only wallet address verification is needed for holdings, the market still needs to be cautious about the flow of unlocked tokens and the risk of large holders selling. Currently, the locked tokens are valued at approximately $2.6 billion, and the decision to delay the first round of unlocking by 90 days has temporarily alleviated concerns about selling pressure. This innovative model of "holding is privilege" attracts institutional funds but also carries the risk of price manipulation, as historical data shows that the project team once cashed out $112 million in a single instance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。