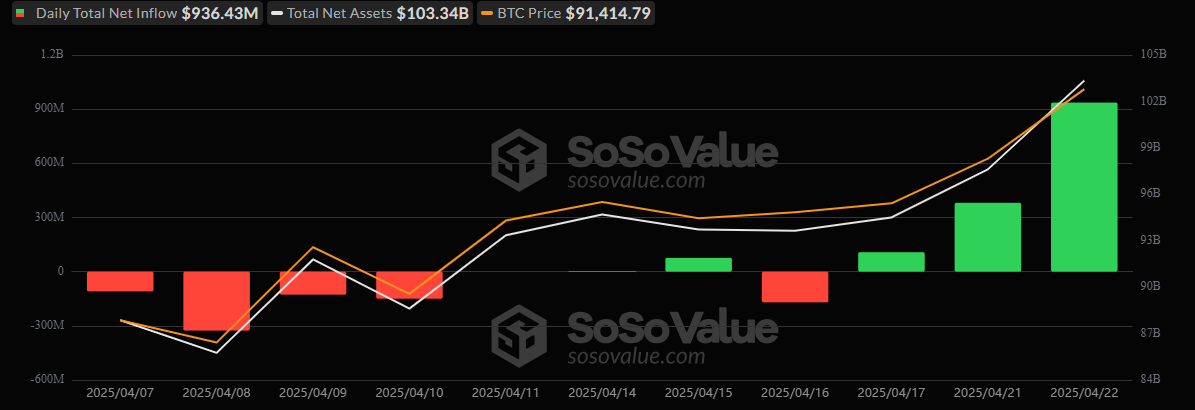

Massive $936 Million Pours Into Bitcoin ETFs As Ether ETFs End Outflow Streak With $38 Million Boost

A wave of capital flooded into U.S. spot bitcoin ETFs on Tuesday, April 22, marking their biggest single-day inflow since January 17 with an eye-popping $936.43 million. The buying frenzy pushed total net assets past the $100 billion mark for the first time in weeks, closing at $103.34 billion.

Ark 21shares’ ARKB led the charge, bringing in a commanding $267.10 million. Not far behind, Fidelity’s FBTC posted $253.82 million in inflows, while Blackrock’s IBIT raked in $193.49 million. Bitwise’s BITB added $76.71 million, and Grayscale’s flagship GBTC collected $65.06 million.

Source: Sosovalue

Even lesser-traded funds got a lift: Valkyrie’s BRRR saw $23.82 million enter its fund, Grayscale’s Mini Bitcoin Trust took in $21.09 million, Invesco’s BTCO added $18.27 million, Franklin’s EZBC netted $10.60 million, and Vaneck’s HODL received $6.47 million.

There were no outflows across the ETFs, with trading volume also reflecting the surge, climbing to $5.59 billion.

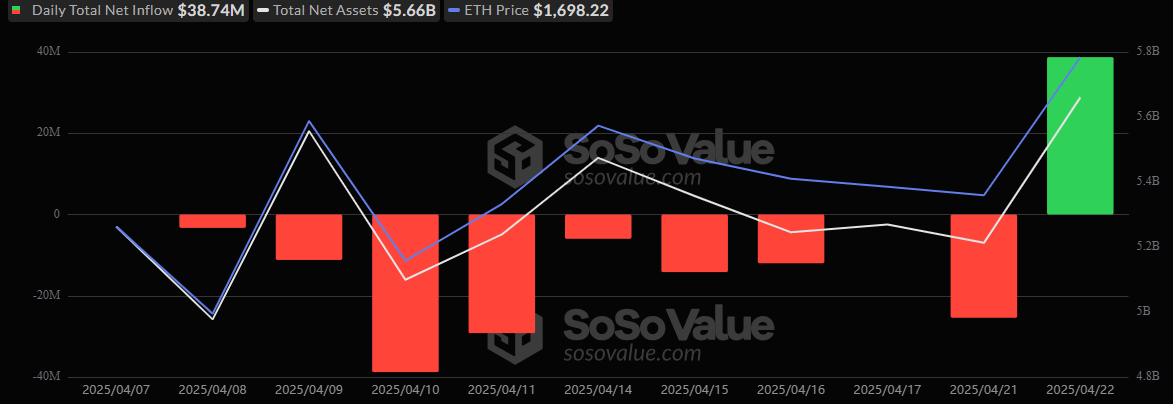

The bullish sentiment spilled over into ether ETFs, which had been mired in outflows. Tuesday brought a long-awaited turnaround, with $38.74 million in net inflows, driven by Fidelity’s FETH ($32.65 million) and Bitwise’s ETHW ($6.09 million).

Source: Sosovalue

Total ether ETF volume more than doubled to $496.30 million, and net assets rose to $5.66 billion.

With bitcoin ETFs leading the charge and ether ETFs finally blinking green, investor confidence appears to be firmly returning to crypto markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。