In the current adjustment period of Web3, the Token Generation Event (TGE) is no longer just a simple financing tool but has become a battleground for projects and the market. Especially in the current environment of liquidity contraction and insufficient investor confidence, how to initiate and in what manner has become a topic that project teams must consider carefully.

IDO is a common method of TGE. Early platforms like Coinlist have birthed many top-tier projects through IDO. However, as the number of projects has increased, the wealth effect of IDO has diminished. Binance's every move constantly stirs the market's nerves. Since 2025, Binance Wallet IDO has become a choice for many projects to launch. Its characteristics of "low entry barriers, high popularity, and strong traffic" quickly became the market focus, attracting a large number of startup projects and community attention, but it also exposed a series of fundamental changes in the new coin market structure, valuation system, and project logic.

However, is this model truly suitable for every project? Which projects can quickly amplify their narrative and achieve a cold start through it, and which projects might face the dilemma of "high opening and low closing" after the market frenzy? The Klein Labs Research team conducted a systematic data study and structural dissection of 10 Binance Wallet IDO projects that have gone live, attempting to help project teams make smarter judgments from a strategic perspective.

1. Background: What kind of market cycle are we in?

From the past few months, we can clearly observe the evolution of market investment preferences:

- Early Preference: High Valuation + Low Circulation Model (VC-led, short-term speculation)

- Mid-term Frenzy: Fully Circulating Meme Coin Model (zero-threshold speculation)

- Current Turning Point: The market is returning to a focus on fundamentals and strong sustainable projects.

At the same time, the structure of the TGE model is also undergoing three stages of evolution:

- Early Model: Low Valuation Issuance + Market Value Discovery Mechanism (narrative-driven)

- Mid-term Model: High Valuation Issuance + Insider Arbitrage (through OTC or selling immediately after release)

- Current State: Returning to Low Valuation Opening (lack of buying interest, no one willing to "take over")

The most intuitive manifestation of this market state is the low valuation launch of Binance Wallet IDO projects. Project teams must exchange extremely low valuations and release ratios for a bit of market attention. Behind this is an important logic:

The valuation of TGE does not reflect the "future value of the project," but is a comprehensive mapping of current market liquidity, expected listings, narrative intensity, and market-making systems.

2. The traffic effect of Binance Wallet IDO remains strong, but controlling the rhythm is key

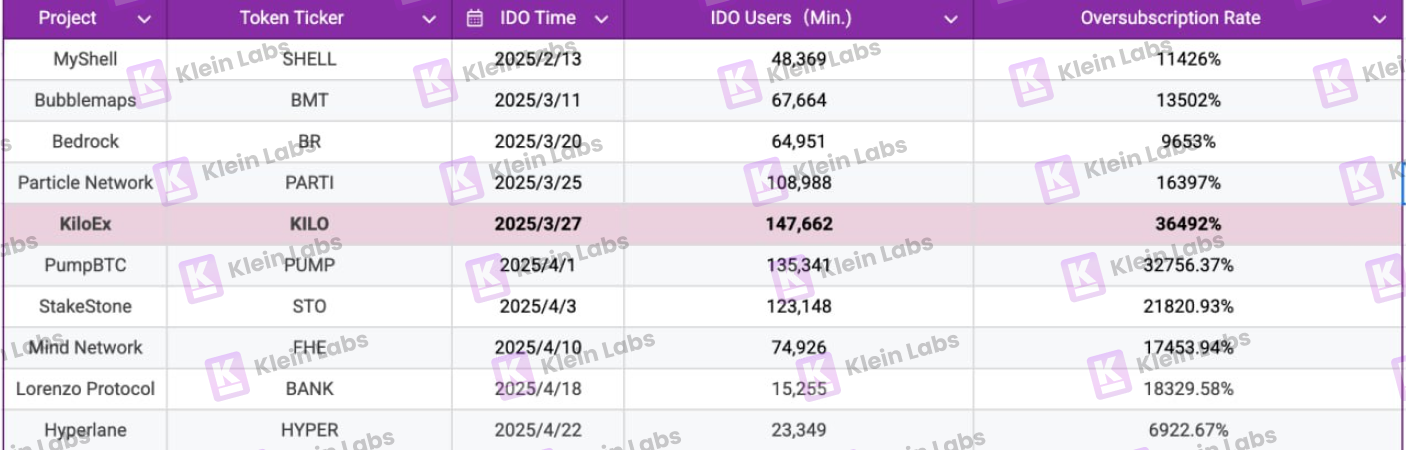

From the data, Binance Wallet IDO has brought significant market attention and brand exposure to projects:

- Average participation: 80,965 people;

- Single fundraising amount: 60,000 – 443,000 BNB;

- Overfunding rate: between 6,900% – 36,500%.

Among them, KiloEx reached an overfunding rate of 36,492%.

Binance Wallet IDO can easily leverage user attention at the hundred thousand level, attracting tens of millions of dollars worth of assets even in a generally cold market.

Although the participation threshold for users has increased with mechanism optimization, it can effectively filter out higher-quality users with long-term value and stickiness, bringing a healthier user structure and community foundation for project teams, which is beneficial for subsequent community operations and user conversion.

With the support of Binance Wallet's easy access mechanism, project teams can still gain strong cold start momentum, significantly compressing user acquisition paths and cold start costs.

3. The TGE model is undergoing deleveraging, and Wallet IDO projects generally start at low valuations

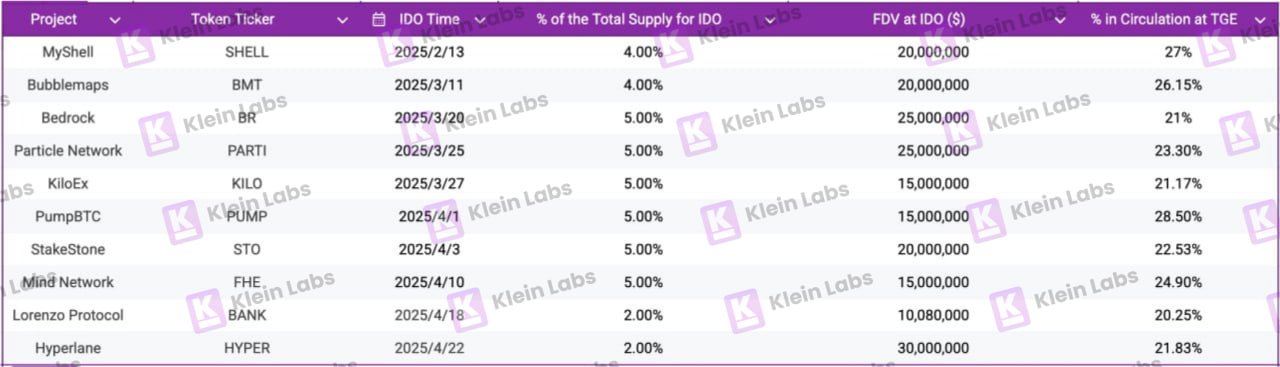

Through data analysis, we found that Binance Wallet IDO projects have very obvious commonalities in token economics:

- The token release ratio during the IDO phase is generally low, ranging from 2% to 5% of the total supply, with an average of 4.44%;

- The circulation ratio during the first issuance (TGE) phase is usually between 20% and 30%, ensuring that initial market liquidity is not overly diluted;

- The fully diluted valuation (FDV) corresponding to the IDO phase is between 10 million and 30 million dollars. Overall, this falls within a relatively reasonable or even slightly low valuation range.

Project teams are still willing to conduct TGE through Binance Wallet IDO at this stage for several considerations:

- The product has taken shape, and there is a need to issue tokens to access use cases / incentive systems / settlement systems;

- There is a need to gain community attention and trading support at a low cost, equivalent to a large-scale market launch, forming a liquidity starting point;

- Adhering to the long-termism concept, accepting low valuations, low releases, and slow-paced growth.

Current Binance Wallet IDO projects must accept the low valuation pressure brought about by declining market confidence. However, this also allows excellent project teams to reserve more room for market capitalization growth.

4. Exchange Performance: Binance Wallet IDO is a ticket to Binance, not a final destination

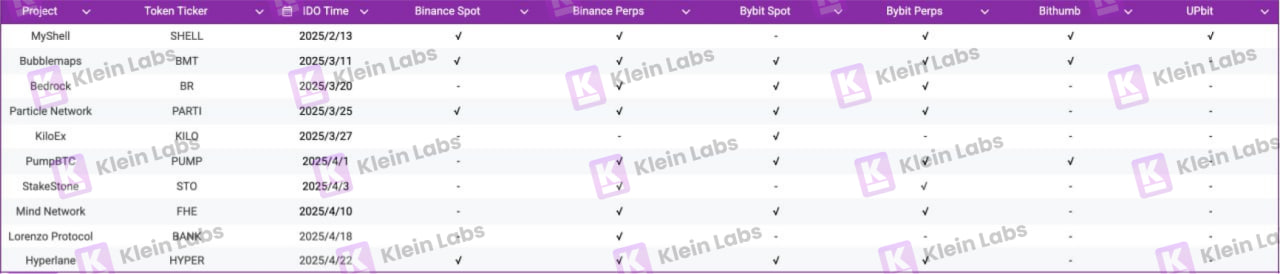

In the imagination of many teams, Wallet IDO means "landing on Binance." However, the reality is far from this:

- The spot listing rate on Binance is 40% (SHELL, BMT, PARTI, HYPER);

- About 90% of projects have landed on the Binance Futures market;

- Bybit spot listing rate is 70%; contract listing rate is 80%;

- The current listing rate on Korean exchanges is not high and is relatively non-standard.

Binance Wallet IDO does not equal listing on Binance. What Binance Wallet IDO provides is more like a trial operation ticket to enter the Binance traffic ecosystem. Whether it can "turn positive" and enter the spot market still depends on the project's post-listing data performance, user feedback, and internal evaluations by the Binance trading team. Project teams should view it as a "rehearsal before the main stage" and prepare adequately for subsequent listings and secondary liquidity support.

5. Price Trend: Strong Start, Long-term Performance Depends on Operations and Market Strategy

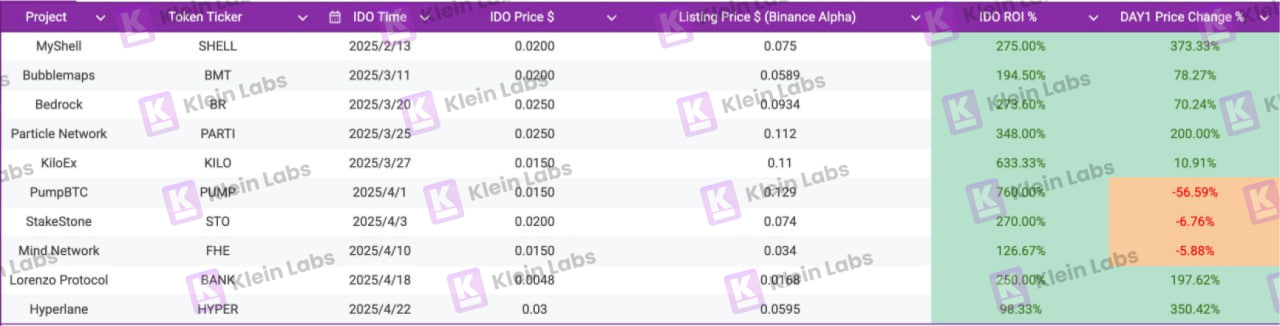

From the current data, most Binance Wallet IDO projects performed excellently on their first day, with return on investment (ROI) generally impressive:

- PumpBTC saw a first-day increase of up to 760%, and KiloEx's return performance was also eye-catching.

- Although there was significant price volatility on the first day, the medium to long-term performance of the projects relies more on continuous operational capabilities, market management strategies, and clear long-term development plans.

- Notably, some projects (such as MyShell, Bubblemaps, PumpBTC) chose to actively expand into the Korean market after the IDO to drive subsequent growth.

Although Binance Wallet IDO projects often have high initial popularity, if project teams lack long-term planning, they will struggle to withstand the multiple challenges in the current market environment—such as weak buying interest, investors no longer chasing short-term circulating supply, and insufficient medium to long-term fundamental support, as well as the premature exhaustion of narrative value. Against this backdrop, the market performance of different projects has gradually shown significant differentiation.

Short-term popularity is indeed easy to obtain, but what truly determines whether a project can go far is still the continuous operational capability and market management strategy. Project teams need to plan the rhythm of secondary market control and investor relations management in advance to avoid rapid price declines and achieve steady long-term value release.

6. Trading Heat Performance: A True Reflection of Market Attention and Capital Momentum

The market performance of Binance Wallet IDO projects varies by project, but overall trading heat is generally high:

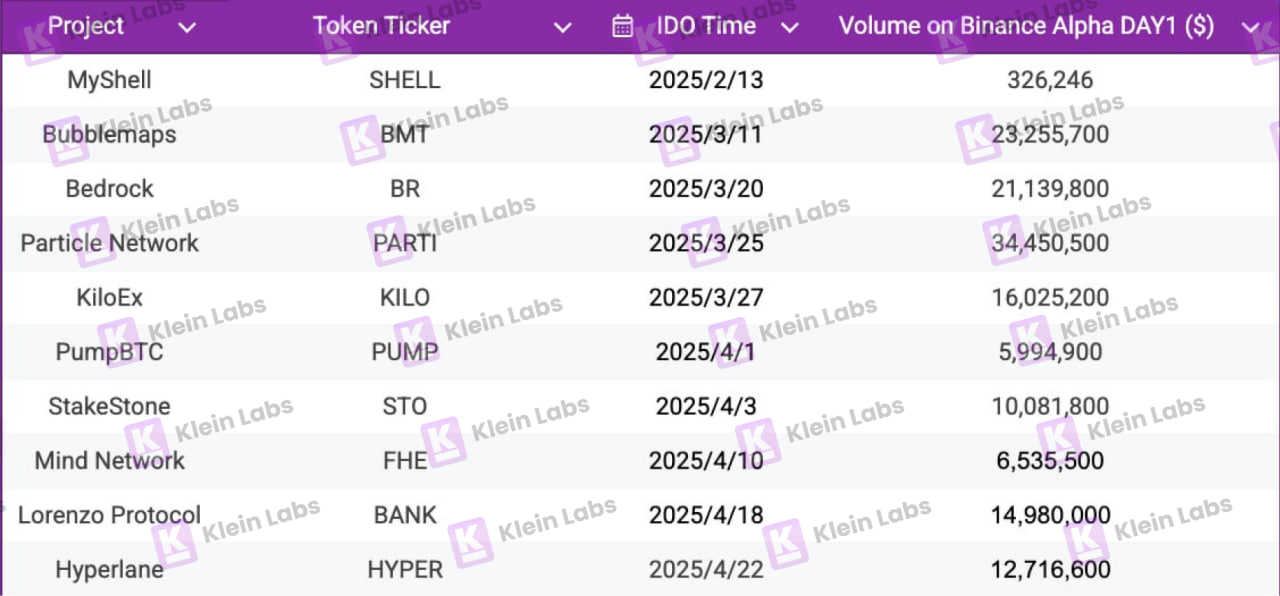

PARTI, BMT, and BR are three standout projects, each exceeding $20 million in trading volume on the first day.

The emergence of high trading volume is not only related to initial traffic but also closely linked to the project's narrative strength, token economic design, and market expectation management;

IDO is merely the "ignition point" of popularity, and whether it can maintain heat and ignite the secondary market depends on the overall execution and operational rhythm control of the project. Many poorly performing projects quickly fell silent after TGE, either due to a lack of continuous content output to maintain topic heat or due to loss of confidence caused by uncontrolled market management.

Conclusion: Binance Wallet IDO is a "value filter" and a narrative validation

Binance Wallet IDO is a structured, high-leverage cold start method for current Web3 projects to initiate narratives, build consensus, and amplify attention. It provides project teams with a "starting script" to leverage large volumes with small costs, but it also places high demands on the team's execution, operational planning, and market management capabilities.

The data performance of Binance Wallet IDO reflects the profound evolution of the entire market's valuation logic and issuance model. It is neither an endpoint nor a pass; rather, it is a window to validate product vision and test market mechanisms at low cost.

Because the market is currently in a late stage of low confidence + low liquidity + high vigilance, it is even more necessary for those truly willing to build long-term projects to step forward and use Binance Wallet IDO to showcase their product value, narrative rhythm, and operational capabilities.

It is not suitable for everyone, but for those with a clear story, defined rhythm, and long-term construction willingness, it is an important springboard to enter the Binance ecosystem and mainstream market vision. In the window period after the bubble bursts, the market returns to the essence of value. This is, in fact, a positive signal for teams that genuinely want to do things and have long-term visions.

Like all platform-based IDOs, after a brief period of joy, how does the feast continue? This is also a question Binance Wallet needs to consider. Simply put, if Binance Wallet IDO can continue to be the preferred launch platform for quality assets, then its lifecycle can be extended as much as possible. Behind this lies the understanding of "quality assets." What projects does the industry truly need? Which projects are suitable for development in this world? Each of us needs to engage in deep reflection.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。