作者:Alice Atkins & Liz Capo McCormick,彭博社

编译:Felix, PANews

投资者通常会涌向美国国债以躲避金融市场的动荡。在全球金融危机、9·11 事件时,甚至在美国自身信用评级被下调期间,美国国债都实现了反弹。

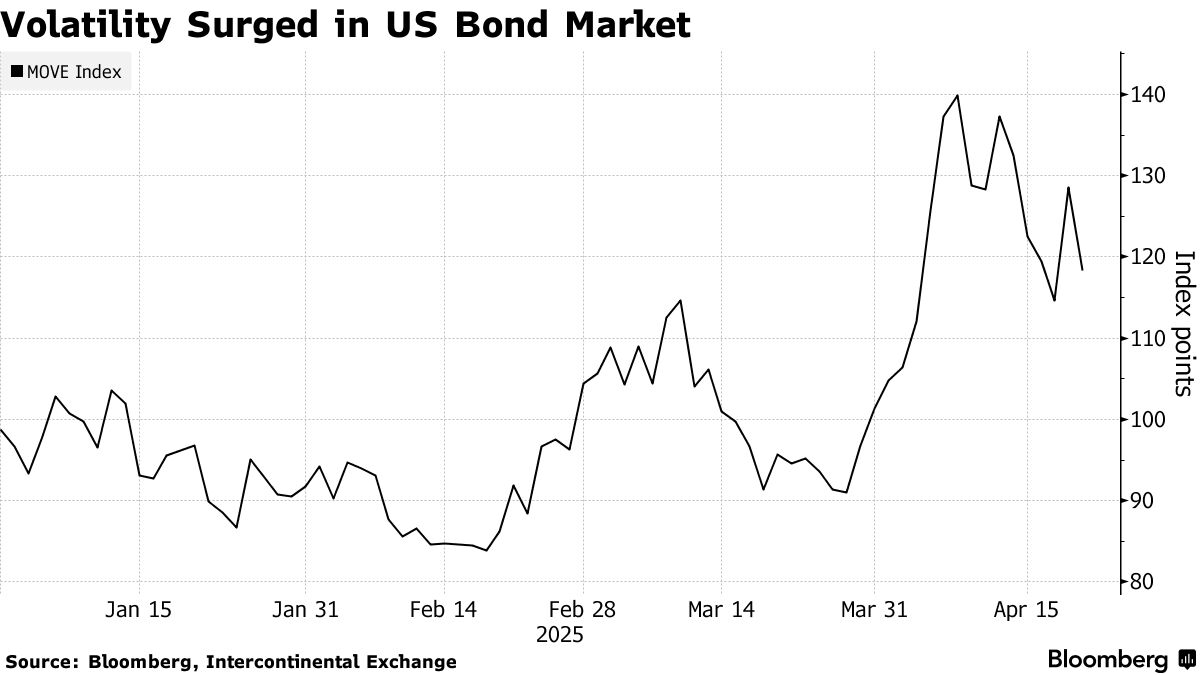

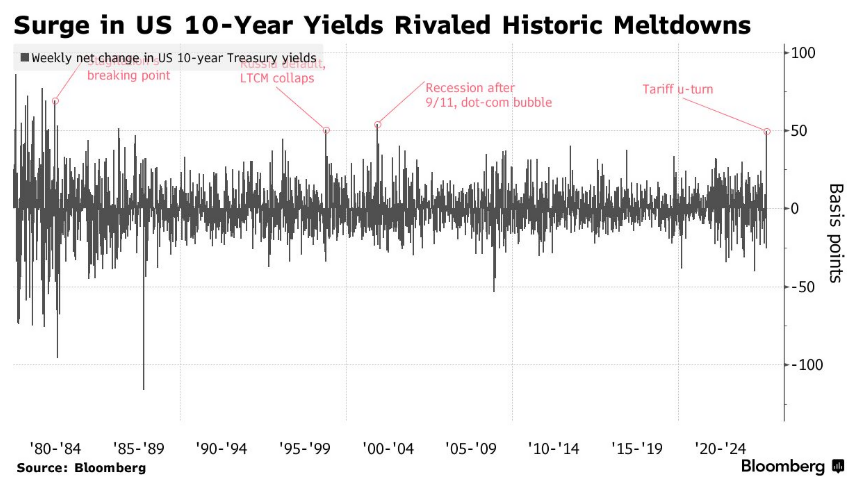

然而在 4 月初,特朗普总统实施“对等”关税引发的混乱中,出现了一件不同寻常的事。随着股票和加密货币等风险资产的暴跌,美国国债价格非但没有上涨,反而随之下跌。美国国债收益率创下二十多年来最大单周涨幅。

长期以来,市场规模达 29 万亿美元的美国国债,被视为市场动荡时的避风港,这一直是全球最大经济体的独特优势。几十年来,它帮助美国控制了借贷成本。但近来,美国国债的交易表现更像是一种风险资产。前财政部长 Lawrence Summers 甚至表示,美国国债的表现就像新兴市场国家的债务。

这对全球金融体系有着深远的影响。作为全球的“无风险”资产,美国国债被用作从股票到主权债券以及抵押贷款利率等各类资产定价的基准,同时还充当着每天数万亿美元贷款的抵押品。

以下是投资者和市场预测人士为解释 4 月份美国国债异常波动所提出的部分观点,以及一些潜在的替代“避风港”。

关税驱动的通胀

即使特朗普针对大部分“对等”关税暂停实施 90 天,但对中国征收的关税仍远高于此前的预期。并且对来自加拿大和墨西哥的汽车、钢铁、铝以及各种商品仍分别征收关税,特朗普还威胁未来可能会加征更多进口关税。

人们担心,企业会以涨价的形式将这些关税成本转嫁给消费者。通胀冲击会打击对国债的需求,因为它会侵蚀国债所提供固定收益支付的未来价值。

如果物价飙升的同时伴随着经济产出下降或零增长(即所谓的滞胀),货币政策将进入一个新的不确定时期,美联储将被迫在支持经济增长和抑制通胀之间做出选择。

追逐现金

一些投资者可能已经抛售了美国国债以及其他美国资产,转而寻求终极避风港:现金。随着美联储推迟降息,美国货币市场基金中的资产规模持续飙升,并在截至 4 月 2 日的一周内创下历史新高。货币市场基金通常被视为类似现金,而且还有一个额外的好处:随着时间的推移能产生收益。

政策不确定性

投资者在投资政治动荡、经济不稳定的国家时会要求更高的回报率。这就是为什么阿根廷政府债券在 4 月中旬的收益率高达 13%的原因之一。

特朗普出人意料的政治策略和激进的关税政策,让人难以预测一年后美国的投资环境会多么友好。

另一个促使资金流入美国的因素是,人们认为美国司法系统和其他国家机构的力量能对美国政府加以约束,并确保一定程度的政策连续性。特朗普敢于挑战阻碍他行事的律师,并迫使美联储和其他独立机构屈从于他的意愿,这可能会削弱一些人对那些曾助力美国成为全球最大外资目的地的制衡机制的信心。

财政压力

20 世纪 70 年代中期,美元取代黄金成为世界储备资产,各国央行纷纷购入美国国债以存放美元储备。由于联邦政府从未违背过偿债承诺,美国国债被视为一项稳固的投资。

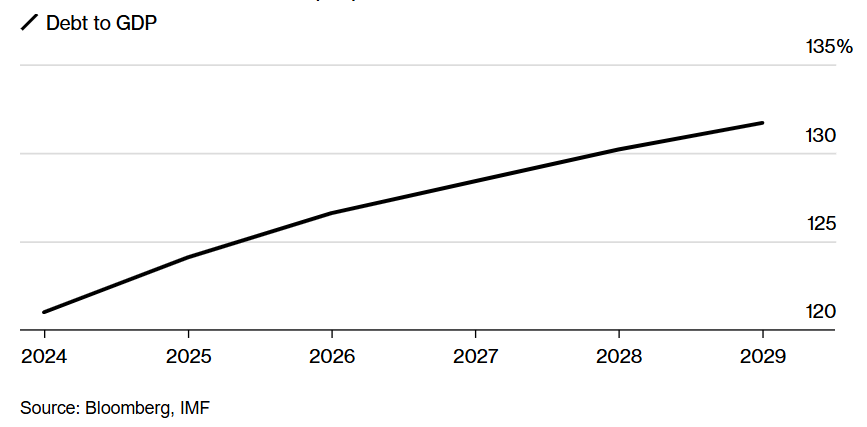

美国国债目前占国内生产总值的 121%。特朗普上任伊始就押注通过减税刺激经济增长来减少预算赤字,最近他又暗示关税收入也有助于减轻预算赤字。

但也有人担心,他的政策只会加剧国家债务。除了他计划中的额外减税措施外,特朗普正试图将其第一任期内实施的减税政策永久化。如果关税导致经济陷入衰退,政府可能会面临增加支出的压力。

鉴于此,富达国际固定收益投资经理 Mike Riddell 表示,美国国债收益率的螺旋式上升可能预示着“资本外逃”,因为外国投资者越来越不愿意为美国的赤字提供资金。“全球‘债券义勇军’显然依然活跃”。

美国债务水平预计会上升

国际货币基金组织预测,到 2029 年,美国债务占国内生产总值的比例将达131.7%。

外国抛售

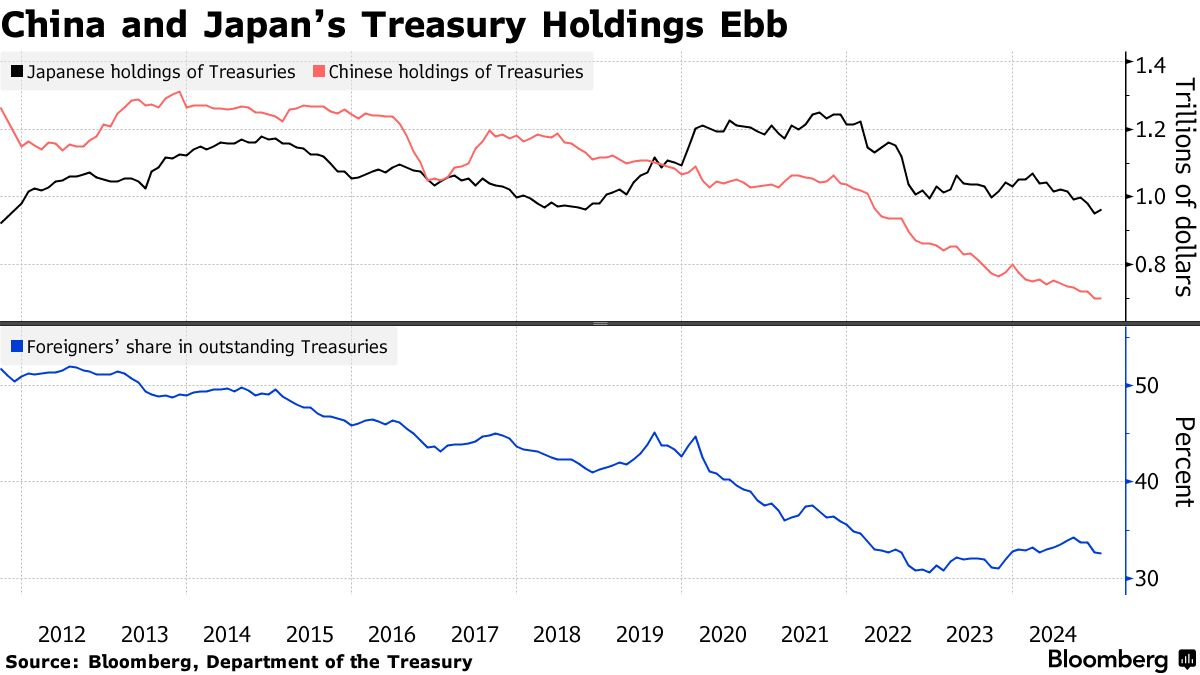

虽然很难实时证明,但美国国债价格下跌时,人们通常猜测是外国在抛售。这一次,有人认为这是对特朗普关税政策的回应。中国和日本是美国国债的最大持有国。官方数据显示,两国一段时间以来一直在减持。

鉴于中国的交易活动是严格保密的,因此很难猜测中国政府在其中扮演角色。但策略师们常常指出,中国持有的美国国债可能是其对美国的潜在筹码——即使大举抛售可能会压低中国外汇储备的价值。

对冲基金交易

基差交易可能是 4 月初美国国债收益率飙升的一个原因。这是一种流行的对冲基金策略,通过现金国债和期货之间的价差获利。

这种价差通常很小,因此投资者通常会使用大量杠杆来为交易提供资金。当市场动荡来袭,投资者急于迅速平仓以偿还贷款时,可能会引发问题。风险在于,这可能会引发连锁反应,导致收益率螺旋式上升,甚至更糟的是,导致国债市场陷入停滞,就像 2020 年基差交易平仓时所发生的那样。

另一些人则指出,此前盛行的“美国国债表现优于利率互换”的押注突然崩盘。事实上,利率互换表现优异,因为银行为了满足客户的流动性需求而清算债券,随后又增加了互换合约,以便在债券市场可能上涨时保持一定敞口。

如果不是美国国债,那会是什么?

欧洲和日本的基金经理发现,现在除了购买美国国债,还有可靠的方案,这可能会吸引他们将资金配置转向政策前景看似更稳定的市场。在更广泛的动荡中,德国债券是主要受益者之一。

黄金这一传统的避险资产在 4 月飙升至历史新高,表现优于几乎所有其他主要资产类别。一段时间以来,各国央行一直在囤积这种贵金属,以期实现资产多元化,减少对美元资产的依赖。然而,与债券不同的是,投资黄金不会带来固定收益。只有在价格上涨时出售,投资黄金才会带来回报。

归根结底,没有哪种投资能提供像美国国债市场那样强大的流动性和深度,真要从美国国债市场撤资需要数年时间,而不是几周。然而,一些市场观察人士认为,4 月份的市场走势可能预示着全球格局的转变,以及对美国经济主导地位至关重要的资产的重新评估。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。