It seems that unifying all Bitcoin ecosystem protocols and accommodating various assets and the implementation of BitMM is no longer just talk, but Thunderbolt still feels like "a strong mathematical paper" at this stage, and there may still be a considerable distance before developers can "use it."

### 1. Why Can't Bitcoin Buy Coffee?

When it comes to Bitcoin, most people first think of its "decentralized" and "immutable" attributes. However, when you actually want to use it to buy a cup of coffee, you quickly encounter an awkward problem: the transaction confirmation time is often longer than waiting for the coffee, and sometimes the transaction fees are even more expensive than the coffee itself. Assets on Bitcoin are still "as immovable as a mountain"—mainly relying on HODL, they cannot be loaned, combined, or interoperate.

The script structure of Bitcoin Script is extremely conservative, limiting most off-chain interaction scenarios. It was not originally designed to handle thousands of payments per second. But the reality is clear—people want Bitcoin to be usable, even if it's just to buy a game skin or tip for a video, and they don't want to wait ten minutes.

### 2. Lightning Network: A Double-Edged Sword

Image source: Cointelegraph

The Bitcoin main chain is like a highway, while the Lightning Network is akin to a toll express lane built alongside it. Its core idea stems from a compromise on the efficiency of main chain transactions: since there are speed bottlenecks in on-chain transactions, it no longer insists on recording every transaction on the chain, but instead establishes exclusive "payment channels" between users to achieve high-frequency bookkeeping, ultimately synchronizing only the fund status at the time the channel is closed to the blockchain. This model is similar to how friends take turns treating each other weekly—people do not immediately bank transfer after each meal but settle the bill in one go after accumulating ten meals. The Lightning Network is essentially a transaction network woven from thousands of such payment channels.

However, this seemingly ingenious system reveals multiple dilemmas in practical applications. First is the high threshold for channel construction; users must lock funds in advance to establish a transaction channel, meaning that to trade with any counterpart, a dedicated channel connection must be established beforehand. Secondly, there is the complex routing problem; when user A and B lack a direct channel, even if there is an indirect path A-C-B, if the intermediate channel lacks funds or the path node is unavailable, the transaction will still fail. More severely, there are security risks; the system requires users to remain online to prevent the counterparty from submitting expired transactions for fraud when the channel closes, which imposes unrealistic demands on ordinary users' device maintenance capabilities.

Despite the Lightning Network being operational for many years, these structural flaws have made it difficult for its practical application to break through bottlenecks. Public data shows that the total amount of funds locked in the entire Lightning Network currently hovers around $100 million, which is nearly marginalized in ecological status compared to the trillion-dollar market value of the Bitcoin system. This inevitably raises deep reflections in the industry: can we build a more complete off-chain payment protocol to break through the existing predicament?

According to Chain Catcher news on April 15, HSBC disclosed in an official press release that Bitcoin Thunderbolt is the most milestone technology upgrade for Bitcoin in the past decade. The overall observation of Thunderbolt resembles "Lightning Network 2.0," but it is not just an upgrade; it is more like a reconstruction of the off-chain Bitcoin interaction paradigm.

### 3. What is the Thunderbolt Protocol?

Image source: Nubit | Bitcoin Thunderbolt

Bitcoin Thunderbolt is a soft fork upgrade based on the Bitcoin base layer. It does not rely on second-layer networks or cross-chain bridges as a compromise solution, but directly modifies the protocol level of the Bitcoin main chain, fundamentally enhancing Bitcoin's scalability, transaction performance, and programmability.

From a performance perspective, Nubit utilizes UTXO (Unspent Transaction Output) Bundling technology to achieve significant optimization of the traditional Bitcoin transaction processing model. The traditional Bitcoin network, due to its single UTXO model, has obvious limitations on transaction speed and throughput. UTXO Bundling allows multiple UTXOs to be aggregated for processing, effectively compressing the transaction data volume, thereby increasing transaction speed by about 10 times without sacrificing security.

In terms of programmability, Bitcoin Thunderbolt reintroduces and expands the OPCAT opcode (which existed in early versions of Bitcoin but was later removed). OPCAT allows for data concatenation operations, enabling developers to build more complex script logic, thus directly implementing smart contracts on the Bitcoin main chain. The most direct benefit of this upgrade is that developers can deploy decentralized applications (dApps) on the native Bitcoin network without relying on side chains, Rollups, or cross-chain bridges.

On the asset protocol integration level, Nubit advocates and implements a unified standard called Goldinals. Goldinals provides an asset issuance framework based on zero-knowledge proofs and state commitments. In simple terms, this is a "Bitcoin-native" token standard that does not rely on external trust institutions and does not require complex cross-chain bridges to verify the existence and status of each token on-chain. BitMM, which operates on Bitcoin, integrates scattered protocol assets such as BRC-20, Runes, and Ordinals. Nubit also has significant breakthroughs in trustless transactions. Its launched BitMM (Bitcoin Message Market) system supports users in conducting trustless transaction matching and information verification on the Bitcoin chain.

Unlike traditional scaling approaches (such as using side chains, Plasma, Rollup, or bridging wrapped tokens), Nubit adopts a "main chain native scaling" path. BitVisa provides a decentralized identity and credential system. Whether it is transaction compression, smart contract support, or asset standard integration and on-chain transaction matching—all operate directly on the Bitcoin main chain. It uses native BTC rather than cross-chain mapped tokens.

3.1 Core Mechanism Analysis

This section is explained based on the article "Stateless and Verifiable Execution Layer for Meta-Protocols on Bitcoin" (see reference link 1). In my understanding, Bitcoin Thunderbolt (Thunder Network) and Bitcoin Lightning (Lightning Network) are similar in that both are proposed scaling solutions to address the slow transaction confirmation of the Bitcoin main chain, with the core goal of improving efficiency and reducing costs. The differences between the two are:

- The design of the Lightning Network leans more towards "payment channels"—it can only be used for transfer payments, does not support smart contracts or complex logic, and has a high threshold for construction and maintenance, which is not conducive to large-scale adoption.

- Thunderbolt, launched by Nubit, aims to provide a programmable off-chain protocol that supports Turing-complete operations, capable of constructing more complex state assets, liquidity protocols, and financial applications.

Flexible and Adjustable Multisignature

Imagine splitting a Bitcoin "signature" in half: one half is in Alice's hands, and the other half is with the committee. Each time it is transferred to a new user, Alice and the committee each add a "little secret" to their half of the signature—only the receiving new user knows this secret. The receiver can use the secret they know to "stitch" the two halves back together to obtain the complete signature without needing Alice and the committee to be online for a conversation.

Asynchronous Fault-Tolerant Committee Ledger

A "service group" composed of several nodes (such as 4n+1) is responsible for bookkeeping, with everyone confirming who the current owner is. Even if a few nodes fail, as long as the majority are still online, the ledger can continue to operate normally. These nodes only "help sign" and "keep accounts," and cannot freely use funds, ensuring security and decentralization.

Atomic Swap Finalization

When it is time to spend this money on-chain, it first goes through three steps of "atomic swap": 1. Alice and the committee spend the original locked output, temporarily giving the money to the committee; 2. The committee locks an equivalent amount in a vault that can only be accessed by "Zenni and the committee" together; 3. Finally, Zenni uses the two segments of the signature to take the money from the vault. This way, neither Zenni nor the committee can run away, ensuring that off-chain reconstruction and on-chain redemption happen seamlessly.

3.2 Thunderbolt's Protocol Design and Key Innovations

- Non-interactive, Recursive Signature Delegation

A tweakable threshold Schnorr signature structure has been designed, where traditional payment channels often require several back-and-forth messages, Thunderbolt only needs to "send a signature with a little secret" each time, greatly reducing the online requirements. - Each Transfer Uses a "New Lock"

With each hop transfer, Alice and the committee update the signature with a new little secret, completely invalidating the old "lock." This way, anyone from before cannot access the new signature, preventing the old signature from being reused. - Only One Trace Left On-Chain

Only a "lock" is made on-chain at the beginning, and all subsequent changes are completed off-chain, with the final spending of this money done on-chain. Compared to the Lightning Network, which requires constant opening and closing of channels, Thunderbolt has fewer on-chain operations and better privacy. - No Money Lost Offline

Even if Alice or Zenni is offline, as long as the majority of the committee is online, transfers or redemptions can be completed at any time without worrying about time locks expiring or opponents maliciously closing the channel. - True "Machine-Proven" Security

All key steps in the protocol have undergone "formal verification" using Tamarin Prover, meaning these security guarantees are not just theoretical but have been repeatedly verified by automated tools.

### 4. How Does Thunderbolt Differ from Existing Lightning Network Solutions?

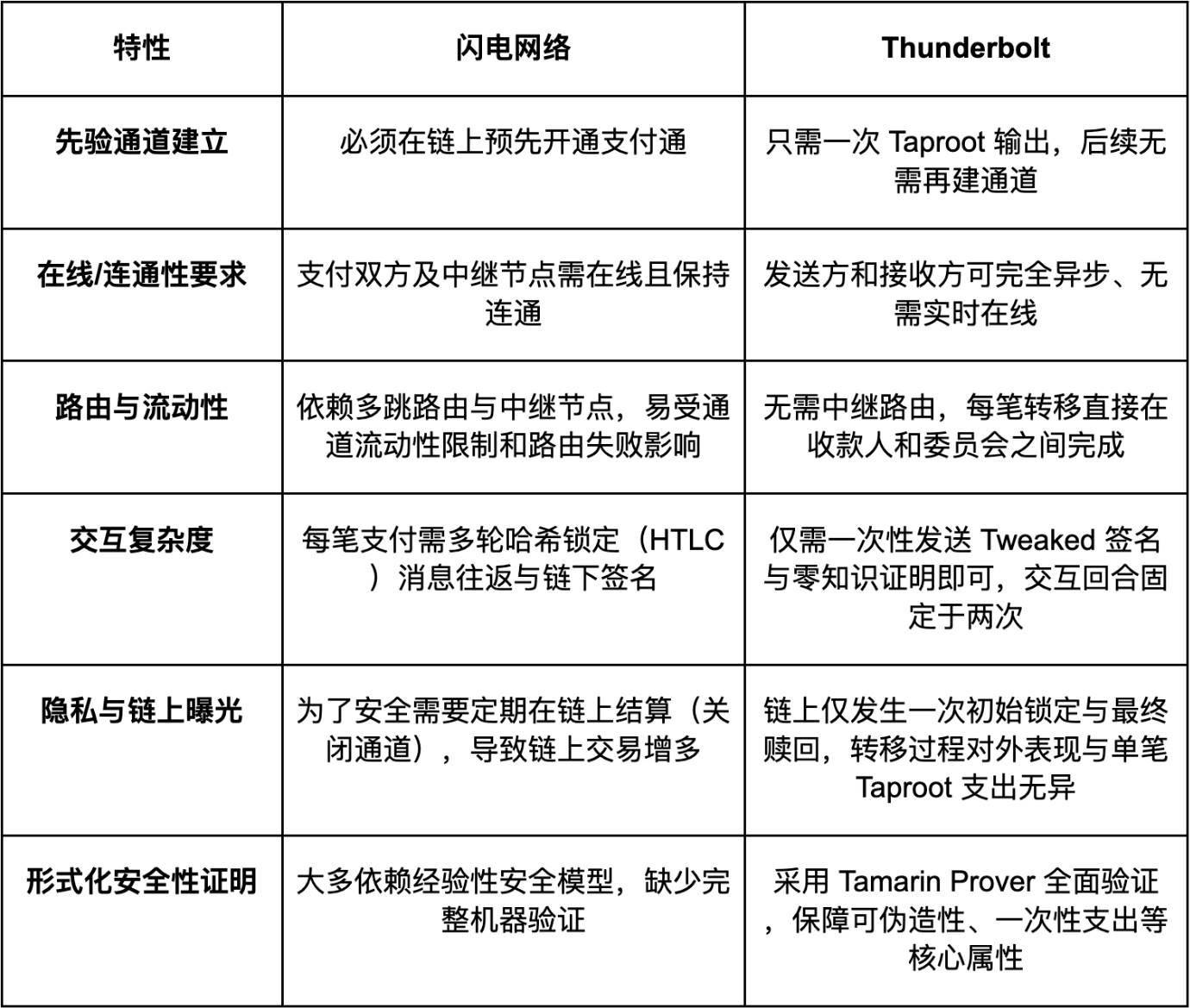

Let’s take a look at the comparison between Thunderbolt and existing solutions (such as the BOLT protocol, Breez SDK, Phoenix) to see what improvements it has made.

Differences Between Thunderbolt and Existing Lightning Network Solutions:

We can see that Thunderbolt's main advantages lie in "security" and "theoretical completeness." It is one of the few that can achieve:

- Protocol design can be proven to be secure

- Malicious users cannot profit unilaterally under any circumstances

However, its disadvantages are also quite apparent:

- Complex deployment: To use Thunderbolt, you currently need to run the entire protocol stack, making it difficult for ordinary wallet users to get started

- Main chain compatibility: The scripting language of the Bitcoin main chain is too rudimentary, and Thunderbolt must implement functions through clever workarounds, increasing the difficulty of implementation

- Lack of ecological support: Unlike BOLT, which has a large number of wallet and node supports, Thunderbolt is still in the "early research stage"

5. Potential Impact of Thunderbolt: A Catalyst for BTCFi?

Image source: Self-made

So, is Thunderbolt the optimal solution for BTCFi? Let's throw out a bold perspective:

Thunderbolt is theoretically the optimal solution for BTCFi at present, but in practice, it is still in the "Alpha stage." In other words, it is like the "Ethereum 2.0 white paper" of the Bitcoin world—full of foresight but not yet at the "engineering system level" of implementation. Based on current observations, I believe there are three potential development paths for Thunderbolt:

- Integrated as a Rollup: As a DeFi Engine on Bitcoin Side

The Bitcoin main chain itself lacks scalability, and Thunderbolt may ultimately become an off-chain module on some Bitcoin L2 (such as BitVM, Nomic, BOB). This is similar to "integrating Thunderbolt into a Rollup as a general contract execution layer."

For example:

- BOB can integrate Thunderbolt channel layer to achieve native BTC transactions

- The RGB ecosystem may also introduce Thunderbolt state management logic

- BitVM itself supports more complex logic, and Thunderbolt will become one of the contract standards

- Serves systems like Babylon, Bitlayer, etc.

- Forming an Independent Standard Ecosystem, Running Parallel to the Main Chain

The greatest possibility for Thunderbolt is to develop its own network ecosystem, node operation system, aggregators, etc., similar to the Lightning Network, and even form Thunderbolt-LSP operators. At the same time, the protocol layer soft fork upgrade promoted by Nubit in conjunction with miners from the Satoshi era introduced two major features: UTXO Bundling and OP_CAT, which can also directly accommodate BTC protocol assets (BRC20, Runes, Ordinals), creating significant imaginative space. Perhaps in the future, it may have:

- Thunderbolt Wallet (similar to Phoenix)

- Thunderbolt Node (light node running channels)

- Thunderbolt DEX (off-chain order matching)

- Thunderbolt AMM (liquidity pool)

- Being Replaced by Simpler Solutions

Of course, if a system emerges in the future that can achieve similar functions without state channels, formal languages, or off-chain protocol collaboration, then Thunderbolt may just be a transitional product, akin to:

- If BitVM achieves a more efficient contract execution environment

- Cross-chain ZK technology allows BTC assets to be deployed completely trustworthily on other chains

- A certain native Bitcoin protocol unifies payment + lending + contract modeling

Finally, from an ecological perspective, the greatest significance of Thunderbolt is not that it can run payments, but that it allows Bitcoin assets to possess "off-chain contract composability" for the first time. This may sound abstract, but the explosion of DeFi on Ethereum shows how critical this "composability" is. The explosion of Ethereum benefited from the full ecosystem of Solidity + Hardhat + Ethers.js + Metamask.

The biggest highlight of Thunderbolt is still the introduction of the two major features: UTXO Bundling and OPCAT. OPCAT introduces native programmability to the Bitcoin network, while UTXO Bundling compresses multiple small transactions for processing, reducing the scale of transaction data and improving on-chain throughput, with logic similar to Ethereum Rollup. It seems that unifying all Bitcoin ecosystem protocols and accommodating various assets and the implementation of BitMM is no longer just talk, but Thunderbolt still feels like "a strong mathematical paper" at this stage, and there may still be a considerable distance before developers can "use it."

Reference link:

(1) https://eprint.iacr.org/2024/408.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。