This is the weakest performance recorded after a halving.

Source: Kaiko Research

Compiled and organized by BitpushNews

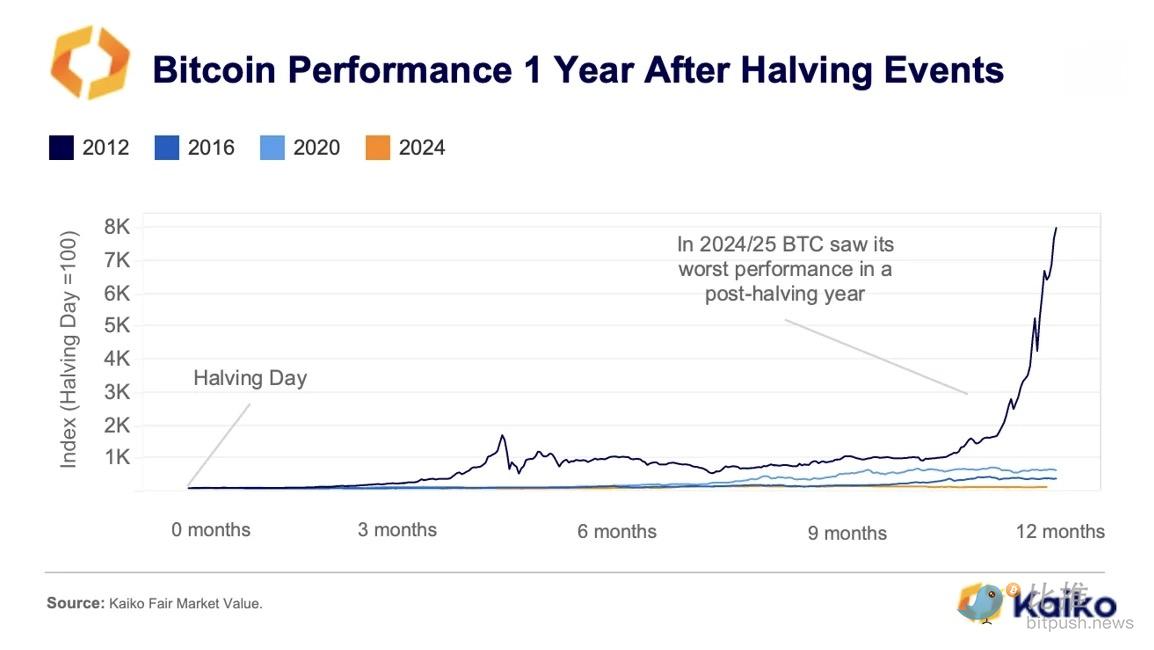

As Bitcoin approaches the one-year anniversary of the 2024 halving, its trading price is between $80,000 and $90,000, marking the weakest performance recorded after a halving in terms of percentage growth.

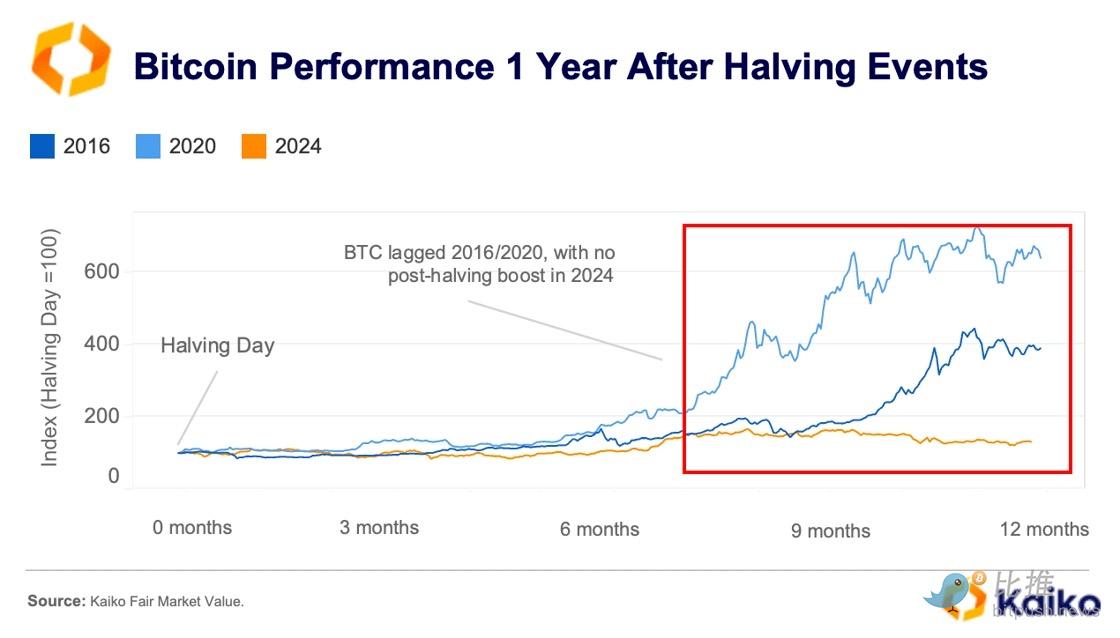

In previous halvings, Bitcoin typically experienced a strong rebound within 12 months: after the 2012 halving, BTC's price surged an astonishing 7000%, while the cycles in 2016 and 2020 recorded increases of 291% and 541%, respectively. So far, the 2024 cycle has not followed this trend.

Except for 2012, the price increases that usually occur nine months after a halving have noticeably disappeared.

This lackluster performance coincides with heightened macroeconomic uncertainty. In the first quarter of 2025, global trade tensions escalated, and risk-averse sentiment surged. Within six months post-halving, the Economic Policy Uncertainty Index (FRED) averaged 317. In contrast, during the same post-halving periods in 2012, 2016, and 2020, the average values of this index were 107, 109, and 186, respectively.

However, clarity in U.S. digital asset regulation is gradually emerging, which may help reduce uncertainty in the coming months and restore investor confidence in the crypto market.

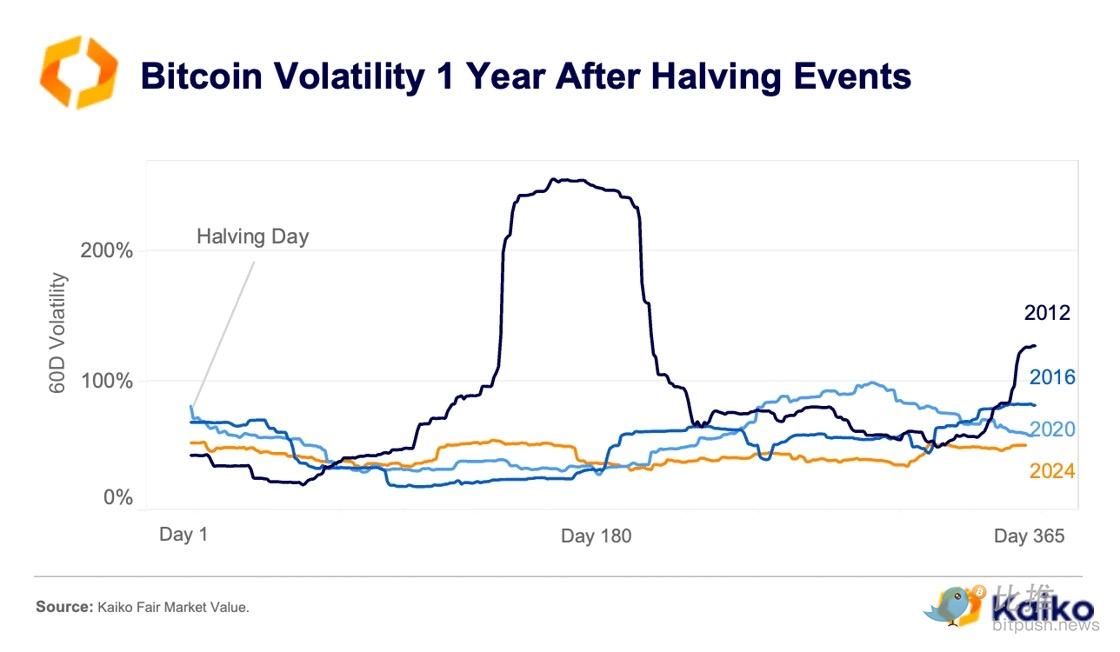

Despite ongoing market uncertainty, Bitcoin's price behavior has changed significantly in 2024. Its 60-day price volatility has sharply decreased—from over 200% in 2012 to barely 50% today. As Bitcoin matures, it is now more likely to deliver stable but potentially more moderate returns compared to earlier cycles.

Meanwhile, miner dynamics present a more nuanced situation. In April, Bitcoin's network hash rate reached an all-time high, indicating increased competition, possibly due to an influx of new miners or the deployment of more efficient hardware. However, when the hash rate rises without a corresponding increase in Bitcoin's price, miners' profit margins are squeezed, highlighting the growing disconnect between network security and price performance.

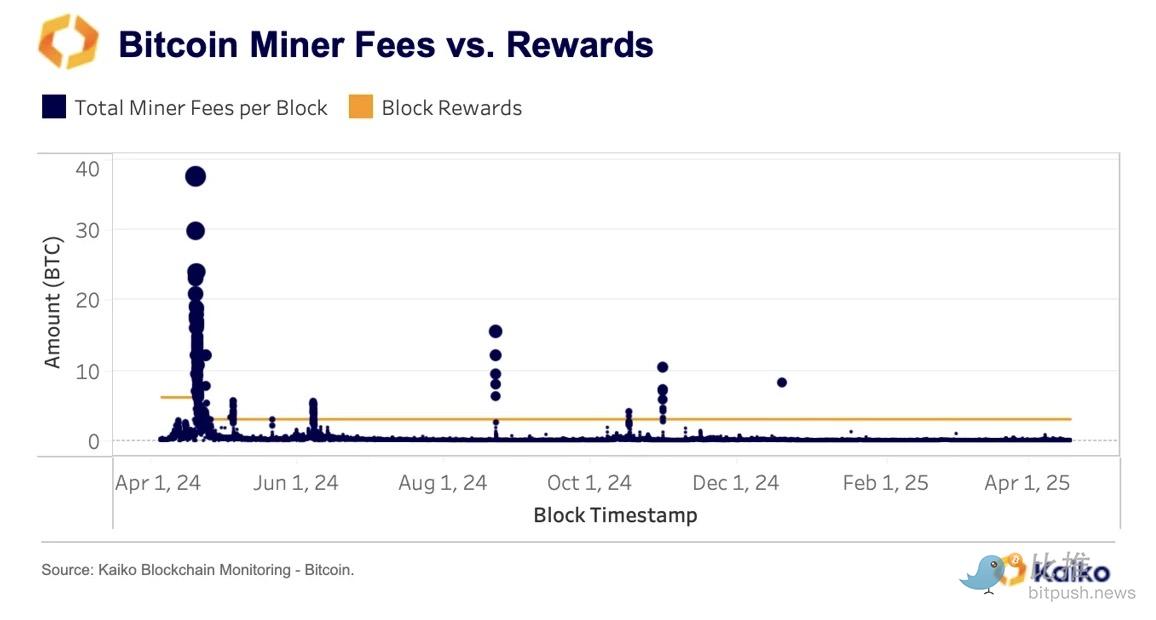

Miner income comes from block rewards and transaction fees. After the 2024 halving, transaction fees briefly surged to an all-time high, primarily due to the launch of the Runes protocol, which increased demand for block space by allowing the issuance of fungible tokens. However, since then, BTC miner fees have declined and are primarily below the block reward (3.125 BTC).

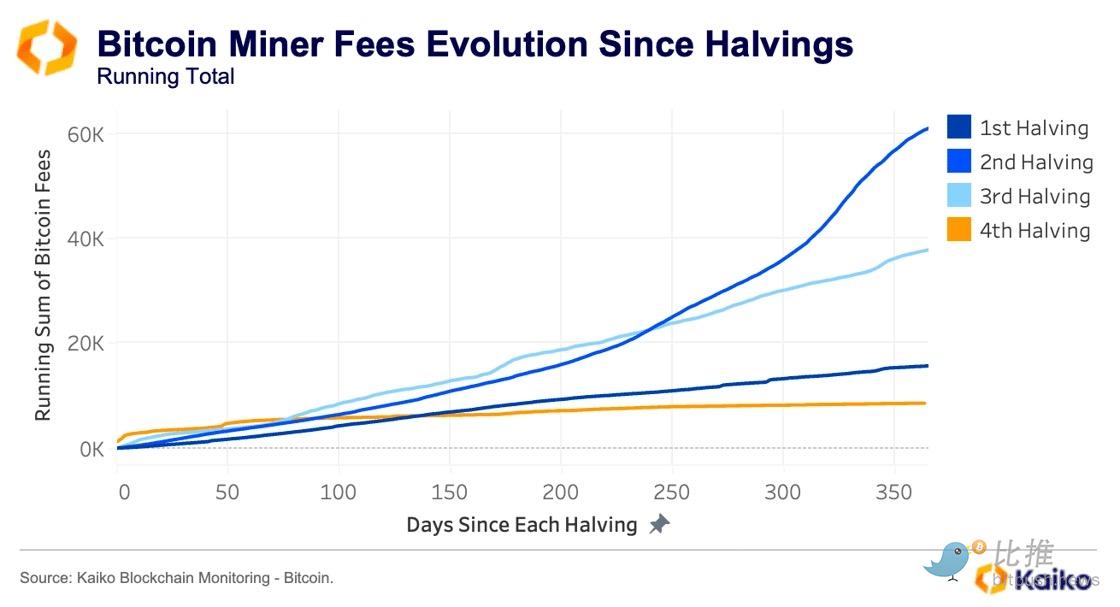

Since the fourth halving, the growth of miner fees has noticeably slowed. With block rewards now halved, stable on-chain transaction activity is crucial for maintaining miner incentives—especially when prices fail to rise quickly. In the year since the 2024 halving, total transaction fees paid have slightly exceeded 8000 BTC, while in the first year after the third halving, transaction fees amounted to 37,000 BTC.

Data Points

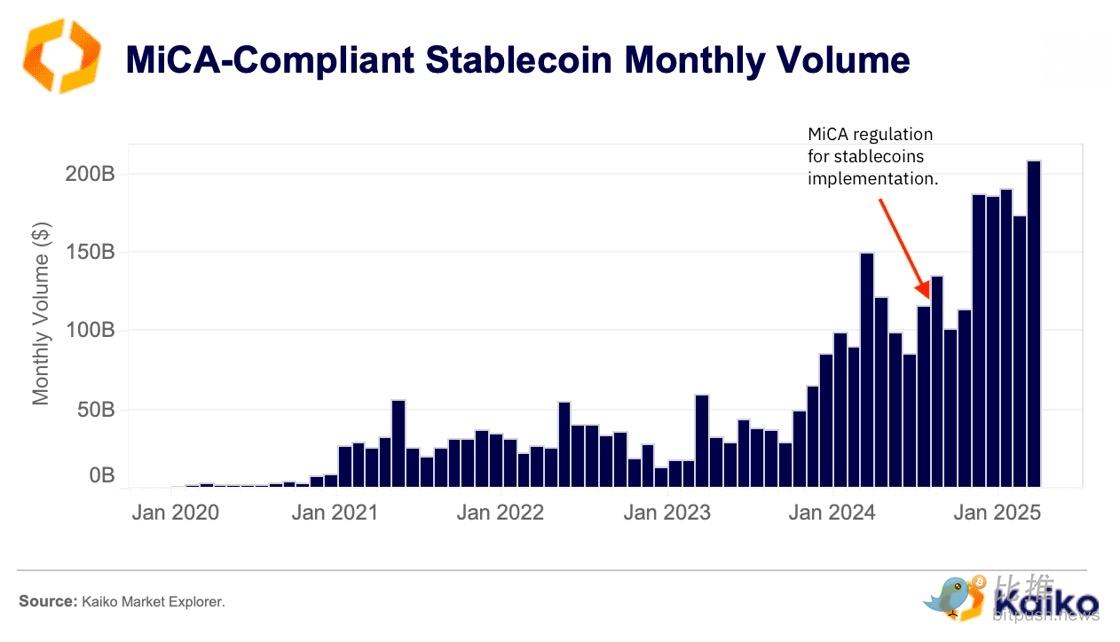

The trading volume of MiCA-compliant stablecoins has reached an all-time high.

Stablecoins regulated under the EU's Markets in Crypto-Assets (MiCA) framework have shown significant resilience amid broader market volatility, with their trading volume growth outpacing that of non-compliant counterparts.

Since the beginning of 2024, the combined monthly trading volume of Circle's USDC and EURC, Banking Circle's EURI, and Société Générale's EURCV has more than doubled, reaching a record $209 billion in March 2025.

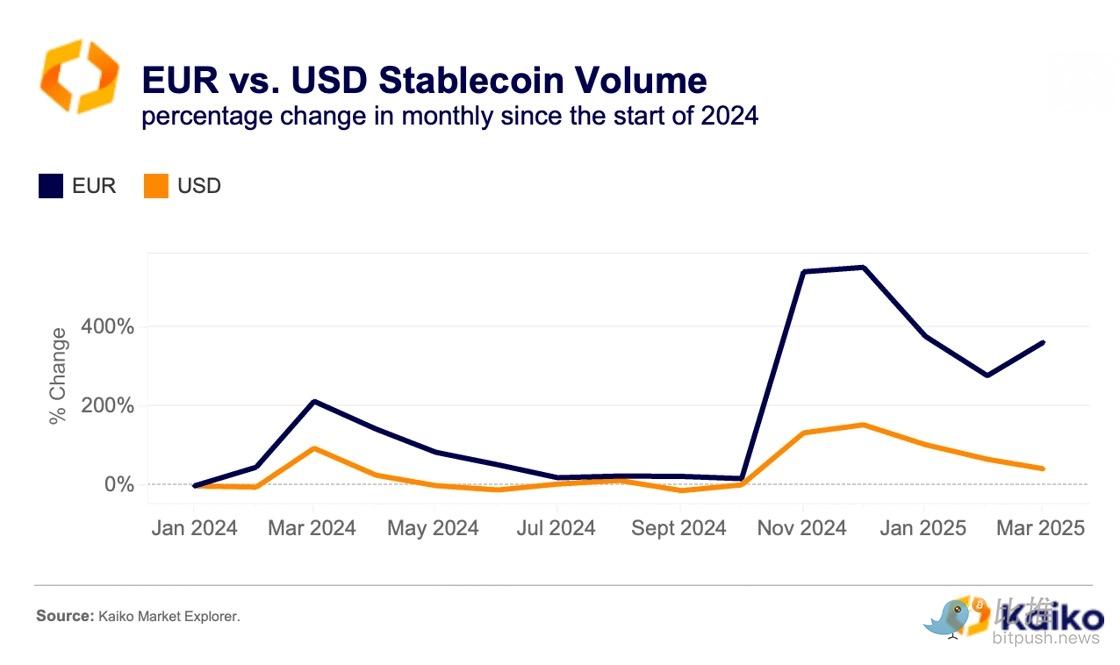

Among MiCA-compliant stablecoins, USDC's nominal trading volume still leads. However, euro-denominated stablecoins have gained significant momentum: from January 2024 to March 2025, the monthly trading volume of euro-backed stablecoins grew by 363%, while dollar-backed counterparts only increased by 43%.

Despite rapid growth, the retail adoption of euro stablecoins remains constrained by high transaction fees and limited liquidity. For example, the fees charged by Coinbase for EURC exchanges are significantly higher than those for USDC, which may limit its broader use.

ETH Staking Index: Coming Soon?

Following the tremendous success of U.S. spot ETFs last year, BTC has dominated the headlines in 2024. These funds have even overshadowed the ETH ETFs, which also attracted considerable inflows. The lack of staking functionality in ETH funds partly explains the lower interest in these products.

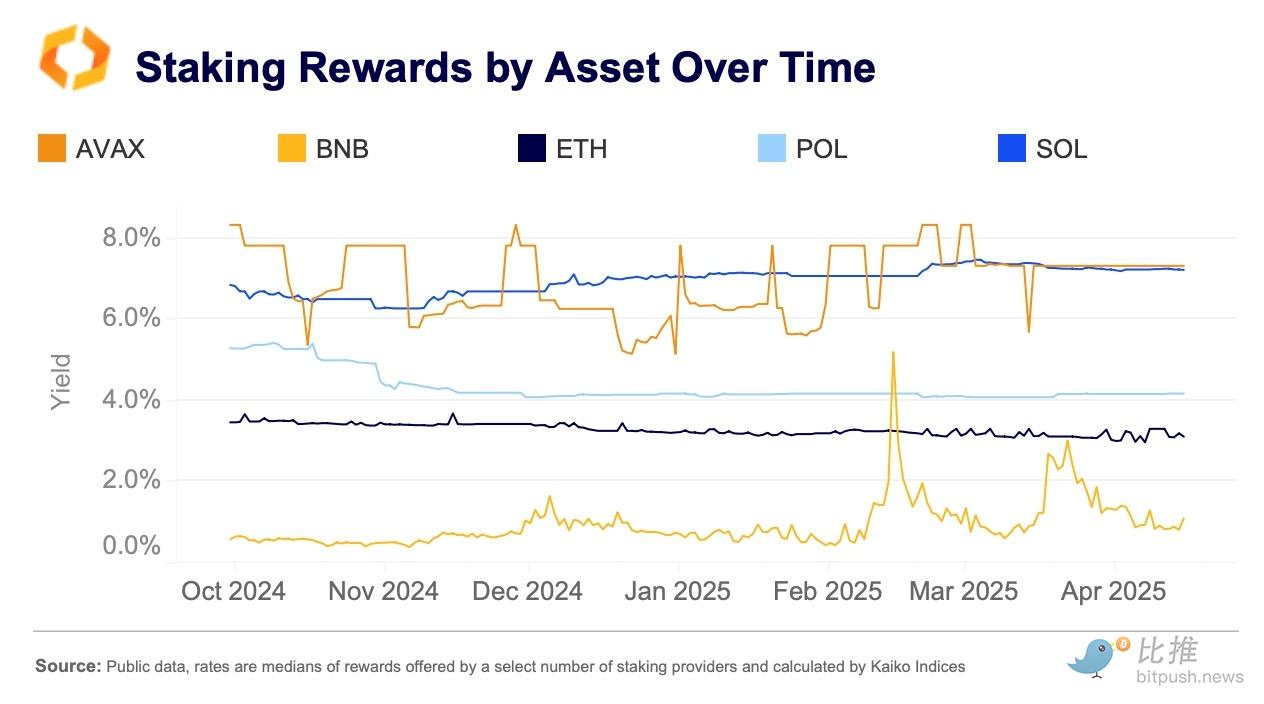

This situation may change in 2025, as issuers seek to revise previous applications to the new U.S. Securities and Exchange Commission. Not only ETH will benefit—there is a large number of proof-of-stake assets vying for ETF approval, many of which offer staking rewards far exceeding those of ETH.

In fact, SOL has consistently provided higher rewards, and the first spot products containing staking rewards for this asset were launched in Canada last week. Demand for these funds has remained healthy, with "Cathie Wood" of Ark Invest purchasing shares of 3iQ's SOLQ ETF, which has nearly reached 100 million Canadian dollars in assets under management.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。