Ethereum Engine Reconstruction Discussion;

Ethena Chain Launch Chooses Arbitrum Camp;

Unichain, MakerDAO, and other old DeFi are on the move;

Recent thoughts on DeFi over the past week.

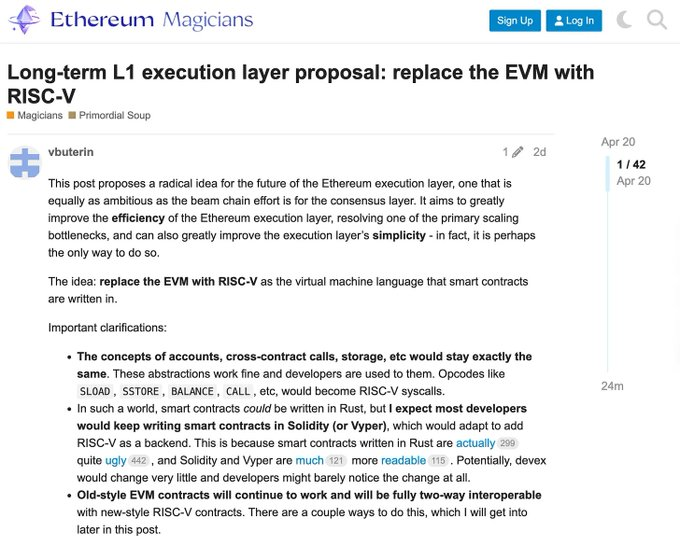

1/ First, regarding ETH, Vitalik proposed using RISC-V to replace EVM as the long-term execution layer.

A simplified interpretation:

(1) It can be roughly understood as changing the engine, with the goal of improving efficiency.

(2) To cope with the potentially massive computational consumption in the future.

(3) To break through the performance ceiling that is difficult to surpass under the EVM framework.

(4) This change only occurs in the underlying execution engine.

(5) It will not change Ethereum's account model, contract calling methods, etc.

(6) Users and developers do not need to change the way they interact with smart contracts when using Ethereum.

In summary, Vitalik believes that in the long run, the bottleneck of Ethereum's execution layer will ultimately face issues that are difficult to verify or require special hardware to run (huge computational resource consumption), which will limit scalability. Using RISC-V is a solution to this problem. As for why RISC-V is better, a simpler understanding is that RISC-V represents a general and efficient computing model, and its hardware and software ecosystem is more mature. It is still in the discussion stage, and the actual implementation of this change will not be small, with an estimated timeline of several years.

2/ Ethena Chain Launch

Converge's choice of the Arbitrum camp was quite surprising to me, as OP Superchain has strong players like Unichain and Base, and Arbitrum is clearly at a disadvantage in terms of camp strength. Although Arbitrum Orbit and OP Superchain are both L2-based scaling solutions, there are some design differences:

(1) Orbit allows developers to create dedicated Rollup or AnyTrust chains: they can either directly anchor to Ethereum as L2 or anchor to Arbitrum as L3.

(2) The vision of OP Superchain is a network composed of multiple parallel L2s. These L2s (referred to as OP Chains) are built on a shared OP Stack standard codebase.

To put it loosely: Orbit is vertical scaling, while Superchain is horizontal scaling. The perspectives on modularity and flexibility differ between the two; Orbit advocates openness, for example, the DA of Orbit chains can choose to publish data directly on Ethereum (Rollup method), maintained by a Data Availability Committee (DAC) (AnyTrust method), or integrated into external data availability networks like Celestia. Superchain, on the other hand, focuses on providing an EVM execution environment equivalent to Ethereum, emphasizing consistency with Ethereum and multi-chain standardization, with modular changes needing to be approached cautiously.

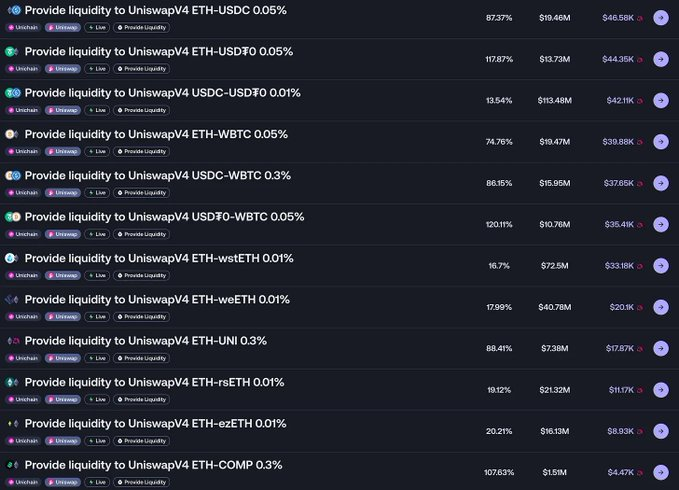

3/ Unichain Liquidity Mining Situation

The returns are quite decent, but you need to control the range yourself; there is not much presence in full-range mining (the APR on Merkl is inaccurate and needs to be calculated based on the amount of funds and the range). Compared to the previous version of liquidity mining, the threshold and difficulty have increased, and newcomers are not very enthusiastic about this; meme players are also unlikely to participate. The current audience is still old miners, and for them, the absence of newcomers competing for yields is quite appealing; they may complain verbally but are quite honest in their actions, essentially playing their own games, making it somewhat difficult for DeFi to break out of its niche.

4/ Ripple's Stablecoin RLUSD Has Entered Mainstream DeFi Protocols

(1) Aave has added RLUSD to V3.

(2) Curve Pool has deployed 53M in liquidity.

Stablecoins have really taken off this year; it seems that every cycle, this sector has a place. There are always angles to find; when regulations are lax, algorithmic stablecoins perform, and when the regulatory environment is good, major players also join the fray.

5/ Optimism Launches SuperStacks Initiative to Prepare for Upcoming Superchain Interoperability Features

(1) From April 16, 2025, to June 30, 2025.

(2) Encourages users to participate in DeFi on Superchain to earn XP.

(3) Protocols can also stack their own incentive measures.

(4) OP officials say there will be no airdrops, just a social experiment.

If you're interested in Superchain, you can participate, for example, by mining on Unichain while also earning XP. I do not recommend trying to farm XP deliberately; I have been paying attention to the interoperability of Superchain, waiting to see what changes will come after its official launch.

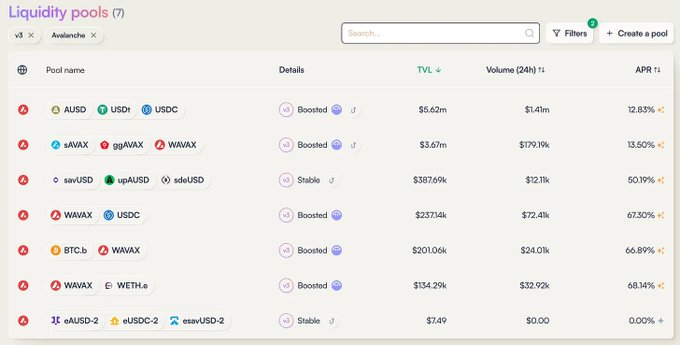

6/ Balancer V3 Launches on Avalanche, Accompanied by $AVAX Incentives

The rewards are decent, but the capacity is average. BAL was previously delisted by Binance, but the protocol is still actively working, including collaborations with the ecosystem and updates. This old DeFi has not achieved the leading position like Uniswap or Aave, and without the token issuance benefits of new DeFi, it is struggling to survive. It can only hope for a major on-chain explosion.

7/ Circle Launches CPN Network, Targeting the Global Payments Market

A compliant, seamless, and programmable framework that aggregates financial institutions, aiming to coordinate global payments through fiat currencies, USDC, and other payment stablecoins. The design of this network aims to overcome the infrastructure barriers faced by stablecoins in mainstream payments, such as unclear compliance requirements, technical complexity, and the secure storage of digital cash.

The first issue it addresses is cross-border payments, replacing the traditional slow and costly payment environment. This sector seems to have been known before as Ripple, but not very familiar, while also providing programmability. Overall, it is a good thing that promotes the adoption of blockchain. If every country has an on-chain stablecoin, the situation would be different, and it is also promoting more countries to issue compliant stablecoins.

8/ "Bridge" War

(1) GMX chooses LayerZero as the information transmission bridge for its multi-chain expansion plan.

(2) a16z crypto purchased $55M worth of LayerZero tokens, locked for three years.

(3) Wormhole releases future planning roadmap.

Some thoughts:

This sector is in high demand but also very crowded. From a profit-making perspective, most rely on transaction fees, which will become increasingly competitive. This is good for users, as fees will likely decrease. From the protocol integration perspective, stability and security need to be considered.

These giants are all highly valued, and it is difficult to design an economic model. From this perspective, such businesses are more suitable for launching a separate chain or mimicking this mechanism to fit into the PoS chain's token model.

9/ Spark (MakerDAO) Deploys $50M to Maple

It is noteworthy that this is Spark's first deployment of funds outside the U.S. Treasury market, but there is a cap of $100 million.

Who is Maple?

Maple focuses on connecting on-chain and off-chain to provide unsecured lending, with main products including the main platform Maple Finance and the derivative platform Syrup:

(1) Maple's clients are both qualified investors and institutions.

(2) Syrup's clients expand on-chain user deposits through SyrupUSDC.

A key role in Maple:

Pool Delegates: Pool Delegates are typically reputable institutions or trading firms responsible for managing loan pools. They are the core managers in the Maple ecosystem, with responsibilities including:

- Conducting credit assessments of borrowers and deciding whether to approve loans.

- Setting loan terms (such as interest rates, durations, etc.).

- Monitoring the execution and repayment of loans.

- Responsible for asset recovery in case of borrower default.

It is evident that the operation of the protocol largely depends on Pool Delegates.

Maple is an old project that was not well-received in the last cycle, mainly because its business model involved absorbing on-chain deposits and then providing unsecured loans to off-chain clients in a centralized manner, which was not easily accepted in the past. However, due to changes in the regulatory environment and shifts in user thinking, it has gradually been accepted. Still, I feel that USDS's choice to deploy funds with Maple remains a relatively high-risk move.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。