Original Title: "Synthetix Introduces Repair Measures, Can sUSD Reanchor?"

Original Author: Azuma, Odaily Planet Daily

The stablecoin sUSD under Synthetix has recently attracted significant market attention due to its prolonged depegging.

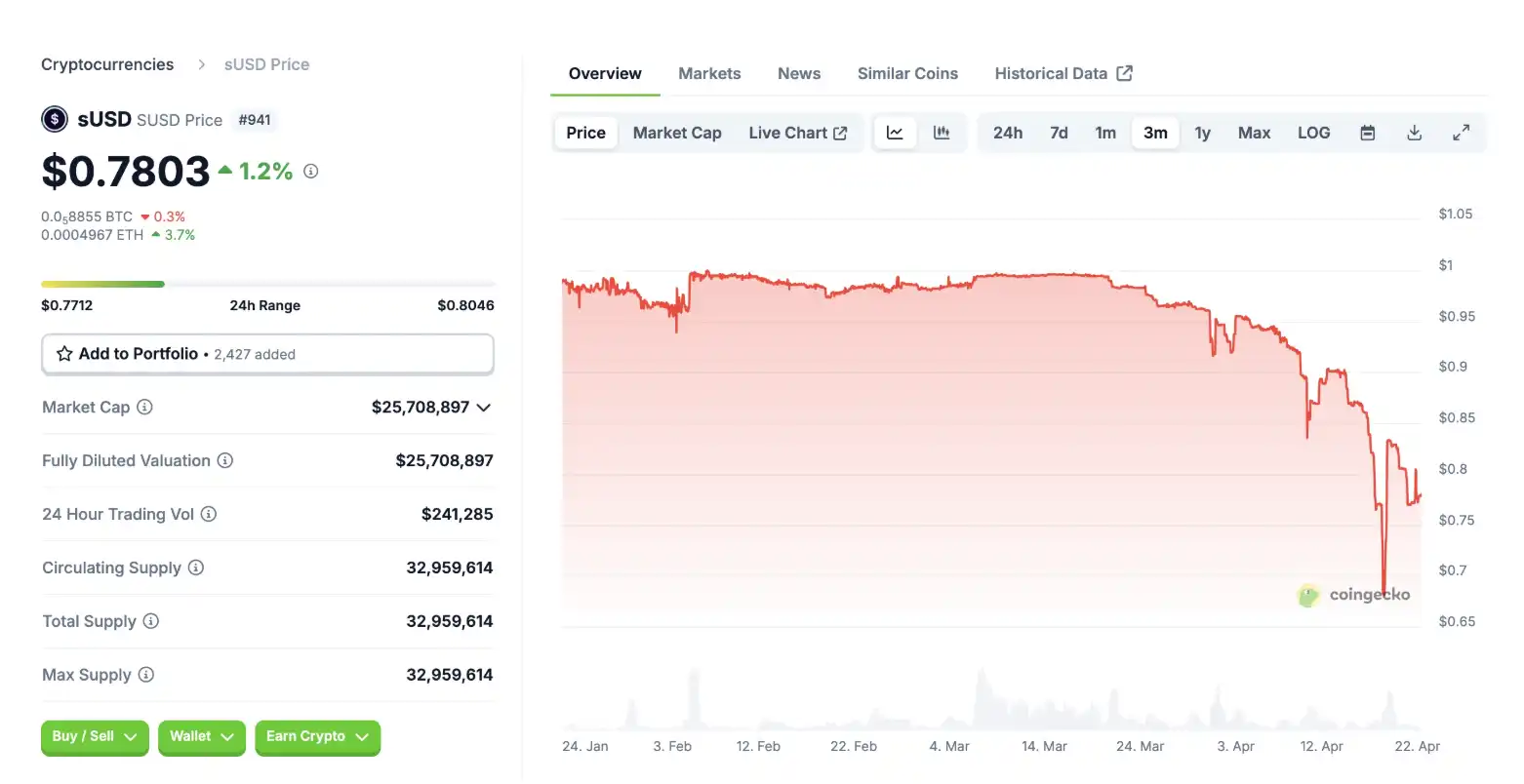

Since signs of depegging first appeared on March 20, the extent of sUSD's depegging has continued to widen, briefly falling below $0.70, and as of the time of writing, it is reported at $0.78. With Synthetix gradually rolling out various error correction measures, sUSD seems to have shown some signs of stabilization at a low level, but whether it can reanchor remains a rather complex issue for now.

Analysis of Depegging Causes

The depegging of sUSD needs to be discussed in the context of Synthetix's positioning shift and protocol changes.

Synthetix's original positioning was as a synthetic asset (Synths) protocol, allowing users to mint synthetic assets that track the performance of different assets (such as BTC, ETH) through over-collateralization, while sUSD is currently the only remaining synthetic asset with relatively broad utility, as Synthetix has gradually phased out the original synthetic asset model in favor of perpetual contract DEX.

Previously, Synthetix users needed to collateralize SNX to mint sUSD at a 750% collateralization rate—meaning for every $7.50 of SNX collateralized, $1 of sUSD could be minted. The minting mechanism for synthetic assets is similar to that of a lending market, where collateral is locked, and synthetic assets become loans that incur debt. The debt of sUSD is denominated in USD, while the debt of synthetic assets like Bitcoin is denominated in Bitcoin, fluctuating with token prices. SNX collateralizers must bear a corresponding proportion of the global debt within the system, which requires Synthetix to design complex hedging strategies to avoid risks from price fluctuations. This demand for hedging, the extremely high collateralization rate, and the system's complexity have led to a lack of interest from SNX collateralizers, prompting Synthetix to recently introduce a new model through the SIP-420 proposal.

In early 2025, the SIP-420 proposal, aimed at simplifying the sUSD minting process and improving sUSD minting efficiency, was approved by governance. SIP-420 introduced a shared debt pool mechanism, planning to gradually shift the minting method of sUSD from an individual collateral model to a collective fund pool model over 12 months. SNX stakers no longer need to mint sUSD individually and bear personal debt but can delegate funds to a public pool, achieving a structure without liquidation and personal debt. Meanwhile, SIP-420 will also reduce the collateralization rate of sUSD from 750% to 200%, significantly enhancing the system's capital efficiency.

However, with the exemption of personal debt, when the price of sUSD deviates from its pegged value, SNX stakers no longer have the incentive to repurchase sUSD at a low price to repay debts (previously, individual collateralizers could buy sUSD at a discount to repay debts and stabilize prices), rendering the protocol's original self-pegging adjustment mechanism ineffective. This is the fundamental reason for the depegging of sUSD.

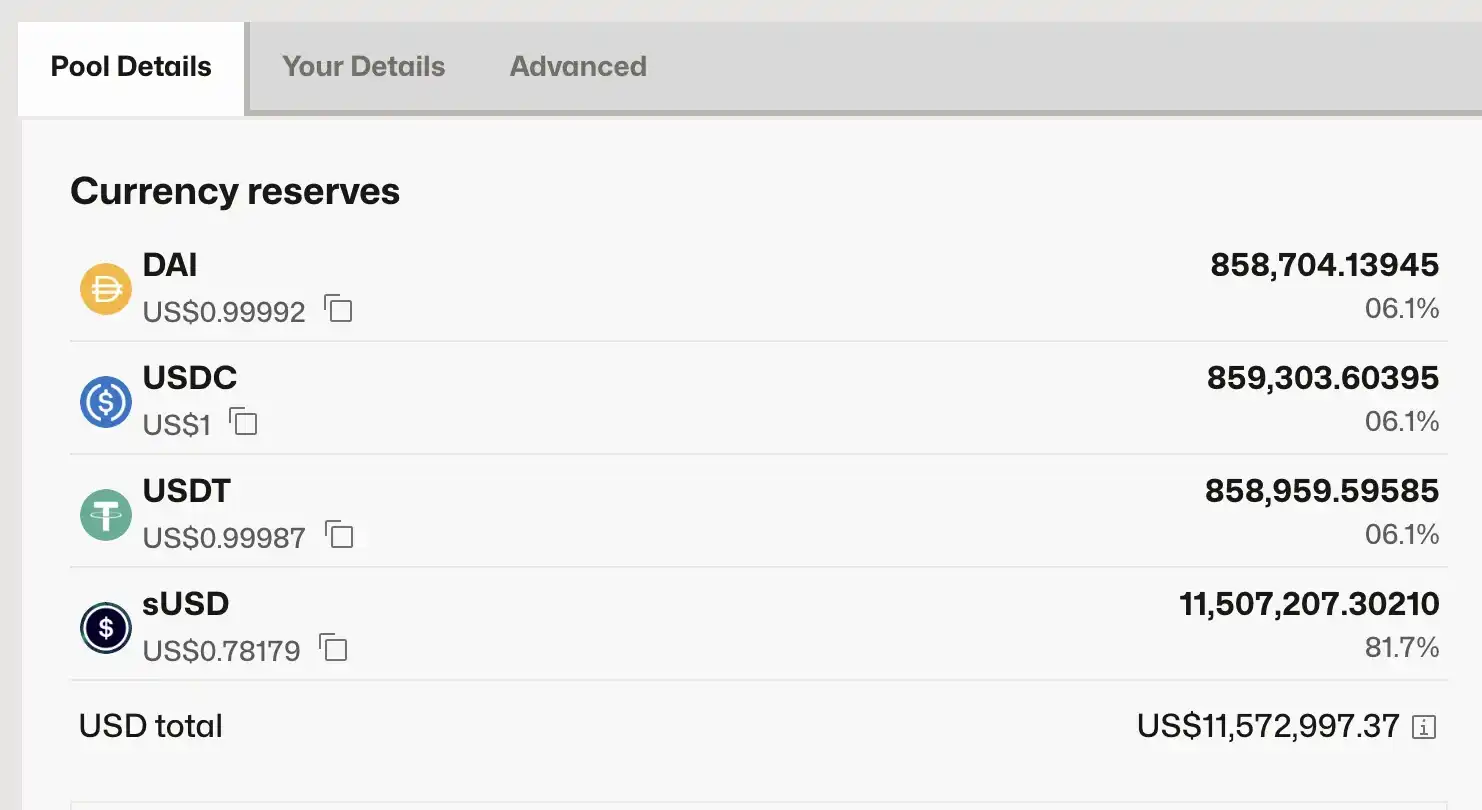

The situation of depegging has gradually intensified because the liquidity of sUSD is not as abundant as imagined. Taking the largest pool on Curve (sUSD/USDC/DAI/USDT) as an example, out of a total liquidity of approximately $11.51 million, the share of the sUSD pool accounts for about 81.7%—which means that the actual exit liquidity has been significantly consumed during the depegging process.

Synthetix's Response Plan

On April 2, Synthetix founder Kain responded for the first time to the depegging of sUSD. Kain mentioned that the depegging occurred because the main driving factor for purchasing sUSD (debt management) has been eliminated, and the new mechanism is in transition, leading to a temporary depegging.

As mentioned earlier, SIP-420 aims to achieve a mechanism transition within 12 months, but the community clearly cannot wait for 12 months with a depegged stablecoin. Therefore, Synthetix has recently launched several additional measures to attempt to repair the price of sUSD. The common keyword among these measures is "incentives."

The first measure is to provide liquidity incentives for sUSD. In the latest incentive measures, the yield for staking sUSD/sUSDe LP on Convex has reached as high as 49.18%;

The second measure is to provide incentives for sUSD deposit behavior through another project developed by the same team, Infinex, with incentives lasting six weeks, distributing 16,000 OP rewards weekly to users depositing over 1,000 sUSD;

The third measure is the latest plan, allowing users to stake sUSD in the 420 pool, with a one-year lock-up period, but offering 5 million SNX as an incentive.

Clearly, the above three measures are aimed at addressing the "insufficient demand for sUSD purchases" issue mentioned by Kain. By providing additional incentives for certain locking behaviors, Synthetix hopes to stimulate the demand for sUSD purchases and limit the potential selling pressure on sUSD, thereby gradually pushing the price of the stablecoin back to its peg.

Especially with the third measure, which has stricter conditions and greater incentive strength, Kain also mentioned yesterday his expectations for this measure and emphasized that the problem is entirely solvable, and the team will gradually resolve the depegging issue by optimizing the incentive mechanism.

It is worth mentioning that Kain also noted that if SNX stakers do not adopt the newly launched staking mechanism to help resolve the sUSD (SUSD) depegging issue, they will face a "big stick"—or hinting that after several incentive measures, the next step will involve imposing penalties on users who still do not "cooperate" with the repair actions.

Since Synthetix has not yet provided a user interface for staking sUSD, the staking operations still need to be handled manually by the team, so it is currently unclear how many users will participate in sUSD staking under the incentives, which will significantly affect the repair effect of sUSD.

Given the current situation, it is difficult to determine whether Synthetix can stabilize the situation. Although there have been some voices in the market suggesting bottom-fishing, I personally do not recommend trying to "pick up the crumbs" at this moment. If one cannot resist the temptation of a discount, they should closely monitor the price performance of SNX—to prevent a "price drop, insufficient collateral, intensified discount, panic selling" death spiral.

Alternative Arbitrage Opportunities

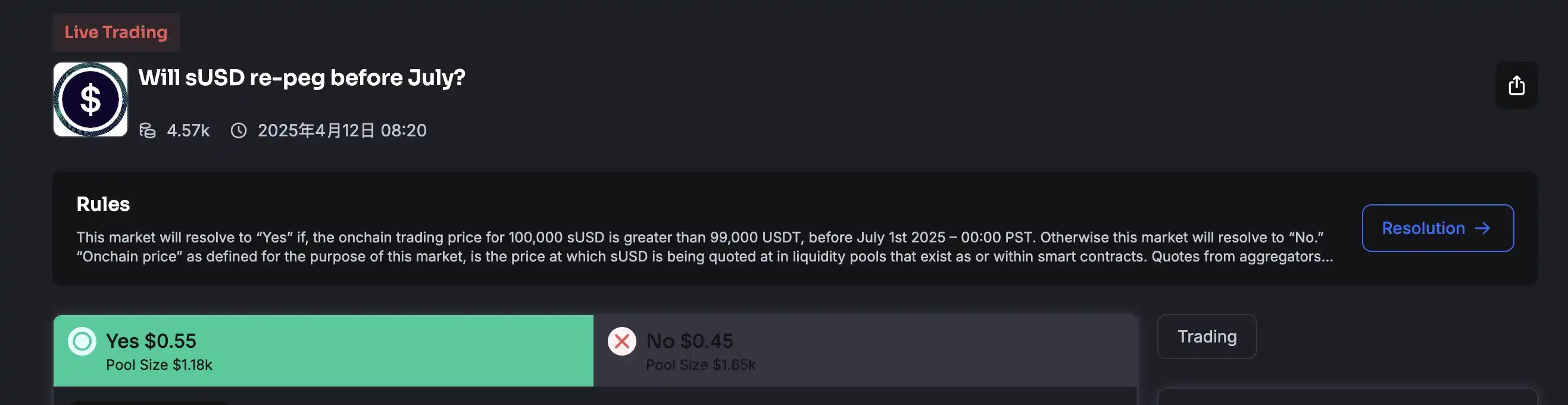

Compared to betting on a reanchor, there seems to be another arbitrage opportunity in the market—prediction markets.

The prediction market Truemarket has launched a prediction pool regarding whether sUSD can reanchor before July, with the current Yes share quoted at $0.55 and the No share quoted at $0.45.

Since sUSD is currently quoted at $0.78, after reanchoring, the price of each unit of sUSD will be restored to $1, and each unit of Yes share can also rise from $0.55 to $1, creating a price difference that provides some arbitrage space.

However, the depth of the prediction pool on Truemarket is relatively small and cannot accommodate larger-scale transactions, so the actual operational space for this strategy is limited—suggesting to keep an eye on other more mainstream prediction markets, including Polymarket, to see if they will open similar prediction pools and look for potential arbitrage opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。