Bitcoin ETFs Rally Led by ARKB and FBTC With Ether ETFs Still in Retreat

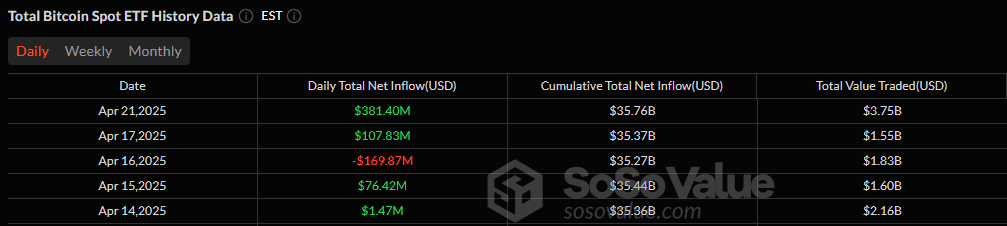

Momentum returned to bitcoin ETFs in a big way on Monday, April 21, with $381.40 million in fresh capital pouring into the market. It was the second consecutive day of inflows, but this time, the bounce was more widespread and far more substantial.

Ark 21Shares’ ARKB led the surge with a standout $116.13 million inflow. Fidelity’s FBTC followed with $87.61 million, while Bitwise’s BITB and Blackrock’s IBIT pulled in $45.08 million and $41.62 million, respectively.

Grayscale’s funds also joined the action, with GBTC receiving $36.60 million and BTC adding $32.55 million. Vaneck’s HODL ($11.72M) and Franklin Templeton’s EZBC ($10.10M) rounded out the wave of green. Remarkably, no outflows were recorded from any of the 12 U.S. spot bitcoin ETFs.

Total trading volume spiked to $3.75 billion, while net assets closed just shy of the $100 billion milestone at $97.61 billion.

Meanwhile, ether ETFs remained caught in their downward drift. Another $25.42 million exited the space, entirely from Grayscale’s ETHE. No other fund saw activity, reflecting a quiet but persistent erosion in investor confidence. Total trading volume reached $213.57 million, with net assets closing at $5.21 billion.

As BTC ETFs continue to show renewed investor interest, ETH ETFs remain weighed down, with the stark divergence continuing to shape the ETF narrative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。