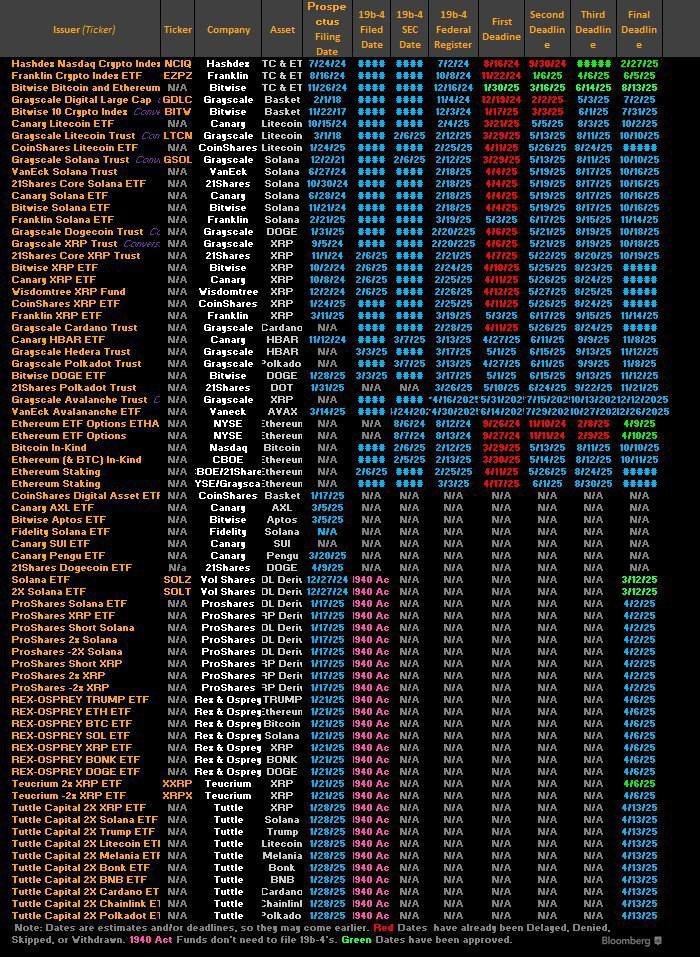

According to a report by Bloomberg, there are currently 72 cryptocurrency-related ETFs awaiting approval from the SEC in the United States. This includes spot ETF applications for $SOL, $XRP, $DOGE, $LTC, $DOT, $AXL, $AVAE, $APTOS, $SUI, $ADA, $PENGU, and $BONK, as well as the much-anticipated $ETH spot ETF staking application.

In fact, this count of 72 does not include the application for the $TRX spot ETF. According to @justinsuntron, Canary Capital has submitted the S-1 form for the TRX spot ETF to the SEC on April 18. Moreover, TRX has an advantage: if the ETF staking approval is granted, the TRX ETF can begin staking simultaneously.

Generally, applications for cryptocurrency spot ETFs represent traditional capital's interest in the token, indicating that a significant number of traditional investors are expected to buy in, which prompts the application. Once approved by the SEC, it signifies that the token complies with the U.S. regulatory framework. It can even be said that once a spot ETF is launched in the U.S., it can be considered a compliant and mainstream asset on a global scale.

Currently, the U.S. has only approved spot ETFs for $BTC and $ETH. The new SEC chair just took office in April, and it is likely that final approval decisions will take some time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。