说实话今天的作业难度直接就大幅提升了,如果 Bitcoin 和美股是同进同退这作业还好写点,但确实 $BTC 在今天走势还是不错的,甚至可以算是阶段性的走出了独立行情,虽然不知道能维持多久,但确实给 BTC 和 加密货币的投资者提供了一定的情绪支持。

美股在今天川普轰击鲍威尔前就走势不太好了,毕竟从今天一早开始就传出了大量的不利于经济的声音,到了美股开盘后川普的发文更是让投资者的情绪从头凉到了脚,一个是政治的掌权人,一个是经济的掌门人,川普就这么直接撕鲍威尔就增加了市场的不确定性。

而投资者担心的就是不确定性,甚至今天川普自己都说出来了,如果美联储不降息就有可能会让美国经济陷入因为“贸易战”而带来的衰退,就这还挺好意思怪鲍威尔的,毕竟是谁带来的贸易战呢?

如果能等美国的经济更稳定一些,最起码过了第一季度的 GDP 以后在考虑,或者是逐渐考虑关税的问题,也不会闹的风险市场一直这么跌下去了,反而是现在的关税和川普上任前除了中国就没有任何的变化,当然今天也和小伙伴聊了,这并不排除是川普的一项服从性测试,筛选出谁才是听话的小伙伴,谁是打对台的小伙伴,可能这对于川普接下来的政策会有帮助。

也许吧,但从现在来看即便没有关税政策,已经让美国的经济有下行的预期了,更别说关税以后的事情了。

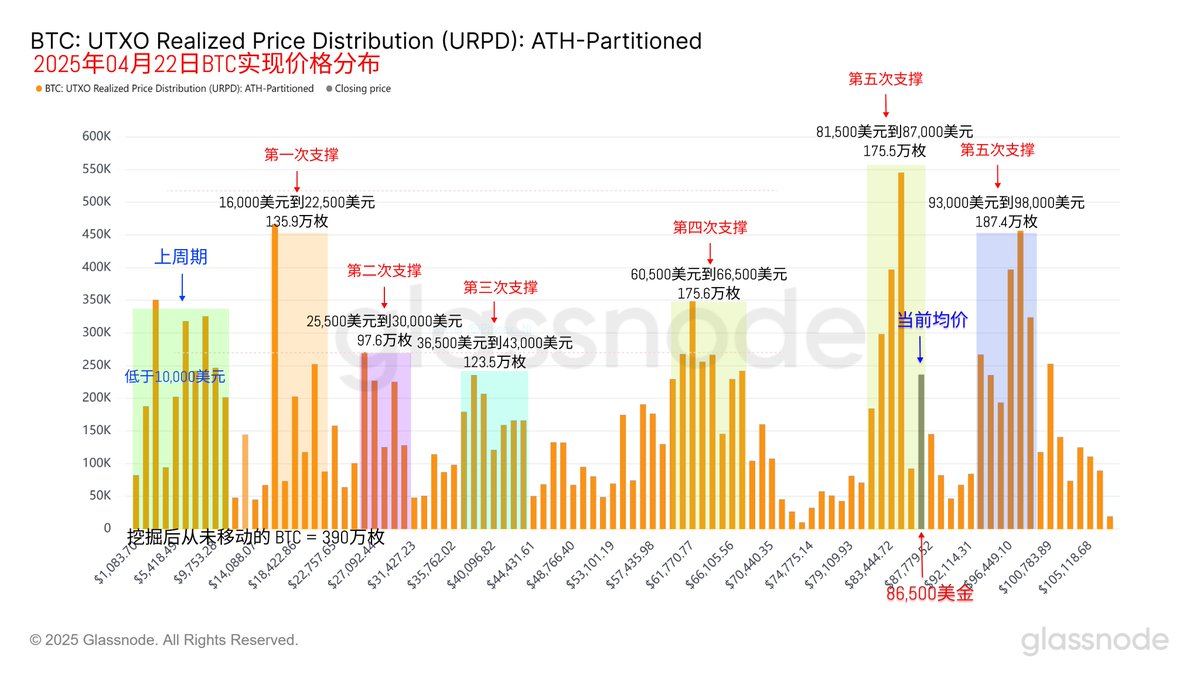

而对于 Bitcoin 来说虽然我们一直从结构上来看,BTC 的支撑是非常稳固的,但这很难让 BTC 能走出完全独立的行情,在没有系统性利空的情况下,可能因为筹码的结构还能抗一下,但如果真的出现了经济衰退,或者是衰退预期,BTC 大概率还是和美股高度统一的。

截止到美股即将闭盘前,美股的下跌稍微有些收缩,在此带动下 BTC 的价格又回到了 87,000 美元的上方,BTC的稳定性还是很强,但美债的走势就不好了,10年期美债又要接近 4.5% ,而20年和30年期的美债距离 5% 也越来越近,风险市场的情绪已经很差了,不太敢继续追多BTC,还是先看看吧。

不过从支撑数据来看,81,500美元到86,500美元还是非常好的筑底点,尤其是 84,500 美元的单一价格最高值也并没有随着价格上升而破坏,但确实能看到部分短期投资者离场的迹象,而 93,000 美元到98,000美元的投资者还是保持着非常稳定的状态,涨跌似乎都和他们没有关系一样。

明天先多观望一天再说吧。

数据已更新,地址:https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。