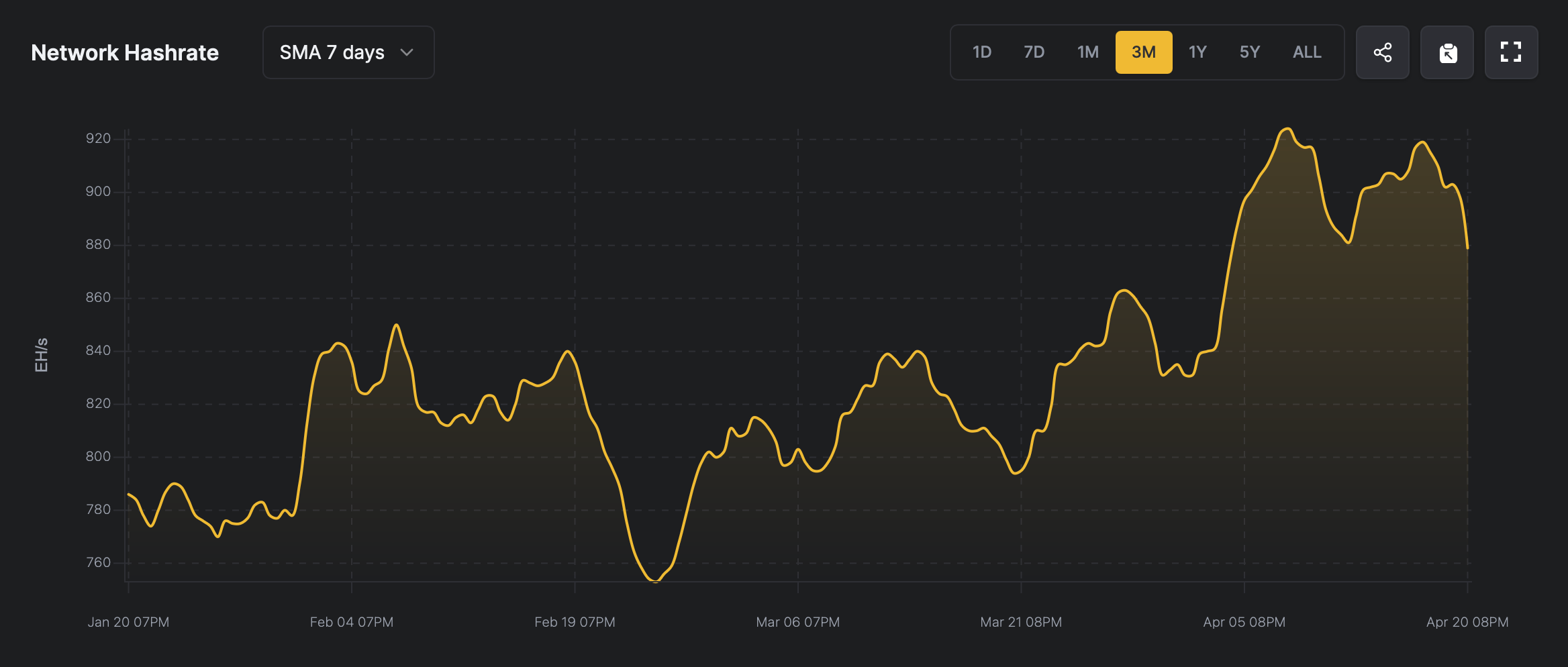

Bitcoin’s computational capacity has eased since last Thursday, when it reached 920 EH/s—just shy of the April 8 record of 926 EH/s. Since April 17, when the hashrate was coasting at 920 EH/s, 52 EH/s has departed the network, leaving today’s total at 868 EH/s.

This shift coincides with increased mining profitability over the past 24 hours, as the hashprice—or the estimated spot value of one petahash per second of hashpower—rose from $43.53 to $45.73 by 11 a.m. Eastern time on Monday. Bitcoin’s move beyond the $88,000 threshold has lifted the hashprice and mining revenue.

Bitcoin network hashrate on April 21, 2025, 7-day simple moving average (SMA) via hashrateindex.com.

Conversely, on April 19 at block height 893,088, the network’s difficulty increased to a record 123.23 trillion. It marked the fourth difficulty adjustment since block 887,040, making block discovery substantially more challenging for miners.

These fluctuations illustrate how miner behavior responds swiftly to economic signals and protocol adjustments, reflecting a subtle tug of incentives and challenges. As profitability rises and difficulty tightens, the network’s equilibrium continually evolves, demonstrating the flexibility, resilience, and tenacity of Bitcoin’s engine.

Following the latest difficulty bump and hashrate retreat, block intervals now hover near 10 minutes, 57 seconds on average. This impedance hints that the next difficulty retarget could translate into a hefty reduction, yet it’s too soon to confirm, with the recalibration slated for around May 4, 2025. Presently, however, projections foresee a notable 8.7% reduction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。