President Donald Trump’s aggressive tariffs and his threats to fire Federal Reserve Chairman Jerome Powell, have left traditional markets wary, with foreign investors fleeing U.S. assets, which has weakened the greenback, but bitcoin ( BTC) and physical gold, appear to have emerged as safe havens.

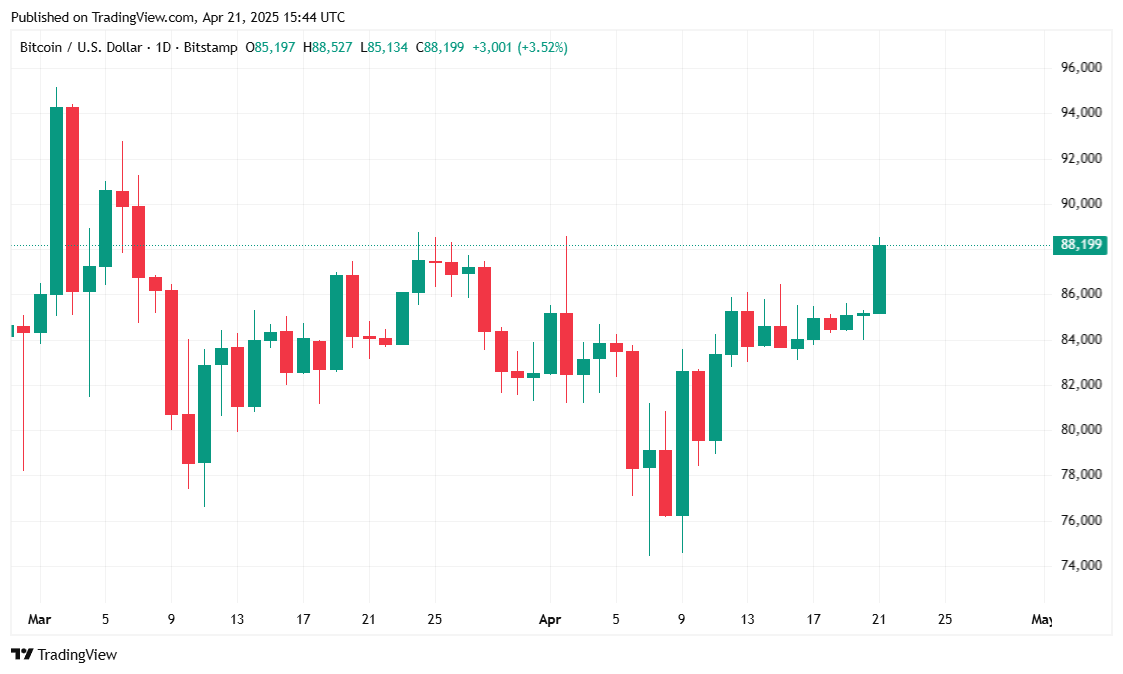

Bitcoin kicked off the week with strong momentum, climbing 4.48% over the past 24 hours to reach $88,260.09 at the time of reporting. The digital asset traded in a range between $84,281.02 and $88,460.10 as investor sentiment continued to improve. Over the past 7 days, BTC has gained 5.08%, supported by steady buying and broader market optimism.

( BTC price / Trading View)

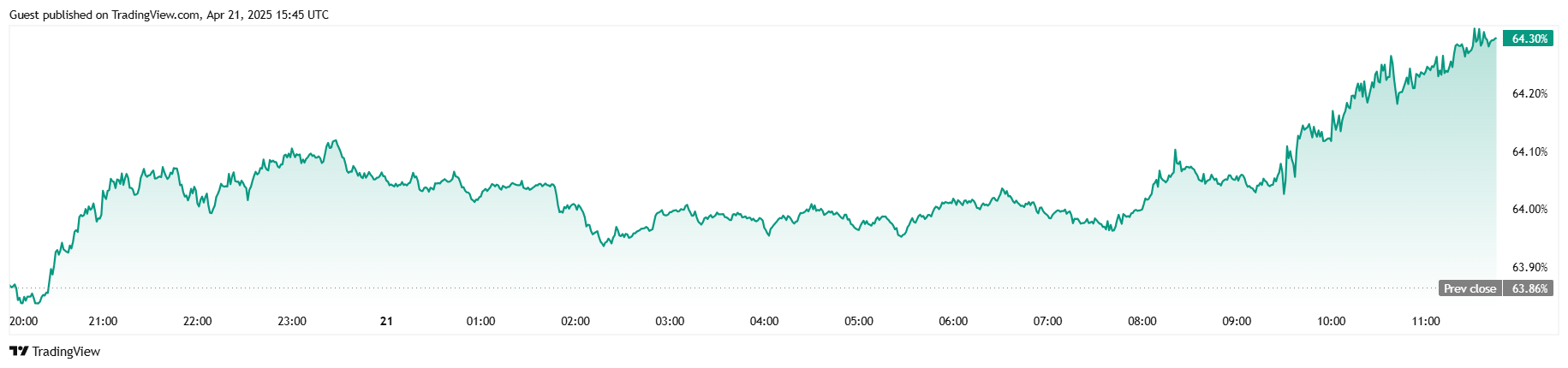

Trading volume soared to $34.41 billion, marking a 133.17% increase compared to the previous day, a jump largely attributed to the typical post-weekend surge. Bitcoin’s market capitalization also saw a healthy rise, up by 4.15% to $1.74 trillion. Meanwhile, BTC dominance climbed to 64.30%, gaining 0.67% and reinforcing bitcoin’s leadership role in the crypto market.

( BTC dominance / Trading View)

Coinglass data shows that open interest in bitcoin futures rose significantly: up 11.45% to $61.89 billion, suggesting heightened investor engagement and bullish sentiment. Despite the surge, overall liquidations remained minimal at $460,490, with $276,400 from shorts and $184,090 from longs. The relatively low liquidation volume highlights the market’s orderly nature, even with rising prices and trading activity.

Trump touted the lower-than-expected inflation numbers released by the Bureau of Labor Statistics on April 10, and on Monday, called Powell “a major loser” for not cutting interest rates to spur the slowing U.S. economy.

“There can almost be no inflation, but there can be a slowing of the economy, unless Mr. Too Late, a major loser, lowers interest rates now,” Trump posted on Truth Social. “Europe has already ‘lowered’ seven times. Powell has always been ‘To Late,’” the president added.

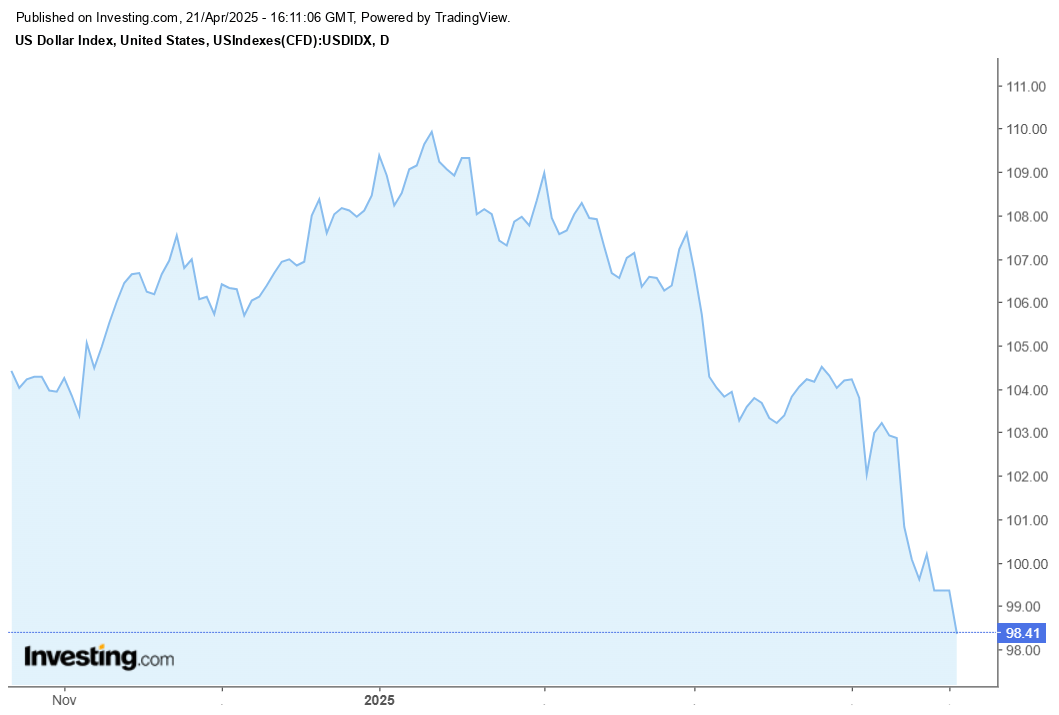

Last week, Trump threatened to fire Powell, bringing the question of Fed independence into focus. The president’s tough trade policies and his shots at Powell, have resulted in an exodus of foreign investors, sending the U.S. Dollar Index (DXY) to a 3-year low, gold to an all-time high, and bitcoin to $88K.

(The U.S. Dollar Index which tracks the strength of the dollar against a basket of foreign currencies, fell to a 3-year low on Monday / Investing.com)

If the trend continues, the greenback risks ceding its global dominance to the cryptocurrency, which was designed specifically as an antidote to reckless fiat policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。