The sharp reversal, dubbed an “Easter resurrection” by QCP Capital, contrasted with December’s muted Santa Rally and coincided with gold hitting fresh all-time highs amid trade war tensions and a weakening U.S. dollar.

QCP noted that the tandem rally has reignited debates about bitcoin’s role as a safe-haven asset or inflation hedge, particularly as equities extended April losses. The firm highlighted early signs of returning institutional confidence, with spot BTC exchange-traded funds (ETFs).

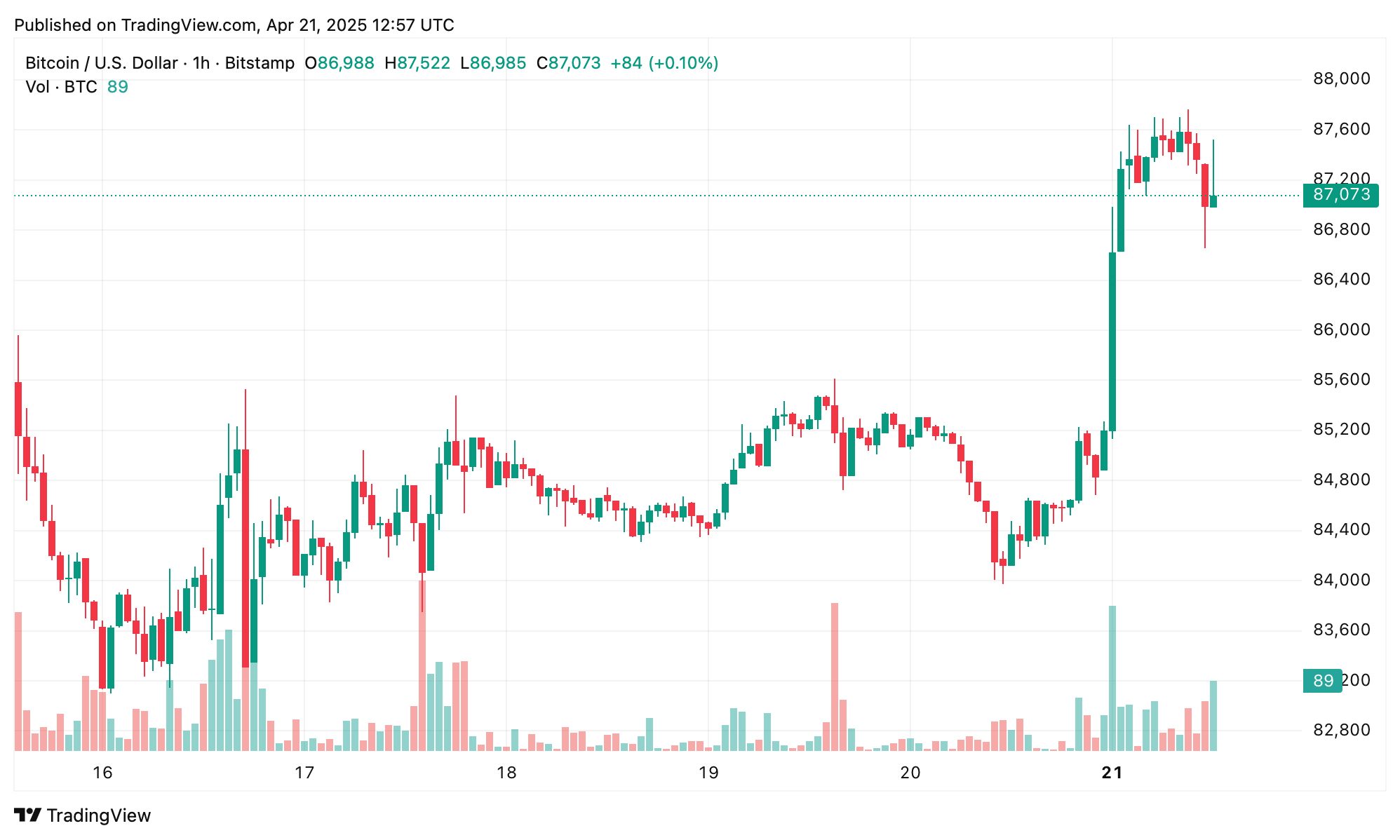

BTC/USD via Bitstamp at 8:57 a.m. Eastern time on April 21, 2025.

ETFs posted $13.4 million in net inflows last week—a stark reversal from the prior week’s $708 million outflows. Options markets also showed more balanced positioning, with risk reversals flattening across tenors.

While the rally could signal a shift in traditional finance’s view of bitcoin, QCP cautioned that the move may need further confirmation, especially with European markets still on holiday.

The correlation between BTC, gold, and equities remains a key focus. For now, QCP is watching the $88,800 resistance level, stating that a decisive break is needed to validate the bullish momentum. Until then, the firm remains cautious about drawing firm conclusions on bitcoin’s safe-haven status. The QCP analysts wrote:

For now, we’re keeping our eyes on the key $88.8K resistance level. Until that breaks decisively, we remain cautious about drawing any firm conclusions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。