Nearly three months have passed since bitcoin notched its record high of $109,356 per coin on Jan. 20, 2025. Since then, a number of voices have suggested that a bear market has taken hold and that the peak was set on that very day. If that holds true, a recovery might be a long way off, as historical averages place bitcoin bear markets between 10 and 13 months—implying a potential turnaround no sooner than Feb. 19, 2026, or as late as May 19, 2026.

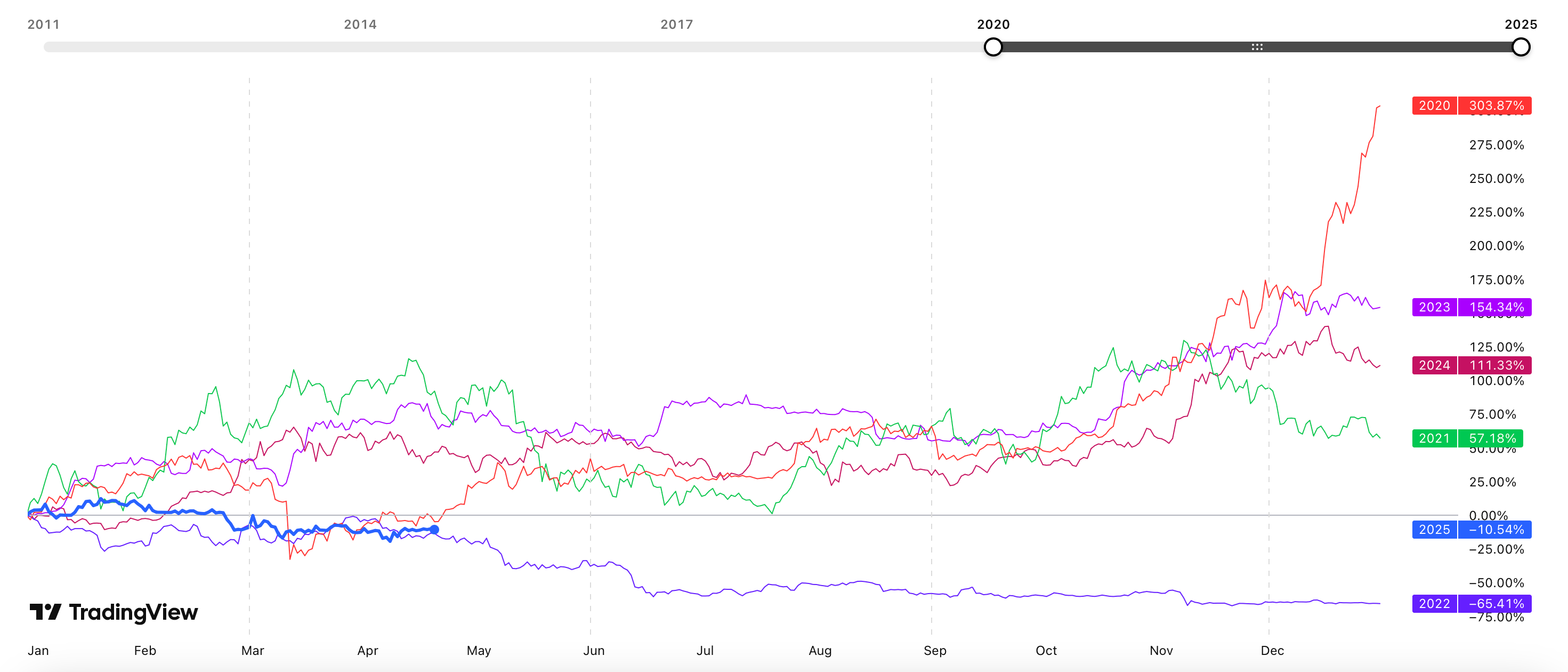

Bitcoin seasonality via Tradingview, which highlights index movements across the course of previous years.

And that’s assuming the bear market wraps up within that window, though it could easily stretch further—especially considering the downturn that followed the 2021 bitcoin bull run extended well beyond the typical 10 to 13 months. If history holds true, BTC has typically retraced 78% to 84% from its previous all‑time highs. An 80% descent from the peak would imply $21,871, while a gentler 70% decline would land around $32,806.

A 60% pullback from the Jan. 20, 2025, apex would approximate $43,742. In earlier bear markets, many altcoins routinely surrendered 70% or more of their worth, with some plunging beyond 90%, notably those lacking utility or cohesive communities. Ethereum ( ETH) touched $4,111 on Dec. 15, 2024, and an 80% setback would place it close to $822 per coin. ETH is already flirting with a 70% decline, having shed 66.36% since that Dec. 15 high.

As bitcoin braces for an extended downturn, investors will watch support levels and market signals closely. Historical trends suggest that recovery could be months away, testing patience and conviction across the space. Analysts say risk management and portfolio diversification remain crucial. The coming months will reveal whether resilience prevails or if deeper declines reshape sentiment around digital assets and strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。