Solana ( SOL) has seen respectable gains this week, advancing 11% over the past seven days, yet it endured a 1% decline in the last 24 hours. The weekly increase led the top ten crypto assets by market cap, although SOL remains more than 29% below its value at the start of the year. Observers attribute the latest uptick to the debut of SOL-based exchange-traded funds on the TSX, Canada’s principal stock market in Toronto, Ontario.

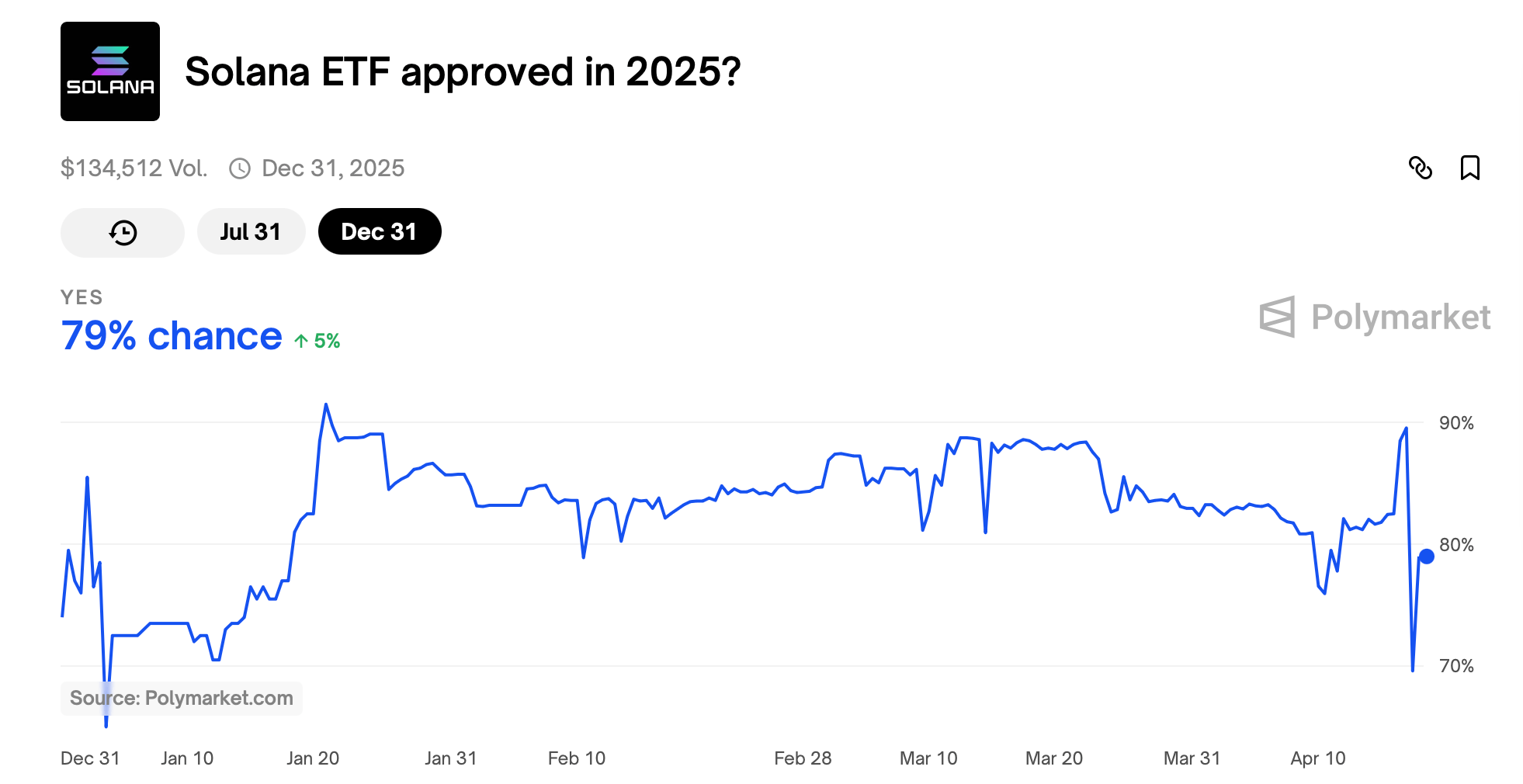

Polymarket bettors wager there’s a 79% chance a SOL ETF will be approved in the United States by the SEC.

The products are spot solana ETFs, each backed by direct SOL holdings, with some incorporating staking options. Although SOL outperformed BTC throughout 2024, it has fallen 21.9% against the dominant crypto asset so far this year as of April 18. Solana has garnered strong support in South Korea, where the won ranked as SOL’s fifth-largest trading pair this week and the second-largest fiat counterpart to the greenback. On Friday, markets such as Upbit showed SOL trading at a 2.15% premium versus the weighted global average.

While Canada has greenlit solana ( SOL)-based publicly traded funds, the U.S. Securities and Exchange Commission (SEC) has not yet endorsed a spot ETF. Seven prominent U.S. asset managers — Fidelity, Franklin Templeton, Grayscale, Vaneck, 21shares, Canary Capital, and Bitwise — have filed for SOL ETF listings. As of April 18, Polymarket shows a 79% probability that a spot solana ETF will receive U.S. approval.

Polymarket’s dashboard indicates the wager’s volume at $134,512. According to the market rules, it resolves to “Yes” if the SEC approves any spot solana ( SOL) ETF by 11:59 p.m. ET on Dec. 31, 2025. Absent that action, the outcome defaults to “No.” SEC approval can occur via a Rule 19b-4 filing or an S-1 registration. The betting framework designates the SEC as the primary authority, though a consensus from reputable news sources may suffice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。