President Donald Trump blasted Federal Reserve Chair Jerome Powell on Thursday for not cutting rates and threatened to fire him, raising questions about the central bank’s independence. Trump’s comments rattled traditional markets, but bitcoin’s price has remained largely unchanged, although U.S. equity markets are closed today in observance of Good Friday.

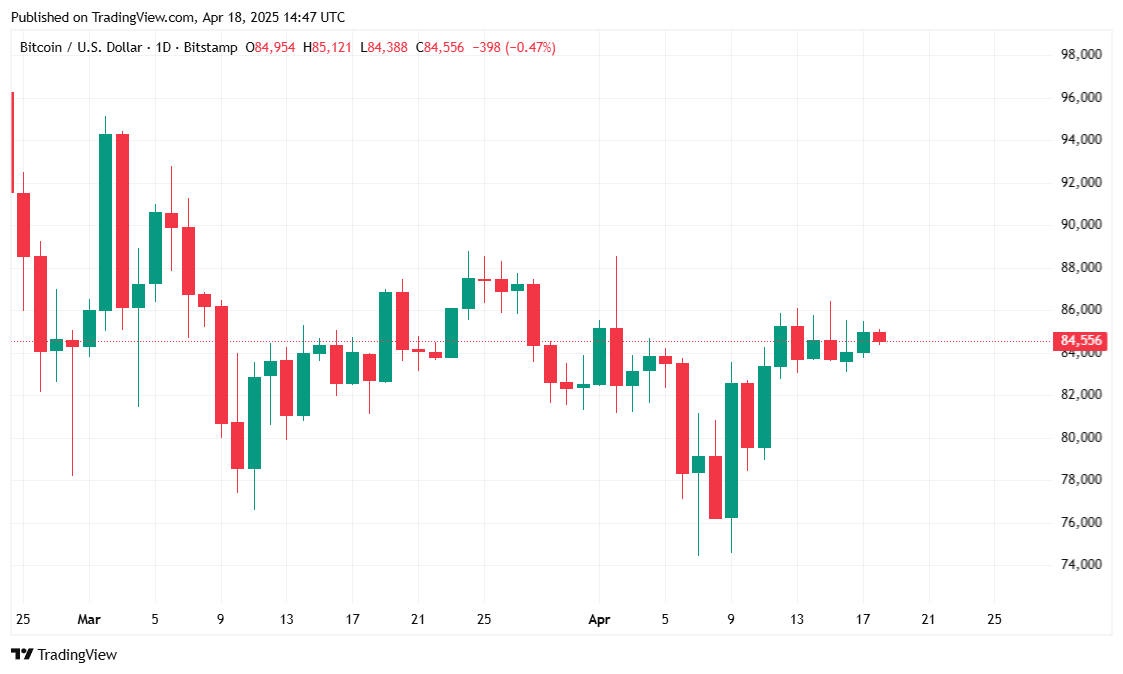

Bitcoin traded steadily over the past 24 hours, posting a modest gain of 0.60% to reach $84,533.15 at the time of reporting. The cryptocurrency hovered in a narrow range between $83,749.75 and $85,449.07, continuing a 7-day upward trend that has seen it rise 3.21%.

( BTC price / Trading View)

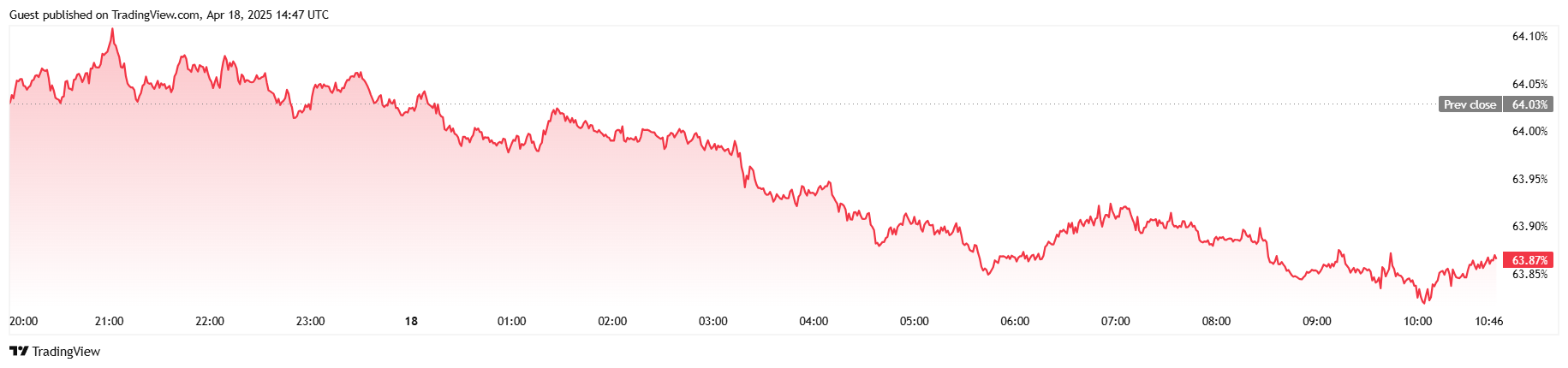

Trading activity dipped sharply, with 24-hour volume falling by 29.26% to $17.94 billion. The drop is largely due to the closure of traditional markets in observance of Good Friday. Still, bitcoin’s market capitalization rose 0.56% to $1.67 trillion, while BTC’s dominance across the crypto market slipped slightly to 63.86%, down 0.24% over the same period.

( BTC dominance / Trading View)

Data from Coinglass showed a slight uptick in BTC futures open interest, rising 1.34% to $54.88 billion, suggesting traders remain cautiously engaged. Liquidations were minimal, totaling just $163,990 over 24 hours: $159,260 from long positions and $4,730 from shorts, reflecting muted trading during the holiday.

Bitcoin was supposed to be the antithesis of central banking, so it is sometimes ironic when announcements by the Federal Reserve have such a dramatic impact on the cryptocurrency’s price.

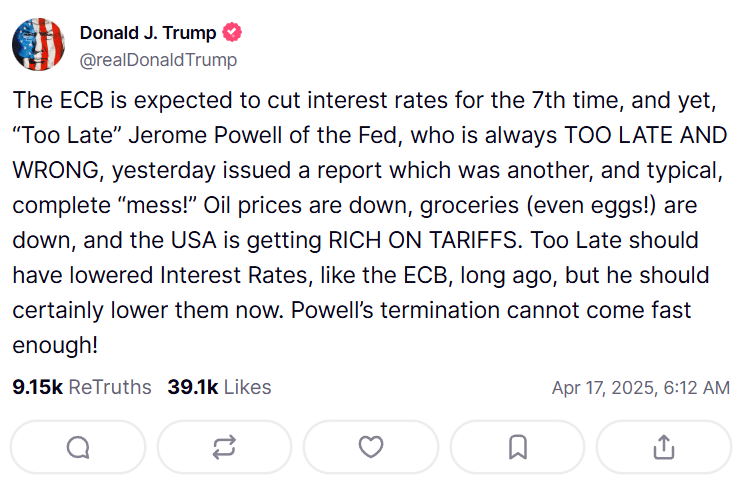

And now with Trump repeatedly saying he might fire Powell, a move that will finally shatter what some deem the illusion of Fed independence, the digital asset’s price may end up even more volatile if it becomes subject to the whims of politicians.

(Trump threatened to fire Fed Chairman Jerome Powell in a Truth Social post on Thursday morning / Donald Trump via Truth Social)

“Trump’s comments reinforce what we already know: monetary policy isn’t operating in a vacuum,” Doug Colkitt, founder of Ambient Finance, told Bitcoin.com. “Political narratives are bleeding into rate decisions, and that only increases uncertainty.”

The issue of Fed independence is undoubtedly critical to traditional assets whose prices are directly tied to interest rates. The question is, will bitcoin’s strong correlation with such assets eventually decouple so that it remains free from central banking and political influence as Satoshi originally envisioned?

“For crypto builders, it highlights the long-term need for both financial infrastructure and thoughtful regulations that don’t just swing with election cycles or central bank politics,” Colkitt said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。