Price is not just an expectation, but a realization of structure.

Author: WhiteRunner

In the first quarter of 2025, Bitget announced the destruction of 30 million platform tokens BGB. The amount destroyed accounts for 2.5% of the total supply, sparking renewed market interest in the deflationary mechanism of platform tokens.

This ratio is relatively high among mainstream platform tokens and signifies that Bitget is accelerating the structured path of BGB's deflation. This article will interpret the underlying supply and demand logic based on the rhythm and causes of this round of destruction, combined with the design of the platform's deflationary mechanism and the actual use cases of BGB.

1. 30 Million Tokens Destroyed: Faster Rhythm, Greater Impact

According to Bitget's official announcement, the total amount destroyed this quarter is 30 million BGB, accounting for 2.5% of the current total supply of 1.2 billion tokens. This destruction ratio is significantly higher than that of most platform tokens (for example, BNB's past single destruction ratio has been around 1%).

The Bitget announcement indicates that this destruction is based on the Gas fees generated by on-chain products in the first quarter, executed in conjunction with the established quarterly deflation plan. All destruction transactions have been recorded on-chain for user verification.

Previously, the Bitget destruction team had destroyed 800 million tokens, locking the current total supply of BGB at 1.2 billion, achieving 100% full circulation. This means the platform no longer retains any reserved tokens or future release space, further enhancing the market's basis for judging scarcity.

2. Mechanism Design Behind the Destruction Rhythm

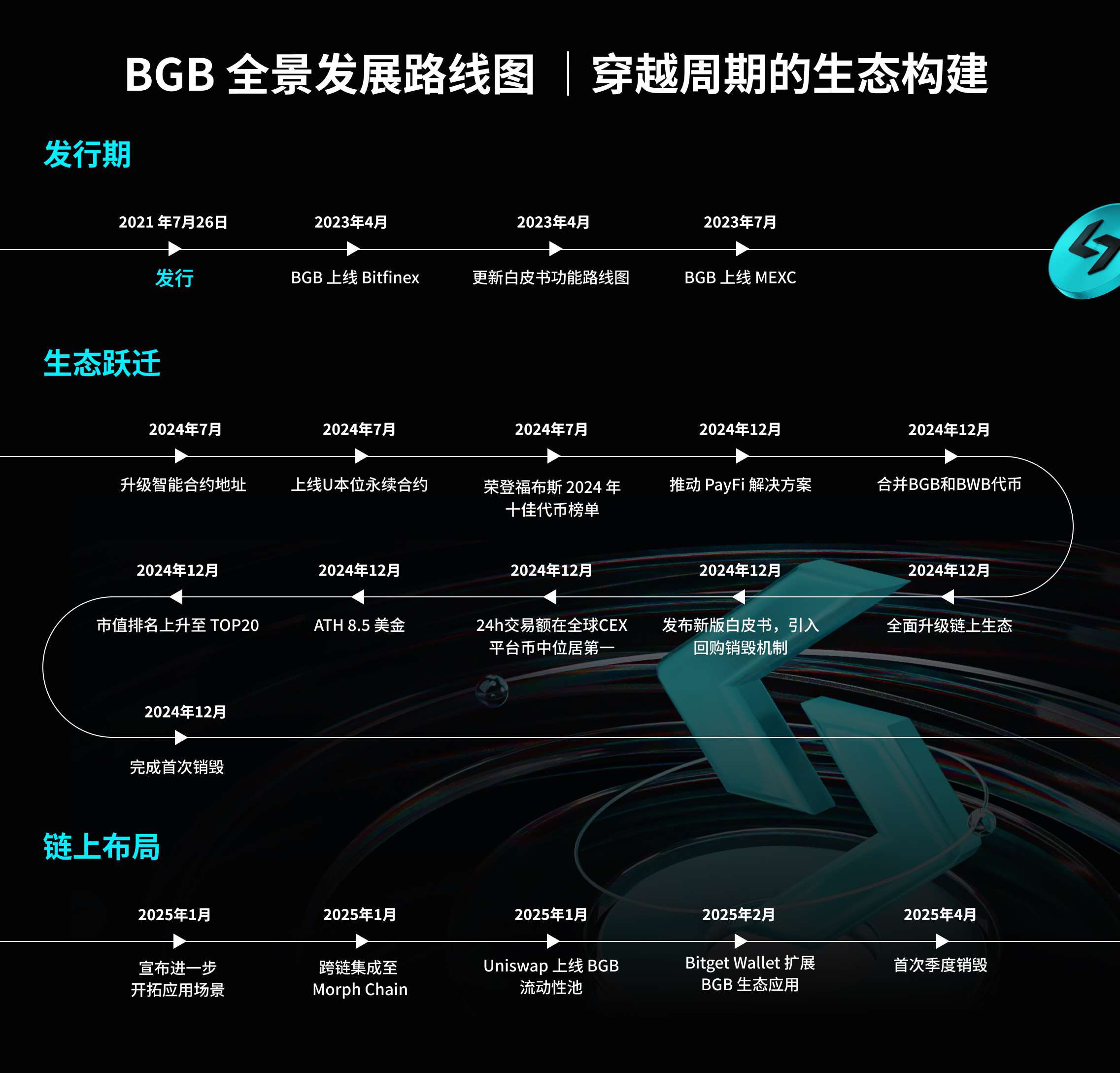

Bitget's operations on BGB deflation are not isolated "occasional destructions," but have entered a mechanism-driven, fixed-cycle destruction phase starting in 2025.

Currently, BGB destruction mainly comes from two sources: fees generated from on-chain usage and a fixed destruction amount, both of which together form the basis for quarterly destruction.

Bitget officially disclosed that starting in 2025, each quarter will calculate the total Gas fees generated by users based on actual on-chain activities in the Bitget Wallet ecosystem, and the destruction amount will be calculated based on this.

The basic logic is: the higher the on-chain usage → the more widespread the use of BGB → the more BGB is destroyed.

This means that destruction is linked to user behavior and the actual on-chain activity of the platform, providing a certain degree of elasticity. After each quarter, the platform will publish the destruction results and record the destruction transactions on-chain, allowing users to verify them on the block explorer.

In addition, Bitget also destroys a fixed amount, which is seen as the platform actively funding support for deflation and is considered a method of value management for the platform token.

Currently, this mechanism is similar to the "destruction" models of established platform tokens like BNB and OKB, but BGB's destruction does not rely on a single business line, covering a broader scope and occurring at a more frequent pace (quarterly rather than semi-annually or irregularly).

Overall, the core features of the BGB destruction mechanism are:

● Stable source: Based on actual on-chain usage;

● Fixed cycle: Executed quarterly, enhancing rhythm expectations;

● Public and transparent: Destruction results are verifiable, operations are on-chain;

● Linked to platform growth: The mechanism itself is tied to business data, avoiding "empty deflation."

These designs make BGB's supply control no longer solely dependent on platform commitments but embedded in product and user behavior, providing a certain degree of self-driving capability.

3. Actual Supply Tightened, Path Clear

In addition to entering the quarterly destruction mechanism, Bitget also executed a key action at the end of 2024—one-time destruction of 800 million BGB held by the team. This decision directly compressed BGB's total supply from the originally planned 2 billion to 1.2 billion and clearly announced that "BGB has now achieved 100% full circulation, with no reserved or locked portions remaining."

The impact of this operation is multifaceted:

1. Completely Eliminating Potential Release Pressure

According to previous market expectations, the 800 million BGB originally retained by the Bitget team would have been gradually unlocked in multiple batches over several years. This batch originally constituted a long-term potential supply variable, which could have influenced market expectations in the future.

Now, this portion of tokens has been completely destroyed at once, and will not enter the circulating market in the future. This "preemptive clearance" approach is relatively rare in platform token projects and eliminates unresolved uncertainties for medium to long-term holders.

2. Total Supply Capped, Structure Transparent

After the destruction, the total amount of BGB is capped at 1.2 billion, all in circulation. Compared to some platform tokens that still retain team shares, foundation lock-ups, or reserved proportions, BGB's current supply structure is clearer and easier to assess.

In other words, the market circulation situation of BGB that users see now reflects the actual supply and demand state, with no risk of a sudden large-scale token release in the future.

3. Responding to User Concerns About "Platform Control"

In the context where users in the crypto space are generally concerned about "whether platform tokens are controlled" and "whether there are large holders behind," the Bitget team chose to completely abandon their tokens, effectively sending a signal: the platform will rely on mechanism-driven support rather than human manipulation to sustain the token price structure.

This action has also attracted industry attention. Bitget's move is equivalent to "actively relinquishing platform control space, allowing BGB to return to a fully market-oriented logic," and is seen as a signal of the platform token governance structure moving towards transparency. For many observers, this "team exit, mechanism takeover" strategy aligns more with the current crypto market's expectations for decentralized transparency.

4. Beyond Deflation, Use Cases Are Also Expanding

Unlike some platform tokens that solely rely on destruction to drive deflation, BGB's deflation logic also includes a "lock-up + usage" dual binding mechanism: using BGB in platform products means automatically triggering lock-up or staking behavior, thereby continuously reducing the circulating supply.

These designs create an internal cycle: user usage → BGB lock-up → market circulation decreases → deflation expectations strengthen. Currently, this cycle is mainly divided into two dimensions: platform product participation and on-chain rights binding.

1. Platform Participation Products: Share Dividends, Earn Returns

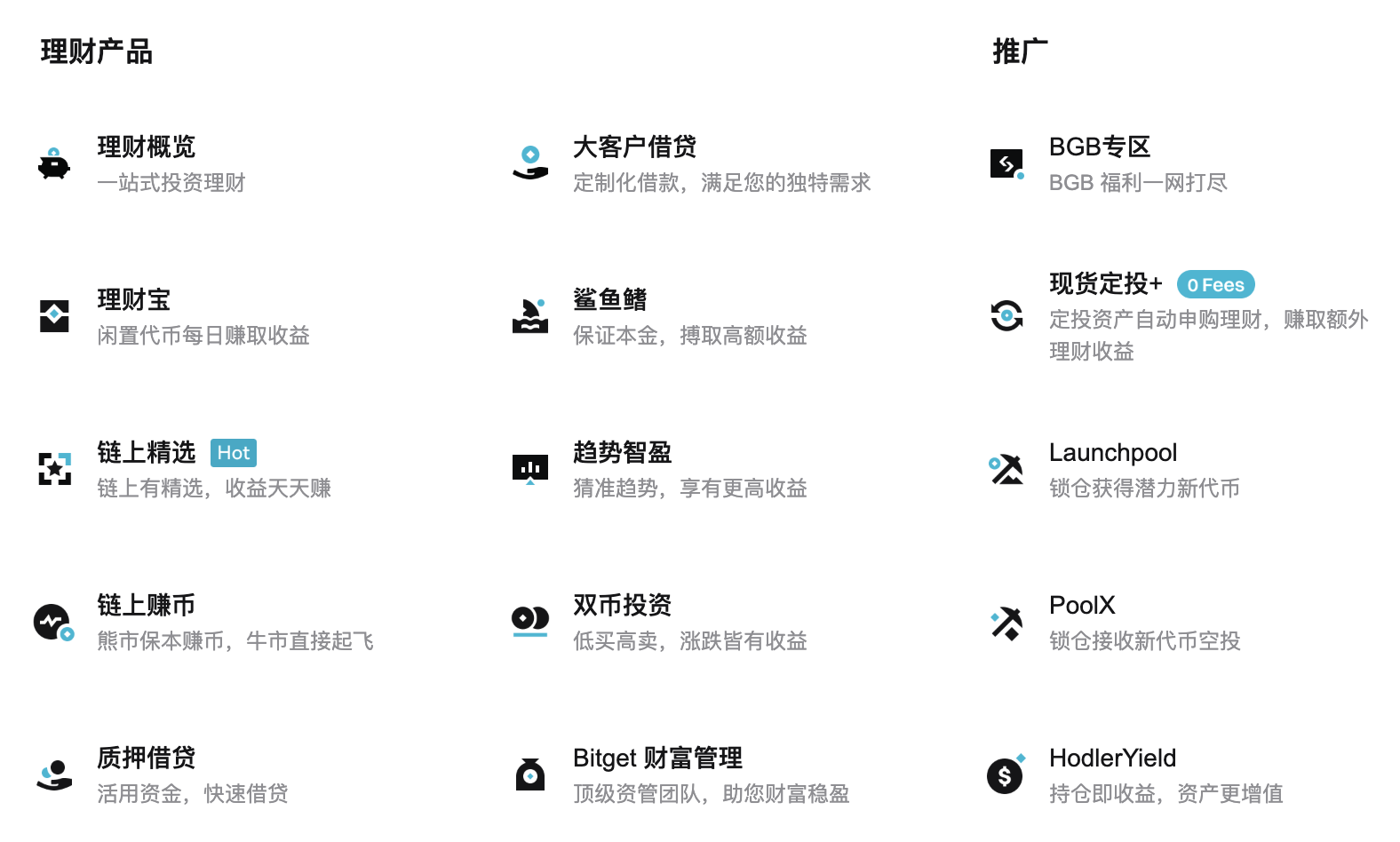

As the core asset of the Bitget platform, BGB has been deeply integrated into various products, including but not limited to:

● Launchpad: Users stake BGB to gain eligibility for participating in new project purchases;

● Launchpool: Staking BGB can earn new token airdrops, a common channel for popular projects' cold starts;

● PoolX: Users stake BGB to participate in multi-asset combination yield strategies, combining short-term high returns with on-chain hot asset distribution;

● Wealth Management Area: A product combination designed around BGB's yield, integrating hot assets or structured strategies to further enhance BGB's capital utilization.

The common feature of these products is that user participation means lock-up, and most products require limited-time staking or advance purchase, which significantly impacts the amount of BGB locked during active market sentiment.

2. On-Chain Ecosystem Layout: Extending from CeFi to DeFi

The use of BGB is also gradually expanding into the on-chain ecosystem, mainly through Bitget Wallet and the Morph chain. Current application paths include but are not limited to:

● BGB Staking: Users can directly stake BGB on the Morph chain to earn approximately 5% annual fixed returns, used for subsequent ecosystem participation or incentive distribution;

● Gas Payment: BGB is now supported for multi-chain GAS payments in Bitget Wallet, lowering the usage threshold for users across chains and for currency exchanges;

● Future On-Chain Use Planning: Bitget has indicated that it will consider allowing BGB to be used for on-chain governance, identity binding, and priority rights acquisition (such as NFT minting, DAO voting, etc.). These uses will further broaden BGB's functional boundaries in Web3 scenarios.

This part means: BGB is not only an exchange platform token but is also becoming a universal token in the Bitget on-chain ecosystem, gradually connecting "centralized financial products" with "on-chain native financial behaviors."

Overall, BGB's usage paths cover multiple scenarios from CeFi wealth management products to DeFi on-chain interactions. Compared to pure destruction-based deflation, this usage-based deflation path is more sustainable, offers a stronger sense of user participation, and is more likely to form stable market demand.

5. Clear Deflation Rhythm, Established Usage Path

In summary, BGB's current deflation logic is no longer an isolated destruction action but has formed a complete path driven by mechanisms + application binding + predictable rhythm.

This path includes at least three levels:

- Clear and Normalized Deflation Mechanism

Destruction is executed once per quarter, with the amount destroyed linked to on-chain usage and platform profits, providing adaptability;

The core team's holdings were completely destroyed by the end of 2024, with the current total capped at 1.2 billion, closing the supply side;

All destruction records are synchronized on-chain, with verifiable data and rules, helping users establish long-term trust.

- Gradually Expanding Application Scenarios, Forming an Internal Cycle

BGB can participate in various yield-generating operations within the platform, such as Launch series products, wealth management, and strategy combinations;

On-chain, it can be used for staking, Gas payments, and has potential for future governance, NFTs, identity binding, etc.;

Users' "usage behavior" naturally constitutes "lock-up actions," indirectly promoting a reduction in market circulation.

- Value Logic Closer to "Practical Platform Assets"

In the past, many platform tokens were questioned for "only relying on destruction, with no actual use," but BGB's current path leans more towards a practical asset model: destruction controls scarcity → usage builds demand → users can receive returns.

BGB has evolved from an initial "transaction fee utility token" to one of the core assets in the Bitget ecosystem. This logic not only allows it to maintain continuous circulation at the CeFi platform level but also begins to play a substantial role in on-chain wallets, staking incentives, project participation, and other scenarios.

Epilogue: Price is not just an expectation, but a realization of structure

Looking back at BGB's price performance over the past three years:

● 2022 peak: $0.2387

● 2023 peak: $0.6950

● 2024 historical high: $8.50

Each round of leap corresponds to the realization of the platform's strategy: 2022 was the starting point for exchange growth, 2023 was the expansion of the product system, and 2024 saw the launch of the deflation mechanism and the implementation of team token destruction.

So, what new price range might BGB reach in 2025?

Considering the current platform scale, BGB's market cap position, and price structure, a reasonable range may seek a phase peak between $15 and $20, with even aggressive models suggesting an upward space of $30.

This is not a fantasy, but a "structural valuation repricing" based on the continuous growth of platform trading volume, stable progress of quarterly destruction rhythm, and the ongoing expansion of on-chain landing scenarios.

In other words, BGB's upward logic has shifted from "speculating on expectations" to "waiting for realization."

For token holders, the core question in assessing its potential has shifted from "how much can it rise" to "has it already embarked on a structural growth path." From the current mechanisms to the ecosystem and trading activity, BGB indeed possesses asset characteristics that provide support downward and anchor upward.

Among all assets, those truly worthy of long-term attention are always those that have established a value support framework but have not yet been fully priced.

At this moment, BGB is precisely at that critical point.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。