Original Author: @BlazingKevin_, the Researcher at Movemaker

In a phase of accelerated industry clearing, Circle's choice to go public hides a seemingly contradictory yet imaginative story—declining net profit margins, yet still harboring enormous growth potential. On one hand, it boasts high transparency, strong regulatory compliance, and stable reserve income; on the other hand, its profitability appears surprisingly "mild"—with a net profit margin of only 9.3% in 2024. This apparent "inefficiency" does not stem from a failure of the business model, but rather reveals a deeper growth logic: against the backdrop of gradually diminishing high-interest dividends and a complex distribution cost structure, Circle is building a highly scalable, compliance-first stablecoin infrastructure, with its profits strategically "reinvested" into market share enhancement and regulatory leverage. This article will trace Circle's seven-year journey to going public, delving into its corporate governance, business structure, and profit model to analyze the growth potential and capitalization logic behind its "low net profit margin."

1. Seven-Year Journey to Going Public: A History of Crypto Regulation Evolution

1.1 Paradigm Shift in Three Capitalization Attempts (2018-2025)

Circle's journey to going public is a living specimen of the dynamic interplay between crypto enterprises and regulatory frameworks. The first IPO attempt in 2018 occurred during a period of ambiguity regarding the SEC's classification of cryptocurrencies. At that time, the company formed a "payment + trading" dual-drive model through the acquisition of the Poloniex exchange and secured $110 million in financing from institutions such as Bitmain, IDG Capital, and Breyer Capital. However, regulatory scrutiny over the compliance of exchange operations and the sudden bear market led to a valuation collapse from $3 billion to $750 million, exposing the fragility of early crypto business models.

The SPAC attempt in 2021 reflected the limitations of regulatory arbitrage thinking. Although merging with Concord Acquisition Corp allowed Circle to bypass the stringent scrutiny of a traditional IPO, the SEC's inquiries into the accounting treatment of stablecoins hit the nail on the head—demanding that Circle prove USDC should not be classified as a security. This regulatory challenge led to the deal's collapse but unexpectedly propelled the company to complete a critical transformation: divesting non-core assets (such as selling Poloniex for $150 million to an investment group) and establishing a strategic focus on "stablecoin as a service." From that moment to today, Circle has fully committed to building USDC compliance and actively applying for regulatory licenses in multiple countries worldwide.

The choice of an IPO in 2025 marks the maturation of the capitalization path for crypto enterprises. Listing on the NYSE not only requires compliance with the full set of Regulation S-K disclosure requirements but also subject to internal control audits under the Sarbanes-Oxley Act. Notably, the S-1 filing disclosed for the first time the reserve management mechanism: of approximately $32 billion in assets, 85% is allocated through BlackRock's Circle Reserve Fund to overnight reverse repurchase agreements, and 15% is held in systemically important financial institutions such as BNY Mellon. This transparent operation effectively constructs an equivalent regulatory framework to traditional money market funds.

1.2 Collaboration with Coinbase: From Ecological Co-Building to Subtle Relations

As early as the launch of USDC, the two collaborated through the Centre consortium. When the Centre consortium was established in 2018, Coinbase held a 50% stake and quickly opened up the market through a "technology output for traffic entry" model. According to Circle's 2023 IPO filing, it acquired the remaining 50% stake in the Centre Consortium from Coinbase for $210 million in stock, and the revenue-sharing agreement regarding USDC was also renegotiated.

The current revenue-sharing agreement is a dynamic game of terms. According to the S-1 disclosure, the two parties share reserve income based on a certain proportion of USDC reserves (the text mentions that Coinbase shares about 50% of the reserve income), with the sharing ratio related to the amount of USDC supplied by Coinbase. From Coinbase's public data, it is known that in 2024, the platform holds about 20% of the total circulating USDC. With a 20% supply share, Coinbase takes approximately 55% of the reserve income, which poses some hidden risks for Circle: as USDC expands outside the Coinbase ecosystem, the marginal cost will rise non-linearly.

2. USDC Reserve Management and Equity Structure

2.1 Layered Management of Reserves

The reserve management of USDC exhibits a clear "liquidity layering" characteristic:

Cash (15%): Held in GSIBs such as BNY Mellon to respond to sudden redemptions.

Reserve Fund (85%): Allocated through the Circle Reserve Fund managed by BlackRock.

Since 2023, USDC reserves are limited to cash balances in bank accounts and the Circle Reserve Fund, with the asset portfolio primarily consisting of U.S. Treasury securities with remaining maturities of no more than three months and overnight U.S. Treasury repurchase agreements. The dollar-weighted average maturity of the asset portfolio does not exceed 60 days, and the dollar-weighted average duration does not exceed 120 days.

2.2 Equity Classification and Layered Governance

According to the S-1 document submitted to the SEC, Circle will adopt a three-tier equity structure after going public:

Class A Shares: Common stock issued during the IPO process, with one vote per share.

Class B Shares: Held by co-founders Jeremy Allaire and Patrick Sean Neville, with five votes per share, but the total voting power is capped at 30%, ensuring that the core founding team retains decision-making authority even after going public.

Class C Shares: Non-voting shares that can be converted under specific conditions, ensuring that the corporate governance structure complies with NYSE rules.

This equity structure aims to balance public market financing with the stability of the company's long-term strategy while ensuring that the executive team retains control over key decisions.

2.3 Distribution of Executive and Institutional Holdings

The S-1 document reveals that the executive team holds a significant amount of shares, while several well-known venture capital and institutional investors (such as General Catalyst, IDG Capital, Breyer Capital, Accel, Oak Investment Partners, and Fidelity) each hold more than 5% of the equity, collectively owning over 130 million shares. A $5 billion valuation IPO could bring them significant returns.

3. Profit Model and Revenue Breakdown

3.1 Revenue Model and Operational Metrics

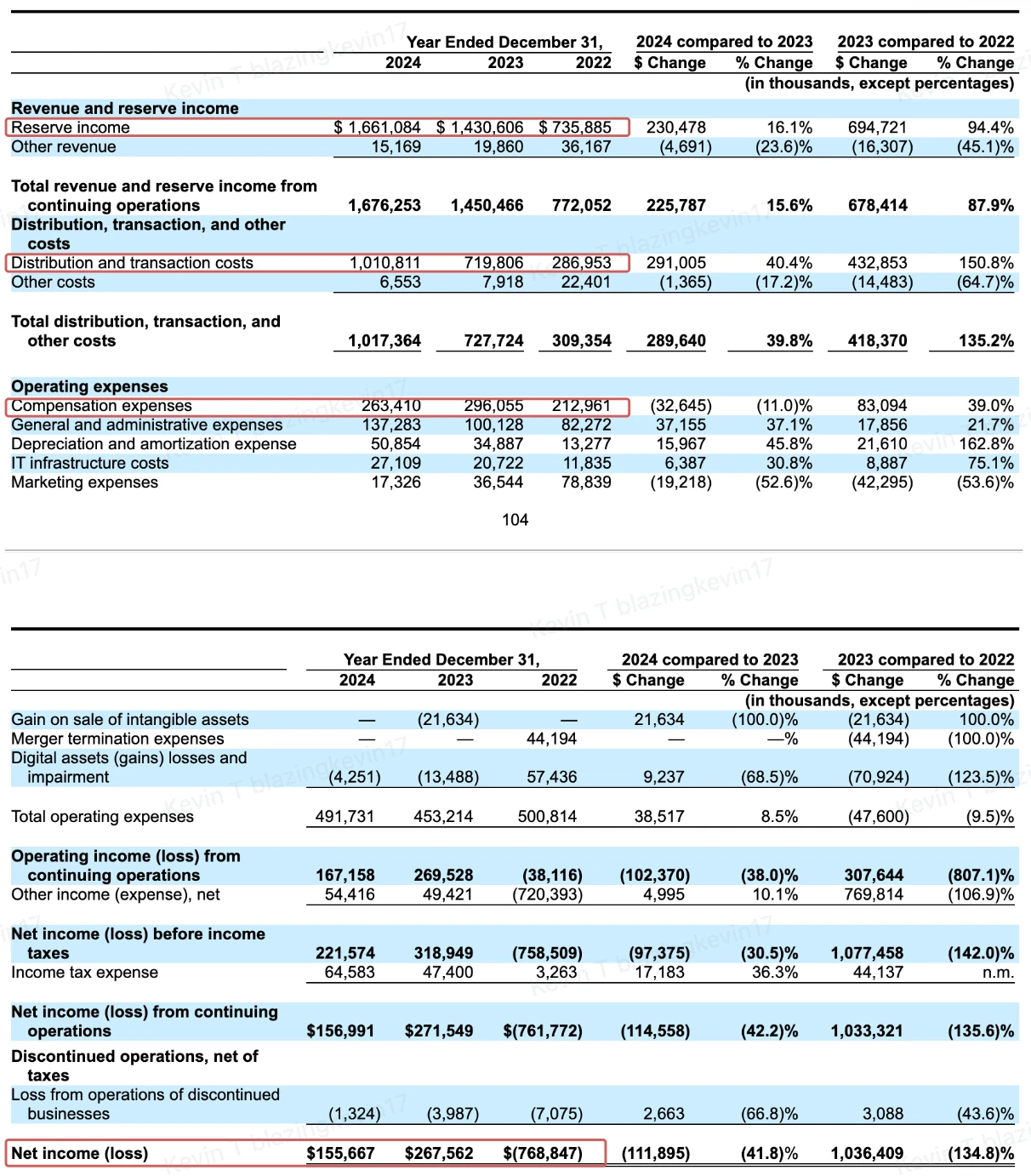

Revenue Sources: Reserve income is Circle's core revenue source, with each USDC token backed by an equivalent dollar. The invested reserve assets mainly include short-term U.S. Treasury securities and repurchase agreements, generating stable interest income during high-interest periods. According to S-1 data, total revenue in 2024 reached $1.68 billion, with 99% (approximately $1.661 billion) coming from reserve income.

Revenue Sharing with Partners: The partnership agreement with Coinbase stipulates that Coinbase receives 50% of the reserve income based on the amount of USDC held, resulting in relatively low actual revenue attributable to Circle, which depresses net profit performance. Although this sharing ratio drags down profits, it is a necessary cost for Circle to co-build the ecosystem with partners and promote the widespread use of USDC.

Other Revenues: In addition to reserve interest, Circle also increases revenue through enterprise services, USDC minting, cross-chain fees, etc., but these contributions are small, totaling only $15.16 million.

3.2 The Paradox of Revenue Growth and Profit Contraction (2022-2024)

Behind the apparent contradiction lies a structural motivation:

Convergence from Diversification to Core: From 2022 to 2024, Circle's total revenue grew from $772 million to $1.676 billion, with a compound annual growth rate of 47.5%. During this period, reserve income has become the company's most core revenue source, with its share rising from 95.3% in 2022 to 99.1% in 2024. This increase in concentration reflects the successful implementation of its "stablecoin as a service" strategy but also signifies a significant increase in the company's dependence on macro interest rate changes.

Surge in Distribution Expenses Compressing Gross Margin: Circle's distribution and transaction costs surged from $287 million in 2022 to $1.01 billion in 2024, an increase of 253%. These costs are primarily used for the issuance, redemption, and payment settlement systems of USDC, and as the circulation of USDC expands, these expenses grow rigidly.

Since these costs cannot be significantly compressed, Circle's gross margin fell sharply from 62.8% in 2022 to 39.7% in 2024. This reflects that while its ToB stablecoin model has scale advantages, it faces systemic risks of profit compression during a declining interest rate cycle.

Profit Realization Turns from Loss to Profit but Marginal Slowdown: Circle officially turned a profit in 2023, achieving a net profit of $268 million, with a net profit margin of 18.45%. Although it continued to be profitable in 2024, after deducting operating costs and taxes, the disposable income was only $101,251,000. Adding $54,416,000 in non-operating income, the net profit was $155 million, but the net profit margin had declined to 9.28%, a year-on-year decrease of about half.

Cost Rigidity: Notably, the company's general and administrative expenses in 2024 reached $137 million, a year-on-year increase of 37.1%, marking three consecutive years of growth. Combined with the information disclosed in its S-1, these expenses are primarily used for global licensing applications, audits, and the expansion of legal compliance teams, confirming the cost rigidity brought about by its "compliance-first" strategy.

Overall, Circle has completely shed the "exchange narrative" in 2022, achieved a profit turning point in 2023, and successfully maintained profits in 2024, albeit with slowed growth. Its financial structure has gradually aligned with traditional financial institutions.

However, its revenue structure, which is highly dependent on the spread of U.S. Treasuries and trading volume, also means that any downturn in interest rates or slowdown in USDC growth will directly impact its profit performance. In the future, Circle needs to seek a more robust balance between "cost reduction" and "incremental expansion" to maintain sustainable profitability.

The deeper contradiction lies in the flaws of the business model: as the attributes of USDC as a "cross-chain asset" strengthen (with on-chain transaction volume reaching $20 trillion in 2024), its monetary multiplier effect actually undermines the profitability of the issuer. This mirrors the dilemmas faced by traditional banking.

3.3 Growth Potential Behind Low Net Profit Margin

Although Circle's net profit margin continues to be pressured by high distribution costs and compliance expenses (with a net profit margin of only 9.3% in 2024, a year-on-year decline of 42%), multiple growth drivers are still hidden within its business model and financial data.

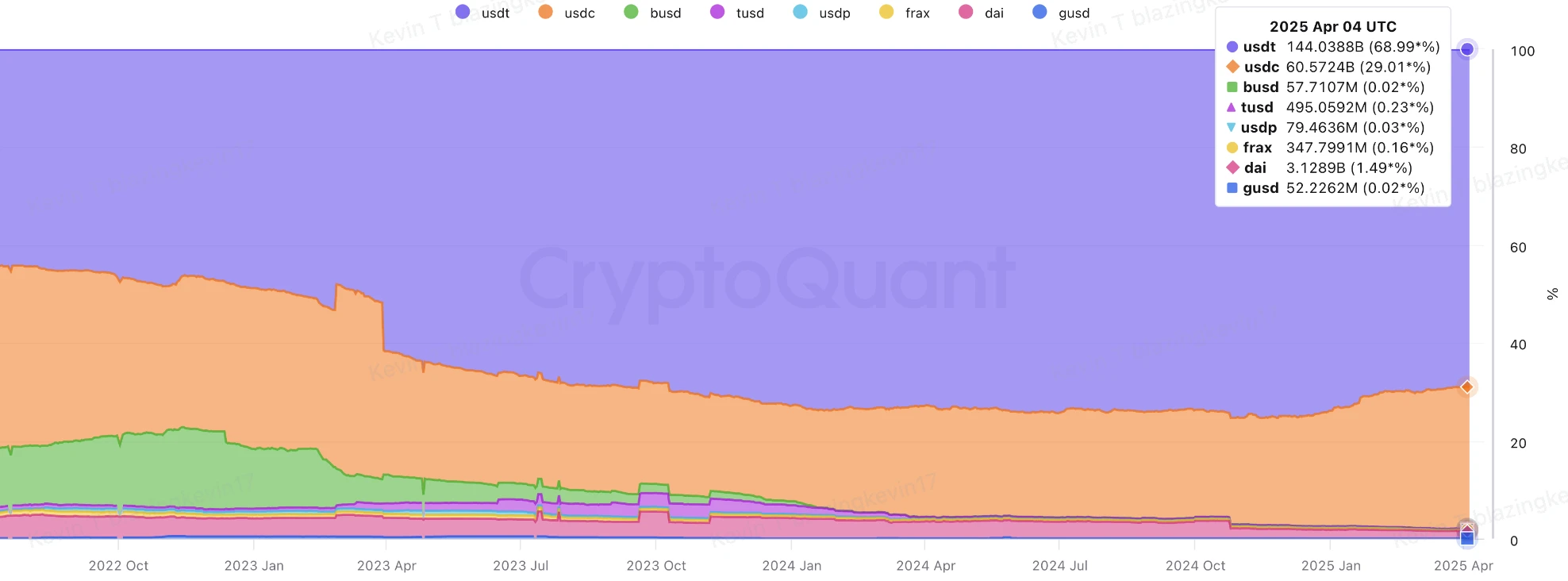

- Continuous Increase in Circulation Drives Stable Growth in Reserve Income: According to CryptoQuant data, as of early April 2025, USDC's market capitalization surpassed $60 billion, second only to USDT's $144.4 billion; by the end of 2024, USDC's market share had risen to 26%. On the other hand, USDC's market capitalization growth in 2025 remains strong, having increased by $16 billion. Considering that its market capitalization was less than $1 billion in 2020, the compound annual growth rate (CAGR) from 2020 to early April 2025 has reached 89.7%. Even if USDC's growth slows in the remaining eight months, its market capitalization is still expected to reach $90 billion by the end of the year, with the CAGR rising to 160.5%. Although reserve income is highly sensitive to interest rates, low rates may stimulate USDC demand, and strong scale expansion can partially offset the risks of declining interest rates.

Structural Optimization of Distribution Costs: Despite the high payments to Coinbase in 2024, this cost has a non-linear relationship with the growth in circulation. For example, the partnership with Binance only required a one-time payment of $60.25 million, which increased its platform's USDC supply from $1 billion to $4 billion, with a significantly lower customer acquisition cost compared to Coinbase. Coupled with the collaboration plan disclosed in the S-1 document, Circle can expect to achieve market capitalization growth at a lower cost.

Conservative Valuation Not Pricing Market Scarcity: Circle's IPO valuation is between $4 billion and $5 billion, based on an adjusted net profit of $200 million, resulting in a P/E ratio of 20-25x. This is comparable to traditional payment companies like PayPal (19x) and Square (22x), seemingly reflecting the market's positioning of "low growth stable profitability." However, this valuation framework has not fully priced in its unique value as the only pure stablecoin entity in the U.S. stock market; typically, unique entities in niche segments enjoy valuation premiums, which Circle has not accounted for. Additionally, if stablecoin-related legislation is successfully implemented, offshore issuers will need to significantly adjust their reserve structures, while the existing compliance framework can be directly transferred, creating a "regulatory arbitrage end dividend." Corresponding policy changes could lead to a significant increase in USDC's market share.

Stablecoin Market Capitalization Shows Resilience Compared to Bitcoin: The market capitalization of stablecoins remains relatively stable during significant declines in Bitcoin prices, demonstrating their unique advantages amid volatility in the crypto market. As the market enters a bear phase, investors often seek safe-haven assets, and the stability of stablecoin market capitalization growth may allow Circle to become a "safe haven" for funds. Compared to companies like Coinbase and MicroStrategy, which heavily rely on market conditions, Circle, as the main issuer of USDC, relies more on the trading volume of stablecoins and interest income from reserve assets, rather than being directly affected by fluctuations in crypto asset prices. Therefore, Circle has a stronger risk resistance capability in a bear market and higher profit stability. This positions Circle to potentially play a hedging role in investment portfolios, providing a certain level of protection for investors, especially during periods of significant market turbulence.

4 Risks—Dramatic Changes in the Stablecoin Market

4.1 Institutional Relationship Network No Longer a Solid Moat

Interest Binding as a Double-Edged Sword: Although Coinbase takes 55% of the reserve income, its share of USDC is only 20%. This asymmetric sharing stems from the legacy agreement of the Centre consortium established in 2018, effectively causing Circle to pay $0.55 in costs for every additional $1 in revenue, significantly higher than the industry average.

Ecosystem Lock-In Risk: The prepayment agreement with Binance exposes an imbalance in channel control; if leading exchanges collectively demand to renegotiate terms, it could trigger a "spiral of rising distribution costs."

4.2 Bidirectional Impact of Stablecoin Legislation Progress

- Pressure for Localization of Reserve Assets: The legislation requires issuers to hold 100% reserves (cash and cash equivalents) and prioritize using federally or state-chartered depository institutions as custodians, while currently, Circle only has 15% of cash held in domestic institutions like BNY Mellon. If compliance adjustments are needed, it could incur one-time costs of hundreds of millions of dollars for fund migration.

5 Reflection and Summary—Strategic Window for Disruptors

5.1 Core Advantage: Market Positioning in the Compliance Era

Dual Compliance Network: Circle has built a regulatory matrix covering the U.S., Europe, and Japan, which is difficult for traditional companies like PayPal to replicate. After the implementation of the "Payment Stablecoin Act," its compliance costs as a proportion of revenue are expected to decrease significantly, creating a structural advantage.

Wave of Cross-Border Payment Alternatives: The "USDC Instant Settlement" service launched in collaboration with Wise has significantly reduced the costs of cross-border payments for businesses. If a portion of the annual settlement volume penetrating SWIFT can be captured, it could bring considerable new circulation, completely offsetting the impact of declining interest rates.

B2B Financial Infrastructure: In Stripe's e-commerce payment system, the proportion of USDC settlements has significantly increased, and its automatic fiat currency conversion protocol can greatly save companies on foreign exchange hedging costs. The expansion of this "embedded finance" scenario allows USDC to gradually evolve from a mere transactional medium to a value storage function.

5.2 Growth Flywheel: The Game Between Interest Rate Cycles and Economies of Scale

Emerging Market Currency Substitution: In some regions with high inflation, USDC has captured a portion of the dollar foreign exchange trading market. If the Federal Reserve's interest rate cuts accelerate the depreciation of local currencies, this "digital dollarization" process could significantly drive circulation growth.

Offshore Dollar Repatriation Channels: By exploring tokenized asset-related projects in collaboration with BlackRock, Circle is converting some offshore dollar deposits into on-chain assets; the value of this "fund pipeline" has yet to be reflected in the current valuation.

Tokenization of RWA Assets: The tokenized asset service launched after acquiring related technology companies has achieved initial management scale, generating considerable annual management fee income.

Interest Rate Buffer Period: With the current federal funds rate still high, Circle needs to push circulation to a critical threshold through accelerated internationalization before the expectations of interest rate cuts are fully priced in, allowing economies of scale to cover the impacts of declining interest rates.

Regulatory Window Period: Before the final implementation of the "Payment Stablecoin Act," leveraging existing compliance advantages to capture institutional clients and signing exclusive settlement agreements with several top hedge funds can create exit barriers.

Deepening Enterprise Service Suite: Packaging compliance APIs and on-chain auditing tools into a "Web3 Financial Services Cloud" to charge traditional banks SaaS subscription fees, opening up a second revenue curve beyond reserve income.

Beneath Circle's low net profit margin lies a strategic choice of "exchanging profit for scale" during its period of strategic expansion. When USDC's circulation surpasses $80 billion, and breakthroughs in RWA asset management scale and cross-border payment penetration are achieved, its valuation logic will undergo a qualitative change—from a "stablecoin issuer" to a "digital dollar infrastructure operator." This requires investors to reassess the monopoly premium brought by its network effects from a 3-5 year perspective. At the historical intersection of traditional finance and the crypto economy, Circle's IPO is not only a milestone in its own development but also a touchstone for the entire industry's value reassessment.

Reference Articles: https://www.sec.gov/Archives/edgar/data/1876042/000119312525070481/d737521ds1.htm#rom737521_10 https://www.bloomberg.com/opinion/newsletters/2025-04-02/stablecoins-are-growing-up?embedded-checkout=true

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation, jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos ecosystem in the Chinese-speaking region. As the official representative of Aptos in the Chinese-speaking area, Movemaker is committed to building a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecological partners.

Disclaimer

This article/blog is for reference only, representing the author's personal views and does not reflect the position of Movemaker. This article does not intend to provide: (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries high risks, with significant price volatility, and they may even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. If you have specific questions, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling these data and charts, but no responsibility is accepted for any factual errors or omissions expressed therein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。