原创|Odaily星球日报(@OdailyChina)

作者|Wenser(@wenser2010)

“救救ETH啊!”

“ETH到底能不能抄底啊?”

“种种迹象表明,ETH能买一点了,但为啥我毫无买入欲望?”

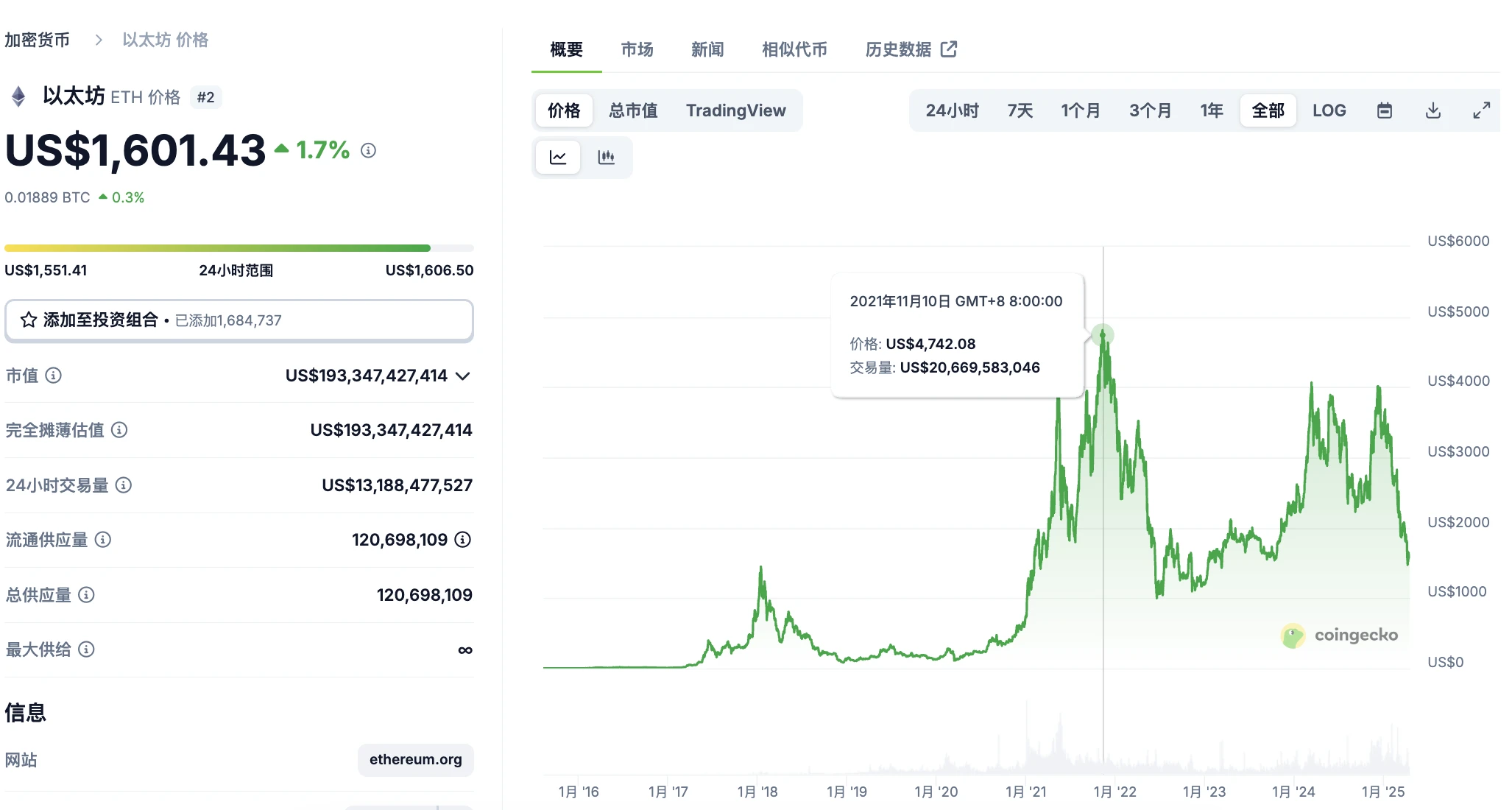

随着市场进入暂时的震荡稳定期,众多加密玩家再次发出以上的呼声,难掩对 ETH 价格的失望,以及对 ETH 价格修复的期待。结合此前看到的一张 K线神对比图,以及近期看到的一篇文章《跌跌不休中,ETH 需要一个新叙事》,或许我们又到了该为 ETH 及以太坊生态寻找新出路的“市场冷静期”。

ETH 走入“诺基亚时刻”:未来潜在下跌势头

先从一张图说起。

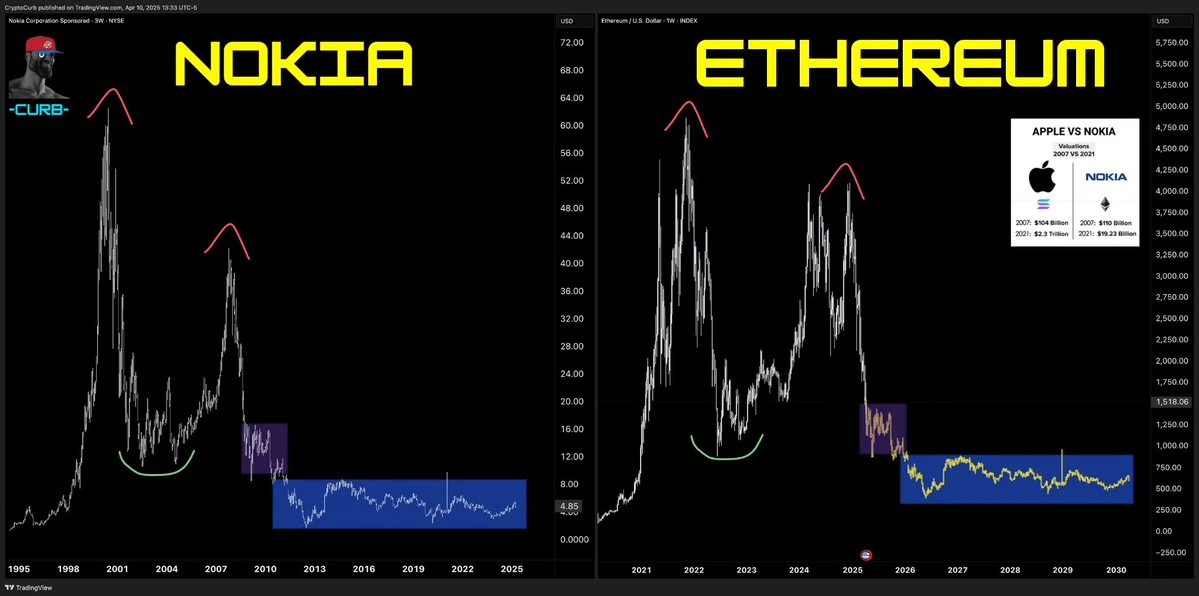

近日,作为 Solana 生态死忠加密 KOL @CryptoCurb 发布了一条推文,将诺基亚股价K线图与ETH K线图放在一起做了对比,从价格走势上来看,二者可以说是……一模一样。

诺基亚 VS ETH

或许这样的对比有些牵强附会,但我们将二者的K线图分开来看,仍然具备一定的相似性——

首先,从周期节点上来说,诺基亚股价高点出现于2000年5月前后,次高点则出现于 2007年11月前后;ETH 的价格高点出现于2021年11月左右,次高点则出现于2024年3月及特朗普当选后的2024年12月。

其次,从历史后视镜的角度来看,诺基亚的高点出现于互联网泡沫时期,即互联网大爆发的前夜;次高点则出现于2008年次贷危机的前夜,苹果发布IPhone 手机的前夕。与之相比,ETH 的高点出现于2021年的牛市时期,彼时以太坊经历了DeFi、GameFi、NFT等生态热潮,代币消耗远大于代币供应,并在2022年9月成功完成从 POW 到 POS 机制的转型;ETH 的次高点则得益于2024年1月比特币现货 ETF 通过之后的政策红利以及特朗普当选美国总统后带来的“特朗普效应”催熟的牛市。

最后,从历史发展阶段来看,诺基亚最终由于抱残守缺,死守“功能机”阵地,未能及时迭代为智能手机,最终错失硬件设备浪潮的船票,被扫进了历史的垃圾堆,而基于 IOS 生态系统搭建的苹果的IPhone 手机以及其他的产品矩阵最终让苹果成功跻身市值万亿俱乐部,一度成为“全球市值第一上市公司”;ETH 如今的状态,与2007年之后的诺基亚颇有些同病相怜之处:没有新的产品,没有引领下一代互联网发展的网络协议,没有“只此一家,别无分店”的生态差异性,反而深受 L2 的吸血与流动性碎片化的困扰。

心怀“世界计算机”愿景的以太坊,如今僵化落后如同曾经的 Windows98 系统。

当 ETH 陷入叙事死局:下一个突破口在哪里?

目前来看,随着价格的持续下跌以及 ETH/BTC 汇率的持续下跌,ETH 具备价值存储功能、类似比特币的“数字白银”叙事已经阶段性证伪;其超声波货币的等叙事定位也受到自身消耗场景稀缺、L2 网络分割流动性以及 POS 机制后的通胀影响而走入死胡同。

随之而来的,ETH 及以太坊生态被寄予厚望的下一个叙事主要为2个方向:

一是 RWA 网络。从市值、TVL 以及开发者数量、用户数量等指标来看,以太坊生态仍然是加密货币的生态主干,因此无数加密用户将以太坊视为 RWA 资产桥接至加密领域的“必经桥梁”。

二是 PayFi 链条。从生态安全性、生态可扩展性以及稳定币流通量、沉淀资产量等方面来看,以太坊生态被认为是 PayFi 链条的主阵地,尽管此前主网 gas 成本在牛市时居高不下,但 L2 的出现以及生态活跃度的下降使得支付成本大幅下降,不少人认为以太坊生态仍然是 PayFi 赛道的必要组成。

但目前来看,以上2个叙事无法作为 ETH 以及以太坊生态的“唯一性叙事”。

换言之,EVM 体系能够做的事情,Solana 生态也能够做,甚至得益于较低的运行成本以及高性能网络,Solana 在 RWA 与 PayFi 赛道或许能够做到更好。这一点,从 Huma.Finance 扩展至 Solana 生态后的快速发展可以管窥一二。更多介绍,详见《“PayFi当红炸子鸡”Huma到底是不是P2P?》。

因此,真正能够为 ETH 及以太坊生态打开局面的,绝不是常规意义上的资产桥梁或者支付链条。

如果想要解决 ETH 的目前表现不力的市场价格,根本之处在于2点:

1、增加消耗量,降低供应量。

2、增强扩展性,减弱分割性。

前者需要更多创新性的协议应用,减少砸盘量;后者则需要剔除流动性分散、寄生以太坊主网生态的L2鬼链。

ETH 如何成长为IOS 生态?暂无可能,但可以借鉴其发展思路

那么下一个问题是:以太坊生态能否成长为如今具有坚固护城河的苹果 IOS 生态呢?

目前来看,这条路也很难成立,因为区块链网络的去中心化特质与 IOS 生态的 AppStore 的中心化审核机制天然相悖;但以太坊生态或许可以成为一个“去中心化安全性解决方案提供商”。

回看苹果之所以能从曾经的经营泥淖走出来,IOS 系统的封闭且流畅的生态提供了发展基础;AppStore 以及基于此逐步发展繁荣的应用生态才是关键。对于现在的 ETH 及以太坊生态来说,助推更多的应用出现,以此孵化孕育更多的创新性产品及协议的诞生,或许能为整个生态开拓出不一样的发展路线。

具体而言,以太坊生态的下一波创新浪潮或许会出现在以下3方面:

1、链上 AI 自动化交易。在 AI 发展一日千里的现在,链上 AI 自动化交易将以远比想象中更快的速度逐步落地,走入现实,实现“所见即所得,所得即所交易”的效果。

2、数字资产管理应用宝。当各类实体资产能够通过区块链网络实现灵活的编号、数字化之后,以太坊网络或许将成长为一个按需选购的“链上应用宝”,供全球经济参与者交易。从这方面来说,IP、内容创作者经济将是重要组成部分。

3、中性化收益产品集散地。机构投资者、具备一定的专业投资者将从链上寻找新的中性化收益产品,如稳定币衍生品生息产品。

当然,以上仅是一家之言,具体发展如何,还需要技术与生态的共同验证。

推荐阅读

ETH Hangzhou现场调查:以太坊已进入中年期,三年内价格新高无望

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。