Bitcoin ( BTC) has maintained its $85K price for the most part, but the metric most analysts are talking about today is the cryptocurrency’s market dominance, which had climbed above 64% at the time of reporting.

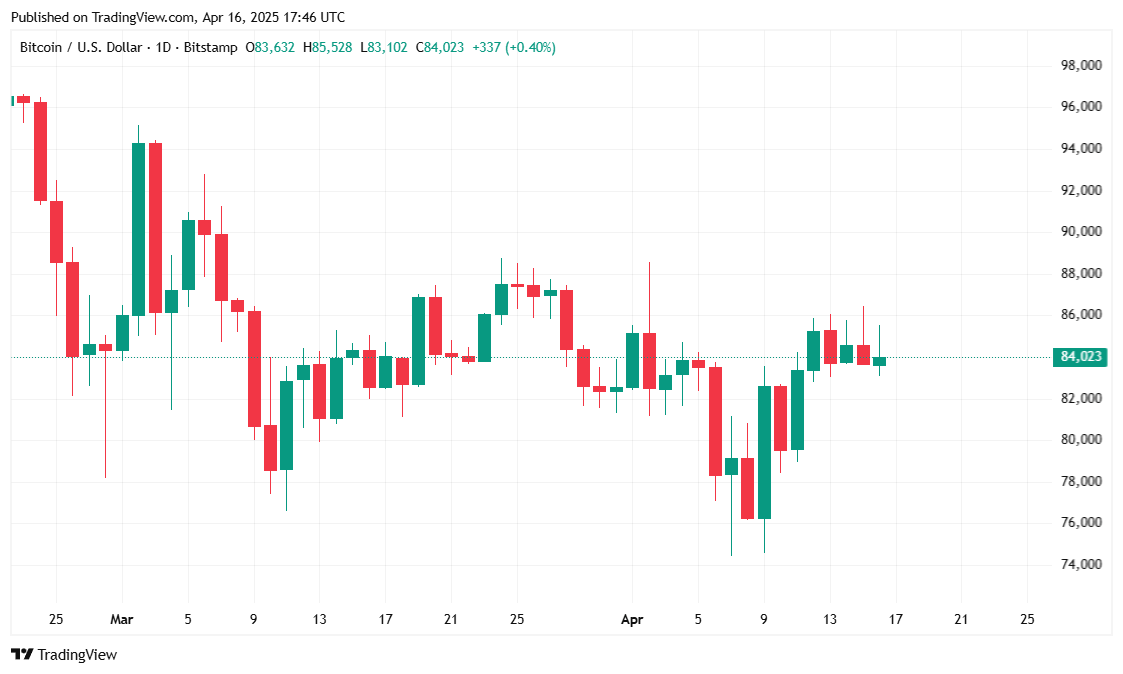

BTC traded in a relatively tight range, between $83,100.62 and $85,232.09 over the past 24 hours. At the time of reporting, bitcoin stands at $84,161.97, up 0.25% on the day and 8.84% over the past week, highlighting a slow but sustained recovery trend.

( BTC price / Tradingview)

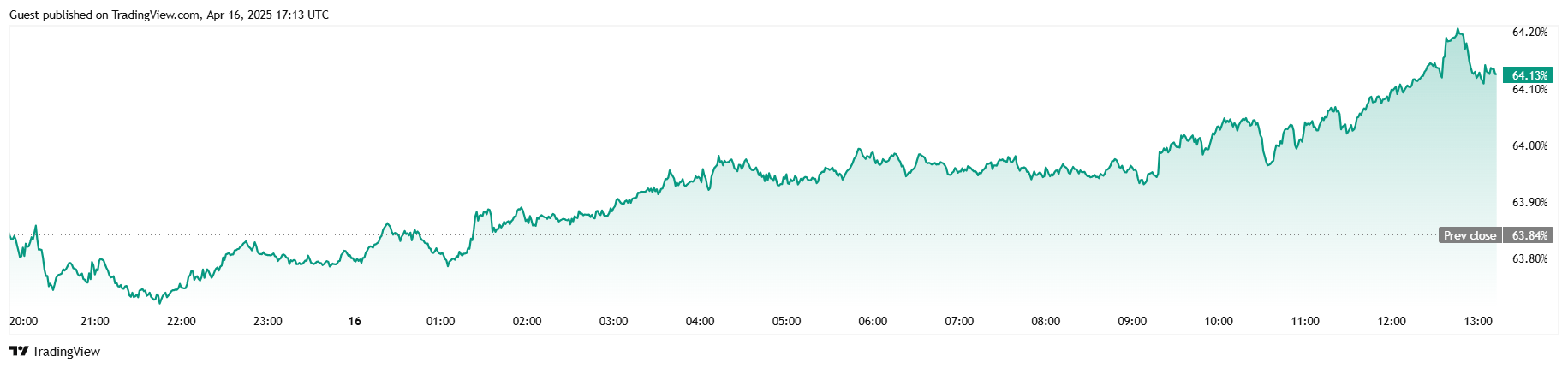

While trading volume dipped slightly by 5.11% to $26.42 billion, bitcoin’s market capitalization rose by 0.31% to $1.69 trillion, suggesting that capital is continuing to flow into BTC even as broader activity cools. BTC dominance, as previously noted, has now risen to 64.13%, a 0.45% increase in 24 hours.

( BTC dominance / Tradingview)

In the derivatives market, Coinglass data shows total BTC futures open interest inching up by 0.23% to $54.95 billion, while liquidation levels have stayed notably low. Only $1.47 million in positions were liquidated, with longs taking the majority of the hit at $1.22 million. The muted liquidation activity suggests a relatively calm trading environment, even as bulls continue to inch forward.

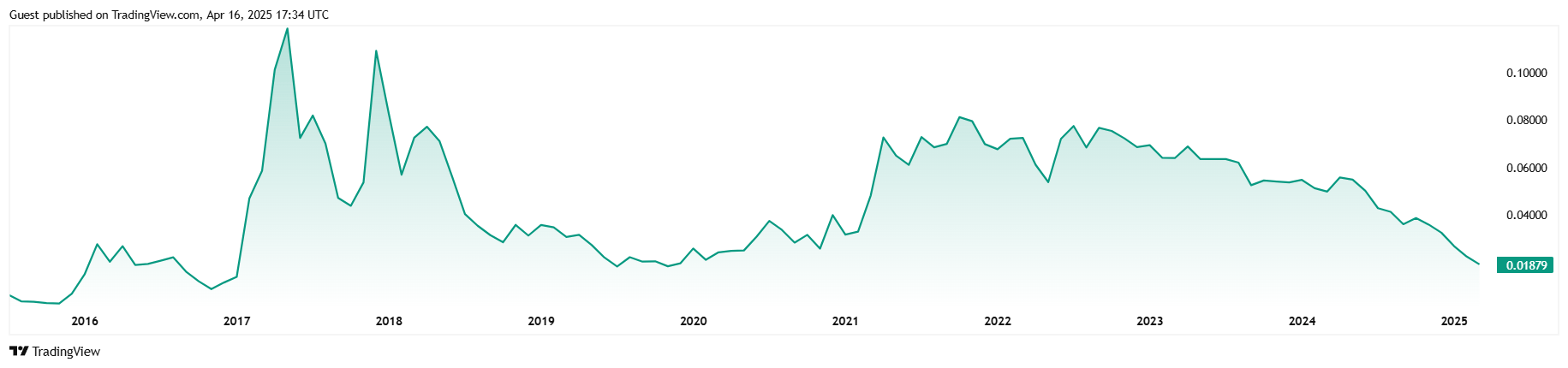

At $1.68 trillion, BTC is the 400-pound gorilla of the $2.66 trillion crypto market. Another metric that captures how well bitcoin has been doing lately is its comparsion to ether ( ETH), the coin with the second highest market cap in the industry. The ETH/ BTC ratio measures ether’s value relative to BTC and data from Coinmarketcap shows that the ratio is languishing at a 5-year low, currently at 0.01870.

( ETH/ BTC ratio / Tradingvew)

Ether hasn’t fared well lately, tanking by more than 50% since the beginning of the year, and currently trading at $1,593.47, down 1.82% over 24 hours. In fact, the top two ETFs in the U.S. are leveraged ETFs that make money from shorting the cryptocurrency.

A strong dominance ratio for bitcoin could mean higher price appreciation, maybe even a new all-time high, once investors become bullish again. This afternoon, however, Federal Reserve Chair Jerome Powell cast a chill over U.S. equities and crypto markets after signaling that a near-term interest rate cut remains off the table. His remarks poured cold water on investor optimism, hinting that monetary policy may hold steady for longer than some had hoped.

By 1:58 p.m., BTC was trading for $83,393 per unit on Wednesday afternoon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。