Just as Bitcoin (BTC) goes through a stressful trading day, Michael Saylor has stepped into the spotlight — without saying much, yet enough. In a new post today, the Strategy CEO shared an AI-generated photo of himself at a chessboard, captioned simply: "Bitcoin is Chess."

What matters is that the timing of the post coincides with rising unease on the financial markets as all await fresh commentary from Federal Reserve Chair Jerome Powell.

Related

Wed, 04/16/2025 - 12:42 Bitcoin (BTC) on Verge of Epic $600 Million Short Squeeze: Details

Gamza Khanzadaev

HOT Stories Strategy's Saylor Issues One-Word Verdict for Bitcoin Two Years Ago Dogecoin (DOGE) Briefly Became Twitter Logo Enormous 131,000,000 XRP Shifted Anonymously, Here's Big Player Behind It 'Sell All Your Bitcoin': Man Who Predicted 2008 Crash Reveals 'Best Trade You Can Make'

Chess, after all, is about structure and strategy, not panic and prediction. Let's be fair, Saylor has mastered playing this long game, as Strategy, the company he chairs, holds one of the largest Bitcoin treasuries on the planet: 528,185 BTC valued at approximately $44.31 billion.

With an average purchase price of $67,458, the current market places the position in a healthy profit zone of roughly 24.35%.

Bitcoin is Chess. pic.twitter.com/pnoOKuOfzJ

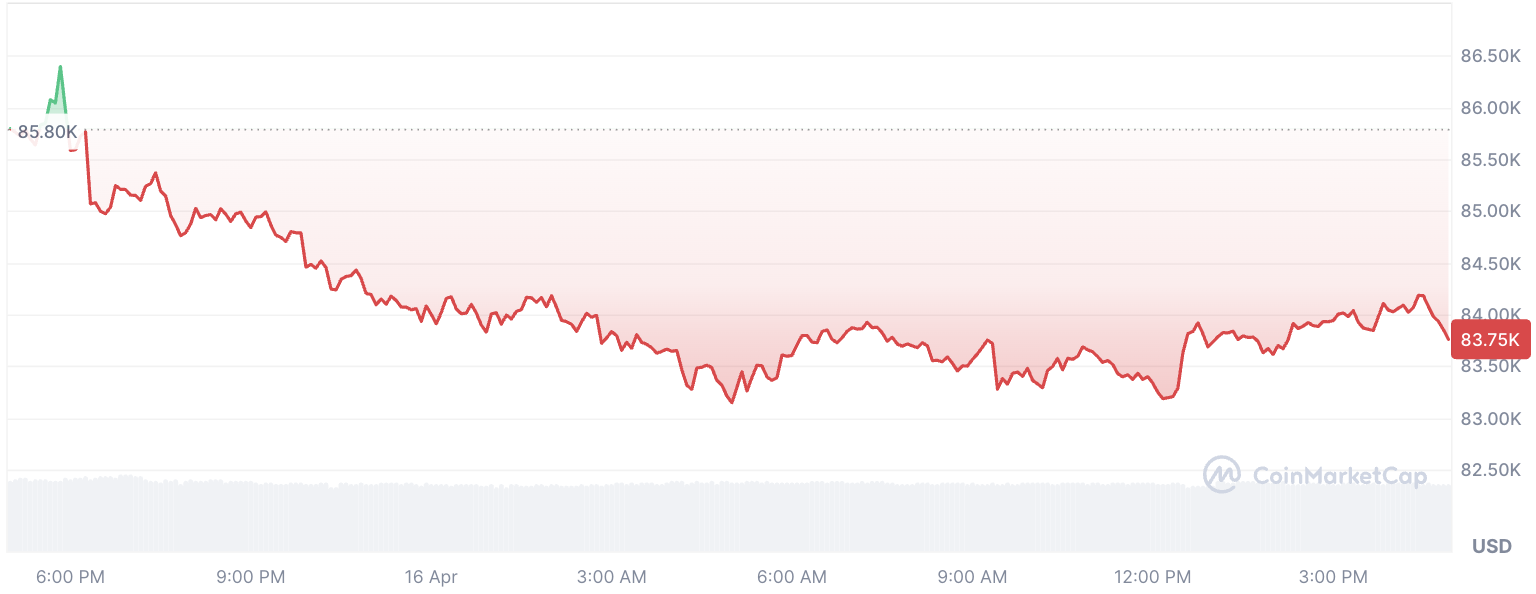

— Michael Saylor (@saylor) April 16, 2025Today, however, it is not profits that dominate the conversation — it is anxiety. Bitcoin’s price chart for April 16 shows all the classic signs of nervous trading behavior. From the reset of the trading session, Bitcoin bounced erratically between $83,100 and $84,300, ultimately landing around $83,909.

Bitcoin Price by CoinMarketCap

The pattern reveals nervous sentiment: sharp reversals, short-lived rallies and no clear directional conviction. It is not a crash, not a breakout — just tension.

Related

Wed, 04/16/2025 - 11:09 Dormant Bitcoin Whale Makes Massive BTC Purchase on Binance

Yuri Molchan

It is no coincidence that this atmosphere aligns with Powell’s anticipated commentary, expected to touch on interest rates, liquidity conditions and macro signals that could ripple through risk assets. In that frame, Bitcoin — as seen through Saylor’s lens — is less about timing the Fed and more about outlasting the noise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。